Tech Enabled Integrated Risk Management (IRM)

Why companies are looking to modernize and transform their integrated risk management (also known as GRC) programs

Successful implementation of integrated risk technology programs result in better business outcomes:

- Provide confidence to shareholders that the business is scaling in a safe and secure manner by proactively managing risks that are most important to strategy

- Understand risk and compliance requirements to more quickly expand - either organically or through M&A - into new markets, geographies or products

- Address the complex and evolving regulatory landscape, while managing the cost of compliance

IRM is the opportunity to align and coordinate existing risk and compliance programs activities, to bring greater efficiency, transparency of information and effectiveness

- Risk and compliance programs are perceived as time consuming, manually intensive, check-the-box exercises with limited business value

- Duplicative programs create risk management fatigue and impedes proactive risk identification from adapting with the rapidly changing risk landscape

- With risk and compliance data and processes scattered across multiple systems in unstructured formats, leaders struggle to make risk-informed business decisions

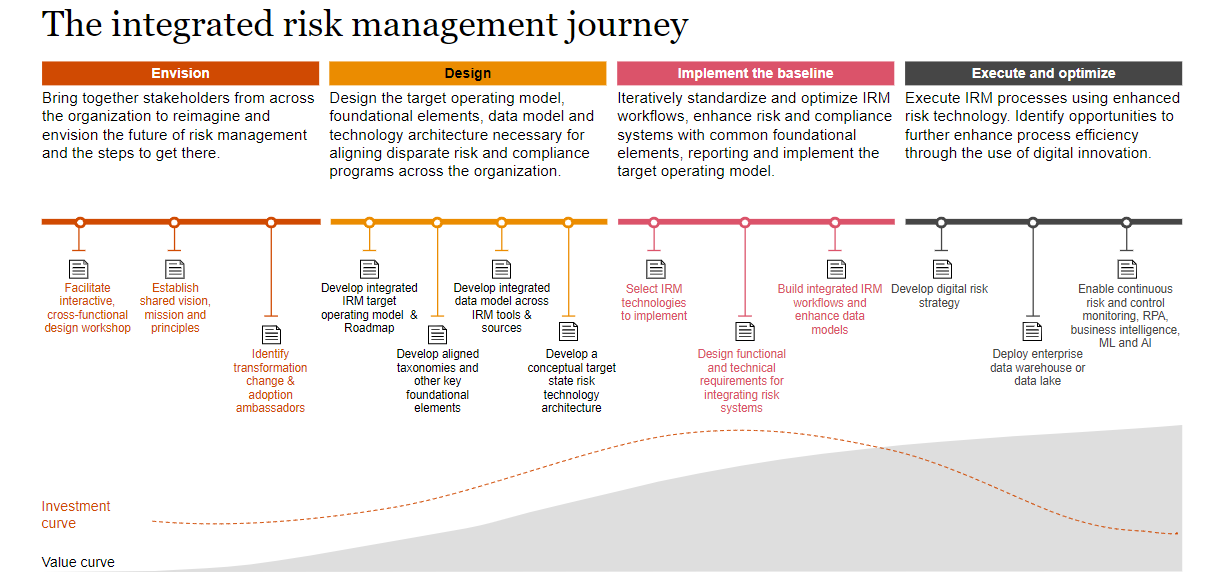

From strategy through execution, the goal of a tech enabled integrated risk management (IRM) program is to help our clients envision, design, launch, manage and continually optimize their digital integrated risk management and compliance solutions.

From a siloed approach to integrated risk management: A consistent framework that aligns risk and compliance functions around a common operating model and standards

From fragmented data and technology to integrated risk technology and analytics: Workflow-enabled risk management with consistent taxonomies, built-in integration points, shared outputs & centralized risk data stores

From onerous and administrative to optimized and value-added: A harmonized data model that provides the right information to the right stakeholders at the right time to inform transparent business decision-making & eliminate redundancy

From reactive and tactical to proactive and strategic: A shared transformation vision that imagines the digital future of work and drives a structured and sustainable long-term innovation strategy

