{{item.title}}

{{item.text}}

{{item.text}}

By Florian Gröne and Junis Rindermann

As web1 has morphed into web2 over the past couple of decades, the internet has become pervasive. Yet, at the same time, the power to drive change—and ownership of the major sources of value—has shifted away from the providers of the underlying network infrastructure, the telecom companies.

Instead, it has been other players—the tech platforms, social networks, digital service providers and cloud hyperscalers—who have delivered the new end user experiences made possible by web2 and captured most of the new value created. Attempts by telecom operators to attract end users and capture a bigger share of value have largely failed. What’s more, the costly infrastructure upgrade from 4G to 5G has not yet delivered on its full promise. As a result, there’s continued uncertainty about what the next big value creator for telecom companies will be.

All of this is happening at a time of peak hype about the next version of the internet—web3—and related concepts like the metaverse and blockchain. Web3 is set to support a new economy in the virtual, 3D, connected and highly immersive world of the metaverse. And although mass adoption of web3 may be five to ten years away, the building blocks of web3 and the metaverse already exist—and are challenging the very concepts that shape the internet as we know it today.

The implication? Now is the time for telecom executives to take a long, considered look at what web3 and the metaverse could mean for their current business models, how they might capitalise on these technologies to capture value and what capabilities they’ll need to develop to do this. The answers will direct them to the investments required today to put their businesses on the path to continued relevance—and ideally to regain some of the ground lost in the past.

As web1 enabled users to access text-based information from mostly diversified sources, web2 extended users’ consumption and creation of content to forms such as images and videos, mostly through centralised platforms. Now web3 will mark a fundamental shift to decentralised and democratised content, with users interacting with content in 3D. Crucially, users will have ownership and control of their assets—including the content they create—without relying on central entities like platforms and banks, with transactions executed by blockchain smart contracts.

This restructuring of the internet ecosystem mirrors the reshaping of the vertically integrated telecom enterprise model that’s now underway. Network operators are carving out and separating their infrastructure assets from the rest of their integrated enterprise. This creates more flexible and scalable infrastructure units better suited to maximising the utilisation—and monetisation—of tower, radio, fibre and data centre infrastructure across multiple service providers, including competitors. Open RAN (radio access network) and open access are gaining traction, establishing protocols to support interoperability and orchestration of virtual networks across distributed infrastructures. So a decentralised connectivity ecosystem is not a distant concept: it is taking shape today.

These profound changes will challenge every player in the internet ecosystem, from platforms and intermediaries to creators, distributors, and app developers. Telecom operators must undertake a holistic rethink of how their core business—providing and charging for connectivity—will operate in a more open, distributed, federated web3 world and decentralised infrastructure. They need to consider how they provide value in a world where content, data, IDs and property rights are largely owned and controlled by users, and how they market, distribute and operate their own services to capture more of that value. What telecom operators can’t afford to do is sit on their hands: inaction brings the risk of losing yet more ground and getting stuck deeper in the commodity/utility corner.

Telecom operators’ route to a business model geared for a web3 world needs to follow three steps.

The web3 world is still evolving, and its direction isn’t certain, so tracking its progression will be vital to identify opportunities. Assess and then regularly challenge your own and your leadership team’s beliefs and assumptions about the forces really at play.

