Foreword

PwC Papua New Guinea’s (PNG) 3rd Family Business Survey (FBS), conducted in the last quarter of 2022, comes at a pivotal time for the PNG economy and PNG family businesses. PNG businesses appeared to have navigated well the challenges they had faced and there was increasing optimism due to the raised expectations for the re-opening of the Porgera gold mine and progression of a number of other resource developments (with a focus on the Papua LNG project). We also had a period of improved political stability with the continuity of the Marape Pangu-led coalition attaining a stronger mandate at the 2022 elections.

However, this was against the backdrop of significant global uncertainty caused by the geopolitical turmoil created by the war in Ukraine, heightened tensions in the AsiaPacific region, global supply restrictions and significant rises in inflation and interest rates. Given that the resource dependent PNG economy is highly reliant on the international economy, trade flows and commodity pricing, it has not been immune to the rising cost inflation and tightening of global investment liquidity.

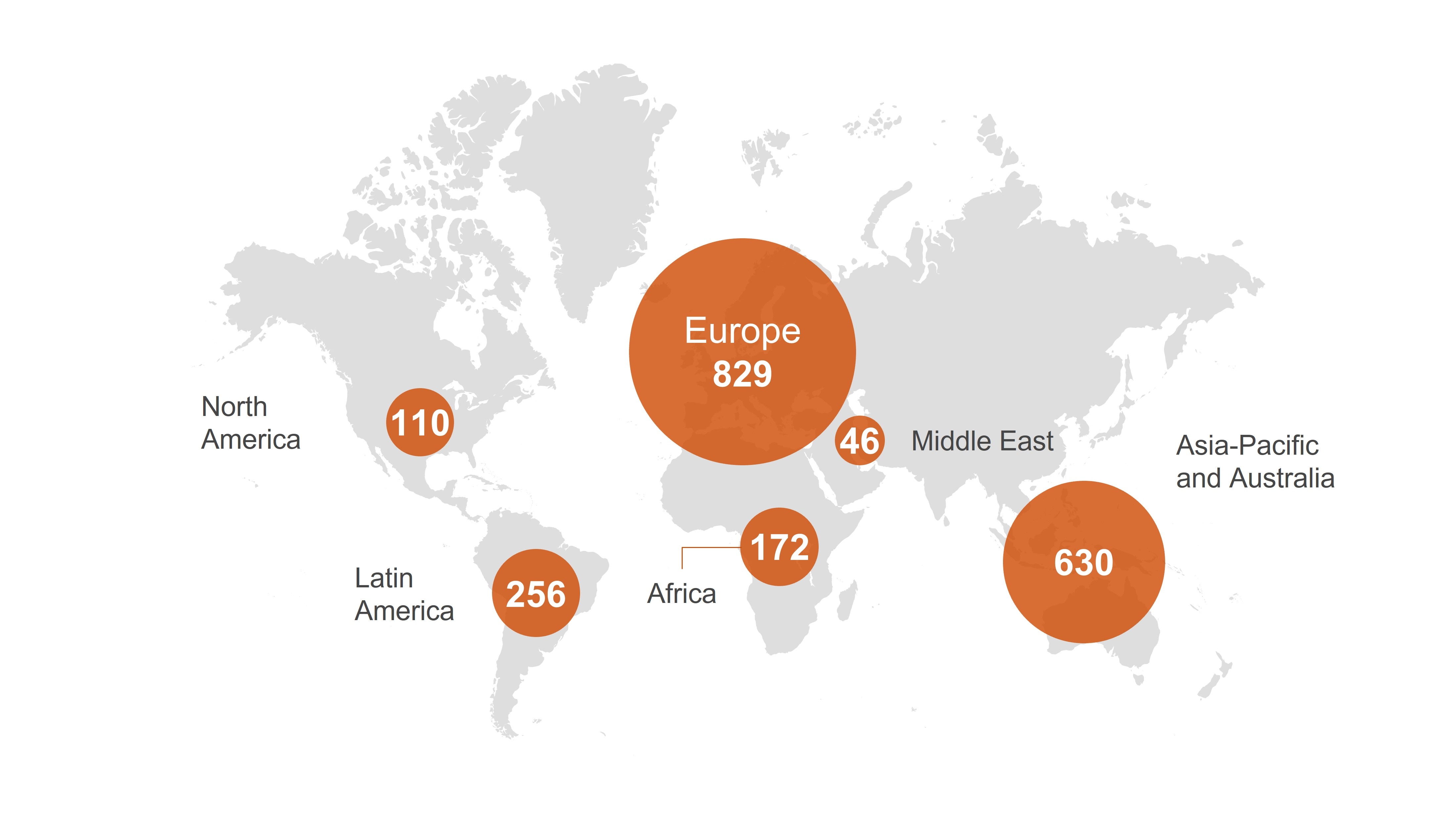

The Global FBS, released in March 2023, surveyed 2,043 family businesses across 82 territories. This year almost one-third of participants (630) were from the Asia Pacific region. In PNG, the third year of our participation, we surveyed 42 family businesses, an increase of 24% from the previous FBS in 2020.

Our PNG FBS was conducted alongside PwC’s 11th Global FBS and therefore provides an opportunity to compare the views of PNG’s family business leaders with their global and AsiaPacific counterparts in this period of great change. The Global FBS, released in March 2023, surveyed 2,032 family businesses across 82 territories. This year almost one-third of participants (630) were from the AsiaPacific region. In PNG, the third year of our participation, we surveyed 42 family businesses, an increase of 24% from the previous FBS in 2020. Not surprisingly for a young nation, some 88% of PNG respondents were either first or second generation businesses, compared to only 72% globally, and 81% in AsiaPacific.

