Our Take Special Edition - 2024 Election: A Republican sweep creates opportunities for financial services

With a Republican Congressional majority and Donald Trump returning to the presidency, the 2024 election will have broad implications for the regulatory and supervisory landscape. Regulatory agencies like the SEC, CFPB and OCC will be able to quickly shift priorities with Trump-appointed leaders emphasizing transparency and reversing Biden-era reforms. Along with increased potential for legislation, the financial services sector is expecting significant deregulation favoring mergers, digital assets, small business capital access and more.

This special edition Our Take outlines our expectations across numerous policy areas including supervision, capital and liquidity requirements, consumer protection, digital assets and AI.

Our Take Special Edition:

2024 Election: A Republican sweep creates opportunities for financial service

Impact from all three branches of government

Since former President Trump won the presidential election and Republicans secured majorities in the Senate and the House, financial sector stocks have risen sharply based on the expectation that a Republican-led government will streamline regulatory requirements, reverse some Biden Administration rulemakings, lower corporate tax rates, and create a friendlier environment for M&A and the development of innovative products and services.

Pop goes the populism. The markets have largely overlooked campaign appeals to populism from President-elect Trump, who voiced support for capping interest rates on credit cards, and Vice President-elect JD Vance, who said “we’re done…catering to Wall Street” and also supported Senator Elizabeth Warren’s (D-MA) executive compensation clawback bill. The markets and many in the industry recognize the best indication of the direction of the next four years is the first Trump Administration, which largely departed from anti-bank populism espoused during the 2016 campaign and quickly shifted to the more traditional Republican drive to reduce “excess” regulation on financial institutions.

Deregulation is on the horizon. The first Trump Administration began its deregulatory agenda by issuing a number of Executive Orders (EO) and Presidential Memoranda, including one directing the Treasury Department to conduct a comprehensive review of financial regulation. Trump will likely again undertake a strategy of setting a roadmap for the financial services agencies through EOs while he awaits his nominees at these agencies to be confirmed, both by issuing new orders and revoking some issued by President Biden, such as the order on climate-related financial risk.

Congress and the courts could cement changes. The deregulatory swing of the first Trump Administration was also aided by rare bipartisan Congressional agreement in the form of the 2018 Economic Growth, Regulatory Relief and Consumer Protection Act that resulted in a wide range of banking regulations applying only to banks with assets in excess of $250 billion in assets, up from $50 billion. This regulatory relief law prompted comprehensive tailoring of banking regulations - some of which has been reversed following the spring 2023 failures of banks with under $250 billion in assets. As the 2018 law still stands, new agency leaders will have a statutory basis to return to the higher thresholds.

Current Ranking Member Tim Scott (R-SC) is poised to become Chair of the Senate Banking Committee and redirect its focus to his priorities, such as expanding access to capital markets for individual investors and small companies. However, any legislation that would provide significant relief to financial institutions would have to obtain enough support from moderate Democrats to overcome an almost certain filibuster from the new Senate Banking Ranking Member Senator Elizabeth Warren (D-MA). There remains a possibility of the Senate majority removing the 60 vote filibuster for most legislation, although incoming Senate Majority Leader John Thune (R-SD) has pledged to preserve it. Notably, a simple Republican majority in both chambers could vote to overturn (and prevent future similar) Biden Administration regulatory actions finalized after August 1st via the Congressional Review Act without the threat of a filibuster. Notably, the Republican 2017-2018 Congress overturned 16 Obama Administration rules under the Congressional Review Act (see Appendix A for a list of potentially eligible regulatory actions).

The impact of the first Trump Presidency on the federal judiciary, which had Republican-appointed judges holding 98 out of 179 circuit court seats in 2020 as compared with 73 seats in 2016, has been felt throughout the Biden Administration as the industry has successfully challenged several regulations (see Appendix B for a list of challenged regulations). With a Republican Senate majority, Trump will be able to further cement the conservative majority on the Supreme Court and appoint more conservative judges across district courts. Along with the Supreme Court’s June vote in Loper Bright Enterprises vs Raimondo to overturn “Chevron deference” to administrative agencies’ interpretations of statutes, this will mean that agencies will have to more carefully craft and limit rulemaking to survive legal challenges - even under future Democratic administrations.