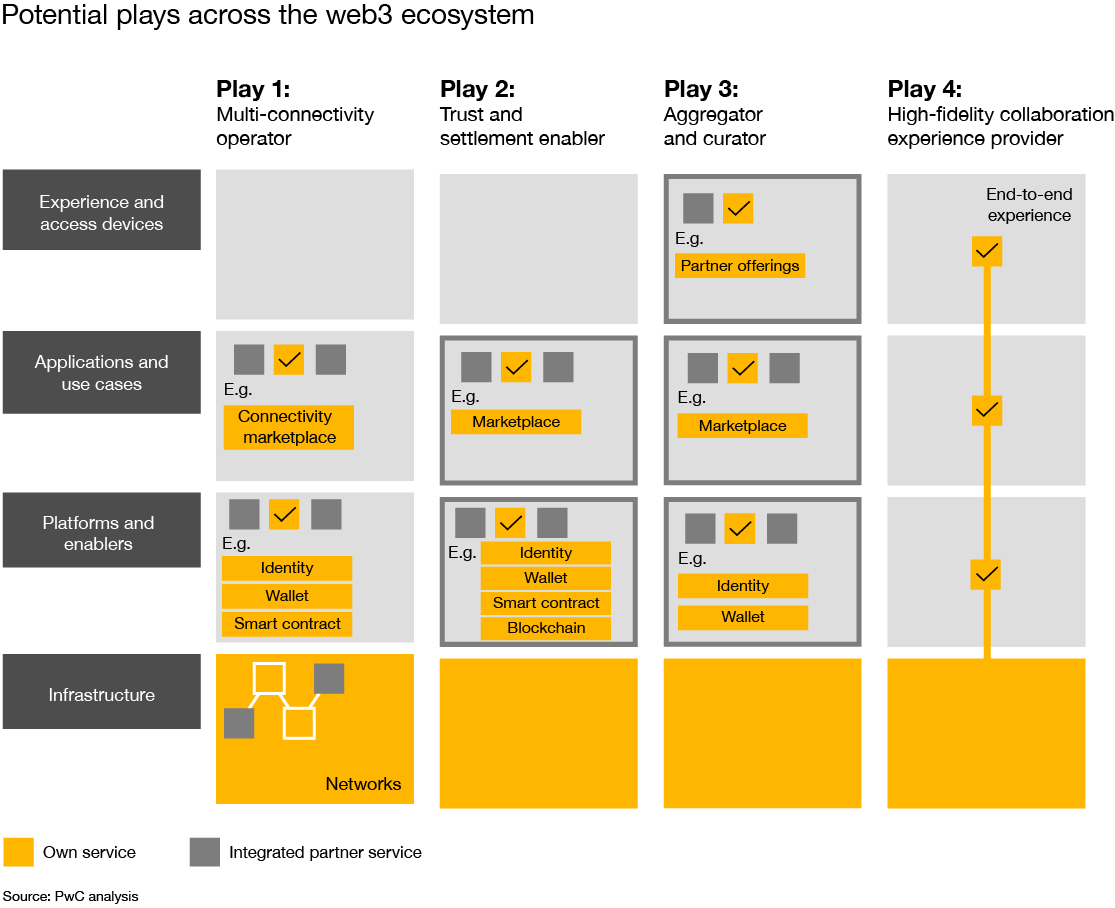

Unpack your understanding of the emerging web3 ecosystem to understand where the strategic control points will lie. These are the areas where the facilitation and provision of key services will become essential dependencies for others in the ecosystem—lending their providers the power to control the ongoing evolution of web3 services and experiences. Translate this strategic vision into a blueprint for your telecom company, built around a set of credible ways to play (see ‘Potential plays across the web3 ecosystem’).

With both defence and offence in mind and leveraging your existing telecom capabilities to play to your strengths, focus execution around no-regrets investments in capabilities addressing the opportunities with the clearest line of sight. Identify the capabilities and technology building blocks to invest in (whether through building, buying or partnering) that will help your operations today, as well as in the web3 of tomorrow.

We’ll now take a deeper dive into each of these three stages.

By its nature, the emergence of web3 and the related decentralised internet ecosystem have produced a highly dynamic environment with lots of buzz, experimentation, dead ends and nonlinear bursts of innovation. That’s why it’s vital to start by cutting through the noise, demystifying the complexities and—to the extent possible—developing a clear-eyed view of the building blocks and technologies that will frame the full realisation of web3 (see ‘The layers of the web ecosystem’).

Based on what we can see today, a handful of assumptions are becoming widely accepted.

Blockchain-style technologies will be a key enabler of web3. These will reach far beyond cryptocurrencies, taking different shapes to serve multiple purposes—including enabling digital ID, asset rights, ownership, credentials and transactions.

The rise of blockchain-based ledgers will see ownership and control of asset ownership and identity management return to users, rather than remain with centralised platforms. This decentralisation won’t happen overnight—web3 technologies will be adopted as they begin to deliver more compelling use cases that can evolve better business models and user experiences.

