Doing deals across the globe with PwC Philippines

Deals and Corporate Finance

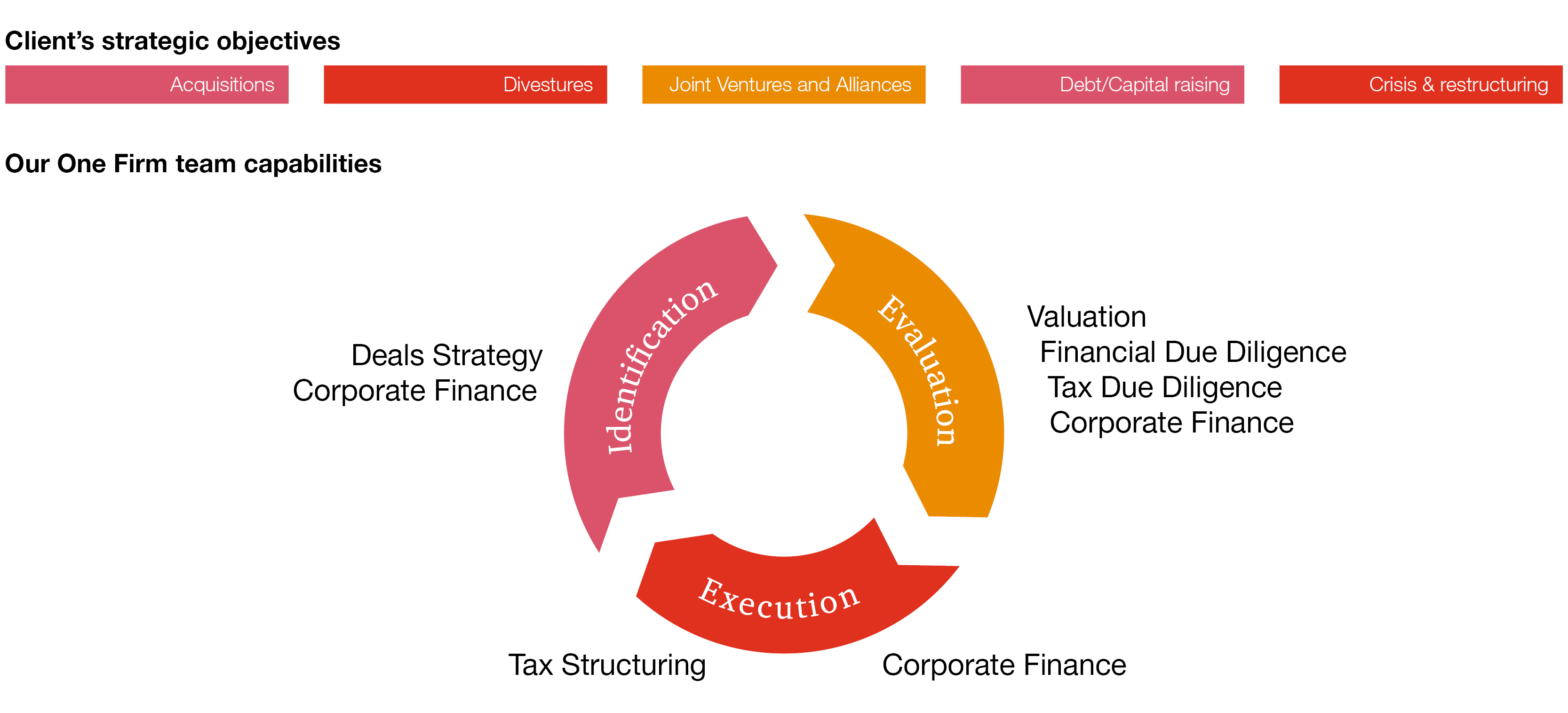

Originating deals, creating deals, executing deals and realizing results from a deal, is what we do everyday.

If you are looking for faster growth, stronger capabilities, a competitive edge or are in need of a dramatic transformation, come and talk to us. We bring to the table a truly connected global network of industry experienced deal advisors coupled with data driven insights that help to support more confident decisions

No matter what business stage you are at, our focus on value is what will help you succeed throughout the deal lifecycle.

Network capabilities

Our Corporate Finance professionals provide a full range of M&A and financial advisory services, from acquisitions and disposals, through to equity and debt raising, debt refinancing, public private partnership arrangements and complex procurement, across all industry sectors, to corporations, private equity firms, public sector bodies, sovereign wealth and other investment funds.

