{{item.title}}

Watch now

Whether you’re prospecting new customers or servicing existing ones, our Industry Cloud lets you customize journeys and offers and deliver consistent experiences across mobile and web.

Our Cloud Intelligence integration fabric links modern and legacy core applications with existing banking ecosystems and leading ERPs. This end-to-end solution delivers a unique customer experience while reducing development time and costs.

A flexible architecture lets you launch our cloud-native, pre-built assets as a replacement to—or in parallel with—existing systems. This can reduce the time, expense and regulatory risk associated with modernizing your bank and core.

Watch this webinar to learn how core technology modernization can help banks and financial institutions reimagine how to serve their customers better, innovate and manage risks in a digital age—and how Industry Cloud can help deliver.

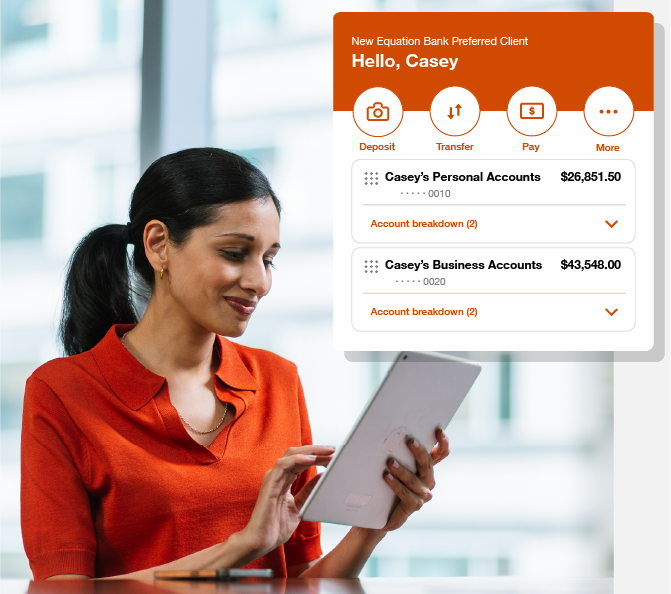

Accelerate your digital modernization by leveraging PwC’s banking experience and customer servicing portal accelerator. The portal provides pre-built features that can be personalized, deployed quickly and help increase your share of wallet. It works seamlessly with our banker servicing portal, and its intuitive interface can help improve efficiency with features like predictive servicing and integrated chat.

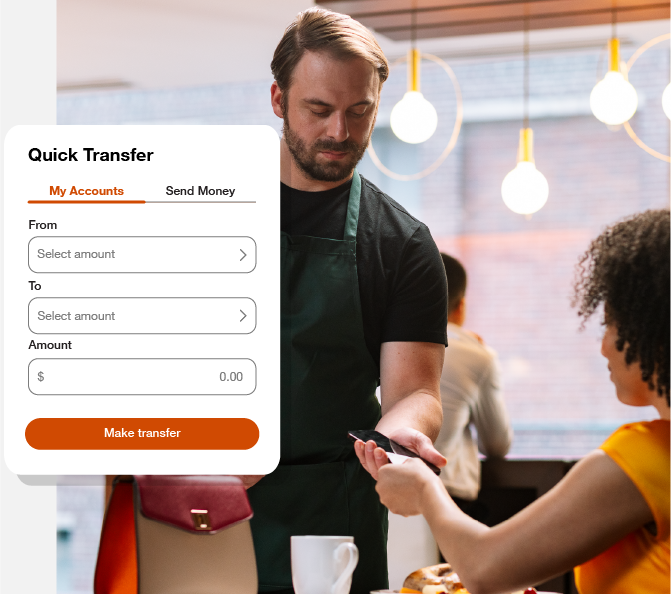

Customers want the ability to move money anywhere as quickly and cost effectively as possible. That’s why PwC created an accelerator that, in real time, intelligently recommends the optimal payment method. Our solution can be integrated easily into your existing digital platform. You can see payment details and even repair them with our powerful dashboard, which consolidates information from multiple payment hubs. This holistic solution is designed to help reduce operational costs and resolution time.

Customer acquisition is the key to fueling growth. Clients expect a seamless omnichannel digital experience and want a bank that understands their needs. PwC helps deliver on this by providing expertise and a set of digital accelerators. Our solution can help you identify ideal customers, build and manage campaigns to drive acquisition with personalized offers and deliver a streamlined, fully digital onboarding experience.

PwC’s Commercial Banking offerings take a business-led approach to help you power transformational change, bolster user adoption and deliver positive ROI. We focus on three targeted solutions: Treasury management onboarding and Commercial deposit account opening, Commercial loan origination and Loan accounting systems. Combined, these can help you digitize and automate the end-to-end Commercial Banking process.

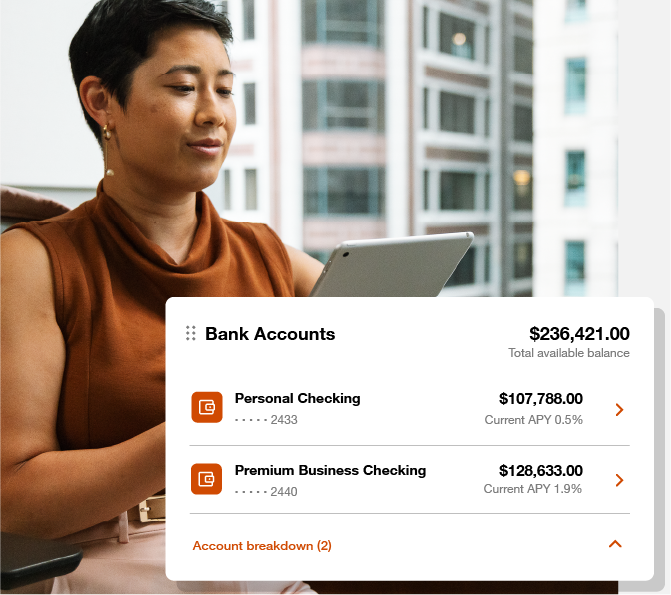

Whether you are moving to a 3rd gen core—such as Finxact, Thought Machine or Technisys—or want to run it alongside a legacy core, PwC’s experience and digital accelerators provide a migration path without disrupting business operations and client experience. Our solution lets users view accounts and data from multiple cores as well as conduct financial transactions between them from a unified interface.

PwC has developed industry-leading services and APIs that can be embedded into existing customer experiences, helping you offer new financial products to your clients. Our services can also be bundled to power a Banking as a Service (BaaS) offering. This allows you to provide full banking capabilities to a broad spectrum of clients, complete with the necessary cyber, regulatory and compliance requirements.

Peter Pollini

Financial Services Industry Leader, PwC US

Alison Hoover

Financial Services Transformation Leader, PwC US

Sean Viergutz

Principal, Banking and Capital Markets Advisory Leader, PwC US

PwC Products & Solutions Leader, PwC US

In our rapidly changing digital world, risk isn't just a challenge—it's an opportunity. Risk Link can be the compass helping guide your financial services organization towards the future of risk and compliance excellence. Our integrated risk intelligence platform can help streamline operations, enhance strategic decision-making and unlock opportunities for increased enterprise value.