Pharmaceutical and life sciences

PwC's Pharma and Life Sciences practice provides guidance on business issues for the biotechnology, medical device technology and life sciences industries.

Welcome to our latest quarterly industry insights for pharmaceutical, life sciences, medtech, healthcare, and not-for-profit sectors. This edition spotlights the Trump administration's healthcare agenda and includes a summary of regulatory and accounting updates as well as PwC’s recently released industry publications about what’s next in pharma and health services. Additionally, we explore other pertinent topics that significantly influence the health industry.

President Trump's strategic agenda for healthcare is taking shape and sets the stage for significant healthcare transformation that aims to prioritize prevention over treatment, enhance personalized care and cut drug costs. Looking ahead, the Trump administration and the Republican-controlled Congress are in a position to accelerate their health agenda with four key themes:

Read our latest publication for insights on how these initiatives can reshape the healthcare landscape, influence market dynamics, and impact budget allocations.

The FASB’s new segment expense standard, ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, is now effective for calendar year-end public entities.

With many public entities having filed their 2024 annual reports, the focus on application of this new guidance will now shift to the interim requirements. ASC 280 requires that nearly all of the annual numerical segment disclosures, including the new disclosures introduced by ASU 2023-07, be made on an interim basis. The reconciliation of the total of an entity’s measure of segment profit or loss for all of its reportable segments to consolidated income before income taxes and discontinued operations is also required for interim periods. However, the reconciliations of the total of reportable segments’ revenues and assets to the consolidated totals are not required for interim periods.

Please refer to our Financial Statement Presentation Guide for further information on the required segment disclosures for interim periods.

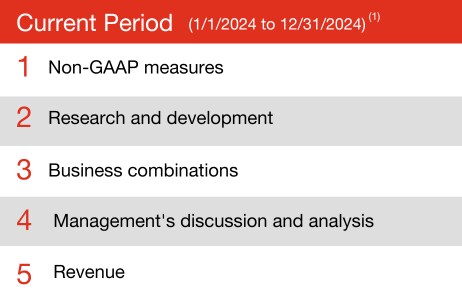

(1) This analysis was performed based on topical areas assigned by research firm Audit Analytics for comment letters publicly issued in the 12 months ended December 31, 2024 (Current Period) and the 12 months ended December 31, 2023 (Prior Period) in relation to Form 10-K and Form 10-Q filings.

Our analysis of SEC comment letters has been updated for letters made public through December 31, 2024. The top five comment letter trends remain relatively consistent with the prior quarter.

Non-GAAP measures continue to be a focus area for the SEC staff, as they consistently top the list of comment letter topics and have recently been at the center of SEC enforcement actions. This In depth provides additional insights on non-GAAP measures. It also includes recommendations for companies’ presentation of non-GAAP measures consistent with the guidance.

Upcoming live webcast: June 12 | 1 – 2:30pm ET

Join us for our accounting and reporting webcast where we will focus on the impact of the new administration on the health care regulatory environment as well as overall accounting and regulatory updates.

What’s next in pharma and health services

Major events shook the industry in 2024 and led to predictions for 2025 along with a vision of value creation over the five-year horizon. You can rise above the challenges of the new year by acting on the 10 sector dynamics we outline for 2025 in our Next in health services 2025 publication.

With many CEOs doubting their business model can survive another decade, it’s time to change the game. We outline four strategic bets and a suite of capabilities to help you determine how your company can create value in the future in our Next in pharma 2025 publication.

Tune into our latest podcast episode, where PwC specialists analyze the key trends shaping the healthcare industry in 2025. Catch up on past episodes here.

Artificial Intelligence is transforming healthcare affordability, enabling providers and payers to reduce costs while improving patient outcomes.

A healthcare organization simplifies risk through a compliance-by-design mindset. Learn more.

We also have featured publications here which offer deeper insights into the Health Industries sector.

PwC's Pharma and Life Sciences practice provides guidance on business issues for the biotechnology, medical device technology and life sciences industries.

PwC's Health services provides healthcare payers and providers with insight on improving the patient experience, changes in regulation and reform and innovating.

PwC’s Health Policy and Intelligence provides risk and regulatory professionals with the latest developments as regulatory requirements evolve in the health industry.

Health Industries Assurance Leader, Global Engagement Partner, PwC US