In this white paper, you’ll discover how:

New digital tools often create new avenues for criminal activity and increase compliance risks

Models are growing in number and complexity as Tier 1 and Tier 2 institutions strive to keep up with regulatory pressures

Improving model risk management (MRM) requires overcoming data integrity, disparate databases and documentation challenges

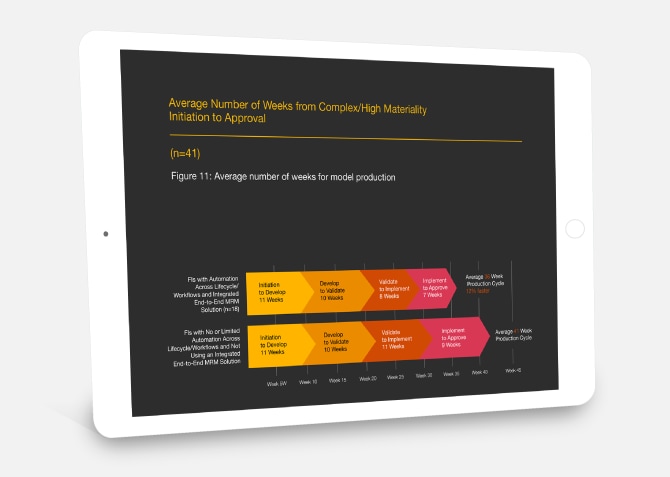

Adopting automation and integration across workflows and throughout the model lifecycle can help boost efficiencies

More work, more complexity, more scrutiny—what's happening?

In today’s dynamic risk environment, traditional governance, risk and compliance (GRC) software alone is no longer enough. Financial institutions (FIs) need a holistic solution that can help them keep pace with the following MRM challenges:

- The digital transformation

The rise of crypto, AI and other digital technologies, along with the expanding Internet of Things (IoT), are providing criminals with new tools. FIs require advanced model solutions that can quickly adapt to address evolving cyber risks. - Faster pace of market changes

Shifting market factors are not only impacting compliance risk analysis but also front-office sales and marketing functions. It’s critical for FIs to have the agility to capitalize on new opportunities while not loading up on risks. - Increased regulations

Growing regulatory pressure and recent high-profile bank failures are prompting regulators to scrutinize risk-model governance, inventory and validation practices, demanding proper controls for model development and monitoring.

Key findings

Discover how automation and an integrated end-to-end MRM solution can help improve model risk operations

Financial institutions need more efficient approaches to meet today’s demands. See where automation is having the greatest impact in Future proof model risk management with an integrated MRM platform, a white paper from KS&R and PwC.

Download the report

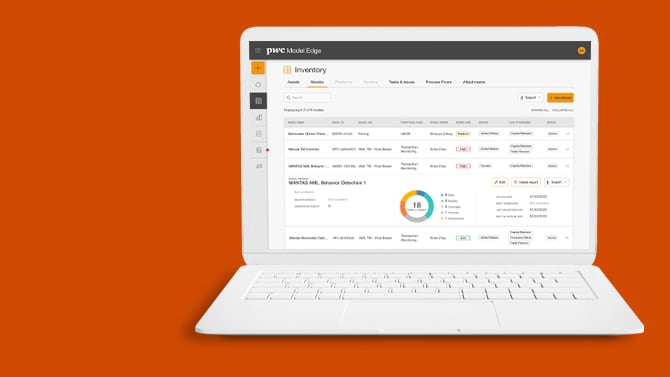

Streamline model risk management with Model Edge

Struggling to manage your model operations? Model Edge, a PwC product, can help accelerate the end-to-end model lifecycle, giving you tools, templates and test scripts to identify and manage risk more effectively.