Change remains a constant in financial services regulation. Read "our take" on the latest developments and what they mean.

Current topics – January 24, 2025

1. The new Trump era begins

- What happened? President Trump began his second term on January 20th with a flurry of Executive Orders (EOs) and Presidential Memoranda. In addition, immediate departures of several agency heads transitioned control of those agencies to acting leaders.

- Which EOs could impact financial services?

- Ensuring U.S. leadership in digital financial technology: Establishes the Presidential Working Group on Digital Asset Markets tasked with developing a “regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.” The working group will include relevant agency heads, chaired by David Sacks, the White House AI & Crypto Czar, and engage subject matter experts outside the federal government. The EO also:

- Directs departments and agencies to identify and recommend regulations that should be rescinded or modified;

- Prohibits agencies from establishing, issuing or promoting central bank digital currencies (CBDCs); and

- Revokes the Biden Administration’s EO on digital assets.

Separately, the SEC issued a new Staff Accounting Bulletin (SAB) to formally rescind SAB 121, which required custodians to maintain an equal fair value asset on the balance sheet as a liability for every digital asset.

- Regulatory freeze pending review: Orders Executive departments and agencies1 to: (1) not propose or issue any rule until it has been reviewed and approved by new agency heads appointed by President Trump; (2) immediately withdraw rules that have not been published in the Federal Register; and (3) for rules that have been published in the Federal Register but not yet taken effect, consider postponing their effective dates for 60 days and conduct a review, which may result in a comment period and/or further delays. In remarks at the World Economic Forum, Trump also promised to eliminate 10 old regulations for every new one.

- Revoking Biden artificial intelligence (AI) EO. Calls on agencies to rescind all policies, directives, regulations and other actions undertaken based on the Biden Administration EO on AI;

- Federal government staffing and hiring: By revoking a number of Biden Administration EOs and issuing new ones, the Trump Administration directed federal agencies and departments to:

- Eliminate offices and initiatives related to diversity, equity and inclusion (DEI) and environmental justice, including actions by Federal contractors; encourage the private sector to end DEI hiring and advancement policies, including by identifying up to nine potential civil compliance investigations of private sector institutions, large non-profits and foundations, bar and medical associations, and higher education institutions with large endowments; freeze hiring of federal civilian employees and end remote work arrangements; and formally establish the Department of Government Efficiency (DOGE) and DOGE Teams within agencies to modernize technology and software.

- Immigration: Many of Trump’s early EOs concerned immigration policy, including those to:

- Declare migrant crossings along the U.S-Mexico border to be a national emergency; bar the use of asylum for those newly arriving at the southern border; suspend the Refugee Admissions Program; resume a policy requiring those seeking asylum to wait in Mexico while an immigration judge considers their cases; and move to end birthright citizenship.

- Energy and the environment EOs call for:

- Withdrawing the U.S from the Paris Agreement; declaring the first national energy emergency to suspend environmental rules or expedite permitting of mining projects; repeal of Biden era energy policies including the (1) ban on offshore drilling, (2) regulations that encouraged automakers to manufacture more EVs, (3) rolling back energy-efficiency regulations for dishwashers, shower heads and gas stoves and (4) restarting reviews of new export terminals for liquid natural gas paused by Biden; halting the leasing of federal waters for offshore wind farms; opening Alaska wilderness for more oil and gas drilling; eliminating environment justice programs across the government; and reviewing all federal regulations that impose an “undue burden” on the development or use of energy sources, particularly coal, oil, natural gas, nuclear power, hydropower and biofuels.

- Tariff and trade EOs call for:

- Beginning an investigation into trade deficits and currency practices; assessing China’s compliance with a 2020 trade deal as well as the United States-Mexico-Canada Agreement; assessing the feasibility of creating an “External Revenue Service” to collect tariffs and duties; reviewing U.S. industry and manufacturing to consider further tariffs.

- Ensuring U.S. leadership in digital financial technology: Establishes the Presidential Working Group on Digital Asset Markets tasked with developing a “regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.” The working group will include relevant agency heads, chaired by David Sacks, the White House AI & Crypto Czar, and engage subject matter experts outside the federal government. The EO also:

- Which agency leaders have changed? The following became Acting Chairs of their respective agencies after the departure of Biden-era leaders: Travis Hill at the FDIC, Mark Uyeda at the SEC, and Caroline Pham at the CFTC. Trump also designated NCUA Vice Chair Kyle Hauptman as Chairman to replace Todd Harper, who will remain on the Board. The Acting Chairs have taken the following actions:

- Travis Hill announced the FDIC’s withdrawal from the Network for Greening the Financial System and issued a statement on his priorities for the agency including reviewing regulations and guidance; adopting a more open-minded approach to innovation and technology adoption; encouraging de novo activity; replacing the merger policy update issued in 2024; withdrawing “problematic” proposals including those on brokered deposits and corporate governance; and ensuring that law-abiding customers do not lose access to bank accounts and services.