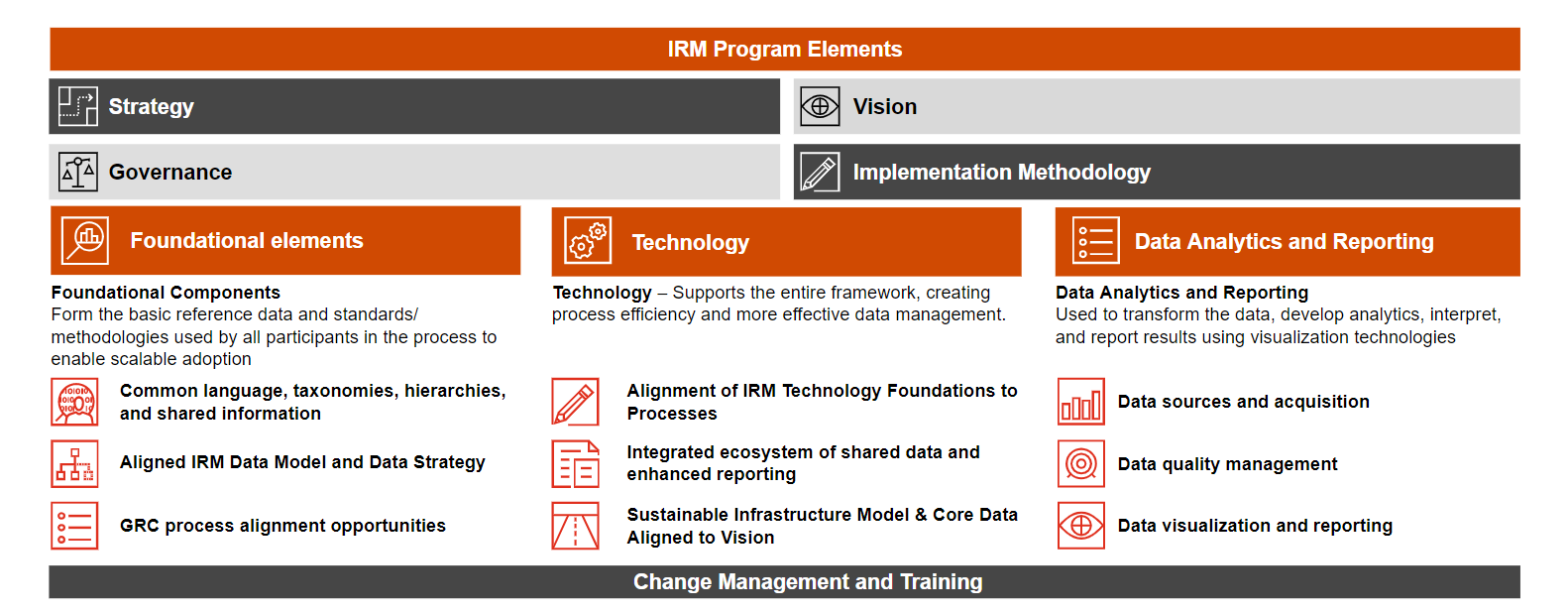

Key components of an effective integrated risk technology (GRC) program

- IRM Strategy, Vision and Readiness

- Define & Align Foundation Elements

- Establish IRM Target Operating Model & Governance

- IRM Architecture (process and tech)

- Design, Implement & Operationalize

- Data analytics & reporting

- Stakeholder adoption

- Path to scaling the IRM program

IRM Strategy, Vision and Readiness

Being ready for implementing a IRM program and technology is as important as the integration itself…and that takes careful planning and alignment. With careful planning, we can de-risk a program right from the start. We recommend beginning with a smart, aligned approach to help set up the project for success. There are eight key elements, outlined below that are key success factors throughout the life of your program.