Being based around decentralised participants, environments and components, web3 is likely to morph and reconfigure much more quickly than web2. This will be aided by the foundational layer of portable and fungible tokens that will move from being embedded in apps and centralised platforms to being abstracted into blockchain ledgers.

With the rise of web3, the physical and digital worlds will begin to overlap and integrate in more fluid, natural ways, through the likes of AR (augmented reality), hybrid experiences and portable tokens that can be used in both environments.

Telecom operators should lay out their options based on their view of the emerging web3 ecosystem. Although there are many different ways to look at this, we find the most useful perspective for the telecom space is one that distinguishes the infrastructure, platform, application and experience layers (see ‘Potential plays across the web3 ecosystem’). We believe telecoms have the potential to play at every layer.

When determining whether a play is viable or not, we recommend a capability-driven approach. Our experience shows that differentiation and value creation become possible when telecom companies align a few truly distinctive capabilities with products and services that fit a market need in a coherent way. Only companies with strategic coherence will be able to occupy—and hold—web3’s strategic control points, because such companies are able to provide value in a way others can’t replicate.

To maximise their chances of success, telecoms should consider their capabilities from two angles: first, the nature of their current role (and capability set) as trusted connectivity utility providers, and second, their ecosystem position as natural integrators, aggregators and distributors of technology, services and experiences operating at (multi-)national scale. Both will be grounded in the past investments they’ve made and the economies of scale they’ve already achieved—and in combination, they provide the foundation to build on.

It’s worth exploring different ways telecoms could play across the web3 ecosystem. We’ll start with connectivity—telecom operators’ heritage, core and natural anchor point—and then move up the layers. Overall, we see four plays capturing an increasing number of strategic control points in the web3 ecosystem, as shown in ‘Potential plays across the web3 ecosystem,’ below.

Let’s take a closer look at each of these plays in turn.