The focus of the FBS for 2022 is on trust, which is fundamental to long term sustainability. Businesses rely on the trust of their customers, business partners, employees, shareholders and other stakeholders that they will be able to meet their expectations - whether that is product quality, service delivery, financial performance, employee engagement, business ethics and integrity or care for the environment and society. Family businesses also rely on the trust of the family members to ensure just and fair treatment and the avoidance of family conflict. Family and privately owned businesses have traditionally held a premium on trust, being driven by deeper core values and sense of community than multinational public companies.

However, the FBS for 2022 is indicating that the very nature of trust has changed and family companies are struggling to prioritise the strategies and actions that build trust with stakeholders and, just as importantly, to communicate your company’s mission, values and impact.

This report focuses on what constitutes the new trust formula, what global family business leaders are doing to bridge the trust gap and how PNG leaders can transform their own family businesses to build trust.

Most family businesses in Papua New Guinea performed strongly in the last financial year and expect a similar performance in the next two years.

Before we dive further into the trust issue, let’s see how family businesses in PNG have performed over the last year and their expectations for the future.

The majority of family businesses in PNG (59%) have experienced increased sales in the last financial year as would be expected post pandemic, and 40% of these experienced double digit growth. However, this lags behind the 71% globally (66% in Asia Pacific) who experienced sales growth (and 43% with double digit growth (41% in Asia Pacific). Interestingly, some 19% of PNG respondents reported a decline in sales, compared to only 8% globally (12% in Asia Pacific). This can probably be explained by local factors such as the extended closure of the Porgera gold mine, uncertainty leading up to the 2022 elections, continuing foreign currency shortages and supply chain issues.

