PwC’s Financial Flows: Digitize your contact centers and middle office

The case for digital enablement

From fragmented workflows built on legacy technology to over-customized designs that hit your system and workflow limits, today's systems are far too complex for the high-volume, high-turnover world of the contact center.

Remote working has increased the urgency for simple coordination and ease of information sharing across teams, while customers expect fast service and don’t have the time, nor the patience, to repeat information or wait on the phone.

Introducing Financial Flows

Financial Flows is a PwC service that leverages our proprietary tools and works with you collaboratively to build a dynamic case management system. We start with our pre-existing design and configure it in your systems to help you digitize, automate and integrate Contact Center and Middle Office workflows on the Salesforce platform. We can more quickly help you configure Salesforce to:

- Automate workflows through task assignments, progress tracking and case notes to ease communication between contact center agents and servicing operation teams.

- Integrate with product and core systems to reduce dual entry.

- Digitally track and report on volumes, status and KPIs.

- Start small with basic case routing and scale up to advanced workflows, leveraging super users instead of Salesforce developers and administrators.

With the move to a more remote market, servicing your customers digitally is critical. The focus has shifted to:

Self-service

Providing digitally-enabled self-servicing to clients that didn't really exist in the past.

Consultative service

Simplifying and automating the contact center intake process across all channels, and moving towards providing consultative service.

Time and cost efficiency

Automating and fully integrating hundreds of middle-office workflows for operations teams to significantly reduce the hours of work and the cost.

Strategy

Not accepting the previous concepts of throwing paper and people at manual solutions and swiveling between multiple systems.

PwC’s Financial Flows services can help solve all of this in Salesforce, with workflows that, once implemented, can be configured by super users, not admins or developers

Key features we enable in Salesforce

The Servicing Shopping Cart

Customers often call in for a handful of topics such as ordering checks, checking balances, travel notifications or possible mortgage rates. The shopping cart model enables a bundling of requests, with predictive reasons for calling. Configured by super users, the page is fully customizable to the categories, sorting, personas, general layout and tips.

