{{item.title}}

{{item.text}}

{{item.text}}

Like so many companies, you’re likely working hard to reduce greenhouse gas (GHG) emissions while also reporting your progress. Assessing energy use across your operations — including offices, factories, warehouses and fleets — is a big effort. Even so, it’s only a start.

The real work — and business advantages — come when focusing on Scope 3 emissions generated beyond your company’s walls. Because these emissions are mostly carbon, they’re often referred to as carbon emissions and arise from activities in your wider value chain. Material Scope 3 impacts will vary by industry and business model, but, for many companies, a large amount of emissions occur upstream via suppliers and raw materials.

Reporting of Scope 3 emissions is quickly evolving. While the SEC’s new climate disclosure rules do not cover Scope 3 emissions, Europe has enacted the Corporate Sustainability Reporting Directive (CSRD) that phases in Scope 3 disclosures over the coming years for companies that meet certain criteria. California passed climate disclosure bills that cover Scope 3 that could impact more than 10,000 public and private companies.

It’s imperative that companies have the capabilities to collect, measure, manage and report on value chain GHG emissions so that they can comply with these expanded disclosure requirements.

Developing a Scope 3 strategy starts with understanding the implications for your specific business. You’ll then move on to measuring and managing those emissions, working closely with suppliers and customers. Many companies have begun to set specific targets on Scope 3, with the more advanced companies focusing on science-based initiatives. When you approach Scope 3 systematically and strategically, you can not only progress on commitments but can also reap significant benefits, such as growing your market share.

As with most ESG areas, Scope 3 requires the attention of the full leadership team. Given its far-reaching impact, every area of the business could be affected, from supply chain and product development to reporting, tax, marketing and, of course, sustainability. In many businesses, this cross-company understanding and collaboration is only just beginning.

