Digital payment and financial technology companies are reshaping the banking landscape, creating new avenues for competition and challenging traditional banks in areas such as customer acquisition, uncollateralized micro-loan disbursement, facilitating overdraft, and cross-selling complementary products.

Banks typically offer lower interest rates on higher secured loans, benefiting customers with substantial collateral. However, when it comes to unsecured lending for high-risk small enterprises, banks often fall short. The lack of collateral and the sheer volume of smaller businesses make the lending process cumbersome, involving extensive paperwork and manual operations. As a result, many small businesses turn to fintech companies for their lending needs. Fintechs provide unsecured loans with faster approval times, addressing the urgent liquidity needs of small businesses. Quick access to cash helps these enterprises maintain sufficient cash flow and ensure smooth operations.

Fintech companies operate like startups, they have the appetite to take risks and experiment with new ideas, and they are willing to burn cash as an expense for growth. They also gather massive amounts of data, which helps them to offer a range of products and services in a tailored, seamless and convenient way. Put simply, they are positioning themselves as more than just banking services, they have become the go to platform for payment services and drivers of financial inclusion in Africa.

What does it take to succeed?

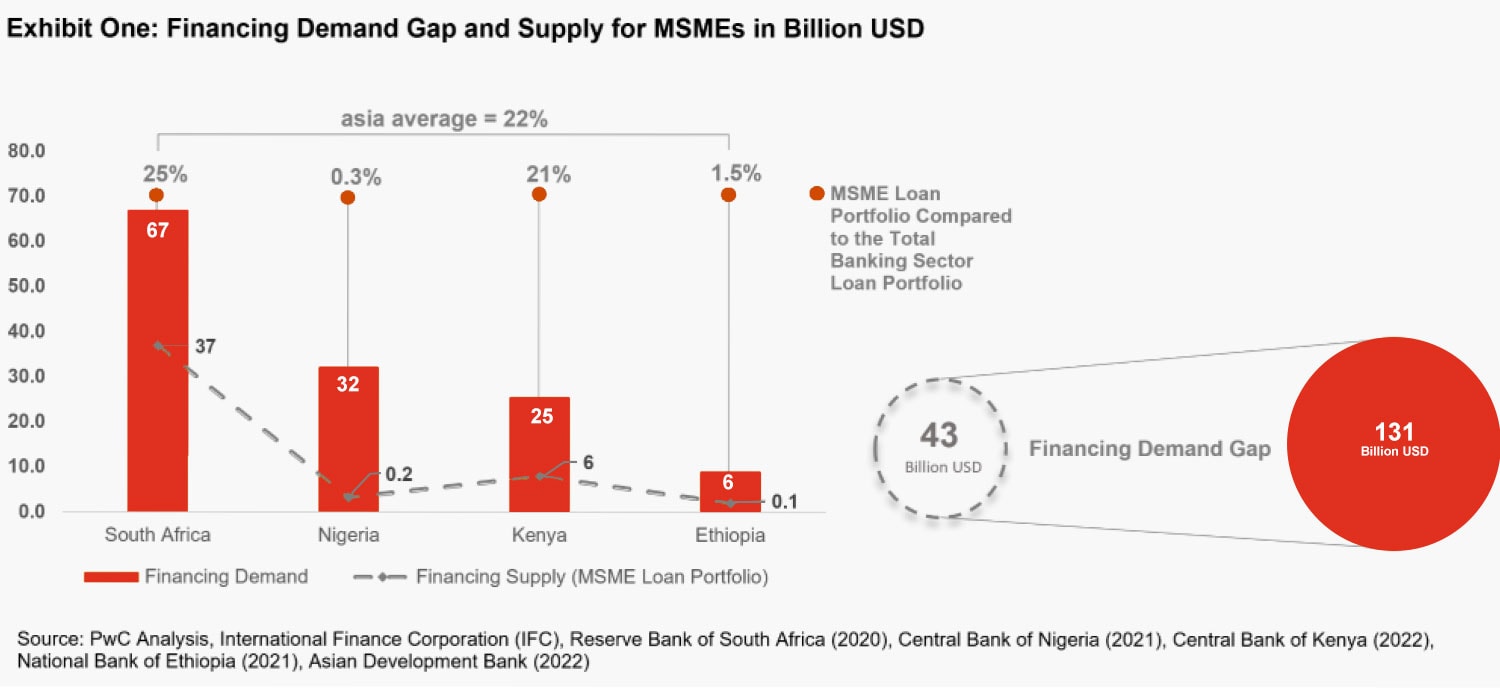

Bridging Financing Gaps for MSMEs: The Sub-Saharan MSME market remains largely underserved. The World Bank estimates the financing demand gap to reach as high as 205% of the current loan portfolio for the four largest economies in Sub-Saharan Africa. And Fintechs are primarily targeting this customer base where banks are lagging behind. They offer products that are tailor made to the specific needs of their customers by identifying gaps, market opportunities and having a fast route to market for these products. For instance, in Kenya, a leading telecom and financial services provider offers unsecured short-term loans for small businesses and has on-boarded more than 6.5 million MSMEs accounting for 90% of all SMEs and enterprises in the country.