- Mark Uyeda announced a new crypto task force to be led by Commissioner Hester Peirce.

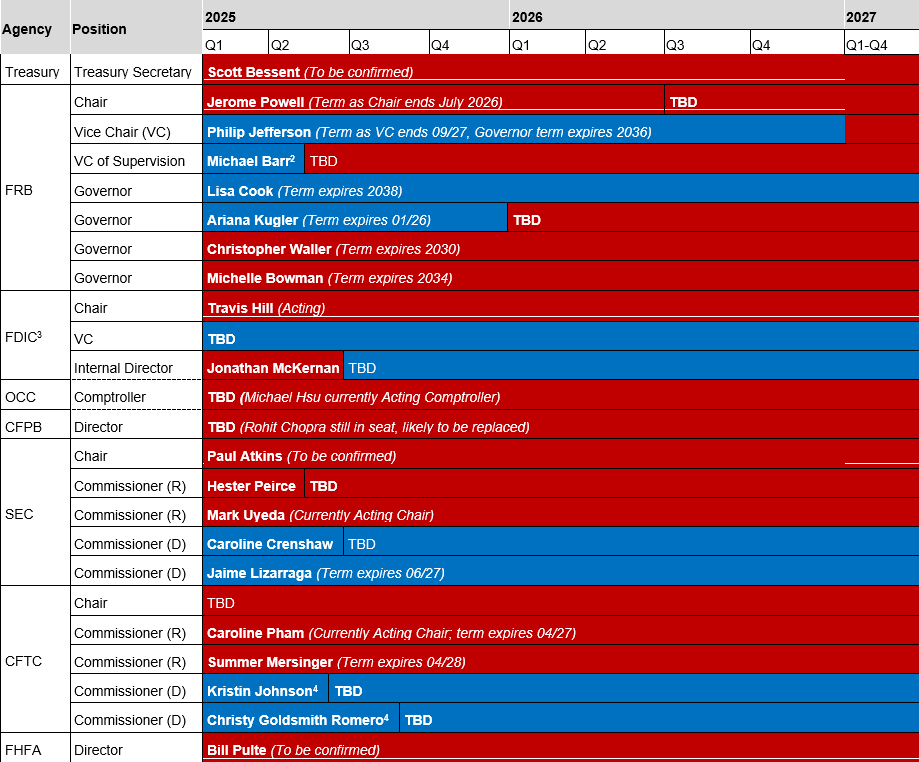

- What’s next? President Trump’s nominations to lead financial services agencies will proceed, including with an imminent Senate vote on Scott Bessent’s confirmation as Treasury Secretary and a Senate Banking Committee hearing for SEC Chair nominee Paul Atkins. See Appendix A for a timeline of agency leadership terms.

Our Take

Back to the future. President Trump’s initial raft of executive actions have a general theme of rewinding the clock to the end of his first administration and reversing policies promoted under former President Biden. However, there are also areas where the Trump Administration aims to create new policies, including around digital assets. Aside from effectively blocking the development of a U.S. CBDC, the EO leaves considerable leeway to the new working group – and the industry experts it consults – to develop a regulatory and supervisory framework for digital assets. One of the biggest hurdles the working group will face is coordinating the policies of agencies like the SEC and CFTC to more clearly designate which products and services each will cover. Although past efforts by Congressional Republicans have attempted to steer more oversight to the CFTC in part due to the SEC’s relatively strict policies under former Chair Gary Gensler, the working group will likely consider and recommend changes that make both the SEC and CFTC regimes less onerous under new Chairs. Legislation to define supervisory jurisdiction and establish a regulatory framework for digital assets would provide the most clarity for the industry and we expect that efforts with strong consumer protection and anti-financial crime elements could win bipartisan support. Even without a confirmed Chair, the SEC’s rapid recission of SAB 121 shows that policy changes could come quickly. Although the SEC had already relaxed enforcement of SAB 121 in response to bipartisan Congressional resolutions to overturn it, its formal removal may be a relief to financial institutions that have resisted offering digital asset custody services due to the potential capital impact of treating them as liabilities.