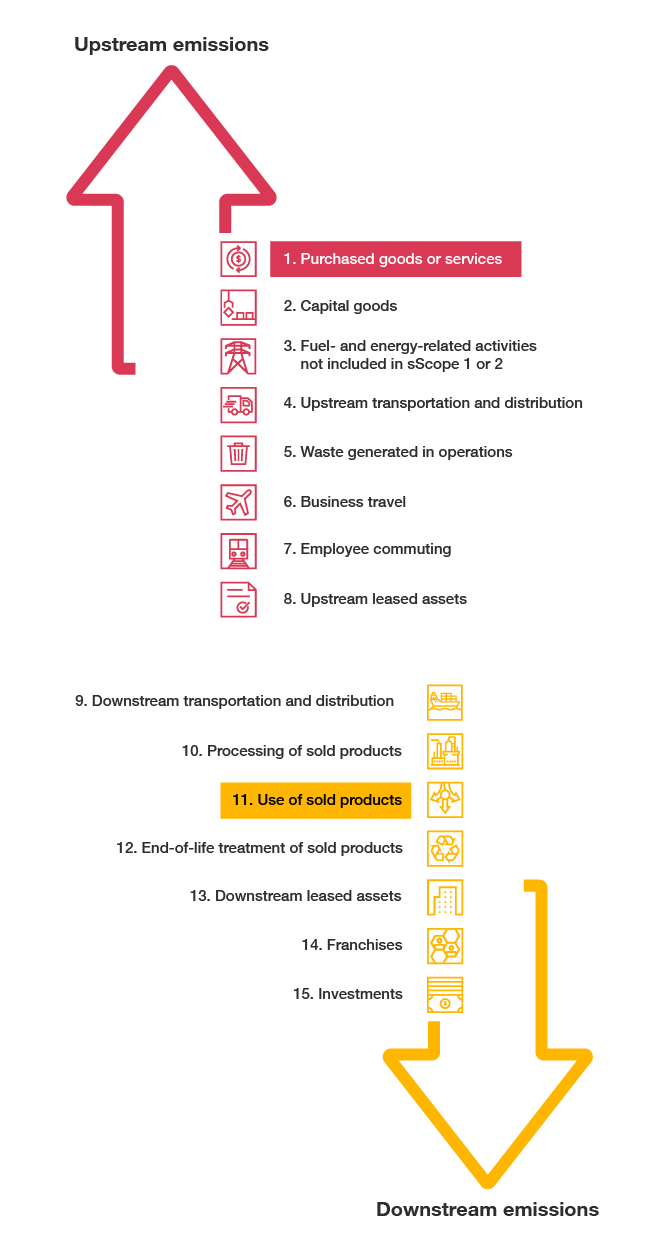

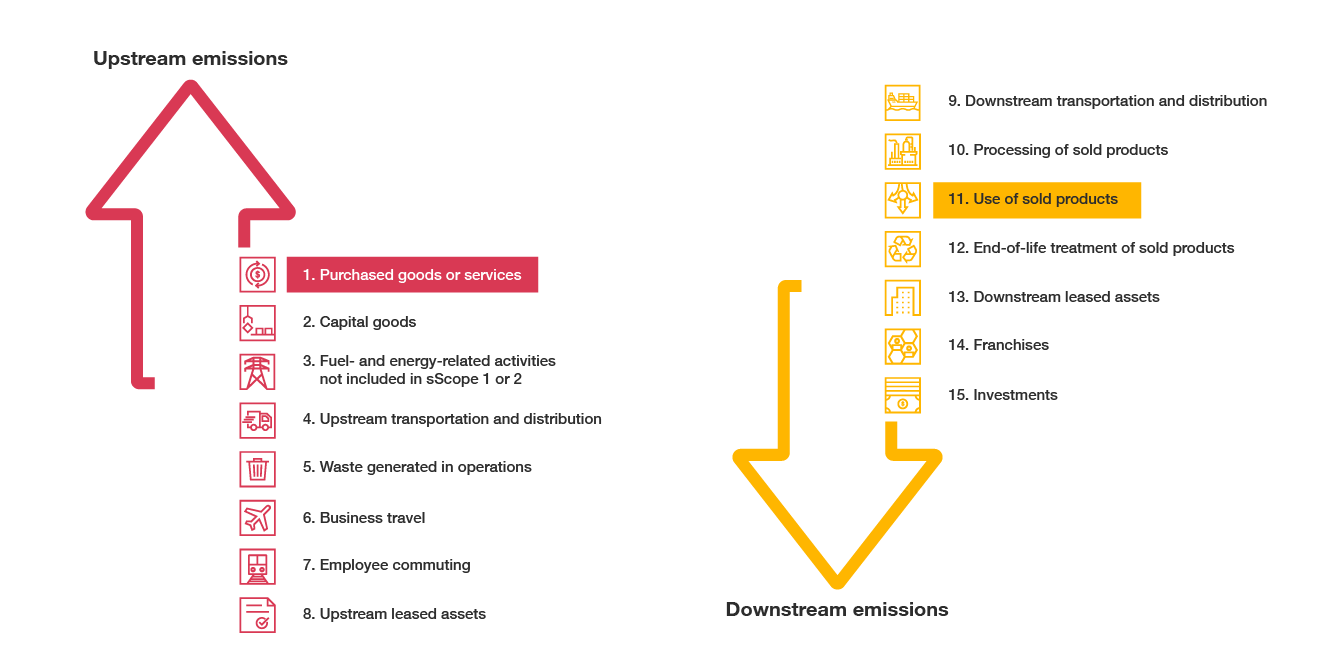

Scope 3 spans 15 different categories in total. Those that are upstream include emissions produced by the external parties that source, produce and transport the raw materials and components you use. Other upstream categories include business travel and employee commuting as well as emissions from waste generated and assets leased. On the downstream side are emissions from the logistics, use and disposal of your products. Downstream emissions also cover those from activities like investing and franchising.

For many companies, categories 1 and 11, which are those related to your supply chain and use of your products, are the most significant. But depending on your industry, other categories may also play a role. If, for example, you’re a financial services firm, category 15 will be key. Likewise, a retailer or hotel group might have many franchisees, making category 14 relevant.

When it comes to Scope 3, you have to think about both your role as a supplier to your customers and your role as a customer to your suppliers. In both cases, it’s all about being able to accurately measure and report on emissions to understand where you (and they) are starting. From there, you’ll look at opportunities to reduce those emissions together.

As a supplier, where do you even begin? Consider the example of a company that makes things. Your customers want verified carbon footprint data for each of your products. For some businesses, that could mean hundreds or thousands of stock-keeping units (SKUs). Leading companies that we’ve worked with tackle this challenge by first doing a high-level analysis of their products, enabling them to home in on those with the biggest top-line impact or the biggest emissions. They then prioritize those products with the biggest potential—for revenue, for emissions reductions or both.

As you build capabilities around data collection and reporting, a key focus will be on creating a data model so that you can assess how changes in materials, suppliers or locations affect a product’s emissions. This can be challenging and there are some common pitfalls to avoid with data modeling and extrapolation. In some cases, you might look to create a lower-carbon, or green, version of a product while also continuing to produce the higher-emissions original. While the green version might not always command a price premium, it could set your company apart from competitors and help you increase market share as customers increasingly look for green products and meet commitments.

When it comes to GHG emissions reductions, science-based targets are an important concept. As part of the SBTi’s Net Zero Standard framework, companies commit to halving emissions by 2030 and getting close to zero emissions by 2050. To get there, they are required to set both near-term and long-term targets. Both may require a significant effort on Scope 3 reductions. Here’s what each covers:

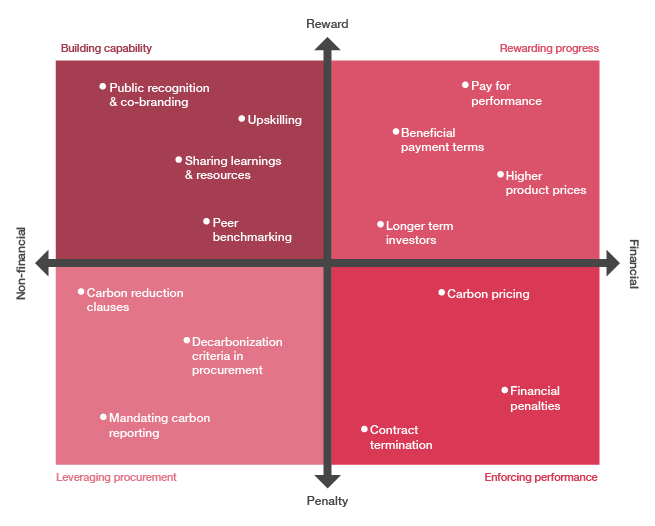

At the same time that you are looking at Scope 3 through a customer lens, you’ll also be asking the same of your suppliers. You need accurate Scope 3 emissions data for everything you purchase, and you’re ultimately hoping to reduce the carbon footprint of those goods. To achieve these goals, we recommend four strategies for incentivizing suppliers. These include both financial and nonfinancial measures and apply to all stages of supplier engagement:

Source: PwC and World Business Council for Sustainable Development, Reaching net zero: Incentives for supply chain decarbonization

{{item.text}}

{{item.text}}