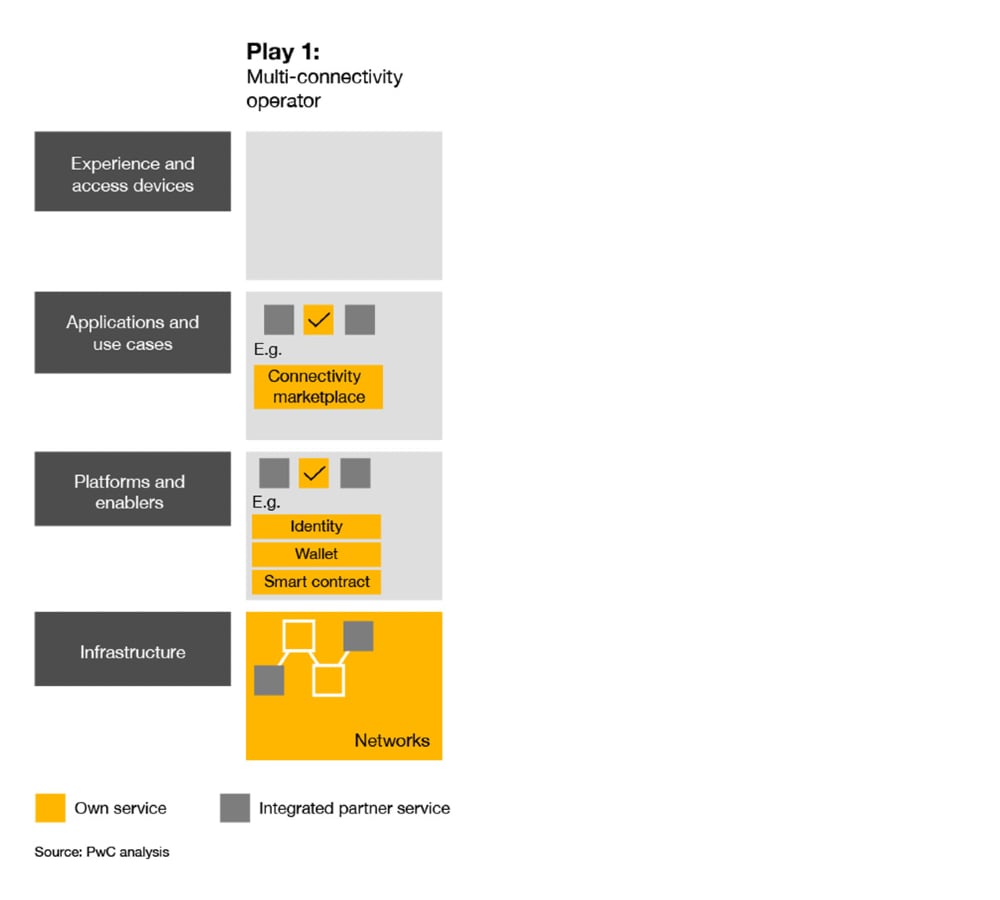

Participating in web3 and its use cases—especially high-fidelity ones like the metaverse or rich mixed-reality experiences—will require a reliable, high-performance infrastructure capable of enabling low-latency connectivity to handle increasing amounts of traffic, and providing the right gradients in quality of service. While web3 implies a move towards a more heterogeneous mesh of decentralised networks, incumbent telecom operators will continue to play a vital role in building and operating the foundational layer of fibre, 5G and, soon, 6G infrastructure that ensures a base layer of pervasive connectivity. They will also need to ensure these networks are interoperable with alternative technologies—from wi-fi to satellite—as well as private networks run by competitors.

This role reflects the telecoms’ large scale and many years of experience in disciplined investment planning. Decentralisation of networks does generate several advantages for telecoms, such as complementary coverage and additional redundancy in coverage. However, it also puts their margins under pressure, since the fragmentation and meshing of different networks from a diverse set of entities, including local telecom providers, communities and new market entrants, will create friction and inefficiencies. Over time, the role of the telecom operator may slip towards a less enviable position of running the “network of last resort.”

Operators with the sufficient scale and investment capacity will have the opportunity to look beyond the basic utility play and take their ongoing efforts in building cloud-based, software-defined, network and edge computing capabilities to the next level. The objective is to provide and monetise the low-latency experiences that are in demand from enterprises, consumers and cloud service providers, including in gaming and media. This speciality alone offers a spectrum of strategic nuances: see our point of view on telecom operators’ roles in the next stage of the cloud infrastructure market in our paper The edge of the cloud.

Alongside the demand for captive networks, there’s an emerging need for platform capabilities that allow users (and “things”) to move seamlessly across any type of network—be it a private home; public wi-fi; private enterprise, venue or campus network; or a regional or (multi-)national cellular network. Customers want this flexibility while also having the data representing their digital twin roam along with them and interact locally and in real time with applications and other data. By providing fit-for-purpose, frictionless, multi-network connectivity in an algorithmic, secure and trust-based way, telecom operators gain the opportunity for a platform play. This is not a new concept, as shown by our look into the industry’s future published back in 2018, but the rise of web3 provides fresh opportunities for such a move to succeed.

Connectivity as a platform in a web3 world will likely involve functional blockchain capabilities that enable users and machines to apply credentials and payments dynamically to access and settle whatever type of connectivity they consume, thereby establishing strategic control around one of web3’s key points of orchestration. Wholesale/wholebuy orchestration platforms could also open growth pathways outside of operators’ captive network footprint, as these could be scaled across multiple geographies, technologies (cellular, wi-fi and other) and even altitudes. Think of a fleet of smart devices that negotiates its upcoming data transmission package with a constellation of over-flying low-earth-orbit satellites that offer the device fleet the optimal trade-off between cost and energy consumption.

Though telecom companies have built up their business around a legacy of provisioning connectivity services, they will now need to become more agile to protect and retain this role. In the future, digital-native virtual operators and possibly a new class of decentralised autonomous organisations (DAOs) will broker, sell and resell connectivity in more modular and flexible ways than we have ever seen before.

Furthermore, all the developments mentioned above pose challenges to the principle of net neutrality on which the internet was founded. It remains to be seen whether web3 will adhere to that principle “by design,” or if it will create an environment where each service consumes the best connectivity it can afford at any given time.

Telecom companies will need to become more agile to protect and retain their role as providers of connectivity services.