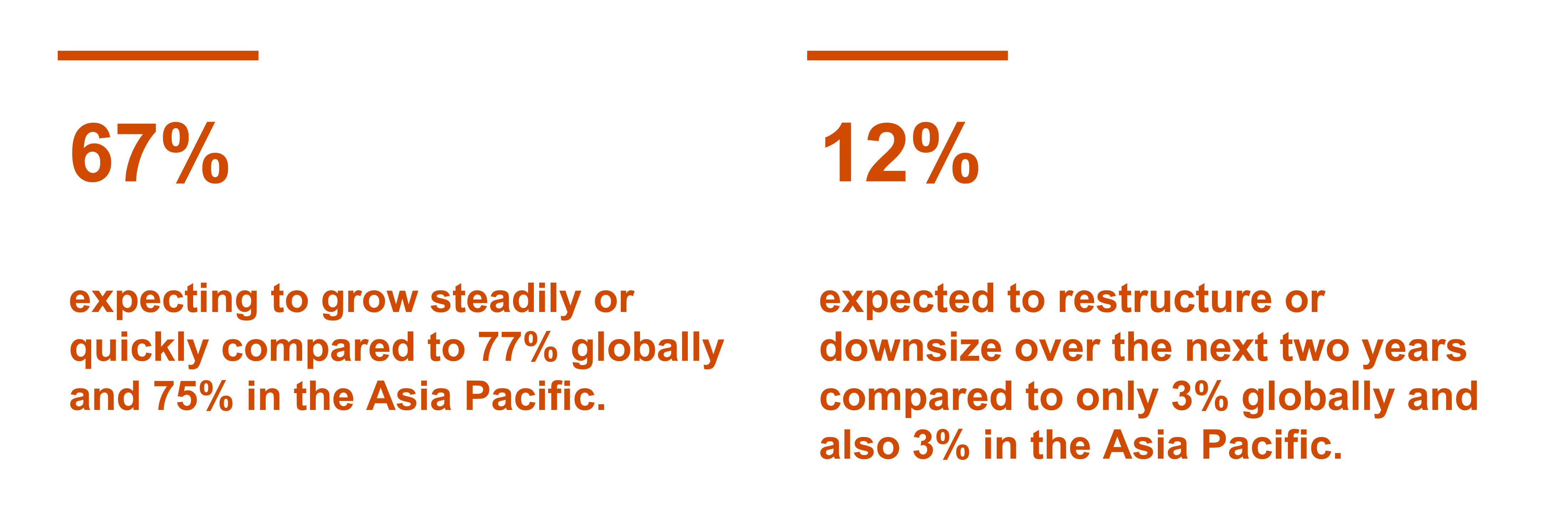

At the same time, the growth ambitions of PNG family businesses over the next two years are less ambitious than their global counterparts, with 67% expecting to grow steadily or quickly compared to 77% globally (75% in Asia Pacific), and there were still 12% of PNG respondents who expected to restructure or downsize over the next two years compared to only 3% globally (also 3% in Asia Pacific).

Clearly, whilst there was some cause for optimism at the end of 2022, PNG family businesses are aware of the potential risks to the economy, and the ability of the government to create an appropriate environment for growth, and deliver on their development priorities.

