{{item.title}}

{{item.text}}

{{item.text}}

The recent crisis in the banking sector has thrust the importance of asset and liability management (ALM) back into the spotlight. A key driver of the disruption in the banking sector was the market value losses on long-dated assets that backed liquid short-term liabilities.

Life insurers are well acquainted with the challenge of managing a fixed asset portfolio against liabilities driven by unpredictable customer behavior and parametric risk outcomes. As such, ALM is a core competency of life and annuity insurers. Most insurers have honed their ALM approaches by applying a wide range of strategies to manage their asset duration and convexity profiles, but they are certainly not immune to disintermediation liquidity risks and asset or liability mismatch risk.

While many insurers have a well-defined ALM mandate, we believe that a more holistic supporting process is needed to execute and monitor their strategy and protect against losses. The modern landscape demands management have access to dynamic, real-time asset and liability data to make informed risk management decisions in an effective manner. However, companies are often constrained by legacy processes that are resource and time-intensive.

Operational constraints hamper the traditional ALM model. Asset and liability systems rely on disparate data sources, competing and often imprecise liability projection systems, and a large volume of time-consuming, manual back-end processes. Other limiting factors include:

As a result, the ALM function too often resembles an exercise in bridging the gap between two disconnected sides of the balance sheet — as opposed to a holistic, integrated approach.

Rapidly shifting economic environments amplify the importance of sound ALM practice. However, it is in these circumstances that the practical limitations are most pronounced.

Daily movements in interest rates, credit spreads, inflation and volatility can rapidly shift a company’s risk profile, and the current ALM models generally struggle to keep pace. Thorough ALM analysis requires days to prepare, while active monitoring solutions often require significant simplifying assumptions that reduce the precision of results.

Under the current model, companies are required to act on outdated information when making significant decisions that impact its long-term risk profile.

To address these limitations, modern technology solutions paired with the required domain experience can be leveraged to help implement a modernized ALM solution that enhances the overall capabilities of the tools used by decision-makers.

Overall, modernization of the ALM process should include several key tenets:

To demonstrate how to deliver these key capabilities and what is possible with modern technology, PwC has developed an Advanced Finance Analytics solution. The solution illustrates how to achieve a flexible, dynamic interface that can be easily customized to in-take market and organizational data in its current structure and formats, and produce holistic, digestible — as well as timelier — ALM metrics.

The end goal of modernized real-time ALM monitoring is to provide better decision-making information faster. Agility and responsiveness to key ALM issues are crucial to managing a life and annuity book. Companies that make the necessary investment in process and technology enhancements now can be well-equipped to better manage their risk going forward.

