{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

Finance functions are transforming to become more strategic in an effort to deliver greater value across the company. A modern finance function can provide quality forward-looking information with deeper analysis, helping to drive better business decisions. Here are the four areas your audit committee should consider as the finance function evolves.

76% of global CFOs surveyed are investing in automating processes and systems either through preserving the current business or reinventing the business for the future

Once leaders decide to initiate a transformation project, it’s important that they lay out a clear path forward, with a transformation plan that links the vision for the project to the company’s overall business strategy. The plan should outline the business case for what should be prioritized and transformed — and why the transformation will drive sustainable value.

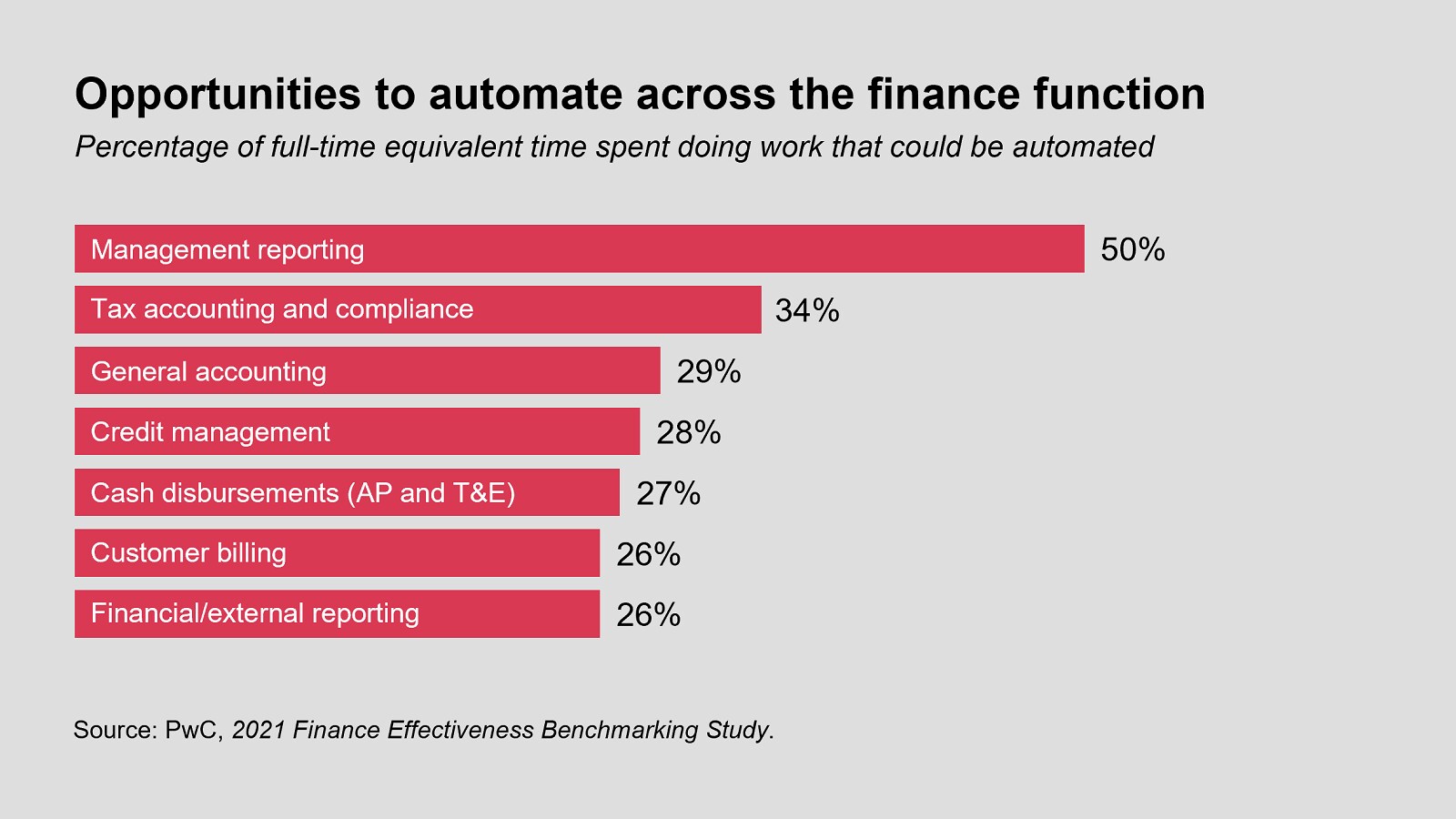

Standardization and automation are two key drivers to unlocking a finance transformation’s value. Process standardization makes a vital contribution to improving productivity and reducing costs; effective process automation increases the efficiency of business operations across an organization and is a major step toward digital transformation.

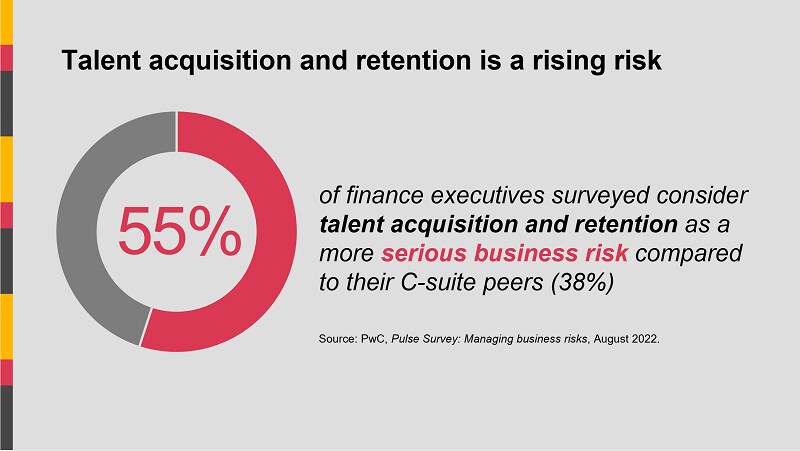

As new technologies, automation and digitally-enabled processes are incorporated into the finance function, the workforce behind it should also evolve. Intelligent automation doesn’t eliminate the need for finance employees: Finance will still need people with experience and business skills to analyze, make judgments, and perform business processes and controls. However, the future finance workforce needs to be “digitally fit,” and the talent strategy should evolve to emphasize augmenting and upskilling, with effective collaboration to build a culture of curiosity and continuous improvement.

Sustained outcomes happen when leaders and teams bring together a strategy clearly linked to value and differentiating capabilities and an operating model that will support the strategy. An organization should establish an end goal and a vision of success post discussion with key finance stakeholders. The audit committee should engage with management to understand KPIs and success metrics upfront, asking for consistent plan and status updates to monitor effectiveness and measure impact during and after the transformation project’s implementation.

The audit committee should know that transformation doesn’t compromise the finance function’s ability to maintain integrity for reporting — finance’s core responsibility. At the same time, the committee will want to understand how the function’s processes will change, how internal controls will be maintained, what system implementation risks exist, how the workforce will be impacted and how the external audit may be affected.

Christopher Dimuzio

Principal, Finance Transformation, PwC US

Partner, Governance Insights Center, PwC US

Jamie Barakat

Partner, Finance Transformation, PwC US

Director, Governance Insights Center, PwC US

Nitin Bansal

Senior Manager, Finance Transformation, PwC US