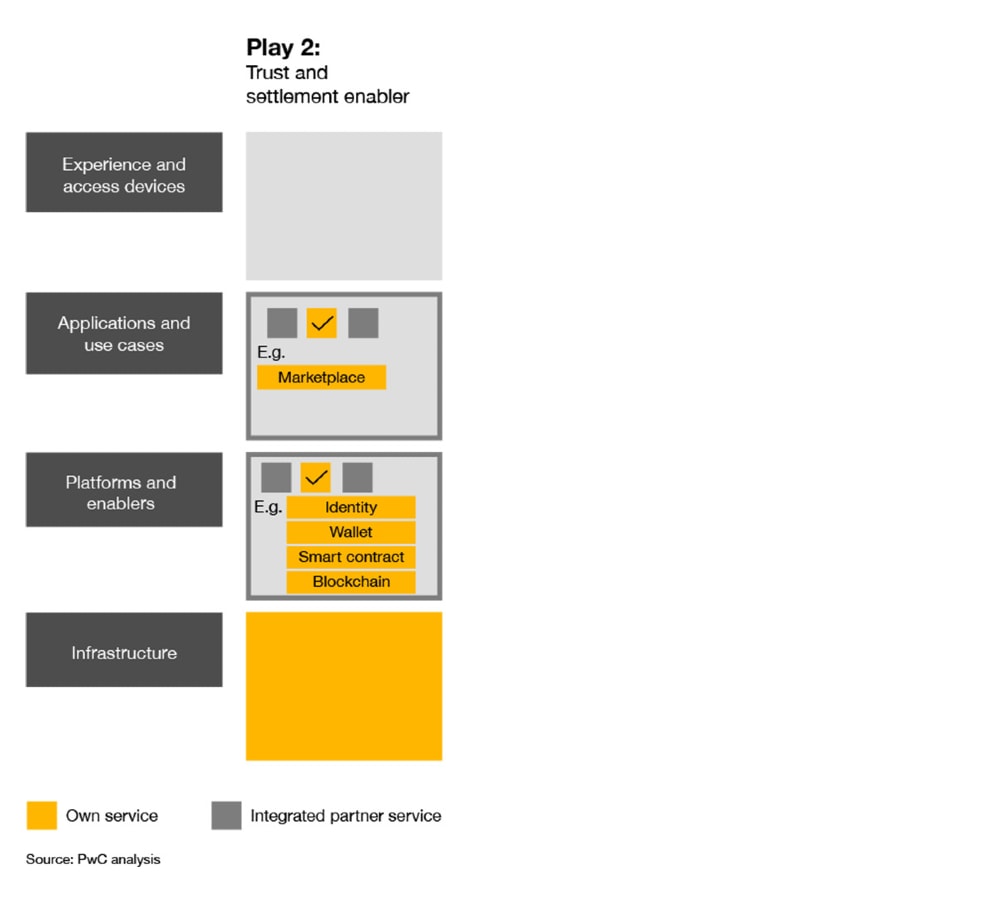

Looking beyond the connectivity infrastructure layer, we enter territory that has been historically defined by the business support systems (BSS) that telecom companies use to run their customer operations functions, ranging from customer enrolment to service provisioning to rating, charging, billing and revenue assurance.

In a web3 world, and considering the democratisation this world ushers in, the space traditionally occupied by BSS is subject to fundamental disruption. Over time, customers will expect to apply smart contracts and tokens that reside in distributed blockchain ledgers, and no longer in physical or digital SIM cards, customer and contract databases, or product catalogues controlled by telecom operators. Telecom operators will need to rethink how they handle customer IDs and credentials, accept payments, and settle asset transfer and other transactions—and so will their business customers.

The emerging opportunity is that web3 will have a need for trusted entities that can operate essential services that support and enable the broader ecosystem. The activities that these entities will undertake might include know-your-customer (KYC) processing and the issuing of credentials for personal and virtual identities; providing assurance on transaction settlements as underwriters subject to regulatory and audit oversight; operating digital wallets and associated tracking and conversion services across multiple ledgers and currencies, including monetary and non-financial assets, brand loyalty, emissions, machine performance, personal health, shopping or dating profiles—the list goes on.