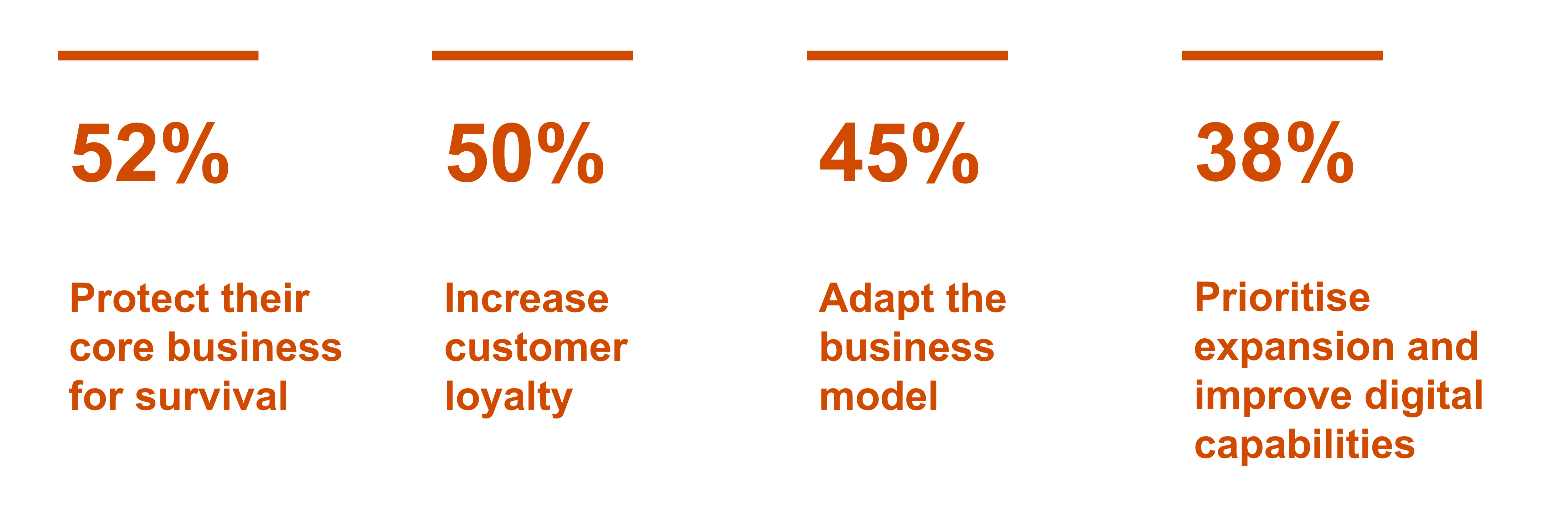

This is also reflected in differences in strategic priorities over the next two years. For global family business, the most important priorities are expansion (51%) (55% in Asia Pacific), improving digital capabilities and protecting the core business for survival (both 44%) (43% and 53% in Asia Pacific) and increasing customer loyalty (42%) (40% in Asia Pacific). The key priorities facing PNG family businesses are to protect their core business for survival (52%), increase customer loyalty (50%) and adapt the business model (45%) (34% globally and 37% in Asia Pacific), with only 38% prioritising expansion and improving digital capabilities.

This suggests that many PNG family businesses are still in “consolidate and wait and see” mode rather than being proactive in developing new strategies.

Perhaps an even more stark contrast is that only 17% of PNG respondents prioritise employee trust, compared to 32% globally (30% in Asia Pacific), only 7% are looking to innovate compared to 27% globally (28% in Asia Pacific) and only 2% are prioritising reducing the organisation's carbon footprint compared to 20% globally (12% in Asia Pacific).

In the longer term, there is some greater consistency in prioritising the generation of long term value for the family and delivering value to customers, although some 24% of PNG respondents are still looking to maximise short term profits compared to only 10% of family businesses globally (14% in Asia Pacific). This suggests a relatively short term perspective for many PNG business families. This is also influenced by the fact that 26% of PNG respondents do not see it as important that the business stays in the family (compared with 12% globally and 17% in Asia Pacific).

At the same time, the level of trust between family members is generally considered high, with 66% of PNG respondents saying that they were fully trusted by other family members compared with 74% globally (71% in Asia Pacific), but only 50% of respondents say there is family alignment about the direction of the company (compared to 59% globally and 55% in Asia Pacific).

And PNG family businesses are still lagging behind their global counterparts when it comes to having a clear governance structure (57% in PNG, 65% globally and 61% in Asia Pacific), clear set of family values (57% in PNG, 70% globally and 63% in Asia Pacific) and documented business purpose (24% in PNG, 45% globally and 36% in Asia Pacific). This is interesting given that 57% of PNG respondents see it as important to ensure the business stays in the family, and 45% say it is important to create a legacy, over the next 5 years (66% and 67% globally and 55% and 61% in Asia Pacific). This suggests further work is needed to help owners in PNG to meet their goals relating to the longevity of their business and legacy.

Family businesses need to adopt new priorities to build trust and ensure sustainability

Trust is as vital in business as it is in personal relationships. From a personal perspective, building trust and rapport requires demonstrating credibility, reliability, intimacy and low self-orientation, often built up through a succession of interactions. But if someone lets you down once, then that trust automatically vanishes. However, for companies, trust has more levels and many more stakeholder relationships to consider.

Customers trust you to provide quality goods and services that meet their expected standards at a fair price

Suppliers trust you to pay them on time and meet other supply conditions

Employees trust you to treat them fairly and respectfully, compensate them fairly and transparently, provide a safe working environment and provide appropriate feedback and development opportunities

Governments and authorities trust you to comply with the laws and regulations

Shareholders expect you to meet high standards of corporate governance, be transparent, true and fair in your corporate reporting and for management not to act in their own self interest.

So the message for family businesses is that you need to close the gap between your traditional views about trust and the expectations of current and future generations of stakeholders.

