Create value through ESG

Assembling today for accountable green strategy

Building a sustainable business is about making a tangible difference — cultivating smarter business for a stronger world. You want to drive value and fuel growth while strengthening our environment and society. Our teams are ready to help you build greater resilience and trust by making strategic moves to manage your environmental, climate and social impacts; and by addressing regulations, investments and metrics across ESG (environmental, social and governance) opportunities.

Step into your ESG journey

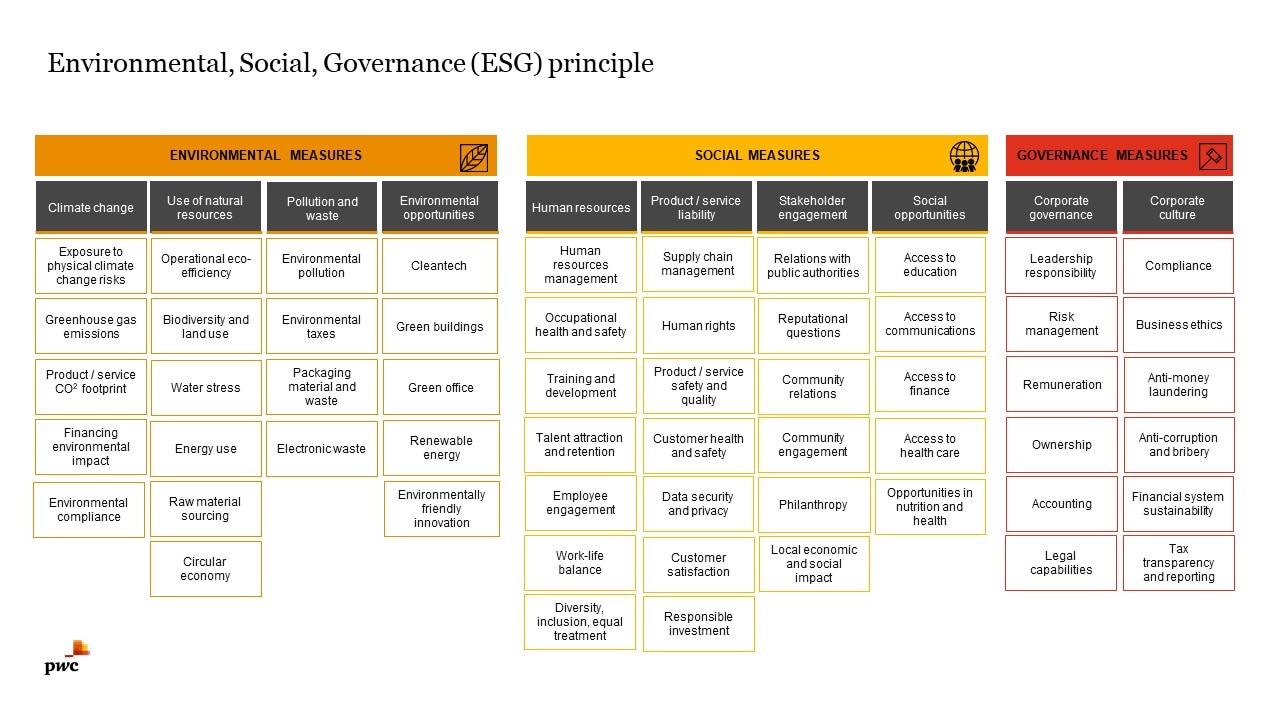

Environmental, social, and corporate governance (ESG) issues appeared in 2005, but the subject has continued to attract special attention since the publication of the UN Sustainable Development Goals in 2015. All these issues taken together constitute the sustainability criterion for businesses. The abbreviation ESG represents a range of issues, and not all of them will be equally relevant in every sector.

In the face of government incentives and regulations, investor standards, and the perceptions of both internal and external stakeholders, ESG expectations shape today’s economic landscape, redefining value and risk in business. In this ecosystem, aligning company actions with ESG priorities into measurable impact is at the top of our agenda.