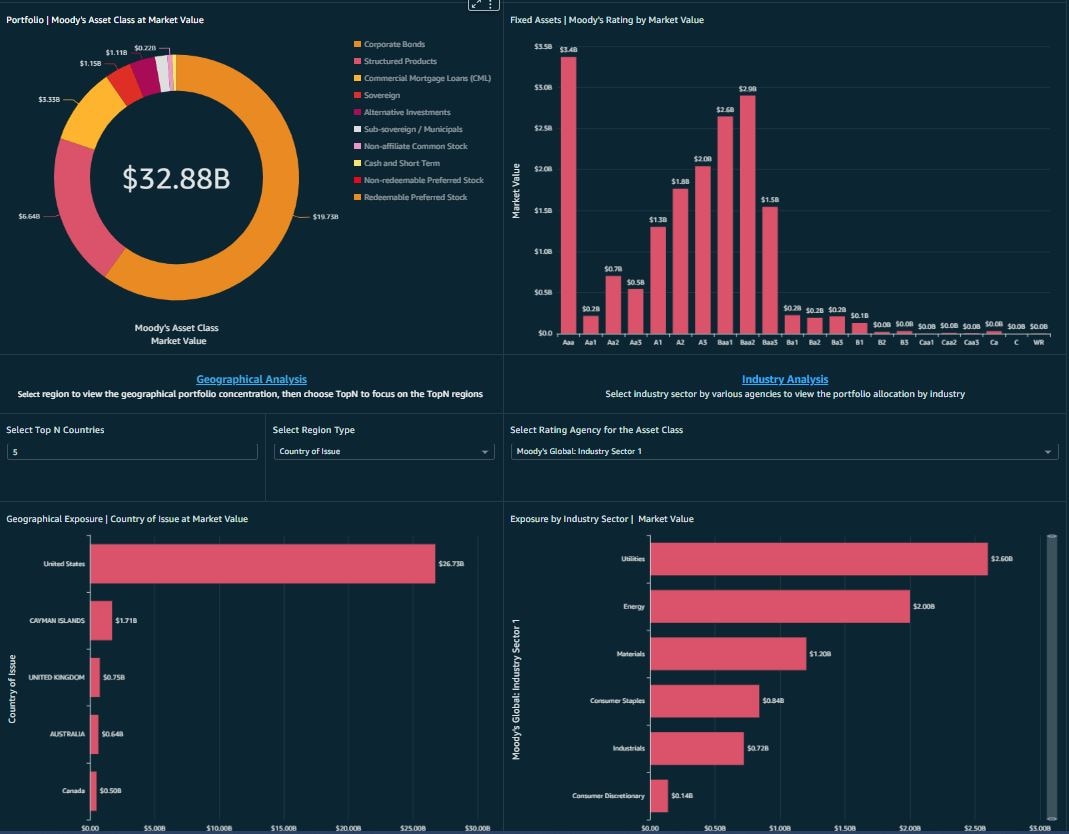

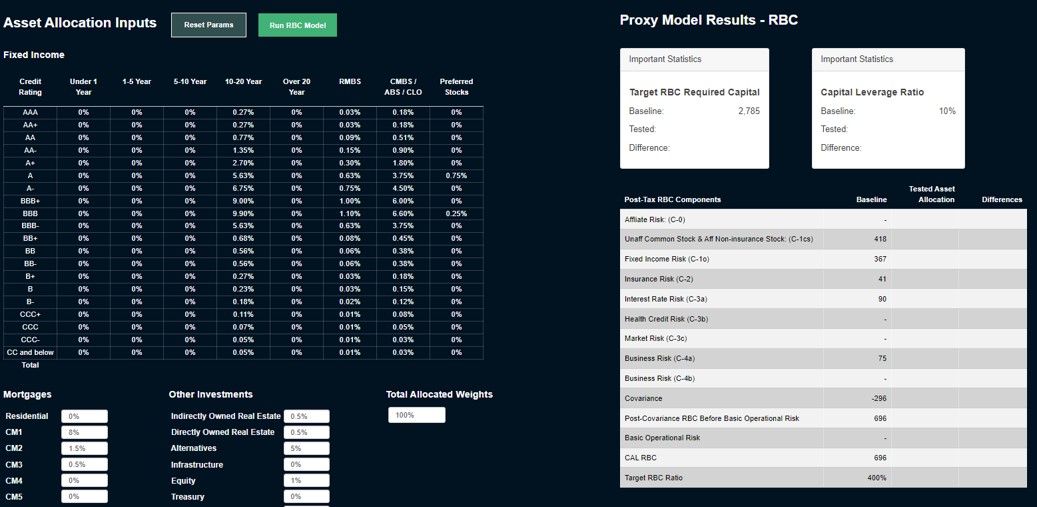

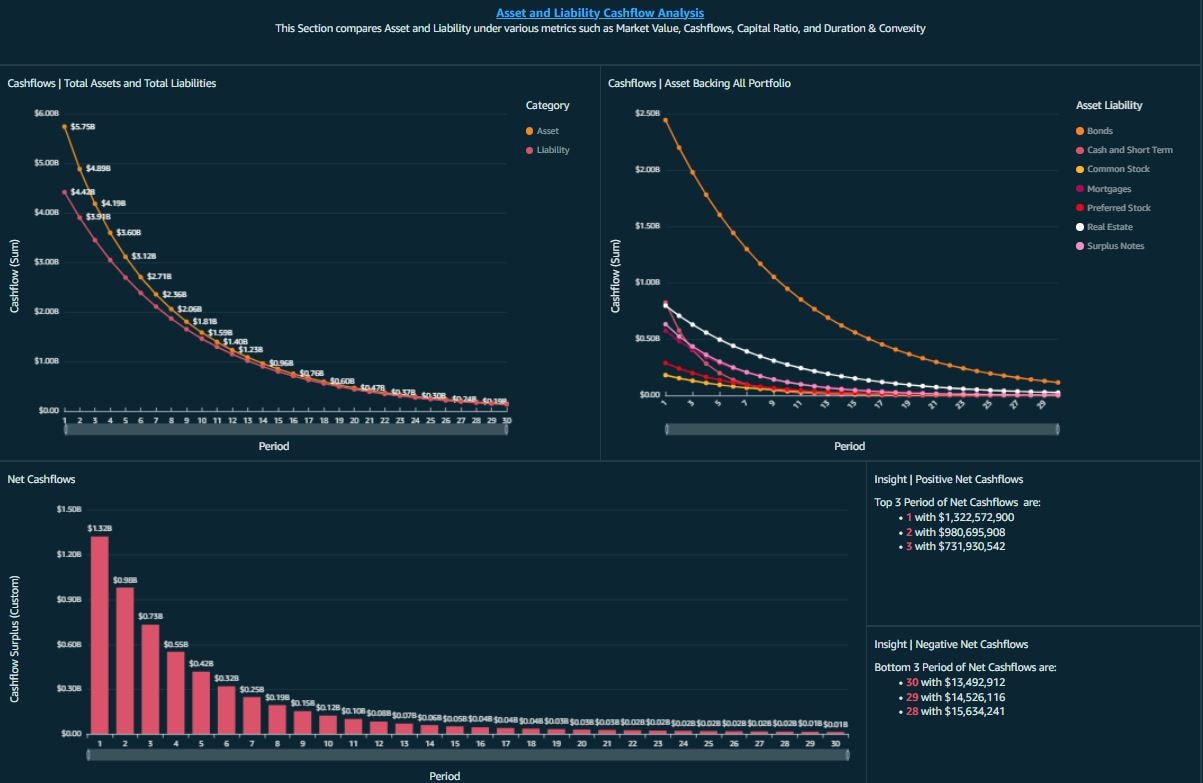