- Personnel is policy

- Shifting practices and priorities

- What should firms do now?

Personnel is policy

Even with support from the legislative and judicial branches, our mantra from past elections remains the same - the greatest and most immediate opportunity for change will come from changing the referees (i.e., regulators) rather than changing the rules (i.e., legislation).

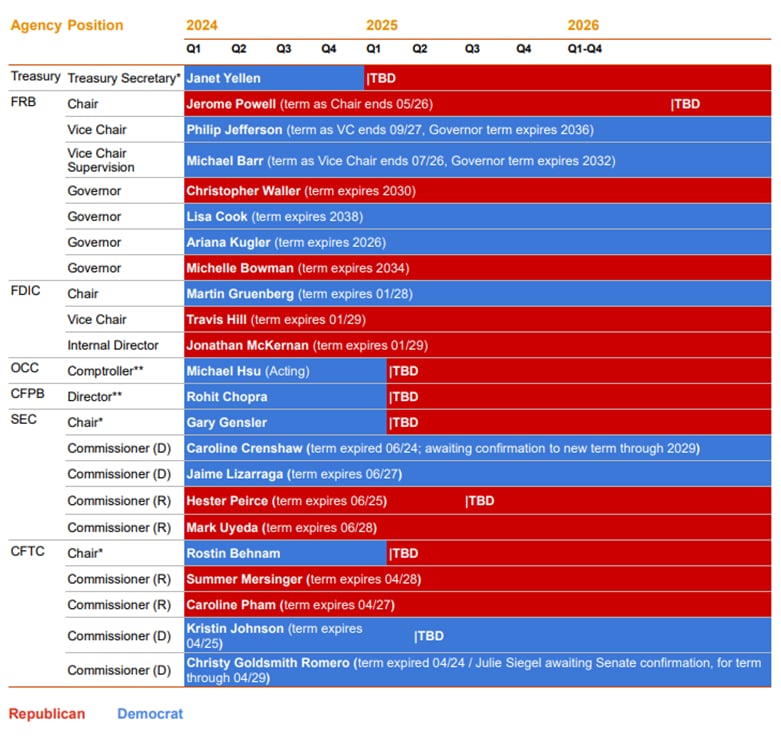

Six agencies can likely change immediately. The new Trump Administration will announce planned nominees for Treasury Secretary and leaders of the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Consumer Financial Protection Bureau (CFPB), the Office of the Comptroller of the Currency (OCC) and the Federal Housing Finance Agency (FHFA) over the course of the transition. Chairs of the SEC and CFTC traditionally resign when the Presidency changes parties; Acting Comptroller Michael Hsu has never been confirmed; and the FHFA Director is subject to the same Supreme Court decision that the CFPB Director must be able to be fired by the President at-will rather than just for cause.

Some of the banking agencies could take longer. Changing leadership at the Federal Reserve (Fed) and Federal Deposit Insurance Corporation (FDIC) will not be as fast or straightforward as the other agencies. Fed Chair Jerome Powell’s term does not end until May 2026 and he has said he will not step down if President-elect Trump asks for his resignation. Michael Barr’s term as Vice Chair for Supervision (VCS) ends in July 2026 and his term as a Fed Governor could last until 2032 - although most Fed Governors do not serve out their full terms (former VCS Randal Quarles left shortly after his VCS term expired). There is some uncertainty around whether Trump could remove Barr from his position, with one possibility largely considered legally permissible - appointing another Governor as VCS, likely Michelle Bowman, while allowing Barr to remain as a Governor. However, even in this scenario, the Fed would likely retain its current makeup for at least the next two years and continue to operate on a consensus-seeking basis.

The future of FDIC leadership is uncertain as President Biden’s nominee to lead the FDIC, Christy Goldsmith Romero, is still awaiting confirmation. In the unlikely event she is still confirmed to a five-year term before the Senate changes control in January, her ability to advance policies at the FDIC would be limited by new Trump-appointed CFPB and OCC leaders on the FDIC board. If she is not confirmed, Martin Gruenberg could attempt to serve out the rest of his term which ends in January 2028. There is also an untested possibility Trump could try to remove him for cause in light of workplace culture issues at the FDIC illuminated earlier this year. See Appendix C for a full timeline of agency leadership terms.

