Our study courses will guide you through the ESG topics from A to Z

ESG, Sustainability and Non-Financial Reporting

ESG, Sustainability

and Non-Financial Reporting

ESG (Environmental, Social and Governance) is one of the biggest challenges in today's business world. Companies realise that their environmental and social impact is crucial to their long-term sustainability and competitiveness.

Our expertise, know-how, and professional knowledge have enabled us to prepare comprehensive courses that will help you gain an overview of the latest changes and trends in ESG and sustainability. You can choose from a wide range of training sessions focused on non-financial reporting, carbon footprint measurement, or sustainable assets and projects.

ESG news and updates

Finalisation of Guidelines for Applying ESRS Standards in ESG Reporting

On May 31, 2024, EFRAG (European Financial Reporting Advisory Group) released the finalised versions of the implementation guidelines for applying ESRS standards in ESG reporting. More information can be found at the link above.

Why study with PwC Academy?

Global knowledge base and experience sharing

We are part of the global network of PwC professionals who cover an extensive range of ESG issues and industries.

Driving and shaping the future of ESG

PwC is represented in and consulted by international bodies driving the future of ESG and related regulations.

Flexibility and responsiveness

We keep track of ongoing developments in ESG in response to evolving trends and regulations.

ESG experts

Comprehensive educational solutions are covered by experts who have extensive knowledge and practical experience in the ESG field.

Award winning sustainability reports

Tutors have a long track record of successfully preparing ESG reports for PwC and clients, recognised by key stakeholders.

Practical and interactive courses

All of our ESG modules are highly interactive and will thoroughly prepare you for your role in ESG and non-financial reporting.

ESG courses

- ESG & Non-financial reporting

- Mandatory ESG reporting – EU CSRD & ESRS Standards

- Mandatory ESG reporting – EU Taxonomy

- ESRS Standards - Environmental pillar

- ESRS Standards - Social pillar

- ESRS Standards - Governance pillar, sustainable due diligence and value chain

- Carbon footprint measurement and disclosure

- ESG reporting for experienced professionals – upgrading from GRI to ESRS

ESG & Non-financial reporting

ESG agenda is developing dynamically and expectations for companies' activities and products are growing. ESG reporting is a means of informing the stakeholders (e.g. business partners – customers and suppliers, investors, employees, regulators, public) about responsible approach to environment, society and governance.

EU CSRD Directive, ESRS Standards and EU Taxonomy pose obligations on large companies to disclose information about sustainability (ESG). There are multiple other evolving regulations and trends to be aware of in the ESG landscape.

Overview for whom the ESG reporting becomes mandatory

The training programme is composed of four practical modules and it is suitable for those who need to understand or cooperate on ESG strategy and reporting in any role (legal & compliance, finance, HR, investor relations, procurement, logistics, environment, sales, marketing etc.). It will be appreciated by beginners as well as experienced ESG coordinators.

Topics covered:

- ESG at a glance: What does ESG mean, why it is important and what are the benefits. Practical illustrations from various industries. Orientation in ESG reports – what to look for and how to read in them.

- ESG reporting – regulations and voluntary frameworks: Who has the ESG reporting obligations and from when. Overview of mandatory and voluntary disclosure requirements (CSRD, EFRAG – ESRS, ISSB – IFRS SRS, GRI, SASB, TCFD).

- ESG report preparation – Content: Selecting the ESG reporting topics (mapping of relevance, prioritisation double materiality assessment). Scope of the report (who is covered entities, group level, value chain). Reporting principles to ensure quality. Stakeholders.

- ESG report preparation – Process: Practical guide – phases and steps in ESG report preparation. Reporting team composition. Anticipating and preventing typical problems.

Course details:

Time: 4 x 3 hours

Tutor: Radka Nedvědová

Mandatory ESG reporting – EU CSRD & ESRS Standards

At the end of July 2023, the European Commission adopted the final version of the 1st set of the European Sustainability Reporting Standards (ESRS) that further specify the requirements set by the EU Corporate Sustainability Reporting Directive (CSRD, approved in January 2023). The reporting obligations apply to large undertakings and groups who need to include ESG information to their annual management reports.

During this course, you will orient yourself in the complex structure of the ESRS, learn what to look for and where, and gain confidence in navigating and working with the standards. You will familiarise yourself with the reporting principles that need to be followed to ensure quality and stand up to mandatory assurance.

You will learn about the structure, topics and disclosure requirements for the three pillars – E, S and G. You will be able to distinguish the mandatory and voluntary disclosures, as well as those that may be delayed.

