Current situation

In the face of rapidly-changing business models and during the quest for top-line growth, cash and working capital are fundamentals that businesses can easily lose sight of.

With Vietnam continuing to be a booming economy and one of the beneficiaries of the trade war between US and China, the capacity to turn sales into cash quicker helps businesses to not only reduce operating costs, but also to have an ultimate competitive advantage and sustain profits.

In our 2nd edition of working capital performance assessments for top Vietnamese companies, our analysis shows that companies continued to have difficulty converting their sales into cash despite a robust top-line growth. More than USD 11.3 billion (~46% of 2018 net working capital employed by businesses) can be released through optimising the working capital performance of these companies.

Key findings

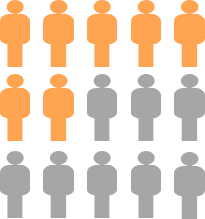

Only 7 out of 15 sectors

improved their working capital performance between 2017 and 2018

Hospitality and Heavy Industry

deteriorated the most in 2018 in terms of C2C

Vietnam continues to lag behind

in terms of C2C compared to other regions

How we can help

- Identify and realise cash and support cost reduction across the end-to-end value chain

- Optimise operational processes that underpin the working capital cycle

- Create a 'cash culture' and upskill the organisation through our focused training, capability development and cross-functional workshops

- Evaluate, design and roll out tailor-made trade and supply chain finance solutions