Edge data centers: how to participate in the coming boom

The market for edge data centers is expected to nearly triple by 2024

The global market for edge data centers is expected to nearly triple to $13.5 billion in 2024 from $4 billion in 2017, thanks to the potential for these smaller, locally located data centers to reduce latency, overcome intermittent connections and store and compute data close to the end user.

However, the right timing and strategy for moving data centers (and related services) to the edge will be different for each organization, depending on the conditions, environment and business opportunities in its marketplace.

Closing the 64 zettabyte data gap

By filtering the data close to the source, low-cost edge centers can help close the potential 64 zettabyte gap between global data center traffic and useable data created.

Five trends driving edge data centers' growth

- Arrival of 5G. The decentralized small cell network of edge data centers provide low cost, low latency support for high device density 5G use cases (e.g., smart-city applications).

- IoT proliferation. Low latency edge processing is key to managing the increasing volume of data as more and more IoT sensors and devices are installed in home and industrial settings.

- Widening data gap. By filtering the data close to the source, low-cost edge centers can help close the potential 64 zettabyte gap between global data center traffic and useable data created.

- Adoption of SDN and NFV tech. Software-defined networking and network function virtualization enable software running on data centers to replace costly specialized hardware.

- Video streaming and AR/VR. Decentralized, low-cost edge data centers reduce streaming latency and provide the performance that consumers and business users demand.

Potential use cases for edge data centers

Edge data centers may soon handle much of the data that flows through many sectors of our economy.

Agriculture: Billions of farm animals are scattered all over the world. Farm analytics to manage disease are adding to the data gap—which edge centers can close.

Banking: Edge data centers provide the low latency that traders and asset managers increasingly depend on.

Defense: Military drones connected to edge computing react faster and relay information more quickly.

Health care: Robotic surgeries depend on ultra-low latency computing and uninterrupted network access, which edge data centers supply.

Industry 4.0: Multiple smart factory use cases include machine predictive maintenance and predictive quality management.

Inventory: Analytics at the edge can increase efficiency for robotic picking and inventory management, as well as for delivery fleet management and package tracking.

Mining: When analyzing data from mines that could indicate dangerous geological or chemical conditions, edge computing’s low latency can save lives.

Adoption of edge data centers will vary by sector

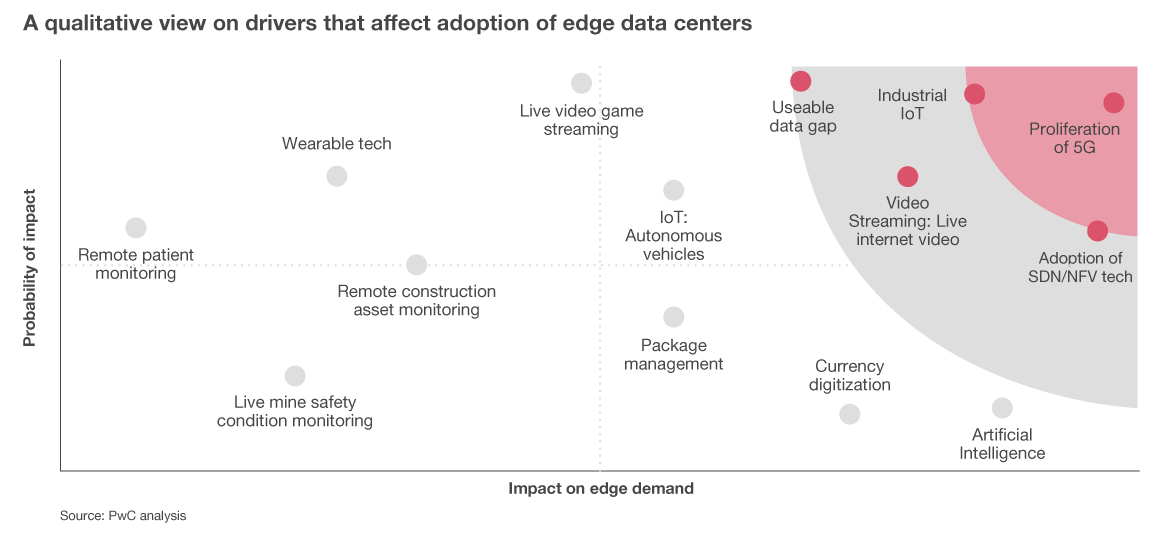

While the global market for edge data centers is expected to be strong, different sectors and industries will likely vary in pace of adoption, based on impact of edge demand and probability of that impact.

Are edge data centers right for you? Five key questions to ask

To make the right strategic choice about how to approach edge data center technology and related markets and applications, companies should look for answers to the following five questions.

- How fast will technology and market trends impact my line of business? (E.g., tailwinds in favor of 5G or I0T may be stronger or weaker for Chinese or US companies.)

- Are my competitors using edge data centers already, or is this my opportunity to take the lead?

- What are the new value chains and how do they fit my present and future business models?

- What’s the cost to build, maintain, administer and secure a geographically dispersed network of edge data centers?

- Are there additional revenue opportunities for my company to build, service and offer managed services for edge data centers?