Budget 2025: Light at the end of the tunnel

In 2010 Apple unveiled the first iPad, Instagram launched into the emerging world of social media, and the PNG Government last delivered a budget surplus. In nearly a decade and a half since the budget has been in deficit, peaking at PGK7.3 billion in 2020, or nearly 9 per cent of the country’s gross domestic product (GDP). Government debt has similarly grown nearly nine-fold, from PGK6.9 billion in 2010 to PGK61.9 billion in 2024.

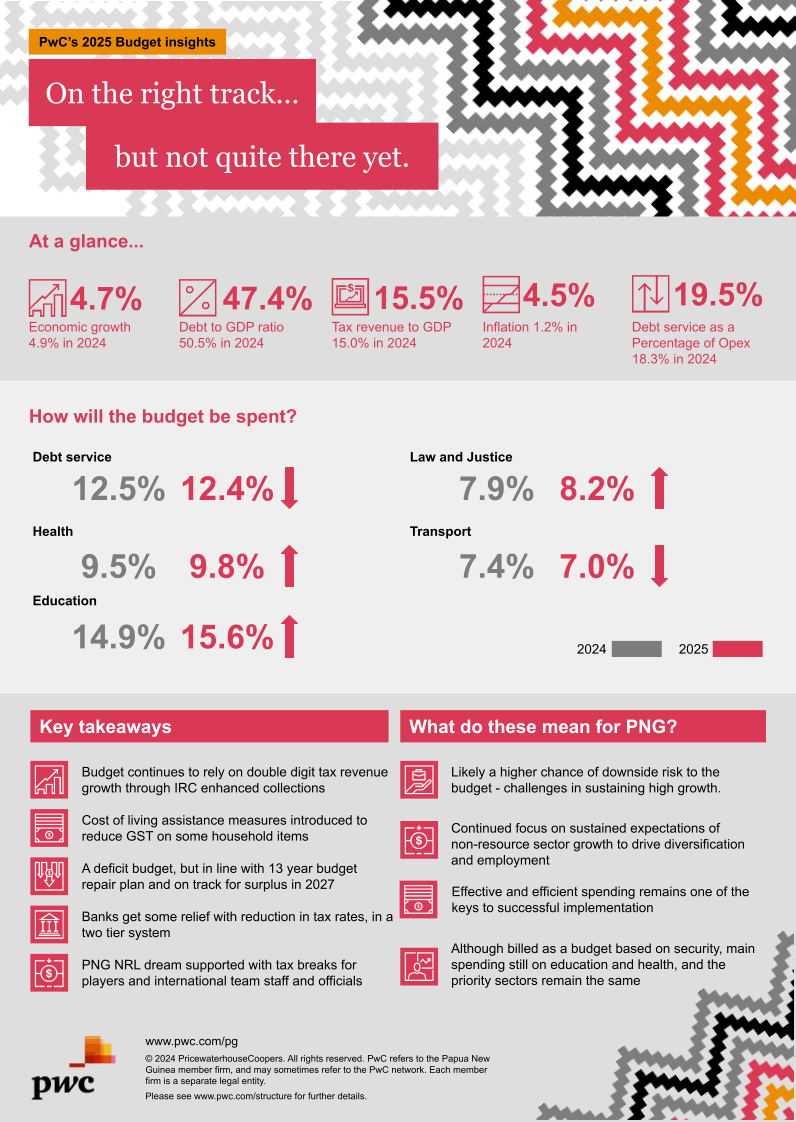

The 2025 PNG budget in many ways is modest in its fiscal ambition and largely reflects a continuation of the budget strategy of prior years – with a few notable expenditure and revenue policy changes, which we will return to below.

But what it does herald is the possible return, within the period covered by forward budget estimates, to a fiscal surplus. The 2025 Budget papers project a surplus of PGK82 million in 2027, just two short years from now. At the close of 2024, about a third of the way into the PNG Government’s 13 year fiscal repair plan set out in 2022, the first budget surplus since 2010 is almost within grasp. But this vision of the future is far from assured. Achieving the budget surplus in the short term is dependent upon continuing the fiscal discipline of the past three years and recent reports of cash flow struggles act as a warning that execution will be challenging.

© 2015 - 2026 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

Contact us

Jonathan Seeto

Managing Partner, PwC Papua New Guinea

Tel: +675 321 1500 | 305 3100

Peter Burnie

Partner, PwC Papua New Guinea

Tel: +675 321 1500 | 305 3100