The business challenge

In our experience, it is crucial for companies to exercise due diligence when verifying their suppliers and business partners in order to prevent potential VAT fraud.

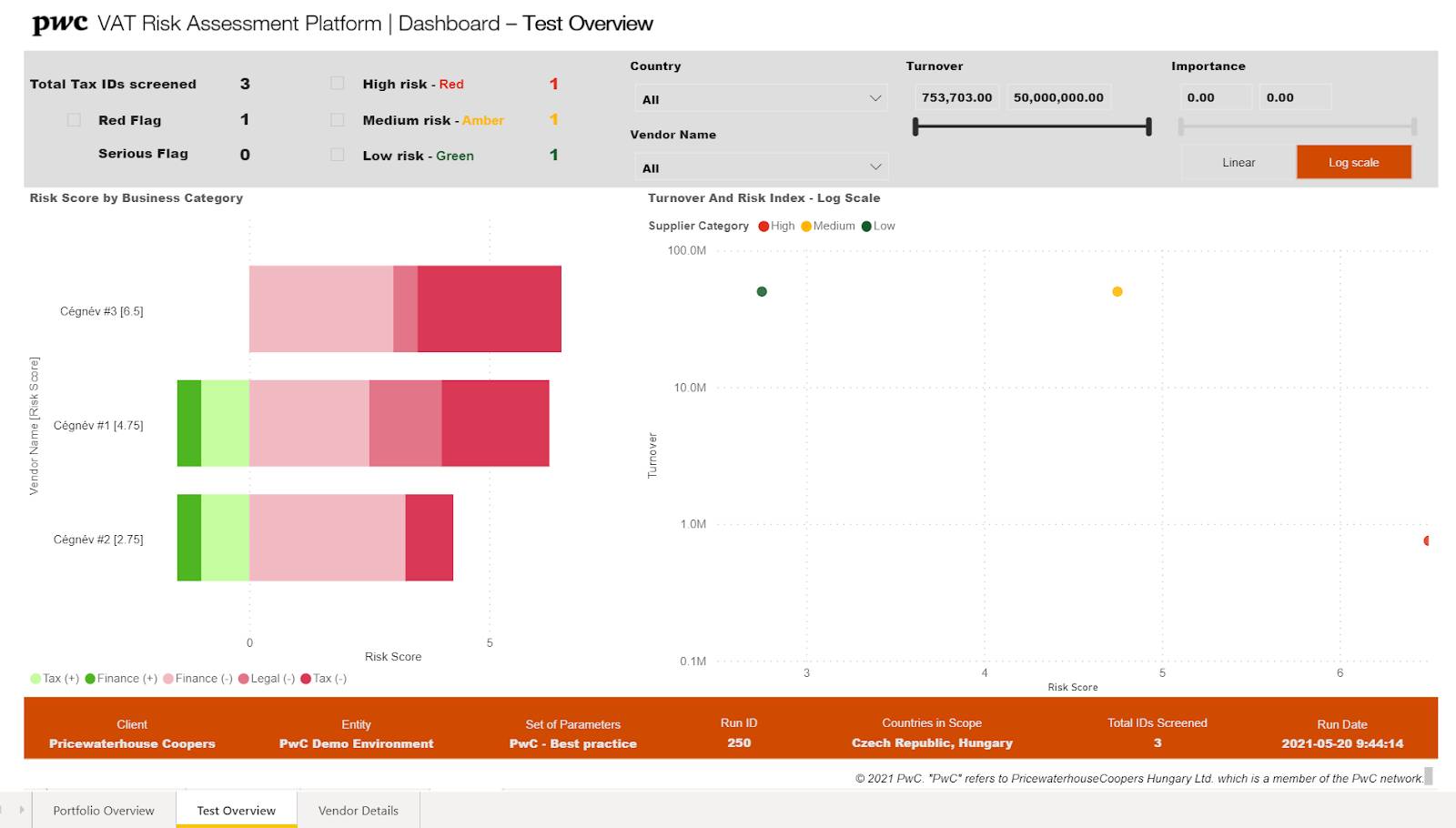

Another important aim is to mitigate the risks arising from suppliers that are not sufficiently stable from a financial, tax or other legal perspective, or the risk of non-payment by customers. By automating the process with software, the entire partner portfolio can be verified not only at the time of tendering or contracting with a supplier, but also on a monthly, weekly or even daily basis. In addition to minimising risks, PwC’s Intelligent Risk Monitoring system can help to significantly reduce the manual work involved in supplier due diligence.

