{{item.title}}

{{item.text}}

{{item.text}}

What if a tool that’s as old as civilization could help your company tackle the pressing challenge of decarbonization? Ledgers have been helping to track what’s valuable for millennia. Today, they can also enable the integration of critical environmental, social and governance (ESG) data — like carbon emissions — with the core infrastructure and architecture you already use to manage your business.

Ledgers act as a single, trusted source of truth, helping everyone get on the same page and make decisions from the same base information. A carbon ledger can be a building block toward providing comprehensive visibility and management of climate data for your company and its most important stakeholders. It can be a key step toward the integration of ESG into enterprise resource planning (ERP).

The need for real-time insight into climate and other ESG impacts of products and operations has never been greater. A significant majority of executives — nearly seven in ten — identify gathering and coordinating ESG data and information across their organizations as a priority, according to PwC’s 2022 Executive Pulse Survey. The need will only grow, thanks to the SEC's climate disclosure rules. Institutional investors, employees, lenders and customers are also seeking more transparency on this front.

To meet these expectations, companies need more visibility, but they too often lack the ability to track emissions and other key sustainability indicators in real time. The challenge goes beyond collecting and verifying the data needed to meet reporting requirements. It’s about having the information needed to make the right decisions that will help keep net zero pledges and other emissions reduction targets on track. Only by making greenhouse gas emissions and other ESG data a core part of ERP can your company achieve that goal.

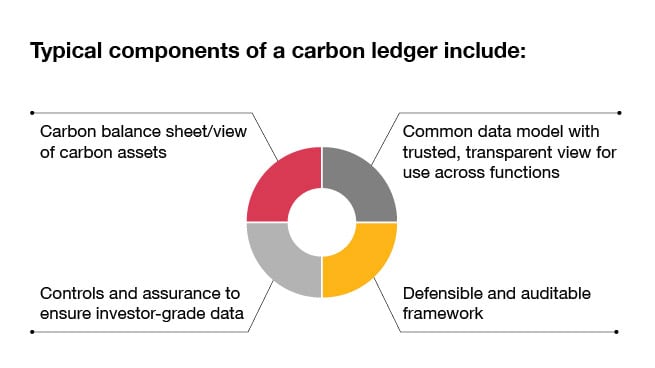

How does a carbon ledger work? Much like a financial ledger, it records credits and debits — only in this case, it’s tracking carbon emissions, credits and offsets, not money. Carbon ledgers rely on a common data model across business functions, an auditable framework and the right processes and controls to produce a single source of truth that informs strategic decisions and satisfies the need for transparency.

Carbon ledgers can help ensure that ESG isn’t siloed off but instead embedded into ERP and all of the business processes and capabilities it enables. How would it work? Imagine you have two sources of a key raw material. Supplier A has a significant cost advantage over Supplier B. But Supplier B produces the material with much lower greenhouse gas emissions. When the finished products are sold, how can you measure and compare progress toward your company’s net zero goal and the bottom line? Only by linking climate change into every function across the company can this be achieved.

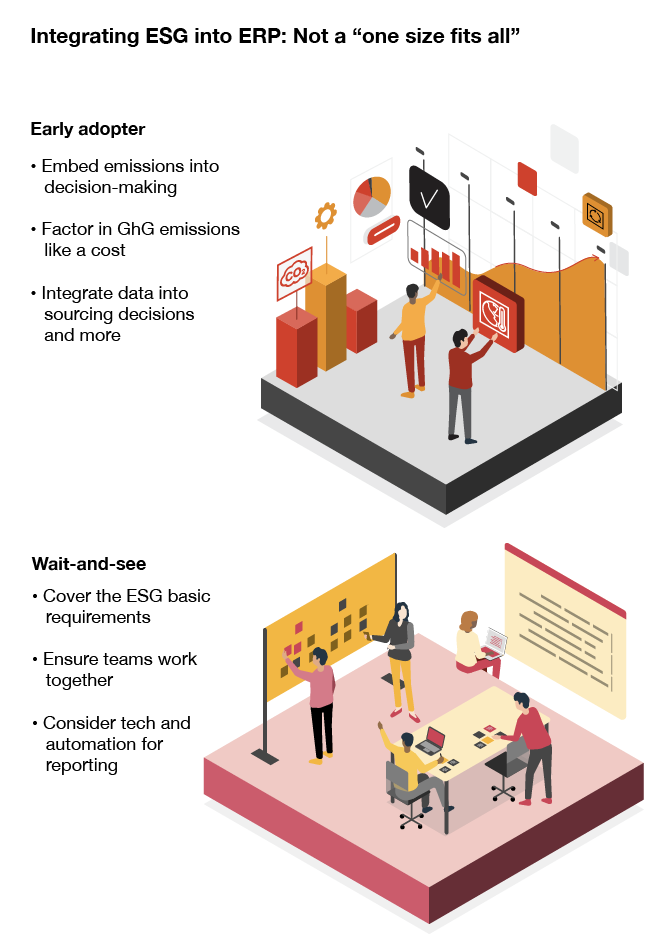

Every company will take a different approach. Some will want to be among the first to seize the opportunity. They may have a lot at stake in being seen as sustainability leaders in the marketplace. Or they may have stakeholders who are demanding faster action on climate change. Other companies may feel it’s more prudent to proceed cautiously.

Successfully incorporating ESG into enterprise resource planning isn’t a one-size-fits-all exercise. After all, each company faces its own opportunities and challenges. And each will need to make decisions about the most relevant standards and metrics on which to base the policies, procedures and controls that will govern how to account for ESG matters. Similar to how a company designs its financial ledger by defining the accounting policies/procedures/controls based on the application of specific accounting standards (e.g., revenue recognition, transfer pricing, etc.), each company will need to go through a similar design process. When done correctly, the outcome is a repeatable set of processes and procedures with controls such that anything that goes into the ledger (or system) is done consistently and the same way regardless of the individual, region or business unit.

One common challenge companies will face is data integrity and governance. A carbon ledger — or, indeed, any other tool that integrates ESG information into enterprise resource planning — depends on the availability of data that is reliable, accurate and trustworthy. Knowing that the availability of reliable data is part of the problem, each company will need to institute a strong data management and governance model to ensure integrity of the available data.

Building ESG into enterprise resource planning isn’t just beneficial when it comes to meeting regulatory requirements or satisfying shareholder demands for transparency. It can be a crucial part of delivering sustained outcomes for all of your company’s stakeholders. Across every function, a clearer picture of how ESG factors into the most important decisions facing your company can help enable higher performance and increased accountability.

An effective marriage of ESG metrics and ERP processes may give your chief financial officer a strengthened ability to provide reporting that satisfies regulatory requirements. Your chief sustainability officer could more effectively meet shareholder/stakeholder expectations for transparency around net zero and other climate commitments. And your chief marketing officer may find that claims about a product’s climate impact are easier to substantiate, meeting the needs of a growing and increasingly discerning market for sustainable goods and services.

Though the carbon ledger concept illustrates the potential of bringing ESG metrics and targets into enterprise resource planning, it’s far from the only application. A more integrated approach to workforce matters, resource consumption or responsible sourcing is also possible. After all, ESG priorities are as diverse as strategies, operations, supply chains and stakeholders. The common thread is an approach that brings ESG to the forefront and forges connections across the enterprise to deliver value.

{{item.text}}

{{item.text}}