Topics covered:

- Cross-cutting standards ESRS 1 and ESRS 2:

- General requirements and disclosures mandatory for all undertakings subject to CSRD.

- Strategy, impacts, risks and opportunities – their management and measurement.

- Double materiality principle. Sustainability due diligence and value chain reporting.

- Time horizons. Structure and presentation of the report.

- Environment: E1 Climate change, E2 Pollution, E3 Water and marine resources, E4 Biodiversity and ecosystems, E5 Resource use and circular economy.

- Social: S1 Own workforce, S2 Workers in the value chain, S3 Affected communities, S4 Consumers and end-users.

- Governance: G1 Business conduct.

The course is suitable for people who will coordinate or participate in preparation of the mandatory ESG reporting under the requirements of EU regulations – CSRD and ESRS. (EU Taxonomy is covered in another course).

Course details:

Time: 2 days

Tutor: Radka Nedvědová

Mandatory ESG reporting – EU Taxonomy

The Taxonomy is a relatively new EU regulation aimed at directing private finance towards sustainable activities. It brings a common classification and definition system of economic activities that are considered sustainable from the point of view of the EU with regard to the set objectives of the EU. Last but not least, it also brings disclosure obligations for companies and groups operating in the EU.

The implementation of taxonomic reporting is a complex discipline that requires a perfect knowledge of regulations and related European legislation.

Topics covered:

- Identification of eligible activities,

- Analysis of technical screening criteria,

- Evaluation of compliance with minimum safeguards in the field of human rights,

- Method of creation and calculation of mandatory KPIs for non-financial institutions,

- Form of Taxonomy report.

Course details:

Time: 1 day

Tutor: Matěj Schánilec

ESRS Standards - Environmental pillar

Target group:

ESG coordinators who are interested in obtaining deeper understanding of standards in the environmental pillar are recommended to take part in this course after participating in the course Mandatory ESG reporting – EU CSRD & ESRS Standards.

Those who participate in measurement and collection of reported environmental information may take this course as a stand-alone option.

Recommended combination of courses:

We recommend combining this course with the training on Carbon footprint measurement and disclosure and ESRS Standards - governance pillar, sustainable due diligence and value chain.

Description:

We are going to have a deeper look into environmental standards: E1 – Climate change (from the disclosure point of view; problematics of the carbon footprint calculation itself is covered by a single special course), E2 – Pollution, E3 – Water and marine resources, E4 – Biodiversity and ecosystems and E5 – Resource use and circular economy.

You will obtain an overview of the common structure of “E” standards, we will introduce key concepts and definitions and discuss the interaction of cross-cutting standards with “E” standards. You will learn about individual disclosure requirements and whether they result from double materiality assessment or whether they are subject to mandatory disclosure regardless of the result of such an assessment. Main provisions of the standards will be, where possible, illustrated practically.

Topics covered:

- Structure of topical “E” standards, important concepts and definitions,

- Interaction of “E” standards with cross - cutting standards ESRS 1 a ESRS 2,

- Mandatory disclosures and disclosures based on double materiality assessment,

- Disclosure requirements:

- Policies,

- Activities,

- Targets,

- Metrics.

Course details:

Time: 1 day

Tutor: Jana Sequensová

ESRS Standards - Social pillar

Target group:

The course is suitable for ESG coordinators who are interested in obtaining a deeper understanding of standards in the social pillar. The course will be useful also to those, who participate in the measurement and collection of reported social information.

Recommended combination of courses:

ESG coordinators are recommended to take part in this course after participating in the course Mandatory ESG reporting – EU CSRD & ESRS Standards. Those who participate in measurement and collection of reported social information may take this course as a stand-alone option.

Description:

We are going to have a deeper look into social standards: S1 – Own Workforce, S2 – Workers in the value chain, S3 – Affected communities, S4 – Consumers and end-users. You will obtain an overview of the common structure of “S” standards, we will introduce key concepts and definitions and discuss the interaction of cross-cutting standards with “S” standards. You will learn about individual disclosure requirements and whether they result from double materiality assessment or whether they are subject to mandatory disclosure regardless of the result of such an assessment. Main provisions of the standards will be, where possible, illustrated practically.

Topics covered:

- Structure of topical “S” standards, important concepts and definitions,

- Interaction of “S” standards with cross - cutting standards ESRS 1 a ESRS 2,

- Mandatory disclosures and disclosures based on double materiality assessment,

- Disclosure requirements:

- Policies,

- Activities,

- Targets,

- Metrics.

Course details:

Time: 1 day

Tutor: Radka Nedvědová

ESRS Standards - Governance pillar, sustainable due diligence and value chain

Target group:

Those who participate in collection of reported governance information may take this course as a stand alone option.