Our community of problem solvers stand ready to build equity, transparency, trust, and resilience by addressing regulations, investments and metrics across ESG opportunities. Our team can help you blueprint and and attain your sustainability ambitions, driving short and long-term ESG value through strategy, scenario planning, mergers & acquisitions, capital allocation, ESG due diligence, business model reinvention and portfolio optimization.

Our Services

- ESG Strategy

- ESG reporting

- ESG Ratings

- Assurance

- Integrate respect for human rights in your supply chains/ Business and Human Rights related services

- ESG Trainings

- Climate strategy

- ESG Governance approaches

- Sustainable finance

- Corporate Sustainability Reporting Directive (CSRD)

ESG Strategy

Materiality analysis

In order to determine which ESG aspects to focus on, we analyse all of the company's operations and supply chain, and consult with its internal and external stakeholders.

Goal setting and KPI selection

We help you select and set specific goals for each strategic ESG area, and identify a set of key performance indicators, which would allow you to monitor the progress, on the basis of which subsequent non-financial information will be disclosed.

Road mapping

We will propose a plan with initiatives for each specific ESG area aimed at achieving the set objectives, which will form the basis of the ESG practice for the upcoming years. Instead of incoherent ideas you will have a structured roadmap with a focus on those projects that will give you the most value.

ESG reporting

Determining a reporting strategy

Developing an approach to reporting: what information to report, how to report and to whom, what standards to use and what requirements to comply with. Analysis of the current quality of non-financial information disclosure and assessment of development objectives, overview of the best practices. Identifying the key material issues.

Development of a report release plan

Formalisation of the business process of report preparation, including control, collection and consolidation of data; determination of deadlines and responsible persons; developing an approach to identifying material topics. We can also help with employee training.

Assistance in the release of the report

Preparation of the final texts of the report based on the information provided. Checking for compliance with selected standards. Design and layout development, and other work related to the report publication.

ESG Ratings

Diagnostics of ESG profile and Gap analysis

We analyse the current level of the organisation's ESG practice in terms of the criteria of the mostly used ESG ratings agencies. We identify current achievements and areas where improvement is needed.

Plan development

We help build a roadmap with ESG projects and initiatives that will help you meet ESG ratings requirements and address current weaknesses in your ESG practice. Initiatives are classified by complexity of implementation and their impact, which helps to highlight the most significant projects as well as identify “quick wins”.

Recommendations on disclosure of information

The quality of ESG disclosure will greatly influence your ESG score. We will assess your current practice and support you in increasing the level of disclosure of non-financial information.

Support in obtaining an ESG rating

ESG ratings are quite diverse. We will help you choose the ones that suit you best, and we will accompany you in the process of working with a rating agency.

Assurance

Assurance of the report

We offer independent assurance of non-financial reporting in accordance with GRI, IIRC, AA1000 and other standards.

Integrate respect for human rights in your supply chains/ Business and Human Rights related services

- Assistance on preparation of relevant ESG internal policies and procedures;

- Assistance on implementation of the UN Guiding Principles on Business and Human Rights (UNGPs) and its reporting framework;

- Human rights due diligence (HRDD)

- Human rights salience assessment

- Human rights impact assessment

- Assistance on preparation of a guideline to conduct the HRDD

- Developing human rights policies, code of conduct, supply chain code of conduct, human rights due diligence policy, and other HR policies

- Developing grievance mechanisms and necessary policies

- Assistance in organising stakeholder (rightsholders) engagement

- Assessing if you comply with human rights regulations and legal requirements, and with international standards such as the UNGPs – i.e. your company policies, regulatory or legal obligations, industry codes, and voluntary codes, and identify areas for improvement.

ESG Trainings

We will assist you to design and deliver internal training on particular ESG topics tailored to address your needs.