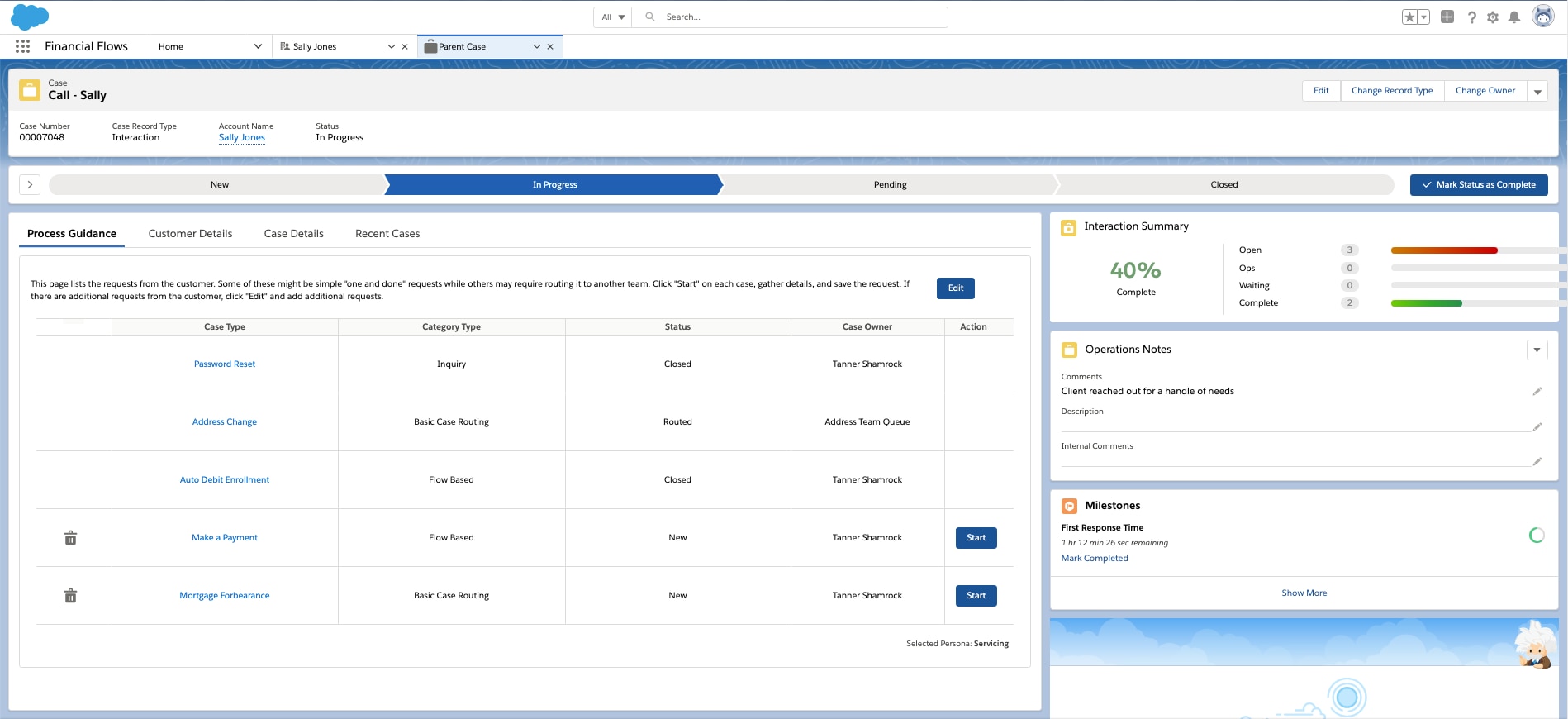

Interaction Process Guidance

A process guidance screen helps the agent keep track of all customer requests, completion status, owners and overall service SLAs of the request. The agent can communicate with the customer across various channels including email or text, while also collaborating with the operations team. Status aware buttons help guide users to each next step.

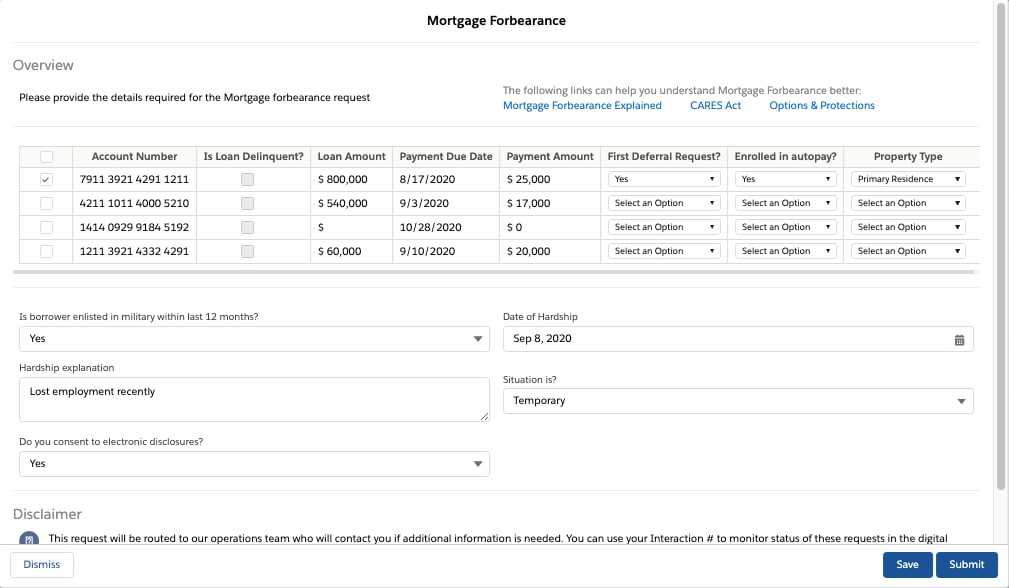

Dynamic Guided Workflows

50+ workflows are designed out of the box and any others you need are simple to create. Forms have a unique look and feel and as requests are received, integrate to a backend system in real time or route to an operations queue for further processing.

Benefits we bring

Made for financial services: Tailored specifically to banking and payments—focusing on interactions, not cases.

Developers not required post-implementation: Scalable, dynamic and completely driven by metadata, it’s designed to be used by business super users, rather than developers.

Training needs are minimized: Guided flows that prefill data and ask for exactly what’s required.

Digitally enabled: Includes a support website portal.

Links all teams: In retail and commercial banking, the Contact Center, Operations, Cards and Treasury Sales and Operations are all connected.

Quick start and rapid evolution: Save months of development and scale quickly.

Standard workflows: 50+ pre-designed workflows out of the box.