Define & Align Foundation Elements

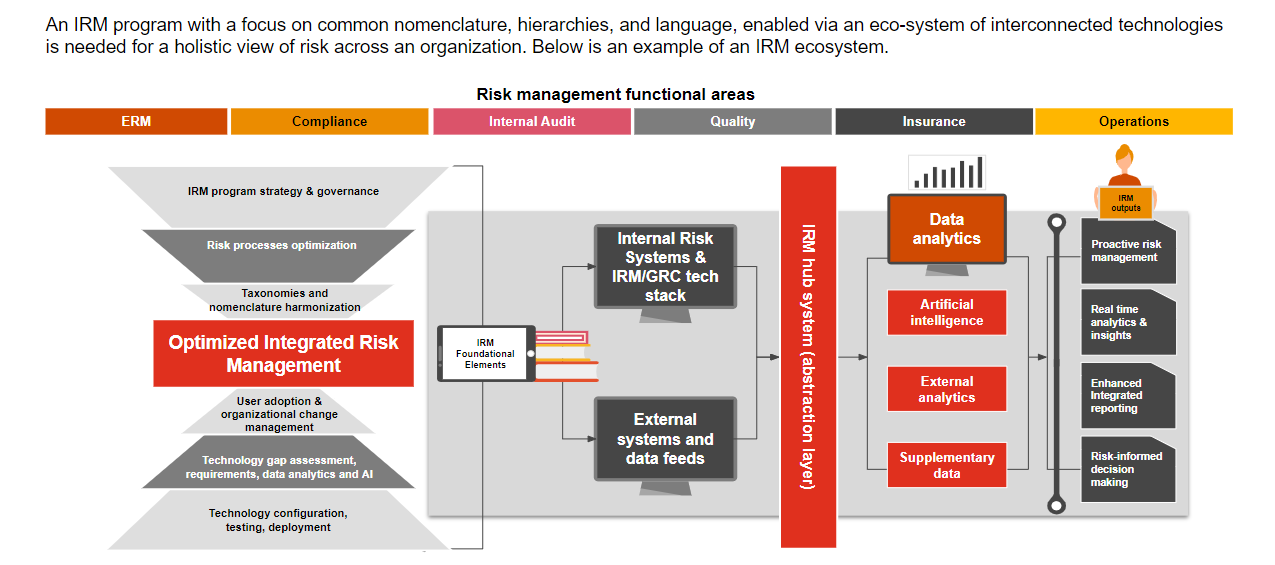

Enabling an integrated risk management program are about alignment of risk and compliance programs. The solution is not a single technology, but an integration of “people - process - data - technology” that aligns risk and control functions around a common operating model, standards taxonomies and architecture - done right, IRM changes the way people work and collaborate.

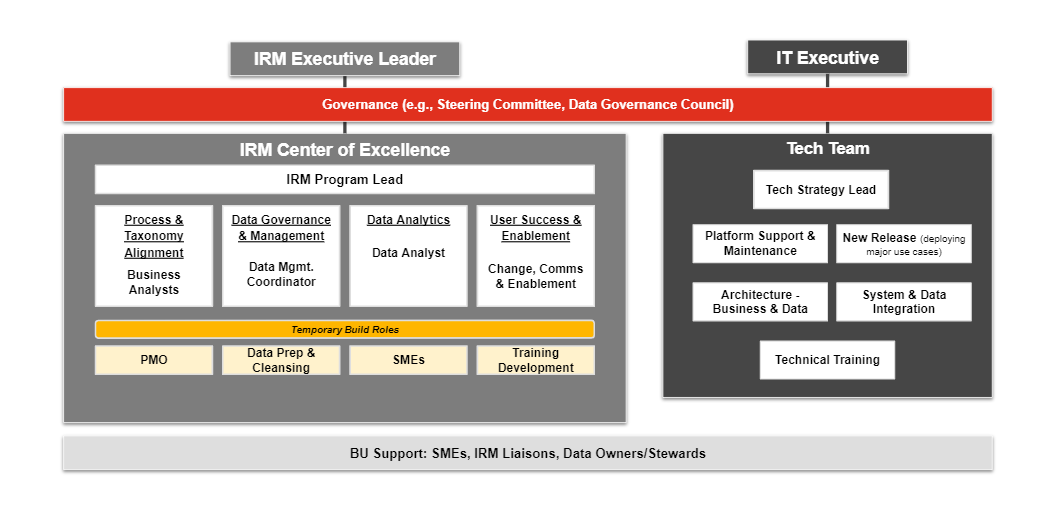

Establish IRM Target Operating Model & Governance

Establishing an IRM target operating model provides an effective, strategic and tactical structure and operating model for current and future IRM initiatives. Centralize a dedicated program management function that is accountable and responsible for driving implementation of the IRM program, while proactively managing program risks and issues. These are critical components of the program to scale the program and manage an effective, strategic and tactical IRM program.

IRM Architecture (process and tech)

Developing an IRM architecture enables common methodologies, repositories and data relationships, allowing discrete functions to execute risk and compliance activities in an integrated manner. IRM architecture is about moving from the traditional “single system of record” to “integrated program of record” enabled via interconnected technologies.

Design, Implement & Operationalize

Use agile delivery techniques to iteratively standardize and develop IRM workflows, enhance risk and compliance systems with common foundational elements, realign feeds to/from source systems, develop integrated risk reporting and implement the target operating model in the business.