Services we offer

- Corporate Finance

- Deals Strategy

- Financial due diligence

- Valuations

- M&A Tax

- Capital Projects and Infrastructure

- Data and Analytics

- Business Resiliency Strategy

Corporate Finance

Our market leading Corporate Finance practice delivers innovative deal solutions, providing advice and support, industry and market knowledge, from initiation through to deal completion.

With a talented team of over 3,000 Corporate Finance specialists in more than 60 countries, we are able to provide independent advice to multi national corporates, institutional investors, creditors and governments seeking to buy or sell businesses, raise capital or improve the efficiency of their funding around the globe.

In the last 10 years, we provided financial advice on 4,234 deals globally, valued at more than US$418 billion, of which 40% were cross borders deals.

We advise our clients on a wide range of transactions, specializing in business disposals, acquisitions, management buy outs, management buy ins, IPOs and refinancings, working closely with our debt advisory team to provide in depth solutions. Our clients range from private individuals to large corporates and private equity firms.

How we can help

- Grow organically, and need access to long term funding

- Make an acquisition and need a long term partner

- Plan to raise capital for acquisitions or expansion

- Develop a market entry strategy for a new geography

- Strengthen your balance sheets by spinning off non core businesses

- Monetize infrastructure assets on your balance sheets

- Spin off a non core business without damaging its performance

- Sell due to succession issues

- Assess synergies with other companies

- Be the consolidator in a particular sector

- Seek an alternative buyer for an existing minority stake

- Look for investors seeking long term yield

Deals Strategy

Deals present unparalleled opportunities for faster growth, stronger capabilities, and dramatic transformation. At PwC, we offer integrated consulting and transaction advisory services from strategy through execution and value capture bringing the most relevant capabilities, perspectives, and insights to your biggest M&A transformations. Our global network of deals professionals is over 15,000 strong, and teams seamlessly with our clients across their entire M&A agenda, blending the capabilities of a strategy, transaction advisory, and management consulting firm. Together, we help clients along the deals journey to capture value and sustain profitable growth.

We help our clients identify the right strategy for their businesses , leveraging our knowledge of the industry, identifying areas with the most realistic potential, and devising pragmatic action plans and M&A strategies that maximize value.

We know the difficult decisions and trade offs that executives face when managing their businesses, allocating resources or contemplating deals.

We know the traps of large and small company cultures.

How we can help:

- Developing the future strategy and operating model of the combined entity

- Determining the business to be divested and the best structure

- Identifying the critical capabilities that need to be strengthened via the acquisition

- Creating deal strategy

- Assessing industry dynamics

- Accelerating corporate goals, with end to end value optimization

- Commercial due diligence

Financial due diligence

Any organization considering a deal needs to check all the assumptions it makes about that deal. Financial due diligence offers peace of mind to both corporate and financial buyers because it analyzes and validates the major financial, commercial, operational and strategic assumptions being made. It also uses past trading experience to form a view of the future and ensure there are no 'black holes.

- Meeting your Deal Objectives by gaining a detailed understanding of the target business, we increase the likelihood of the deal achieving its objectives. We help you to identify and understand critical success factors so that informed decisions can be made.

- Quality of Earnings Analysis by identifying one off revenues and costs, we provide you with a normalized earnings analysis which forms the basis for the business plan.

- Cash Flow and Normalized Working Capital we can advise you on the peak and trough cash flow requirements of the business as well as the normalized working capital for the purposes of the SPA.

- Identification of Vulnerabilities, Upsides and key Deal Issues in addition to earnings, we assess Net Debt, Pensions and Treasury all of which may form part of price negotiations.

Potential issues you may be facing:

- You want to strengthen your company's core business by acquiring rival products that are almost identical in function/performance to your own.

You need to build on your company's existing activities by purchasing complementary products. - You want to purchase a company to gain access to its existing products in new markets, or to increase your customer base.

- You need to expand your company's current portfolio of products and services through the acquisition of new ones potentially to provide a hedge against the movements in the markets in which the company operates.

- You want to spread your company's market risk by purchasing a company providing similar products or services in another country.

Valuations

Today’s most innovative organizations are seeking to unlock greater value from existing assets and ongoing capital expenditures as well as new acquisitions, investments and complex corporate arrangements. At the same time, regulators are demanding greater transparency through fair value reporting, putting more emphasis on the importance of valuation and value analysis.