FSOC could quickly be made up of nearly all Trump-appointed members. The above changes will result in an almost immediate Trump-appointed majority on the Financial Stability Oversight Council, which is made up of the Treasury Secretary, Fed Chair, Comptroller, CFPB Director, FDIC Chair, SEC Chair, CFTC Chair, FHFA Director, NCUA Chair, and an independent insurance expert. As the current insurance expert and Fed Chair Powell were appointed by Trump in his first term, the only members not appointed by Trump will be the NCUA Chair who can remain in place until April 2027 and possibly the FDIC Chair. Regardless, it is clear that the FSOC could quickly have majority support for changes to policies finalized under the Biden Administration, like its analytic framework for financial stability risks and updated guidance on the nonbank financial company (NBFI) determinations process. A new Treasury Secretary could use FSOC’s statutory requirement to meet regularly as a means to coordinate efforts to streamline regulations rather than topics discussed by the current FSOC, like hedge fund and private credit risk. The new FSOC majority would also likely reaffirm the state based system of insurance regulation.

Shifting practices and priorities

With all of these structural aspects in mind, we discuss likely changes across the following financial regulatory agency practices and priorities.

Deregulation does not mean relaxed supervision, but changes to exam processes are possible

The banking agencies will continue to fulfill their statutory obligations to maintain the safety and soundness of the financial system as well as protect consumers by conducting examinations and requiring remediation in response to identified issues. The SEC and CFTC will also persist in investigations and cases against market manipulation, fraud, and failures of fiduciary responsibilities. There will also continue to be a focus across all agencies on cybersecurity and use of the financial system to aid criminal enterprises. It is also worth noting that both sides of the aisle were critical of self-identified supervisory missteps by the Fed and FDIC with respect to the banks that failed in spring 2023. Examiners across both agencies will seek to prevent similar issues in the future, particularly when it comes to impact to depositors and the deposit insurance fund.

That said, the industry will find new agency leaders more willing to make adjustments in response to complaints around opaque expectations, policymaking through enforcement, and examination findings that relate more to form over substance. Adjustments could include making exams less invasive and more transparent, focusing on substantive deficiencies, and clearly tying supervisory actions to statute and rule violations - particularly in light of the Loper Bright decision. The industry will also seek more clarity on the steps needed to remove supervisory actions as well as supervisory recognition that demands for unduly fast remediation timeframes can lead to worse outcomes. However, such changes would take time to work through the agencies and affect the behavior of career examiners who remain in place across Administrations.

It is also worth noting that President-elect Trump’s announced “Department of Government Efficiency” could impact the entirety of the federal government, including the financial services agencies. However, reductions in agency staff could result in adverse outcomes for the industry in the form of less experienced examiners as well as extended timelines for reviewing applications and responses to enforcement actions.

Basel III endgame re-proposal will not see the light of day in its current form; G-SIB surcharge might

The Basel III endgame, which had a planned re-proposal that has not yet been issued, will certainly be delayed further. If VCS Barr remains in his position, he will have to begin negotiations anew with a new Comptroller, CFPB Director, and possibly FDIC Chair. This will take time, and if Basel III endgame is ultimately re-proposed, it will likely include further relief in line with industry feedback, including with respect to market risk and remaining “gold plating” on credit risk charges. The industry also will likely pursue changes that reduce overlap between Basel III endgame and existing aspects of the stress testing regime. There is unlikely to be movement on the requirement for banks with between $100 and $700 billion in assets to reflect unrealized losses and gains on certain securities and other aspects of accumulated other comprehensive income (AOCI). Ultimately, we do not see a re-proposal emerging until mid-2025 at the earliest - if at all.