In today’s digitalised world, we trust companies to protect our personal and corporate information, keep it private and only use it for the purposes it was initially provided for. We are seeing too many issues Impacts of the effect of data breaches on companies and their customers are becoming increasingly common,

In addition, increasingly there is also a broader societal expectation on companies that they will help meet social needs, protect the public health and environment and act in a fair manner that contributes to good governance.

So trust is vital for business and brings benefits at a macro-economic level. This has been confirmed in a number of studies where there is a positive relationship between trust and growth (see Trust, Associational Life and Economic Performance by Stephen Knack). Multinational corporations are all well aware of the strong correlation between trust and profitability and are investing heavily, not only in building the competencies, motives, means and impact they are having, but just as importantly, in communicating the message that they can be trusted to do the right thing.

Trust has always been a vital competitive advantage for family businesses. Family businesses do not have to focus on short term profit goals and meeting the expectations of the market - they take a longer term view of success and typically have a wider sense of building value and contributing to their local communities. Traditionally the Edelman Trust Barometer confirms that family businesses are more trusted than other businesses. However, the gap is closing - because most international corporations have been proactive in building trust and broader ESG initiatives into their strategies and communicating to wider stakeholder groups. So the message for family businesses is that you need to close the gap between your traditional views about trust and the expectations of current and future generations of stakeholders.

So what has the FBS for 2022 told us about trust?

Some 93% of global respondents considered that having the trust of a broad range of stakeholders was important or essential (88% for PNG respondents and 90% in Asia Pacific) but only around 37% of respondents considered that they don’t encounter any major challenges building trust with stakeholders (36% for PNG respondents and 34% in Asia Pacific). This leaves the potential for an issue where trust may be eroded over time.

In terms of whose trust is most needed, the customer is still seen as king (82% said this was essential), followed by employees 68% and family members 63%. Responses from PNG family businesses were similar to these global findings (71%, 62% and 67% in PNG and 79%, 67% and 54% in Asia Pacific). There appears to be a large expectation gap in trust with these groups as only 51% of respondents globally said they were fully trusted by their customers (50% in PNG and 44% in Asia Pacific), 46% fully trusted by their employees (53% in PNG and 41% in Asia Pacific) and 74% fully trusted by their family members (66% in PNG and 71% in Asia Pacific).

Of concern for PNG is that 11% of respondents actually said they actually don’t have high levels of trust with family members (compared to 3% globally and 4% in Asia Pacific), but did not have a similar issue with customers or employees. This suggests that further work is needed by the family business to earn trust with all family members so that the longevity of the family business and legacy can continue.

Interestingly, the stakeholder group with the highest divergence from the global findings was around needing the trust of policy makers and regulators, which only 27% of global respondents saw as essential but was ranked as essential by 40% of PNG respondents (37% in Asia Pacific). When asked about the actual level of trust from policymakers and regulators, only 20% of PNG respondents considered they were fully trusted compared to 40% globally (35% in Asia Pacific). This clearly indicates how important government and statutory bodies such as the IRC, Customs, ICA and IPA are to PNG business and a perception of an apparent lack of trust that most PNG businesses are currently experiencing.

To build trust, we need to build positive relationships and to achieve this, we should be open and consistent in our dealings and provide transparent and honest communication. Speak out on social issues and show that you care about what’s going on in your community. There is also a need to demonstrate confidence in strategies and decision making but be prepared to quickly acknowledge if anything goes wrong.

But the survey tells us that many PNG family businesses are not taking the actions required to build trust.

So in many aspects, PNG family businesses are lagging behind in adapting their strategies to close the trust gap. Many PNG family businesses are doing great things in relation to supporting their local communities, promoting diversity in the workplace, providing development opportunities for their teams, improving their supply chains, waste management processes and recycling and countless other smaller or larger ESG initiatives. However, PNG family businesses need to do more to communicate their purpose and the actions being taken to meet their commitments to ESG principles.

As mentioned earlier, the majority of PNG family businesses feel it is important to be trusted by customers. Yet, less than half believe they are fully trusted by their customers. This is concerning given the fact that only 1 in 5 PNG family businesses actually have a system in place to gather their customers’ feedback and only 31% view understanding their customer’s needs as a key priority (compared to 43% globally, and 41% in Asia Pacific). It appears that this is the time for PNG family businesses to focus on their customers, improve engagement, and better understand their customers needs so that they can position themselves for sustainable growth.