Regulatory freeze EO is not the biggest threat to Biden era regulation. The EO to freeze and review pending regulations is a common action for new administrations and does not directly impact most of the agencies that institute rules impacting financial institutions. However, independent agencies with leaders appointed by the new President typically follow the spirit of such directives and have even more latitude to review the regulatory policies of their predecessors than what is outlined in the EO. This is illustrated in Travis Hill’s statement which foreshadows broader review and replacement of already-effective FDIC policies. There are also several other avenues for Biden Administration rulemaking to be overturned, including lawsuits and simple majority votes in the House and Senate under the Congressional Review Act (CRA). For example, the CFPB finalized several rules in the last several months (e.g., personal financial data rights or open banking and limitations on overdrafts) that are within the 60-legislative-day CRA lookback period as well as facing legal challenges from industry groups that are likely to be successful. Taken more broadly, parties interested in the fate of Biden Administration rulemaking should look past the provisions of the regulatory freeze EO and closely follow the policy positions of President Trump’s nominees, the introduction of CRA motions and updates from the courts. See Appendix B for a non-exhaustive list of regulations that may be affected through these channels.

Second and third degree impacts remain to be seen. Beyond those most directly tied to regulation, many of Trump’s initial EOs will affect the functioning of regulatory agencies, the economy, and various industries in a way that may ultimately impact financial institutions. For example, efforts to reduce staffing at the agencies may require them to adjust their priorities and operations, including those related to examinations. Financial institutions may also need to assess the impact on their clients as EOs that seek to drastically cut down on the number of undocumented immigrants, refugees and asylum seekers could impact agriculture, construction and other industries with high reliance on immigrant labor. On the other hand, clients involved in mining, oil and gas may have new opportunities for investment and other financial services. Adjusting trade policies and tariffs is a familiar priority from Trump’s first Administration that is likely to see more concrete progress in a second term. Financial institutions may have to consider the impact of potential policy changes on import/export financing, on clients that rely on trade with Canada, Mexico, and China, and on the broader U.S. economy. Finally, although this has not yet been addressed in an EO, comments by Trump and Senate Banking Committee Chairman Tim Scott (R-SC) confirm that the Administration will seek to enact policies preventing financial institutions from cutting off law-abiding clients from accounts and other financial services as they have argued this has affected entities across the energy, firearm and digital asset spaces. The Senate Banking Committee will hold a hearing on “de-banking” on February 5th.

1. Federal executive departments and agencies most directly affecting the financial services industry include the Departments of Treasury, Commerce, and Labor. Executive Orders are generally not explicitly directed toward independent agencies such as the Fed, OCC, FDIC, CFPB, SEC and CFTC.

2. Appendix

Appendix A

The following chart is an approximate projection of financial services agency appointments and term lengths. Cabinet secretaries and Chairmen of the SEC and CFTC are typically replaced by a President of a new party. Supreme Court rulings allow the President to remove the Comptroller of the Currency and CFPB Director and President Trump is expected to do so.

Appendix B: Rulemaking watch list

The following is a non-exhaustive list of regulatory actions that may be overturned or modified as a result of decisions from new agency leaders, Congress, or court rulings.

Agency |

Rule |

Effective Date |

Legal Challenge |

CFPB |

3/17/2025 |

X | |

CFPB |

1/17/2025 |

X | |

CFPB |

10/1/2025 |

X | |

CFPB |

5/14/2024 |

X | |

CFPB |

8/29/2023 |

X | |

CFPB |

Interpretive rule applying Reg E to digital payments |

N/A |

|

CFPB |

Proposed rule to amend FCRA to apply to information sold by data brokers |

N/A |

|

CFPB |

N/A |

||

FDIC/ OCC / Fed |

N/A |

||

FDIC/ OCC / Fed |

N/A |

||

FDIC/ OCC / Fed |

4/1/24 – 1/1/31 |

X | |

FDIC/ OCC / Fed |

10/23/2023 |

||

FDIC |

N/A |

||

FDIC |

N/A |

||

FDIC |

10/28/2024 |

||

Fed |

4/5/2021 |

X | |

FinCEN |

Guidance on listing of voluntary carbon credit derivative contracts |

12/1/2025 |

|

FinCEN |

1/1/2026 |

||

OCC |

1/1/2025 |

||

OCC |

1/1/2025 |

||

OCC, Fed, FDIC, NCUA, CFPB, FHFA |

10/1/2025 |

||

SEC |

4/29/2024 |

X | |

SEC |

3/14/2025 |

||

SEC |

9/5/2023 |

||

CFTC |

10/12/2024 |

||

CFTC |

1/1/2025 |

||

SEC/CFTC |

3/12/2025 |

X |

2. Michael Barr will step down as VCS on February 28th, 2025 but will remain on the Fed Board as a Governor. President Trump will need to choose another existing Governor as the new VCS or move them to a position at another agency to create a vacancy at the Fed.

3. The Comptroller of the Currency and CFPB Director are members of the FDIC Board. Because FDIC bylaws prohibit more than three members of one party on the Board, the Vice Chair and Internal Director cannot be Republicans if Trump’s nominees to lead the OCC and CFPB are Republicans. Jonathan McKernan’s term technically expired in May 2024.

4. Johnson’s and Goldsmith Romero’s terms have expired but they may remain on the Commission until their replacements are confirmed.