In July 2023, alongside the Basel III endgame proposal, the Fed issued a G-SIB surcharge modification proposal. In the same September 2024 speech when he outlined anticipated changes in a Basel III endgame re-proposal, Barr said he would recommend that the G-SIB surcharge proposal would be amended to not include the originally proposed changes associated with client clearing and would be modified to account for effects from inflation and economic growth in the measurement of a G-SIB's systemic risk profile. As the Fed acted alone on this proposal, it could re-propose and finalize these changes while Barr and Powell are on the Board. In response to a re-proposal, G-SIBs would likely push for modifications that eliminate overlapping components of the measurement methodology.

Long-term debt requirements are more likely to be finalized; resolution expectations will remain

The spring 2023 bank failures resulted in the banking agencies lowering the thresholds for requirements and guidance concerning resolution and recovery planning as well as a proposal to expand long term debt requirements to banks with over $100 billion in assets. Although minority members of the Fed and FDIC generally supported issuing the long term debt proposal for comment, they disagreed with some aspects of its calibration and lack of tailoring. As they agree in principle with the benefits of long term debt requirements, they could modify the rule in line with their critiques if they take control of the agencies, rather than abandoning it altogether.

The agencies have steadily escalated resolution planning expectations over the last year, with the FDIC finalizing new requirements for insured depository institutions (IDIs) with over $50 billion in assets; the Fed and FDIC criticizing several of the G-SIBs recent plans; and both agencies issuing new guidance for large regional and foreign banks. As the new guidance was supported by FDIC Vice Chair Travis Hill, Director Jonathan McKernan, and Fed Governor Michelle Bowman, expectations for these banks are unlikely to change. In addition, even though Hill and McKernan opposed the IDI rule, they may hold off on amending the requirements when they are in the FDIC majority as the bank failures brought considerable attention to depository institution resolution readiness.

Liquidity risk management will remain top of mind; rulemaking would face a difficult path

As liquidity and interest rate risk management were underlying factors in the spring 2023 bank failures, the banking agencies have devoted considerable supervisory attention to banks’ contingency funding plans and made numerous statements to encourage use of the Fed’s discount window and the Federal Home Loan Bank system. In May, VCS Barr confirmed that the Fed is considering new liquidity requirements, including for banks to maintain a minimum amount of readily available liquidity based on a fraction of their uninsured deposits as well as a potential restriction on the extent of reliance on held to maturity assets under large banks' liquidity coverage ratios and internal stress tests.

Barr could still attempt to formally propose these requirements, but he would likely face industry pushback and would need to negotiate with the other agencies to avoid divergent standards. In the meantime, we expect that the agencies will continue to use the supervisory process to push banks to update their contingency funding plans and incorporate updated assumptions around the potential speed, nature and severity of deposit outflows and liquidity stress propagation.

Changes at OCC, FDIC and DOJ will ease M&A approvals

The OCC and FDIC both finalized updates to their merger review frameworks on September 17th and the FDIC’s updates were opposed by both Republican members. FDIC Vice Chair Travis Hill criticized the FDIC’s updated policy as “potentially making the process longer, more difficult and less predictable” due to its reduced emphasis on market concentration thresholds and expectation for applicants to demonstrate that a merger would better meet the convenience and needs of the community. FDIC Director Jonathan McKernan opposed the policy on the grounds that it 1) moved away from metric-based presumptions or safe harbors for mergers that do not pose competitive concerns, 2) did not include a clearly defined, tailored approach to assessing competitive effects in rural markets, and 3) only focused on ways a merger could increase risk to financial stability. Industry stakeholders opposed the OCC’s policy on numerous grounds, including its removal of expedited review and its rigid approval assessment framework. Accordingly, it is likely that new leadership of both agencies would revise these policies in line with these critiques and aim to make the process more efficient.and transparent. Along with an expected Department of Justice with a more relaxed stance on anti-trust enforcement, we expect streamlining of bank merger frameworks to pave the way toward accelerated consolidation efforts.

Community Reinvestment Act modernization will likely go back to the drawing board

In October 2023, the Fed, FDIC and OCC finalized their rule to modernize the Community Reinvestment Act (CRA). The final rule was challenged by an industry lawsuit filed in February 2024, arguing that the agencies exceeded their statutory authority and violated the Administrative Procedures Act. If the final CRA modernization rule is overturned, the agencies will need to go back to the drawing board to agree on updates to account for changes in the industry since the rule’s last major update in 1995. During the last Trump Administration, disagreement among the agencies resulted in independent action, with the OCC finalizing its own updates in June 2020 and the Fed issuing a separate proposal in September 2020.

