PwC Online Reporting Tool (3.0)

PwC’s Online Reporting Tool is designed to provide a continuous link between corporate invoicing/ERP systems and the tax authority’s Online Invoicing System. This enables mandatory and fully compliant reporting without the need for costly and time-consuming customisation of ERP systems.

Version 3.0 of NAV’s Online Invoicing System was launched on 1 January 2021. The grace period lasted until 31 March 2021; since then all taxpayers concerned must submit their data online in a predefined XML 3.0 file format, without manual intervention.

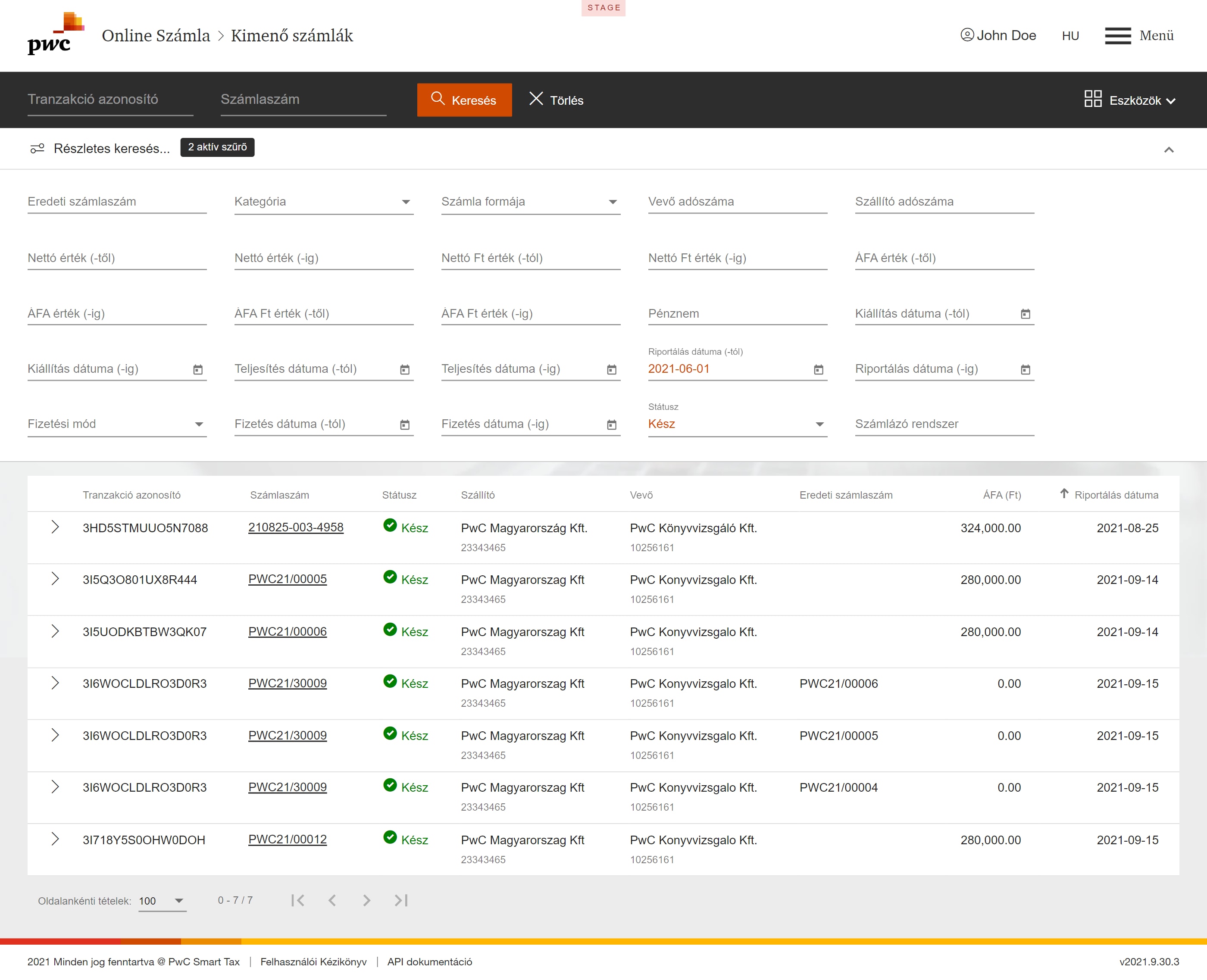

PwC’s Online Reporting Tool helps you to fully comply with this legal obligation. Invoice data transferred from the invoicing or ERP system can be viewed as a list, in XML format, and in an easy-to-read invoice format (PDF). The system also verifies the reported data, which helps to detect and avoid incorrect data submission. Users can monitor the status of each transaction via an easy-to-use, streamlined UI. The system is also designed to withstand temporary Internet outages: unsubmitted invoices are automatically submitted once the connection is re-established.

PwC’s SmartTax team is continuously developing the Online Reporting Tool to ensure that it complies with regulatory changes and to keep it up to date with technical changes to NAV’s Online Invoicing System. This version tracking and regulatory compliance is included in our fee as a standard service.

In addition, our solution offers a range of reporting-related features. These features include: generating an XML file in the prescribed format; creating an Excel export file; managing and storing data for multiple legal entities at the same time; and, if reporting is not possible for some reason (for example, no Internet connection or NAV’s systems are unavailable), the application will queue up the invoices until the problem is resolved. If the reporting fails and there is no confirmation of receipt or an error message, the system will generate a log of such issues.

PwC Online Reporting Tool Cloud

PwC’s Online Reporting Tool is also available as a cloud-based solution. Our solution is built and operated in a cloud-based environment hosted by PwC, saving our clients significant time and costs associated with migration and management. There is no need for internal or external IT support or to maintain costly IT infrastructure. Thanks to the cloud connection, version updates are automatic, the software provides customised user management and authentication, and enables real-time queries and analyses of each transaction and communication with the Online Invoicing System.

Smart Tax Cloud

As part of our service, PwC’s SmartTax team will provide access to a customised software application (PwC Online Reporting Tool Cloud) that will allow you to fully comply with the online data reporting requirements. The application can automatically generate the above-mentioned XML file, with the content and structure prescribed by the tax authority, based on invoice data exported from your ERP system.

After generating the XML file, the application automatically communicates with the tax authority’s system to supply the required data, and to receive and store the tax authority’s response (a confirmation message and a unique ID for each invoice reported).

The application also handles the reporting of other documents that qualify as invoices, such as correction invoices, credit invoices, and invoice adjustments.

The application will also keep track of any connection issues and outages in the tax authority’s system when data transmission is not possible.

PwC’s developers will tailor the application to your needs and adapt it to source invoice data exported from your ERP or invoicing system. When designing our solution, we made sure that it can be extended as fully as possible.

The Cloud version offers several special features, such as:

- querying customer and/or supplier invoices;

- extended reconciliation to monitor the reported data and the invoice data in the ERP;

- optional integration with PwC’s Tax Return Unified Support Tool, which automates the preparation of VAT returns.