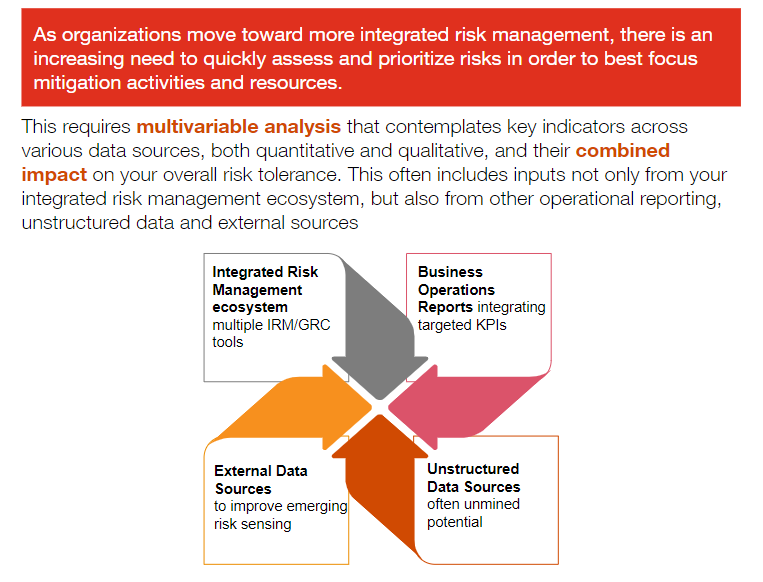

Data analytics & reporting

Design, build, test and deploy integrated risk reporting, dashboards, and analytics to meet executive, regulator, and Board needs; and to help management to make better risk-informed decisions.

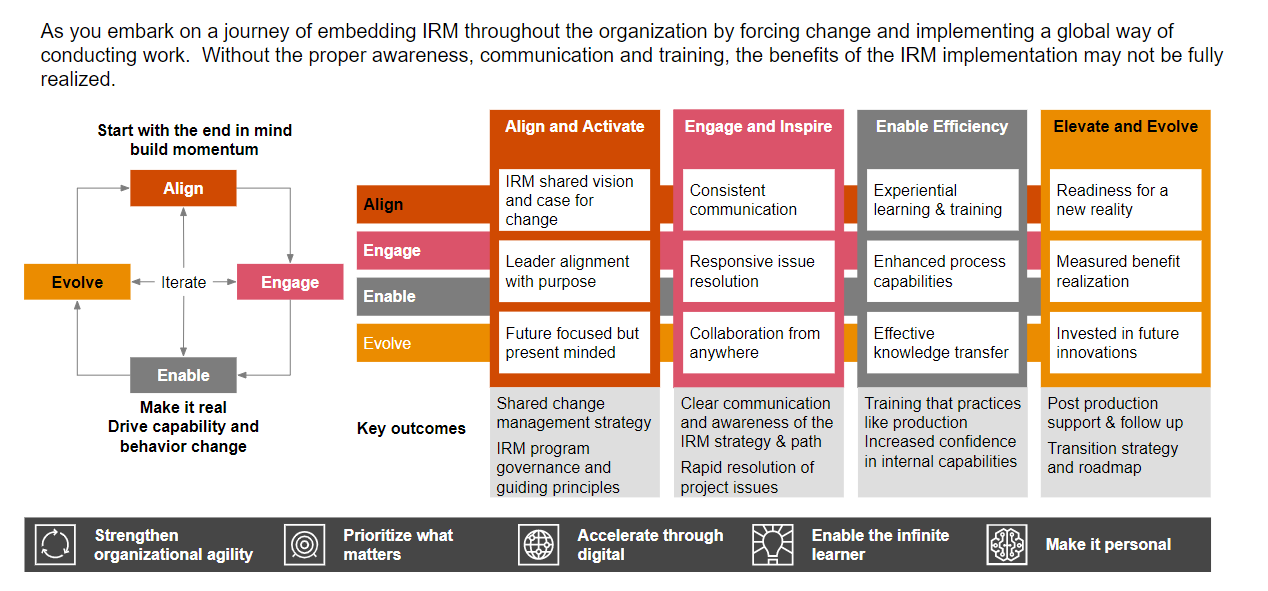

Stakeholder adoption

Establish change management strategy which involves people adopting new mind-sets, policies, practices, and behaviors as well as helps people not only make the IRM program come to life but also sustain its benefits.

Path to scaling the IRM program

Operationalize and continuously mature the integrated risk management processes using enhanced risk technology. The journey never ends and continue to identify opportunities to further enhance process efficiency through the use of digital innovation and risk and control centers of excellence (COE). Develop a strategy and deliver it in iterative cycles.