The CFPB will pull back from Chopra’s aggressive consumer protection stance

A new CFPB Director will likely return the Bureau to its more limited approach during the last Trump Administration of fulfilling its statutory responsibilities and going no further. This does not mean that the CFPB will cease its enforcement activity as it still carries a statutory consumer protection mandate and in fact issued 112 enforcement actions under the last Trump Administration while the current Biden Administration CFPB has issued 88. However, the severity of penalties will likely decrease and the Trump Administration may seek opportunities to scale back CFPB requirements and activities to focus on transparency, efficiency, and “consumer choice.” The last Trump-appointed CFPB Director Kathy Kraninger took actions aligning with this approach, including rescinding the “ability-to-repay” requirement of the agency’s payday lending rule, dismissing all 25 members of its consumer advisory board, shutting down public access to its consumer complaint database, and limiting its oversight of student loans.

A new Director could also reverse or modify rules finalized under the Biden Administration by declining to defend them against ongoing legal challenges or proposing new rules that supersede them. There are current lawsuits against the final CFPB rules on consumer data access, credit card late fees, and small business lending reporting - each of which could have a different trajectory. The credit card late fee rule has seen substantial opposition from Republicans including Senator Scott and is unlikely to survive in its current form. The rule to implement Dodd-Frank Section 1071 on collecting small business lending data has thus far survived legal challenges but the latest ruling has been appealed by industry plaintiffs. A new CFPB Director could issue an updated version of the rule that addresses some industry criticisms, including the collection of gender identity and sexual orientation data. On the other hand, the rule to implement Dodd-Frank Section 1033 and provide third parties access to consumers’ financial data has had some Republican and industry support, particularly from fintechs. As the lawsuit against the rule works through the courts, a new CFPB Director could choose to propose a modified version.

More broadly, the Republican sweep of Congress could affect the funding and structure of the CFPB. Congressional Republicans have been critical of the CFPB since its inception, and could reconsider legislation to limit the agency’s authority and funding, including a bill to subject the CFPB to the regular Congressional appropriations process. However, Senator Warren would vigorously defend the CFPB so any such legislation would only pass if the filibuster is removed.

Climate risk management will be de-emphasized and SEC disclosures will not survive

The SEC’s climate risk disclosures are not likely to go into effect during the new Trump Administration as they are already facing a difficult legal battle that a new Chair could choose not to fight. However, companies that operate in the European Union and/or California will face even more stringent climate risk disclosure requirements under the European Union’s Corporate Sustainability Reporting Directive and California’s SB253. In August, the California legislature formally declined to delay its sustainability reporting regulations, meaning that both public and private companies that meet certain revenue thresholds and "do business" in California need to prepare to report information on their greenhouse gas emissions as soon as 2026. In fact, shortly after the election, California Governor Gavin Newsom convened a special session of the state legislature to protect “California values…including climate action” from an incoming Trump Administration. Beyond California, it is possible that states with significant corporate and financial services presences such as New York and Illinois could consider similar climate-related disclosures.

The banking agencies will likely de-emphasize climate risk management expectations outlined in their high level principles and discontinue efforts such as the Fed’s climate scenario analysis initiative. The OCC’s most recent bank supervision operating plan elevated consideration of climate-related risk from information gathering to “target examinations to assess banks’ ability to identify, measure, monitor, and control climate-related financial risks in a safe and sound manner.” The next supervision plan under a Trump-appointed Comptroller would likely remove the climate-related risk section altogether. However, there is growing recognition across the industry that physical and transition risks associated with climate change can have a real impact on their strategies and operations. While there will be no supervisory actions associated with climate risk management anytime soon, examiners may still be interested in how banks are integrating climate risk in the management of other risk stripes. In addition, similar to the disclosures landscape, European regulators will continue to focus on climate risk and the New York Department of Financial Services has issued its own climate risk management principles for banks and insurers.