While seeking to position themselves as trusted platform operators in the web3 ecosystem, telecom companies can capitalise on the fact that they are regulated entities, with recognisable brands and institutional credibility, and a lot of the web2-equivalent infrastructure, systems and processes already in place. Web3 may offer an opportunity to apply these capabilities for the benefit of a decentralised ecosystem that, for many use cases, will need to address a trust gap—and in which other participants may be willing to cede strategic control to telecom operators as commonly acceptable, non-threatening and trustworthy entities.

Web3 will have a need for trusted entities that can operate essential services that support and enable the broader ecosystem.

Telecom operators have distributed products (like smartphones and accessories), services (apps and enterprise software) and content (music, video and games) at scale to their subscribers for decades. They also have a full range of digital and physical distribution channels at their disposal. In fact, telecom companies operate one of the largest direct-to-consumer commerce platforms at a national level in most markets, often second only to a small handful of dominant e-commerce platforms.

In a web3 world, this combination of instant scale and the ability to activate a captive audience makes telecom operators strong contenders to aggregate and match customer demand and product/service supply, recommend and personalise offers, create bundles across categories and provide merchant capabilities—including the trust and settlement capabilities discussed above (see our article on telecoms as platforms). The decentralised nature of web3 will likely result in a need for AI-guided transparency and intelligent curation of apps, commerce and experiences, in much the same way that search and marketplace business models proved pivotal to the success of web2.

Although telecom operators are conceptually in a strong position to become natural points of aggregation today, to assume this role they will first need to significantly improve their digital-first customer experience; dramatically simplify and extend their capacity to onboard and serve large numbers of app, commerce and experience partners; and create a marketplace framework that runs on a web3 trust and settlement “operating system.” So realising the opportunity to achieve strategic control around points of commerce aggregation will require significant homework.

In a web3 world, the combination of instant scale and the ability to activate a captive audience makes telecom operators strong contenders.

