{{item.title}}

{{item.text}}

{{item.text}}

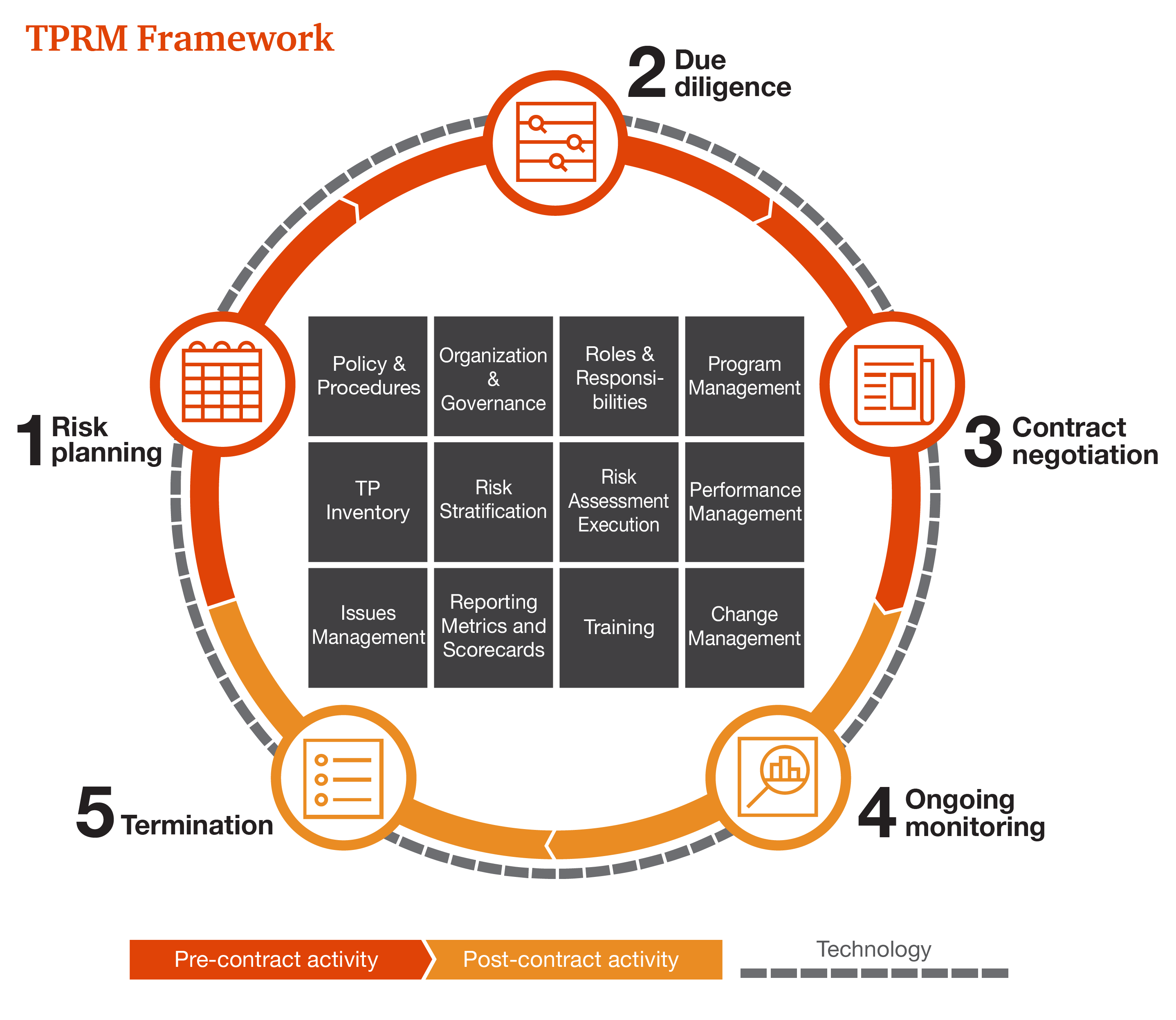

Our team applies innovative approaches and technologies that help our clients effectively manage their risk exposure so they can properly identify, mitigate and monitor the third-party risks most impactful to their operations. We help our clients design, build and manage fit-for-purpose third-party risk programs that protect their operations, brand and reputation at an optimal cost to operations.

TPRM Program Assessment:

Compare your program maturity against industry peers, regulatory expectations and leading practices to enhance your TPRM program commensurate with the risks posed by your network of third parties

Program Design & Build:

Design and build a fit-for-purpose TPRM program that protects your organization's operations, brand and market reputation

TPRM Assessment Support:

Conduct high-volume third-party risk assessments targeted to specific risk areas. Define and assess the proper third-party controls through observations, review of requested evidence as well as remote and on-site verification testing

Technology Selection, Implementation & Optimization:

Select the most appropriate TPRM technology solutions to meet your third-party risk management needs. Review and optimize existing TPRM applications to improve technology coverage and drive a consistent, efficient and integrated TPRM program

TPRM Managed Services:

Receive end-to-end TPRM technology and process support that meets the needs of your operations, risk profile and regulatory expectations

Customer Risk Response:

Organize, structure, and build a formal, technology-enabled program to streamline the management of customer audit and risk assessment requests, based on a library of standardized, approved responses

{{item.text}}

{{item.text}}