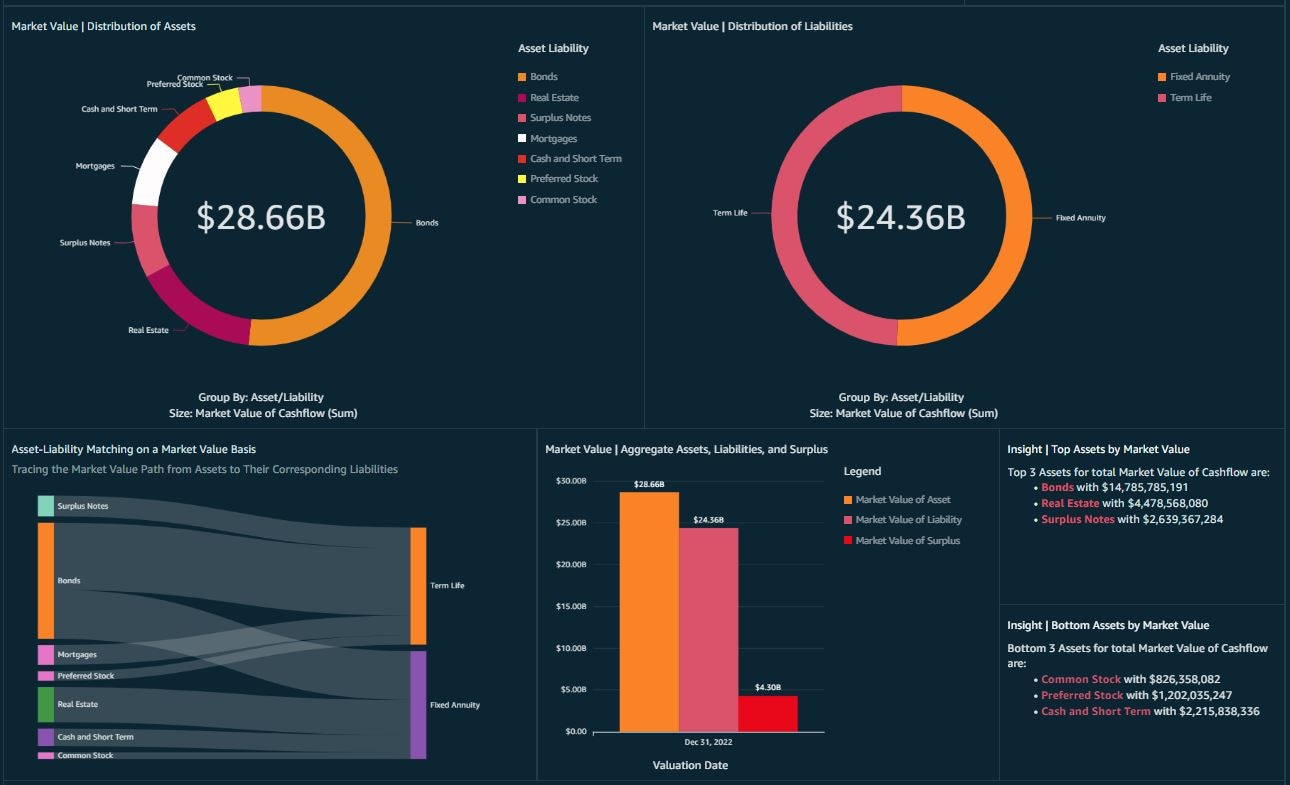

Below are some snapshots of our Advanced Finance Analytics solution:

{{item.text}}

{{item.text}}