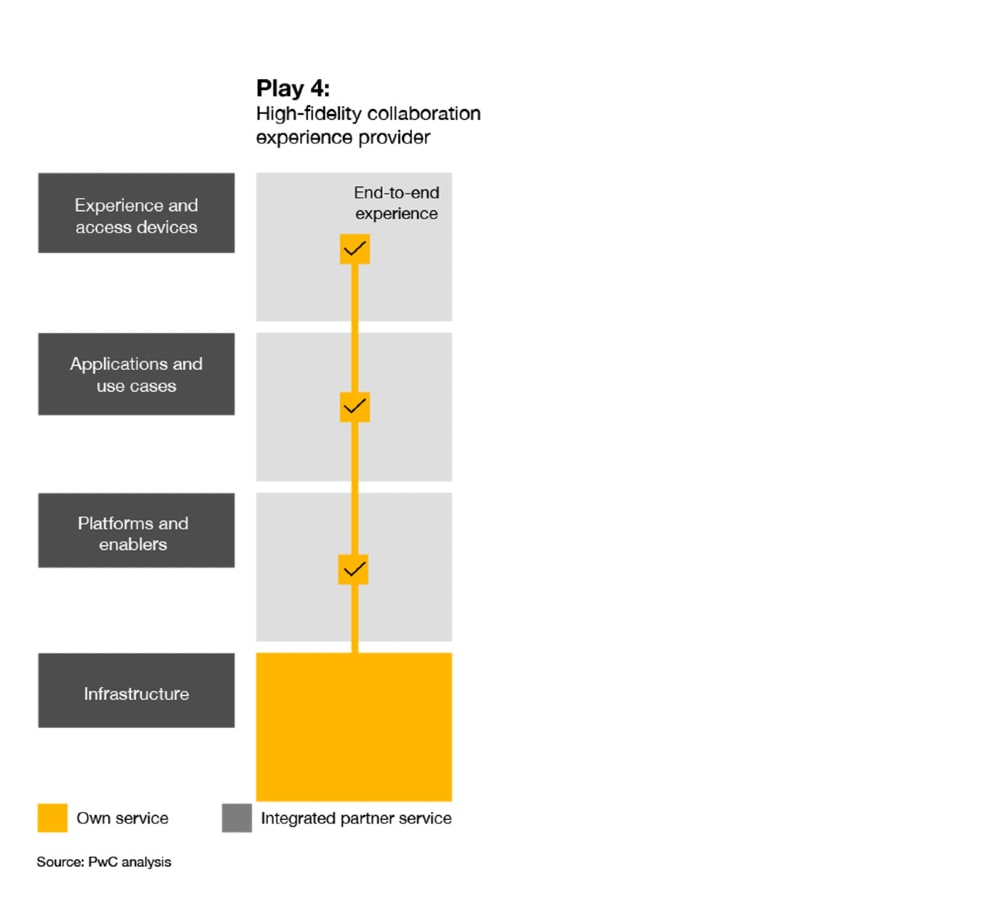

To a degree, this final play is about re-embracing the roots of what it means to be a telecom operator. The original initial business purpose of telecom companies was to ensure that communications services—starting with the telegraph before moving to voice calls and then internet sessions—worked with the highest possible levels of reliability and quality. With the move towards decentralisation on the one hand and new immersive experiences such as those on offer in the metaverse on the other, web3 is emerging from two trends that may lead to a new reliability and quality gap in the communications space.

As web3 evolves, we’re likely to see a disconnect where decentralisation pushes mainstream connectivity towards becoming a lowest common denominator of minimum viable broadband over a decentralised mesh of networks, while the immersive experiences demand high speeds and throughput, low latency and guaranteed quality of service. This high-fidelity need reflects a strong new web3 opportunity, centred on a new class of communications and collaboration services. These will likely include 3D video streaming; holographic rendering; virtual, augmented and mixed-reality environments; and other technologies that critically depend on end-to-end reliability and quality—all attributes at the core of telecom companies’ proven capability set of integrating and operating communications services at scale.

All of this points to a clear market opening for telecom operators to create differentiated, compelling communication experiences end-to-end across the web3 ecosystem. It’s a further way for them to fight back against the technology companies’ highly successful over-the-top communications offerings that have effectively cannibalised telecom operators’ own services. Now the two groups of contenders meet again in a new decentralised web3. Telecom companies have a real chance of winning out if they can adapt more quickly to the opportunities of the decentralised ecosystem and move at pace with partners to build out the next level of high-fidelity and seamless communication experiences.

Telecom companies have a real chance of winning out if they can adapt more quickly to the opportunities of the decentralised ecosystem.

Clearly, web3 offers no shortage of both opportunities and challenges for telecom operators. So, how best to move from analysis of the options into execution?

Following a thorough review of the strategic options and ways to play in web3, we believe the optimal approach for a telecom operator involves three key actions.

This articulation will translate into a capability map that should serve as a blueprint for the desired web3 target state. It will provide a clear modular taxonomy to facilitate discussions on investment decisions, road-mapping and prioritisation. In turn, it will act as a backdrop to defining leadership accountabilities and product ownership for each capability.

However, this execution blueprint should always be seen as a flexible and adaptable tool, not an immutable truth. Because the web3 world often will continue to dynamically evolve, so will your execution plan need to be adaptive and able to rapidly respond as web3 needs, opportunities and ecosystems shift.

As you start the execution journey, the initial focus should be on no-regrets actions. A web3 connectivity play, for example, is less an option and more a necessity. So get to work. The shortlist of actions to accelerate your web3 plans will also likely include the modernisation (or pivot) of legacy BSS environments to adopt web3 principles, and the foundational investments into blockchain capabilities. More ambitious plays—such as broader ecosystem enablement through telecom-run trust and settlement platforms, or marketplace aggregator plays—promise higher value creation over time, but also imply bigger leaps on the capability-building agenda. Yet initial moves to improve your capabilities in these areas could still bring benefits to today’s operations.

But whatever plays you commit to, bear in mind that web3 is both five years out in terms of time-to-mainstream, and is also a more dynamic, rapidly evolving and constantly reconfiguring ecosystem than the internet we know today. You will need to be ready to invest with stamina and patience for the next decade (don’t expect a two- to three-year return!)—and be prepared to experiment, fail and learn; collaborate with many partners; and adjust your strategy as new potential pathways reveal themselves.

In short: assess the landscape, pick your plays and make your move. And the time to start? Today.

{{item.text}}

{{item.text}}