Retail banks must adapt to these changing landscapes by embracing technology, focusing on customer experience, and offering products and services that are in sync with their target customer base. By collaborating with fintechs, banks can leverage their technological innovation and agility to close the substantial funding gap in Africa. This partnership allows banks to reach underserved markets more effectively, ensuring that both players not only survive but thrive in the evolving financial ecosystem. This strategic pivot can enable banks to capture significant market share and tap into the lucrative potential of the unbanked and underbanked populations

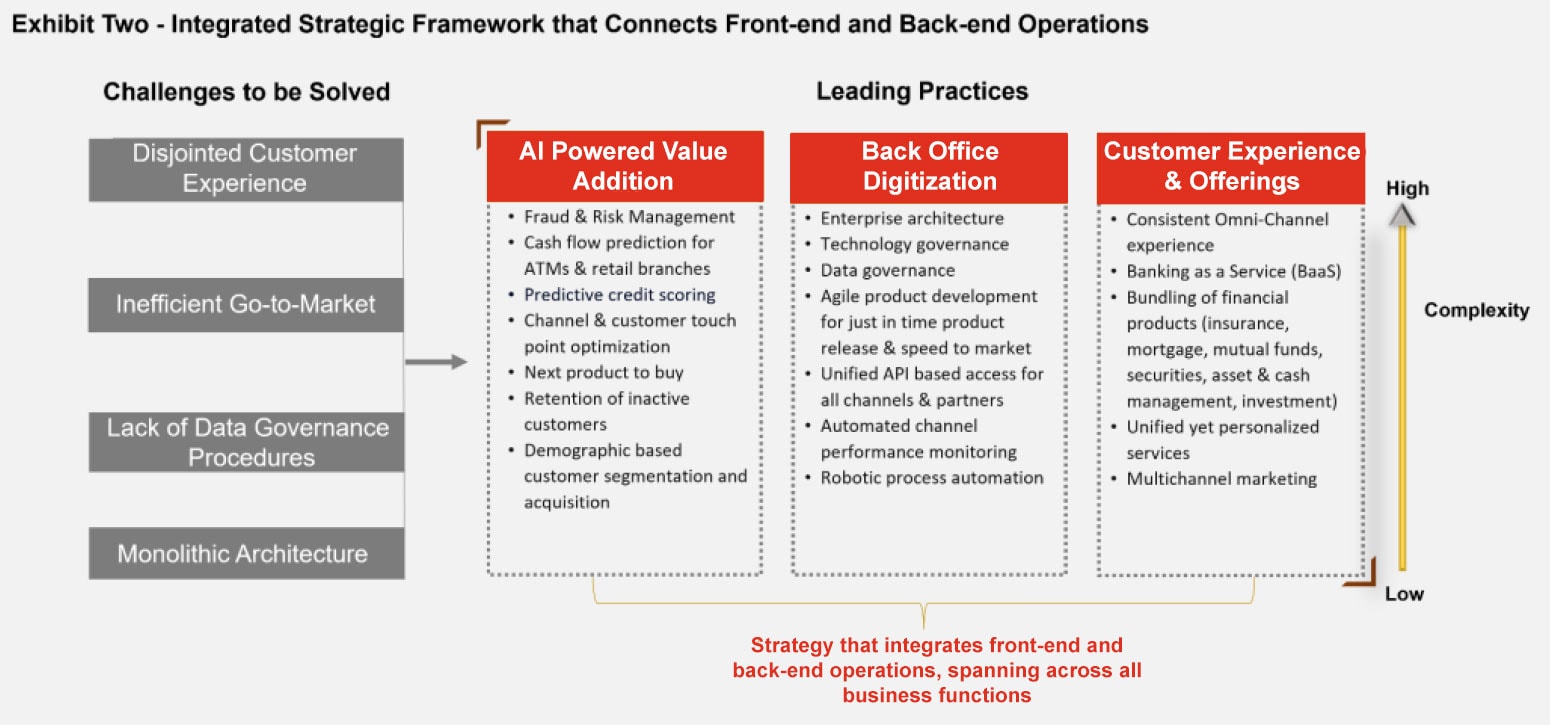

Market-Led Innovation: In this highly competitive space the traditional one-directional pipeline approach of getting digital products to market is a recipe for failure. Banks must continuously evolve to meet customer needs and stay ahead of the competition. One critical aspect of this evolution is market-led innovation, which involves aligning product development with market demands. The adoption of agile product development embodies the core tenets of lean startup methodology, which advocates for experimentation, rapid iteration, and a fail-fast mindset. Emphasizing on assessing design, functionality, pricing, and user experience on the product side, as well as partnerships, channels, customers, regulators, and competitors on the market side will allow banks to gain a holistic view that enables them to gain insights, rapidly respond to market demands, and make informed decisions.

Revamping Go-To-Market Capabilities at Scale: The disconnect between strategy and go-to-market implementation is a major obstacle for banks. Having the right product-market-fit requires more than just a compelling value proposition. Defining the target customer segments, setting the right pricing strategy, creating channel partnerships, and having a strong brand positioning will also be equally important to differentiate oneself from market players. Generating awareness and increasing brand visibility among the target audience, delivering go-to-market capabilities at scale, reducing churn rate and ensuring seamless online–offline integration between digital touchpoints and physical branches are crucial for success under the entire GTM process. Leveraging predictive analytics to map customer decision journeys can also provide valuable insights, lead generations, and incremental sales, ultimately driving growth and profitability.

Hyper-Personalized Services: Building capabilities on insights driven operating models and having a strong foothold on advanced data analytics is essential for gaining a deeper understanding into a unified 360-degree customer profile. Banks face two critical issues when it comes to deploying advanced analytics use cases.

Delayering: For MSMEs seeking financing, slow loan pre-approval processing times, cumbersome application procedures, and lack of personalized service are common issues that affect MSME access to capital. The solution lies in embracing digital transformation through the delayering of legacy systems.

Legacy banking systems resemble a tangled web of interconnected layers, often referred to as "spaghetti architecture”. These systems operate in silos and components within a bank’s infrastructure do not seamlessly communicate with one another which creates a disjointed customer experience and leads to redundant processes. This complexity not only hampers agility and innovation but also poses a significant challenge in adapting to the changing market dynamics and customer expectations.