Recommended combination of courses:

ESG coordinators are recommended to take part in this course after participating in the course Mandatory ESG reporting – EU CSRD & ESRS Standards.

Description:

We are going to have a deeper look at two important areas of ESRS Standards. Firstly, we are going to explore the only topical standard from the governance pillar, standard G1 Business conduct. You will obtain an overview of the structure of the standard and learn about its interaction with cross-cutting standards ESRS 1 and 2. You will broaden your knowledge of the individual disclosure requirements and whether they result from double materiality assessment or whether they are subject to mandatory disclosure regardless of the result of such an assessment. Main provisions of the standards will be, where possible, illustrated practically.

Second part of the course will be concentrated on disclosure of information in the value chain. Value chain is a relatively new, complex and cross-cutting topic in the context of corporate reporting and ESRS. Its prominence is emphasized by the existence of EFRAG’s Value chain implementation guidance and by the newly approved Corporate sustainability due diligence directive - CSDDD. The course will introduce main provisions of this directive, principles featuring in the implementation guidance and their link to mandatory provisions of individual ESRS standards.

Topics covered:

- Structure of G1 standard, important concepts and definitions,

- Interaction of standard G1 with cross - cutting standards ESRS 1 and 2,

- Mandatory disclosures and disclosures based on double materiality assessment,

- Disclosure requirements: EFRAG’s Implementation guidance IG 2 Value chain and its link to cross-cutting and topical ESRS standards ,

- Definition of value chain, upstream and downstream subjects, relationships and dependencies,

- Incorporation of value chain into materiality assessment,

- Specifics of value chain in “E” and “S” pillars,

- Transitional provisions - phasing of disclosures about value chain,

- Due diligence based on OECD and UN principles - recommended steps and practical examples,

- Directive CSDDD:

- Applicability: who and when,

- Obligations resulting from CSDDD,

- Relationship with sustainability reporting.

Course details:

Time: 1 day

Tutor: Radka Nedvědová

Carbon footprint measurement and disclosure

European regulation, finance providers and major customers start requesting information on carbon footprint of a company or its products. Join us to learn what are the components of carbon footprint, how to calculate and how to decrease it.

You will learn about the following topics:

- Greenhouse Gas emissions – what are they and how to measure them:

- scope 1 (direct emissions),

- scope 2 (indirect energy-related emissions) – location vs. market-based method,

- scope 3 (other indirect emissions) – downstream, upstream,

- Emission factors, CO2 equivalents,

- Company carbon footprint,

- Product carbon footprint,

- Carbon neutrality vs. Net Zero – offsets and compensations,

- Carbon footprint measurement and reporting standards – GHG Protocol, ISO 14064, ISO 14067, CDP,

- Carbon footprint calculation – phases, boundaries,

- Decarbonisation – SBTi, goals and means of reduction.

Course details:

Time: 1 day

Tutors: Martina Rozkošná, Josef Novotný

ESG reporting for experienced professionals – upgrading from GRI to ESRS

We tailored this course to the needs of participants who already have experience with ESG reporting and do not need to start from the basics.

You will appreciate this training if you already report on sustainability on a voluntary or mandatory basis, based on Global Reporting Initiative (GRI Standards) or another methodology. Although this is a very good ground for fulfilling the future obligations imposed on large EU companies and groups by the CSRD directive, there are some significant differences that will require a robust preparation.

We will take you through the major differences between voluntary (e.g. GRI-based) and mandatory CSRD reporting and explain their practical implications for the report content, process and sustainability governance.

We will focus on the following topics (and more):

- Double materiality assessment – extended by financial perspective of ESG matters,

- Inter-operability, similarities and differences between GRI and ESRS requirements and indicators,

- New mandatory disclosures in ESRS (differences and additions),

- Inclusion of entity-specific (industry) disclosures in the absence of ESRS sector standards,

- Mandatory EU Taxonomy disclosures (new to majority of reporters),

- Requirements for structure and form of the report, integration to annual report,

- Rules for claiming an exemption due to inclusion in consolidated report prepared by parent company,

- Mandatory external assurance.

