{{item.title}}

{{item.text}}

{{item.text}}

With digital expansion becoming a primary focal point for major banks in the United States, a reevaluation of marketing and customer outreach strategies is needed. Changes in customer engagement strategies are essential to retain or recapture growth.

Larger banks have widely sought to improve user experience and expand product offerings in the digital channel. For example, banks have sought to improve application times, reduce customer compliance pain points, and offer instant virtual cards. But few have even begun to evaluate how to evolve their marketing and outreach strategies despite the fact that the way in which customers interact with banks is shifting. A redesign is necessary alongside bank products themselves, as the way banks design products and market them is no longer effectively captured by a one-size-fits-all approach. This ‘personalized advice’ approach goes beyond long-term financial goals. It incentivizes known customer behavior in order to facilitate a financial partnership. Marketing strategies centered around supplemental incentivization of ongoing customer behavior is a probable evolution to current digital marketing campaigns. This is likely the new path for relationship building between bank and customer as digital increasingly becomes the primary point of contact in the industry.

Digital channels, and specifically mobile apps, provide customers with a high level of access to banking services. As such, a strategic shift to take advantage of this access seems only prudent, and banks pursuing digital expansion opportunities might want to consider remapping their traditional engagement tactics. Such a change could recapture growth from direct digital banks which, while growing their share of retail deposits from 14% to 28% between 2014 and 2017,1 have demonstrated a limited ability in establishing primary banking relationships. This new data-driven, proactive approach to customer outreach could help build loyalty and increase engagement in an environment where a large number of financial institutions are competing for wallet share. Traditional marketing campaigns could face diminishing returns as more targeted, customer-centric campaigns take their place.

-----

1 - PwC 2018 Digital Banking Survey

Source - Wilson, Dontá. "Client Centricity - Investors Day 2018", https://bbt.investorroom.com/webcasts-and-presentations?item=105, BB&T, 2018

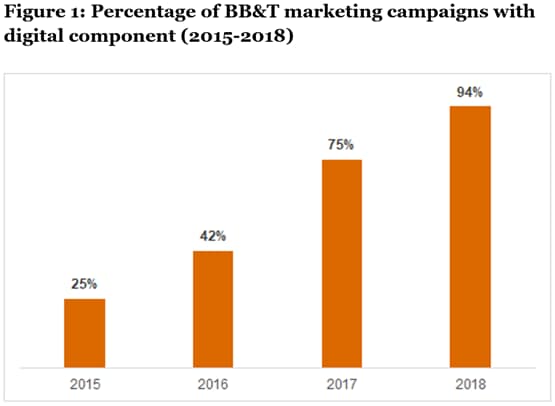

Broad-based marketing campaigns with digital component are table stakes.

Digital marketing may evolve into app-based notifications built on customer habits as a next stage to drive engagement.

Customer relationships will require more constant maintenance.

As the frequency and quality of non-digital interactions declines across the banking industry, the inability to effectively market to customers in digital channels could have a detrimental effect on growth. Customers visit branches less often, and most major US banks report the average customer visits a branch once a quarter, some just once a year. This limits touch points in traditional interaction channels (e.g., branches), even for multi-product customers. Data-driven insights and personal outreach can drive revenue higher and, when used in conjunction with a refined marketing strategy, may stimulate an increase in the number of quality interactions a bank may have with its customers. Banks should study customer preferences and habits, such as an annual vacation, as a catalyst for incentivizing a variety of alternative services and/or products.

A strategy centered around this tactic can improve relationship building. By rewarding certain behaviors, rather than simply promoting an unused or unwanted product, banks afford themselves an opportunity to capitalize on rising levels of digital customer acquisition and higher levels of digital transactions. Wells Fargo, for example, reported the digital acquisition in its credit card business increased 56% in the last year. Other large banks have experienced similar growth.2 This likely results from the faster application and issuance times and better compliance processes that only enhanced digital acquisition capabilities can provide. Digitally-engaged customers are shown to have higher levels of card spend and higher levels of engagement overall at the largest US banks.3 Engaged customers drive growth and, as such, should be the focal point. Next stage growth efforts likely requires higher levels of personalization and targeted product offerings across business lines.

-----

2,3 - Mack, Mary and Modjtabai, Avid. "Consumer and Small Business Banking", Wells Fargo & Company, May 10, 2018

{{item.text}}

{{item.text}}