Delayering involves shifting into a federated operating model of untangling intricate layers of monolithic systems, breaking them down into smaller, more manageable components. This transition offers several strategic advantages for banks. Unlike traditional monolithic point-to-point architecture, where changes to one part often necessitate modifications across the entire system, microservices architecture allows for targeted updates and enhancements without disrupting the entire ecosystem. It also fosters agility by empowering banks to evolve and scale individual components autonomously and quickly adapt to technological advancements.

Open Banking: Payment banks and fintech players have integrated technology into their core strategy, enabling them to grow their risk-calibrated core operating profit while also providing a seamless banking experience. Open banking enables these third-party players to integrate their operation with the core system and data pool of banks through Application Programming Interfaces (APIs), allowing them to co-create innovative products and services on top of the bank’s technology infrastructure.

Banks can also consume these APIs to gain insights into their customers' behavior and preferences, enabling them to curate their products and services more efficiently. Banks typically generate more revenue from lending than from payments, and open banking provides an opportunity for banks to tap into the customer base of digital wallet service providers and offer micro-credits, with fintech partners providing the latest technology for credit scoring and risk management. In return banks can monetize APIs and generate revenue, get access to a broader customer base and expand their reach to underserved areas with minimal cost on infrastructure, distribute and cross-sell banking products, and increase their footprint through channel partnerships.

Ultimately, open banking provides a win-win situation for both banks and fintech players, enabling them to innovate, differentiate, and compete more effectively. Regardless of location, customers consistently prioritize convenience and personalization. However, given the exchange of customer data, including transaction history among different digital marketplace partners, obtaining customer consent and aligning open banking operations with central bank regulations are critical considerations.

As the finance industry undergoes rapid digitization, retail banks find themselves at critical junctures. Understanding how to balance their traditional role as custodians of money with their evolving identity as a financial technology company is essential for their success in the digital era. The ability to discern when to compete independently and when to forge strategic partnerships will also be critical.

Banks possess inherent advantages, they are well positioned to absorb losses, manage risk, and leverage existing infrastructure, making them the perfect drivers of financial inclusion with the unbanked population. The market is huge, there is ample space for all players to compete and thrive. However, to excel in delivering seamless customer journeys, and to avoid being sidelined in customer-facing activities, banks must swiftly adapt to the rapid changes. The future belongs to those who not only possess a well-defined digital strategy but also have the innate ability to function as digital natives.