We help our clients understand value throughout the deal cycle from the initial assessment of whether an option is worth pursuing, to advising on how a certain deal structure may impact value, through to valuing the acquired intellectual property or R&D pipeline for regulatory, tax or financial reporting purposes.

How we can help:

- Purchase price allocation

- Impairment tests

- Business and equity valuations

- Model review

- Intangible asset valuation

- Forecast analysis

- Cost of capital analysis

M&A Tax

We work with you, as part of an integrated cross line of service deals team within PwC and together with your legal team to deliver on the tax aspects of the deal from inception to implementation, buy side or sell side.

Our tax services on deals include, vendor or buy side tax due diligence, tax structuring, tax modelling and sale and purchase agreement advice.

Where we can help:

- Risk: Identify and mitigate tax risks via diligence and sale and purchase agreement input

- Commercial: Understand the commercial deal and business model , balance with design and implementation of a tax efficient structure

- Deliver Value: Minimize effective tax rate and tax leakage ; Maximize tax deductions and for financing and relief for transaction costs via tax structuring and modelling

- Flexibility: for a tax efficient cash flows, refinancing and cash repatriation to shareholders

Capital Projects and Infrastructure

The PwC Philippines infrastructure team is part of PwC’s broader Capital Projects and Infrastructure integrated global network. The CP&I team advises clients throughout the world, across geographical borders, product offerings, and infrastructure sectors.

We help our clients plan, finance, manage and deliver large scale capital projects and infrastructure. Combining engineering, technology, sector and finance expertise, our teams work with companies throughout the full lifecycle of a capital project. Our clients are from both the public and private sector and include investors, contractors, owners, shareholders and users.

Our team leverages the creative mindset and problem-solving experience of our professionals, which includes financial, project management, risk management, and engineering specialists.

We offer the following services in infrastructure projects:

- Bid advisory

- Transaction advisory

- Project finance

- Financial modelling

- Feasibility studies

We have robust experience in the power, transportation, healthcare, telecommunications sectors, among others.

Data and Analytics

With the latest technology, analytics, and a global network of industry specialists, we work with you to turn complex data into business intelligence. These data-driven approach to decision making can help you move forward with confidence in your big decisions.

We build trust in this digitally-connected society. We propose data-driven solutions to important problems.

How we can help you in your big decisions:

- Deals analytics Harness data-driven insights to drive better deal decisions and realize value

- Data analytics workshops Facilitate workshops to help you upskill your people

- Spatial analytics Transform geo-location data into location-based intelligence to uncover the ‘where’ factor of opportunities, risks, strengths, and weaknesses

- Predictive analytics Build robust predictive models so you can navigate the future now

- Management dashboard Efficiently turn business data into business intelligence for management decisions in the board room, minimizing the need to build reports

Business Resiliency Strategy

Unprecedented crisis, economic downturn, change in the regulatory environment, technological disruptions, competition and other uncontrollable factors can threaten profitability and financial position. Early intervention, innovative thinking and decisive action are vital in guarding and improving the business’ performance and value.

With varying issues, challenges and uncertainties presented each day, we work with decision makers in navigating through best possible options to overcome roadblocks, improve business operations and achieve short to long term strategic goals. Together, we can turn adversities into opportunities.

We can help you solve important problems through:

- Performing diagnostic review, identifying improvement opportunities and developing action plans to help generate, conserve and control cash and manage liquidity

- Providing tailored independent review to a lender or a corporate focusing on key business issues to help decision makers determine the best way forward

- Presenting optimized analytical solutions based on a range of internal and external data sources

- Assisting corporates in developing business plan, reducing costs, generating cash and effecting operational changes to the structure of a business in order to increase value

- Supporting businesses in their negotiations with various stakeholders and with the implementation of various short and long term solutions to counter financial underperformance

- Assisting with the disposal of assets, within a very short timeframe, to help relieve financial pressure, manage stakeholder interests and explore restructuring options

- Helping companies engage with financial institutions to raise debt for a range of business needs

- Maximizing tax savings on financing structures and transaction costs

- Supporting companies to identify vulnerability and risk in their supply chain which will adversely impact production

- Providing insolvency/rehabilitation advice to navigate and communicate with key stakeholders

Contact us

Mary Jade T. Roxas-Divinagracia, CFA, CVA

Deals and Corporate Finance Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Anna Marie G. Ordoñez

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Catherine H. Lipana-Gomez

Deals and Corporate Finance and ESG Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Karen Patricia Rogacion

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Darwin B. Saribay, CFA

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8459 3438