A more favorable environment for digital assets

The digital assets space had some of the most positive reactions to the election, with Bitcoin reaching a new record high. Many in the space see allies in the incoming Trump Administration, including Trump himself as he repeatedly vowed during his campaign to ease digital asset regulatory restrictions, and the incoming Congress. Digital asset companies and groups were significantly active in donations and advertising during this election and it has resulted in what one CEO called “the most crypto-friendly Congress ever.”

The quickest changes to digital asset policy would come through changing the makeup of the SEC. A new SEC Chair could officially reverse policies like the Staff Accounting Bulletin (SAB) 121 classifying digital assets as liabilities and pull back on what the industry has criticized as “regulation by enforcement” in cases where the SEC has issued charges related to registration rather than fraud. A new Comptroller could also open doors for bank engagement with digital assets, following the example of former Comptroller Brian Brooks who took several steps to advance the integration of blockchain, stablecoins, and digital assets into the mainstream financial system including interpretive letters on banks’ use of stablecoins to conduct payment activities and ability to provide custody services for digital assets.

Legislation to define supervisory jurisdiction and establish a regulatory framework for digital assets would provide the most clarity for the industry and there is reason to believe that efforts with strong consumer protection elements could win bipartisan support. Notably, both chambers passed a resolution to overturn SAB 121 before it was vetoed by President Biden and the House passed the Financial Innovation and Technology for the 21st Century Act which would delegate more oversight authority to the CFTC. The CFTC is already considered to be less critical of digital assets than the SEC and any nominee to lead the agency would likely be vetted for industry-friendly views.

Fintechs will get some wishlist items but should not expect a major policy overhaul

Many in the fintech space also expect a loosening of restrictions that will enable innovation and further forays into providing financial services to consumers. A key flashpoint over the last few years has been access to a Fed Master Account, with the Fed issuing guidelines and successfully defending decisions to deny access to some non-traditional depository institutions. Not only are these policies unlikely to change unless there is turnover of Fed leadership and key staff, they may remain in place due to opposition from traditional banks. Conversely, fairly fast turnover on the FDIC Board will stall recently proposed adjustments to 2020 rules governing parent companies of industrial banks and loan companies (ILCs) and brokered deposit regulations. New FDIC and OCC leadership could also usher in a revival of issuing banking and industrial loan company (ILC) charters to fintechs. However, in light of previous successful legal challenges and the Loper Bright decision, it will likely take legislation to clarify the agencies’ ability to issue charters to fintechs.

When it comes to fintechs partnering with traditional banks, third party risk management has been a growing concern for the banking agencies in recent years, with the Fed and OCC even creating new supervision groups dedicated to novel technologies. We do not expect this concern to go away under new leadership, particularly with regard to cybersecurity and data protection. Nevertheless, new leaders may undertake an approach to encourage innovative practices with policies like regulatory sandboxes and other steps recommended in the 2018 Treasury report on nonbank financials, fintech and innovation.

Regulators will keep a watchful eye as AI adoption continues

As financial institutions continue to increase the pace of adoption of artificial intelligence (AI), they can expect a more supportive regulatory environment. Trump has vowed to withdraw President Biden’s EO on AI calling for security safeguards, data privacy protections, prevention of algorithmic discrimination and consumer protection measures. Instead, he will likely return to the spirit of his first Administration’s EO, which called for reducing barriers to AI innovation. Nevertheless, while the agencies will be cautious not to unduly inhibit the adoption of this rapidly evolving technology, they will continue to be focused on their statutory obligations to oversee financial institutions’ use of this technology under the familiar lenses of cybersecurity, consumer protection, and third-party risk management. State agencies and lawmakers are also carefully watching financial institutions’ use of this technology and will likely step to fill any gaps. California has led this effort to date, with Governor Gavin Newsom recently signing 17 AI-related bills that include data privacy and protection requirements, consumer protection measures and anti-fraud and deceptive content laws.