The following trainings are included (not an exhaustive list):

- The Labour law, its key considerations and practical issues which can affect ESG performance of companies

- The personal data protection law, practical issues, and cybersecurity aspects

- Corporate governance and its ESG aspects

- Human rights due diligence

- Sustainable supply chain

- Diversity and Inclusion training

- Change management

Climate strategy

Measuring carbon footprint

Identifying the baseline of the company's climate impact for subsequent monitoring. We will help you assess your GHG emissions for all three scopes, and establish a monitoring and reporting system.

Climate risk assessment

Identification and prioritisation of climate risks is conducted using scenario analysis tools. Risk assessment becomes the basis for further strategy.

Goal setting

We will propose specific objectives to reduce your carbon footprint - commitments that the organisation can make and communicate to the public. Science-based approach (SBTi) is also included.

Action plan development

We will propose a plan with initiatives and projects that will help the organisation achieve its climate goals in the medium term. Initiatives will be classified according to the complexity of implementation and the resulting effect. We can also help implement specific decarbonisation initiatives and projects.

Support in reporting

Advice on disclosure of climate-related information. We can also help with the development of a plan for the implementation of TCFD recommendations.

ESG Governance approaches

Sustainable development is impossible without the involvement of the board of directors. Effectiveness depends on a corporate governance structure that helps to take into account the interests of stakeholders, on the development of policies and the quality of ESG risk management.

How can we help?

Development of governance system

We will help develop a sustainable governing system, including the development of an organisational structure, the distribution of roles and responsibilities, the development of internal policies and regulations.

Risk management

Integration of ESG risk management into the organisation's risk management system, which will help to adapt the strategy in the future which will be necessary for public disclosure.

Training

A special workshop for senior managers will help with determining priorities in the sustainability area and with the development of a plan for further action.

Sustainable finance

The introduction of ESG principles into lending processes is becoming the main direction of sustainable development for commercial banks, since it is the portfolio of borrowers that represents the most significant impact of the bank on the economy, society and the environment.

How can we help?

Sustainable products

We help banks develop green and social products, including both lending and non-lending products. In particular, we develop criteria for sustainable products, support their design, and analyse market prospects.

Negative screening

We will support the preparation of industry statements and policies that describe the bank's restrictions on financing certain types of activities that do not comply with the bank's ESG principles. We will help with the classification of the portfolio by climate risks for reporting purposes and the subsequent development of sustainable financing practices.

ESG scoring

We will develop a system for evaluating borrowers according to ESG criteria, including an information request form, evaluation criteria and methodologies. We will also create a technical solution for effective assessment and management analytics.

Corporate Sustainability Reporting Directive (CSRD)

The EU’s Corporate Sustainability Reporting Directive (CSRD) is an incoming piece of regulation. It requires companies to make extensive, detailed disclosures about sustainability performance and related strategic implications. Disclosures are prescribed by European Sustainability Reporting Standards (ESRS).

The ESRS are reporting standards for sustainability within the EU that cover a multitude of environmental, social, and governance (ESG) topics — including climate change, biodiversity, human rights, etc. The primary purpose of ESRS is to enable a simple and logical structure of sustainability information. The standards are an integral part of the CSRD and there are a comprehensive set of 12 ESRS in operation, with more in the pipeline.

Why PwC Mongolia

Our global network of nearly 2,000 sustainability professionals is recognized as a leader in delivering ESG business services and helping companies integrate sustainability into their strategy, financing, acquisitions, transformation and reporting.

Our seasoned background in cross-disciplinary assurance services

Providing assurance, tax, legal, people and advisory services to local and international entities of all sizes and across all sectors of the economy, our community of problem solvers can help you navigate the regulatory requirements and standards affecting your entity. Our proficiency in financial reporting will help strengthen the reliability of ESG data you share with stakeholders.

Our commitment to further cultivating ESG in Mongolia

This motivation for making a tangible difference & fostering smarter business is not limited to sharing insights, thought leadership, industry research, publications and participating in ESG events across the nation. Our association and compliance with leading standard-setting bodies fashion the future of sustainability reporting and ready public and private sector leaders for new disclosure requirements.

Our cross-disciplinary community of solvers from tax, deals, legal, people, assurance can help you incorporate sustainability principles into everything you do.