Employees’ trust is also needed to be earned. As there was also a big expectation gap with employee trust it was surprising that only 17% of PNG family businesses viewed improving employee trust as a priority (32% globally and 30% in Asia Pacific). If you can’t attract and retain talent, you will have no business in the future.

Employees are the most important asset of a business. Putting effort and resources now into your employees should be top of mind. Your employees, and potential future employees, want to know that the company has a purpose, that it cares about them and the community and that employees are encouraged to speak up and contribute their ideas. Surprisingly only 10% of PNG family business owners have internal processes in place for employees to question management’s decisions (22% globally and 19% in Asia Pacific). These results tend to suggest that PNG family businesses are potentially blessed with an abundance of long serving loyal employees. This may well be the case, however, but are PNG family businesses ready to bring through a new generation of employees in their pursuit for longevity and legacy? It would appear not, based on the fact that PNG respondents do not put as much importance on attracting and retaining talent as their global counterparts, with only 38% giving it a high priority compared to 63% globally (61% in Asia Pacific). This may make it harder for PNG family businesses to attract and retain the necessary skills to successfully transition into the digitalised and more socially conscious economy. It may make it harder for PNG family businesses given that 74% of Australian and New Zealand family businesses do see attracting and retaining talent as a high priority.

It was also interesting to note that only 64% of respondents in PNG mentioned that they wanted to make a profit, but not at the expense of any of our customers or employees (77% globally and 76% in Asia Pacific).

So what about trust between the business and the family?

We have already mentioned that for PNG family businesses, this is an area that needs a lot of work potentially due to a misalignment between the goals of the family and business, or misalignment between family members. Some 36% of PNG family businesses think that disagreements among family members is one of the biggest challenges to building trust (22% globally and 21% in Asia Pacific) and only 50% report that conflict rarely or never arises (61% globally and 64% in Asia Pacific). Disagreement and uncertainty builds resentment which then leads to conflict. Communication between family members is high (71% in PNG say family members regularly communicate about the business which is higher than the 65% globally and 62% in Asia Pacific), however, only 50% say there is family alignment on company direction (59% globally and 55% in Asia Pacific). It is important that family members trust and support each other. There will always be family conflict, and this is normal if it is handled and discussed within the family, without using third parties or resolution mechanisms for dispute resolution. But there are still 24% of PNG family businesses who say that they have no form of policies or procedures in place amongst the family (19% globally and 23% in Asia Pacific), although the percentage of PNG respondents with wills in place was very high at 60% (35% globally and 33% in Asia Pacific). This lack of formal governance has an effect on how the business is run and how decisions are made within the family. It is difficult for other family members to have trust in those currently running the business if there is a lack of discussion and consensus on company values and purpose.

So going through the process of having family discussions and preparing shareholder agreements or family constitutions can be of great benefit. It is possible that there is still time for PNG family businesses to address this with 55% of PNG respondents saying the business is currently owner managed (32% globally and 41% in Asia Pacific) and 33% being family managed (38% globally and 33% in Asia Pacific).

Transforming to build trust

Overall we are seeing improvements within PNG family businesses when it comes to key areas around Growth and resilience, Sustainability and corporate responsibility, digital transformation and family governance comparing results from 2018 and 2020 to this year's findings. The issue is that our improvements are not at the same pace as what we are seeing in these areas at a global and regional level. As such we encourage family businesses in PNG to rethink how they remain relevant for future generations and build the trust that is necessary for sustainability. The traditional PNG family business commitment of giving back to the community through supporting local charities, sporting organisations, schools and health projects should be part of a broader strategy of demonstrating actions across a range of things that matter to your stakeholders and then making those efforts visible to all your stakeholders. The good thing is that there is still time to make the necessary transformations.

About the Family Business Survey

PwC’s Family Business Survey 2023 is an international market survey of family businesses. The goal of the survey is to get an understanding of how family business leaders perceive their companies and the business environment. The survey was conducted online in collaboration with the Family Business Network International (FBN). The survey conducted 2,043 interviews in 82 territories between 20 October 2022 and 22 January 2023.