Insights into the costs of going public

When a market window for an initial public offering (IPO) opens, it’s essential in today’s economic environment for an organization to be ready to seize the opportunity and be realistic about what is required. The process of going public can be lengthy and costly, but the potential rewards make it worthwhile for many organizations. In our experience, companies tend to underestimate the costs of going public, which can include the execution of the IPO filing process, the incremental costs of being public, and the ongoing costs required to prepare the business to operate as a public company. A realistic expectation of these costs can help improve budgeting, limit surprises and ensure alignment of the management team, board of directors and other key stakeholders.

How much could your going public costs be?

Our IPO cost calculator provides you with a peer comparison of publicly-disclosed costs of going public. Enter your sector, revenue and expected deal value below to get an estimate.

Estimate my costs

A holistic approach to IPO readiness

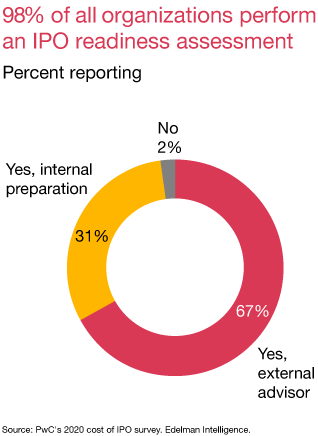

Planning, managing and executing an IPO is a complex task. If your organization is well prepared, the process can be more efficient and less costly than it would be otherwise. If you are thinking about going public within the next year or two, it’s time to begin an IPO readiness assessment that will guide your next steps.

An IPO readiness assessment is a focused evaluation of your organization and its processes, systems and overall preparedness to operate as a public company. The assessment will help you determine where your company stands and then identify and prioritize the gaps in public company preparedness.

Executives at nearly 40% of companies that completed an IPO said they wished that they had used a more formal IPO assessment process and framework. Taking a cross-functional view of readiness—beyond accounting, financial reporting and legal matters—is essential. A holistic IPO readiness framework identifies critical functional areas that may need to be assessed, created or enhanced by organizations prior to becoming a public company.

Lessons from companies that have gone public

- Start early

- Don’t go it alone

- Make sure the business is ready

Start early

Starting earlier provides more time to ready an organization to operate as a public company, and more importantly, allows additional time to focus on marketing the offering and other crucial business decisions that can enhance investor confidence in the company’s management team.

Don’t go it alone

It's important to get external help. An independent advisor can help reduce surprises, improve efficiency and decrease time to market. It’s even more important to make sure it's the right independent advisor for your organization.

Make sure the business is ready

While readiness to operate as a public company is critical to being able to take advantage of market windows, the business must be ready to perform, especially in the early stages of its public life. Measuring up to investor expectations in the first quarter or two post-IPO is crucial.

Costs of going public

The costs of going public can vary widely. They are affected by a number of factors, such as the complexity of the IPO structure, company size and offering proceeds, as well as a company’s readiness to operate as a public company. Regardless of the nuances surrounding a private company’s transformation into a public one, all IPOs share a common thread: a substantial investment of time and resources. Setting realistic expectations and having a plan in place can not only accelerate the budgeting process, but can make it more precise, limiting surprises that arise as a company transitions into the public markets. It also gives management teams enough time to develop systems, controls and processes to support the requirements of being a public company.

While the underwriting fee typically constitutes the largest direct cost that a company incurs as it goes through an IPO, the legal, accounting and tax costs are also consequential and can increase significantly for companies facing additional complexities in preparing for an IPO. The categories of costs that are ultimately disclosed in a company’s IPO prospectus include underwriting, legal, accounting, printing, registration with the US Securities and Exchange Commission (SEC), filing with Financial Regulatory Authority (FINRA), exchange listing and other miscellaneous costs directly attributable to the offering. Common examples of costs in each of these categories are as follows:

“[An organization can] take advantage of improved equity market conditions even in uncertain financial times with proper IPO readiness, planning and execution.”

Common examples of costs

- Underwriting fee

- Legal

- Accounting

- Printing

- SEC registration

- FINRA

- Major US exchange listing

- Miscellaneous

- Non-disclosed costs

Underwriting fee

Investment banks charge underwriting fees as they take a company public. Underwriting fees are the largest single direct costs associated with an IPO. Based on public filings of 1300 companies, costs to companies range an average of 4% to 7% of gross IPO proceeds.

Legal

Companies working with external company counsel and underwriter counsel incur costs primarily for the following services:

- Performance of due diligence on the company’s operations, management and business

- Drafting of the Form S-1 (a required SEC registration statement) and providing other advice related to the offering

- Managing S-1 filings, SEC comments and responses, and coordination with the SEC

- Interactions with the underwriter, their counsel and other matters directly related to the offering

- Advice on matters related to going public

- In certain filings, the costs of underwriter counsel is reflected in the miscellaneous costs category

Accounting

Companies incur accounting costs in working with the auditor and accounting advisor. Such costs are directly attributable to the offering primarily for the following services:

- Accounting advisor fees associated with technical accounting and financial reporting issues that are directly attributable to the offering

- Accounting advisor fees associated with the quarterization of financial results (if only required by investment banks and not Regulation S-X)

- Accounting advisor fees related to preparation of the Form S-1

- Review of SEC filings

- Interactions with underwriters, underwriter counsel and external company counsel on matters directly related to the offering

- Comfort letter issuance

- Advice on non-audit matters, specifically relating to the offering, e.g., non-GAAP measures and key performance indicators in MD&A

Printing

Companies incur printing costs for the following services:

- Document management

- SEC filing, printing, and distribution

- Digital and XBRL support

SEC registration

Companies incur SEC registration costs in filing with the SEC. Those are calculated at a rate of $153.10 per $1,000,000 of the aggregate offering amount.

