Advanced analytics fuel tomorrow’s commercial strategy for drugs and devices

Advanced analytics in the pharmaceutical and life sciences industry – including tools such as artificial intelligence, machine learning and data mining – has the potential to transform the pharma commercial function. Process automation and data-driven predictive insights have the ability to dramatically change how executives make strategic decisions and manage financial performance across all commercial areas. While some organizations have begun to advance their analytic capabilities, the level of sophistication varies substantially from one company to the next. This variability is driven by challenges in moving a company culture to one that embraces advanced analytics, recruits and develops the right analytic talent, and invests to cultivate an integrated data environment to support advanced analytic methodologies and tools.

Companies at the higher levels of analytics maturity have identified a working model for analytics, and have succeeded in the race for talent, with support from a corporate culture that embraces data-driven insights and decision-making, and incentivizes workers to learn new skills. Assembling the right mix of technology, data, and skills can lead to stronger revenue growth and improved operational performance in the commercial function.

An advanced analytics capability could—depending on the type of product and lifecycle stage—deliver “at least a 10 percent net impact from a top- and bottom-line perspective,” said Sai Jasti, GlaxoSmithKline’s chief data officer, US commercial pharmaceuticals, in an interview with HRI.

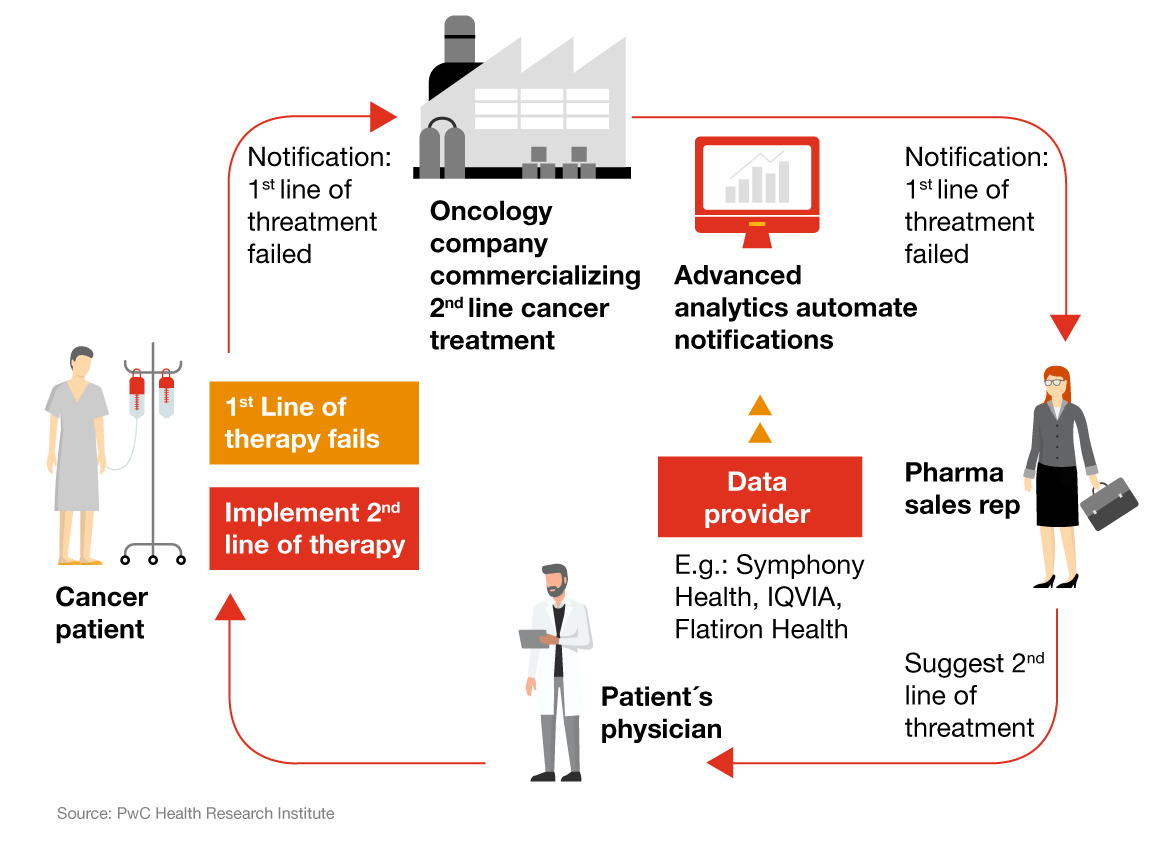

How an oncology company could use advanced analytics to boost commercial opportunities for a second-line treatment for cancer patients

Recommendations

- Explore and aggregate currently accessible data sources

- Adopt analytics and technologies used in other industries

- Find a partner to overcome challenges associated with cost, time and talent

Explore and aggregate currently accessible data sources

Siloed data continues to prevent pharmaceutical and life sciences companies from extracting the maximum amount of value from data. Drug and device companies should introduce digital and analytic training programs to current employees to increase workforce digital IQ.

Adopt analytics and technologies used in other industries

The collection and use of consumer data has dramatically improved revenue growth in other industry sectors. Drug and device makers should consider bringing in new talent with experience using technology, data and analytics to generate insights. Organizations should also evaluate new technologies in the context of specific business problems to get the most out of investments.

Find a partner to overcome challenges associated with cost, time and talent

While many of the largest pharmaceutical companies have organically grown their advanced analytics function over time, midtier and smaller manufacturers need to catch up quickly in order to compete. A hybrid or fully outsourced model for analytics may help these organizations catch up with, or leapfrog, their competitors. Organizations should evaluate the pros and cons of each model type according to individual needs and experience.