A new SEC Chair will likely unwind many of Gensler’s proposed and final reforms

Current SEC Chair Gary Gensler has used his term to advance a number of priorities, including environmental, social and governance (ESG) disclosures, market structure reforms aimed at leveling the playing field with wholesalers, increasing transparency around private funds, and improving cybersecurity risk management across SEC-supervised entities. He has made substantial progress on these priorities, finalizing 40 rules since 2021, but several have already run into legal challenges ( the Fifth Circuit Court of Appeals vacated five August 2023 SEC rules aimed at enhancing private fund investor protection) and others will likely be blocked or undone by a new SEC Chair. Instead, new SEC leadership would likely prioritize clarity and wider availability of digital asset-based securities; a review of and pull back on the volume of data required to be filed with the SEC; more friendly regulation to encourage capital raising, including for small businesses; and a return to the focus of the SEC on retail investing.

On the ESG front, in addition to the likely demise of the SEC’s climate risk disclosures discussed above, efforts to propose new human capital disclosures will not see any further progress. The proposed disclosures on ESG investment practices will not be finalized and a new SEC may even issue guidance against prioritizing such factors for retirement investors. In addition, there is an ongoing legal challenge to the SEC’s approval of a Nasdaq rule to require its listed companies to disclose information about their board demographics and have a certain proportion of members from an underrepresented group. A new SEC Chair could pull back from defense against this lawsuit and decline to approve any similar rules.

Several rule proposals impacting investment advisers (IAs) will likely not move forward given their pushback from the industry and opposition by Peirce and Uyeda. For example, the proposal on IAs outsourcing certain functions would require additional obligations on many service providers who are not within the SEC’s jurisdiction. Other outstanding proposals will either not be finalized or run the risk of being overturned under the Congressional Review Act, including 1) a proposal to require certain stock orders to be exposed to an auction market before they can be executed by a wholesaler, 2) the SEC’s first best execution standard, 3) a proposal to require certain large Treasury trading platforms to register and comply with Regulation ATS, Regulation Systems Compliance and Integrity (SCI), and the Fair Access Rule, and 4) proposed requirements to address the use of predictive data analytics by IAs and broker-dealers.

Final rules that have been criticized by Congressional Republicans and/or opposed by current Republican SEC Commissioners Hester Peirce and Mark Uyeda could be reversed or modified by a new Chair, including 1) new rules that expand the definition of a “dealer” to include a broader subset of market participants, 2) more detailed private fund disclosures on Form PF, and 3) cybersecurity disclosures by public companies. In contrast, some of Gensler’s other reforms that have not seen significant opposition, such as central Treasury clearing, could proceed to implementation with limited modifications or delays.

Sanctions and financial crimes will still be a priority, but will see some shifts in focus and standards

Sanctions are an important aspect of foreign policy that often remain in place across Administrations. However, we could see shifts in the focus of sanctions, including potential loosening of those related to Russia and strengthening against Iran and Venezuela. China will likely remain a consistent target of restrictions, such as the Treasury Department’s recently finalized outbound investment restrictions. New actions could align with Senator Scott’s calls for using economic tools to counter China and JD Vance’s bill that would restrict the Chinese government from accessing U.S. capital markets if it violates international finance, trade and commerce laws.

As there is high bipartisan interest in diligent enforcement of anti-money laundering (AML), counter-terrorist financing (CFT), and sanctions standards, there is unlikely to be any slowdown in activity. However, we could see some changes to lessen the compliance burden with elements of the customer due diligence (CDD) rule and AML requirements for registered investment advisers. New leadership of the Treasury Department and Financial Crimes Enforcement Network (FinCEN) could be more open to changes to allow more innovation and efficiency in identifying and reporting suspicious activities.

What should firms do now?

- Prepare for regulatory change. To get ahead of what may come once Republicans take control of Congress and the Presidency - potential legislation, agency appointments and deregulation - firms should ensure that regulatory change management processes are operating effectively to monitor regulatory developments, assess their impact on the organization and communicate those implications to the relevant stakeholders. They will need to update enterprise risk assessments and resulting risk inventories to reflect how these implications may affect business strategies and operations. Open and frequent lines of communication with risk leaders will be critical to support swift decision-making.