Course details:

Time: 3,5 – 4 hours

Tutor: Radka Nedvědová

Overview of Courses

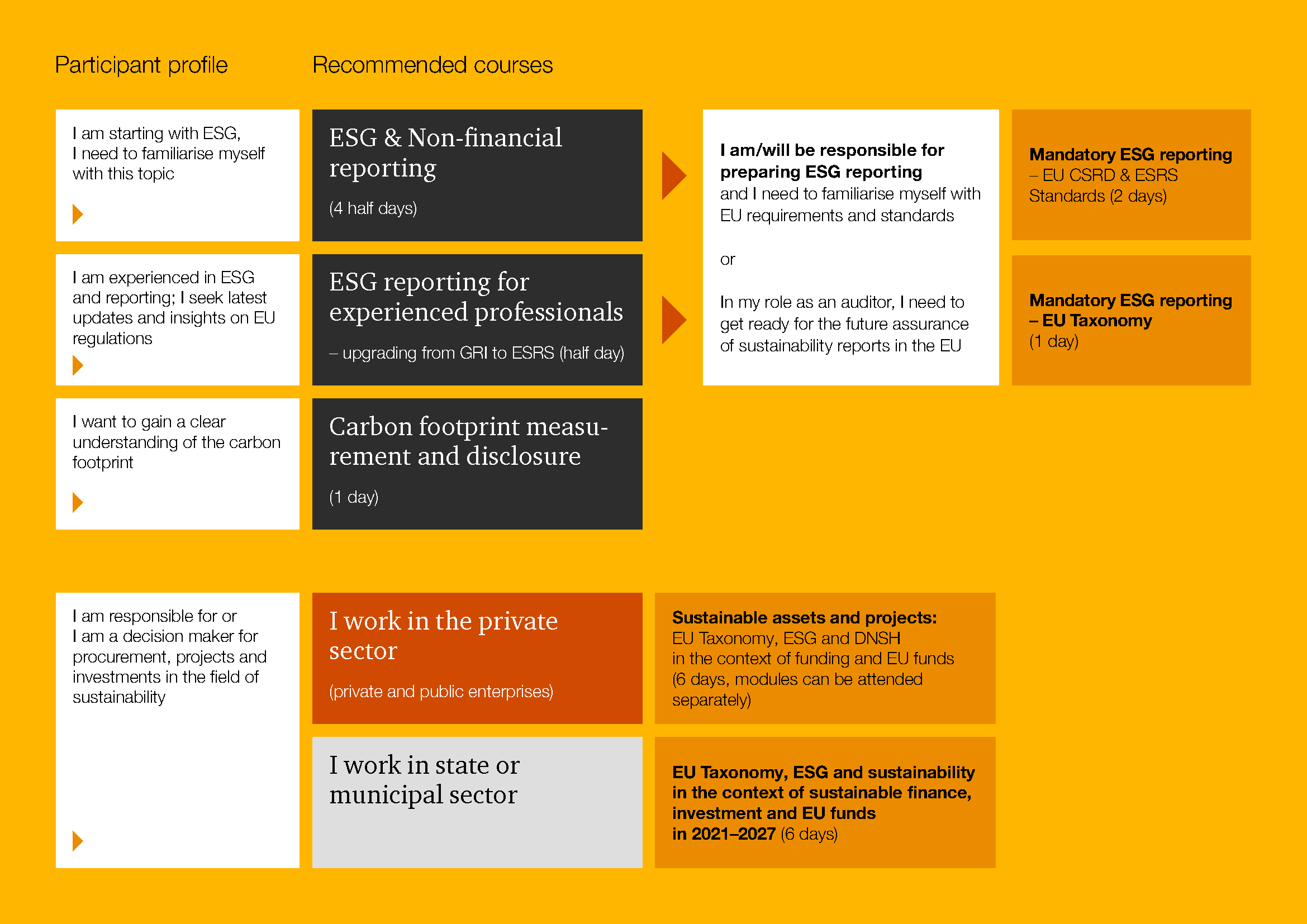

Are you hesitating about selecting a course and considering which training to choose to meet your expectations? We have prepared a clear navigation that will assist you in making your choice.

Dates and details

| Course | Course dates | Price |

| ESG & Non-financial reporting | autumn 2025 | 743 EUR (+ VAT) |

| Carbon footprint measurement and disclosure | 27 November 2025 9 a.m. – 5 p.m. |

494 EUR (+ VAT) |

| Mandatory ESG reporting – EU CSRD & ESRS Standards | autumn 2025 | 822 EUR (+ VAT) |

| Mandatory ESG reporting – EU Taxonomy | autumn 2025 | 494 EUR (+ VAT) |

| ESRS Standards – Environmental pillar | autumn 2025 | 494 EUR (+ VAT) |

| ESRS Standards – Social pillar | autumn 2025 | 494 EUR (+ VAT) |

| ESRS Standards - Governance pillar, sustainable due diligence and value chain | autumn 2025 | 494 EUR (+ VAT) |