FINRA

Companies incur FINRA costs in registering with the nongovernmental organization that writes and enforces rules for brokers and broker-dealers. FINRA costs are calculated at a rate of $500 + 0.015% of the proposed maximum aggregate offering amount, up to $225,500, with the cap set to increase to $1,125,000 in July 2025.

Source: FINRA Section 7 — Fees for Filing Documents Pursuant to the Corporate Financing Rule

Major US exchange listing

Companies incur exchange listings fees to list on a stock market exchange. The two major exchanges in the US charge companies an initial listing fee as well as ongoing fees as follows:

(1) Source: NASDAQ Initial Listing Guide

(2) Source: NYSE Listed Company Manual 902.03 Fees for Listed Equity Securities

Note: The NASDAQ has three market tiers: The NASDAQ Capital Market, The NASDAQ Global Market, and the NASDAQ Global Select Market. The NASDAQ Global Market and NASDAQ Global Select Market have the same listing and annual fees.

Miscellaneous

Miscellaneous fees consist of multiple types of costs, including the following:

- Blue sky fees

- Transfer agent fees

- Reimbursement of underwriter costs (e.g., roadshow costs)

- Reimbursement of underwriter counsel costs, if not included in legal fees above

Non-disclosed costs

Several additional categories of costs are not disclosed within a company’s IPO prospectus. These costs primarily relate to various additional accounting and legal fees that are not considered to be directly attributable to an offering. For example, costs associated with year-end audits, including re-audits, as well as required quarterly reviews are not included within the disclosed accounting fees.

Separately, legal fees related to intellectual property, litigation, mergers and acquisitions, legal entity restructuring, and the drafting of new articles of incorporation, audit committee charter, by-laws, and other agreements are also not disclosed by registrants as a component of legal fees. Based upon our survey of executives of companies that completed an IPO, 43% said that accounting and financial reporting costs were higher than they expected. Thirty-seven percent also indicated that legal costs were also higher than anticipated.

How much could your organization’s going public costs be? Let’s find out.

Our IPO cost calculator provides you with a peer comparison of publicly-disclosed costs of going public. Enter your sector, revenue, and expected deal value below to get an estimate of your potential costs to go public.

Source note: PwC analysis, SEC filings for US IPOs on major exchanges from 2015 – 2024. We have excluded IPOs that were best efforts, under $25 million, special purpose acquisition companies (SPACs), dual listings, domestic market uplistings, as well as other bank offerings, min-max offerings. Total IPOs reviewed: 1,300

The data provided above is for illustrative purposes only, and should not be used as a substitute for consultation with professional advisors.

Incremental costs of being public

The costs associated with going public often get the majority of attention of management teams and board of directors. However, the costs required to prepare the business to operate as a public company, or the costs of being public, may be even higher. Most private companies have rightly focused historical investment on scaling their business and often postponed investment in systems, people, processes and broader infrastructure that will be required to operate as a public company. There are also other incremental, annual costs borne by a public company, primarily relating to additional regulatory compliance obligations. Based upon a survey of CFOs, the estimated incremental costs of being public are broadly split across the five areas outlined to the right.

The inherent difficulty in estimating the costs of going public is that they will differ tremendously based on an organization’s existing footprint and level of readiness to go public. Complicating estimates further is the fact that certain costs are one-time costs, and others are recurring costs. Generally, organizations will need to enhance their teams across several functional areas to operate on a public company timeline and meet various regulatory obligations. The amount of incremental cost incurred is highly dependent on the size and complexity of the company and the expertise of its existing personnel. Such costs are recurring and are generally concentrated in accounting and reporting, legal, tax, internal audit, financial planning and analysis, investor relations and human resources.

Investments in systems are also critical to prepare for the increased reporting requirements associated with being a public company. Costs should be expected across several areas of an organization, including enterprise resource planning systems, human resources information systems, tax software solutions, contract management systems and various other ancillary software platforms and tools. These costs may be one-time (implementation, perpetual software licenses) or recurring (cloud-based or term licenses). Beyond system costs, investments in information technology (IT), compliance and cybersecurity will also be required, which may add to the overall costs of being public.

Finally, incremental audit fees and Sarbanes-Oxley Act (SOX) compliance costs make up a large component of costs required to operate as a public company, primarily a result of SEC reporting requirements.

With you when the bell rings

To create a clear path forward, you need the confidence that comes from working with a team of straight-talking advisors and actionable insights from a team of dedicated professionals. Find out how we can guide you through each step of the readiness assessment process and beyond.

Contact us