- Prepare for EOs and legal uncertainty. EOs can come quickly, without the visibility and advance notice that typically accompanies legislation. They are also likely to invite legal challenges, as are new regulations in the post-Chevron era. To manage the uncertainty, firms should develop monitoring and risk-assessment capabilities that account for these complexities, conduct scenario planning and prepare potential responses.

- Assemble wish lists for regulatory relief and supervisory transparency. Trump-appointed agency leaders will likely be more receptive to well-reasoned feedback on compliance burdens without commensurate benefit and supervisory practices that result in more confusion than improvement. The new administration will not grant every request, but firms should be prepared to provide defensible reasoning for relief in response to new proposals and requests for information.

- Maintain strong compliance practices. While regulatory changes work through the agencies and courts, supervisory expectations will remain high and some states will retain requirements that are pulled back on a federal level. Throughout this process, firms should continue to maintain robust compliance and risk management practices, both to avoid supervisory actions and as a strategic imperative.

- Appendix A: Regulatory actions potentially subject to Congressional Review

- Appendix B: Key legal challenges to financial regulation

- Appendix C: Agency leadership timeline

Appendix A: Regulatory actions potentially subject to Congressional Review

The below regulatory actions (including some guidance, as the Congressional Review Service notes that “the definition is sufficiently broad that it may include agency actions that are not subject to traditional notice-and- comment rulemaking, such as guidance documents and policy memoranda”) were published after the current estimated eligibility date to be overturned by the Congressional Review Act.

Agency |

Action |

Publication Date |

CFPB |

Personal Financial Data Rights |

11/18/24 |

CFTC |

9/12/24 |

|

CFTC |

Guidance on Listing of Voluntary Carbon Credit Derivative Contracts |

10/15/24 |

FinCEN |

Anti-Money Laundering Regulations for Residential Real Estate Transfers |

8/29/24 |

FinCEN |

9/4/24 |

|

OCC |

10/22/24 |

|

OCC |

9/25/24 |

|

OCC, Fed, FDIC, NCUA, CFPB, and FHFA |

08/07/24 |

Appendix B: Key legal challenges to financial regulation

Rule |

Detail |

Status |

CFPB Open Banking Rule (1033) |

The lawsuit alleges, among other claims, that the CFPB interpreted “consumer” unreasonably to include authorized third parties. |

Pending before Eastern District of Kentucky Federal Court. |

CFPB Payday Lending Rule |

The lawsuit challenged the CFPB’s funding structure as being “double insulated” from Congressional appropriations. |

The Supreme Court decided that the CFPB’s funding structure is constitutional on May 16, 2024. |

CFPB Credit Card Late Fees Rule |

The lawsuit alleges, among other claims, that the rule would prevent card issuers from collecting penalty fees that are “reasonable and proportional.” |

A Fifth Circuit panel denied a petition to change venue to DC in June 2024. |

Fed, FDIC and OCC Community Reinvestment Act |

The lawsuit alleges, among other claims, that the rule exceeds statutory authority by adding assessment areas outside of banks’ physical deposit-taking presences. |

Northern Texas District Court granted a preliminary injunction in March 2024; the Agencies are prohibited from enforcing against the plaintiffs until a final decision is reached. |

CFPB Small Business Rule (1071) |

The lawsuit alleges, among other claims, that the rule exceeds statutory authority by adding new data points to be collected. |

The Southern District of Texas Federal Court upheld the rule in August 2024. |

SEC Climate Disclosures |

The lawsuit alleges that the rule is arbitrary and capricious and did not undergo a proper cost/benefit analysis. |

The Eighth Circuit was appointed in March 2024 to hear combined cases. Previously, the Fifth Circuit issued a preliminary injunction. |

SEC Stock Buybacks Rule |

The lawsuit alleges that the SEC failed to undertake a proper cost/benefit analysis. |

Fifth Circuit decided that the rule is unconstitutional in October 2023. |

SEC Private Funds Rule |

The lawsuit alleges the rule exceeds statutory authority under the Advisers Act and is arbitrary and capricious. |

Fifth Circuit struck down the rule in June 2024 and the SEC announced that they will not appeal. |

Appendix C: Agency leadership timeline