How we can help

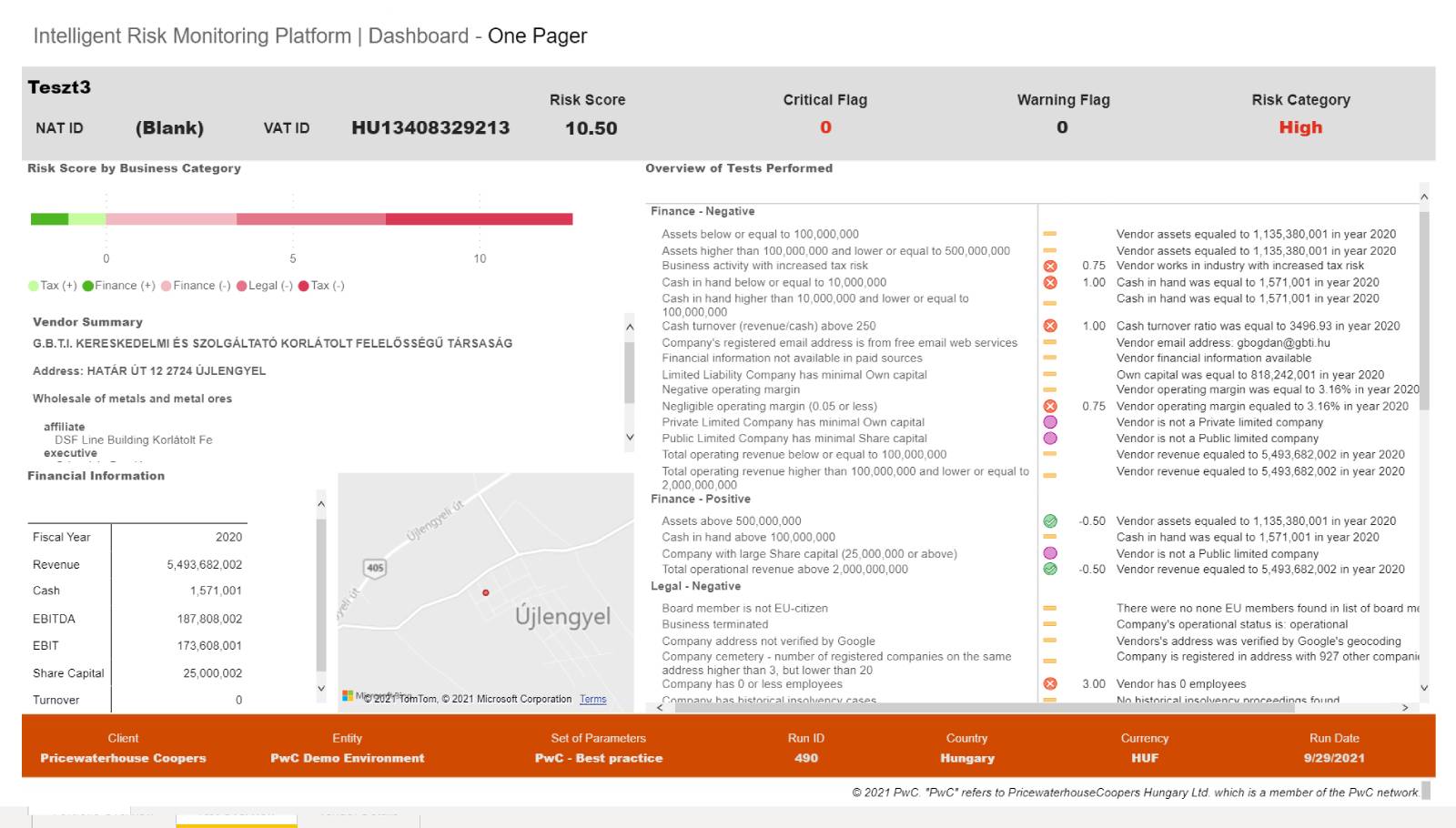

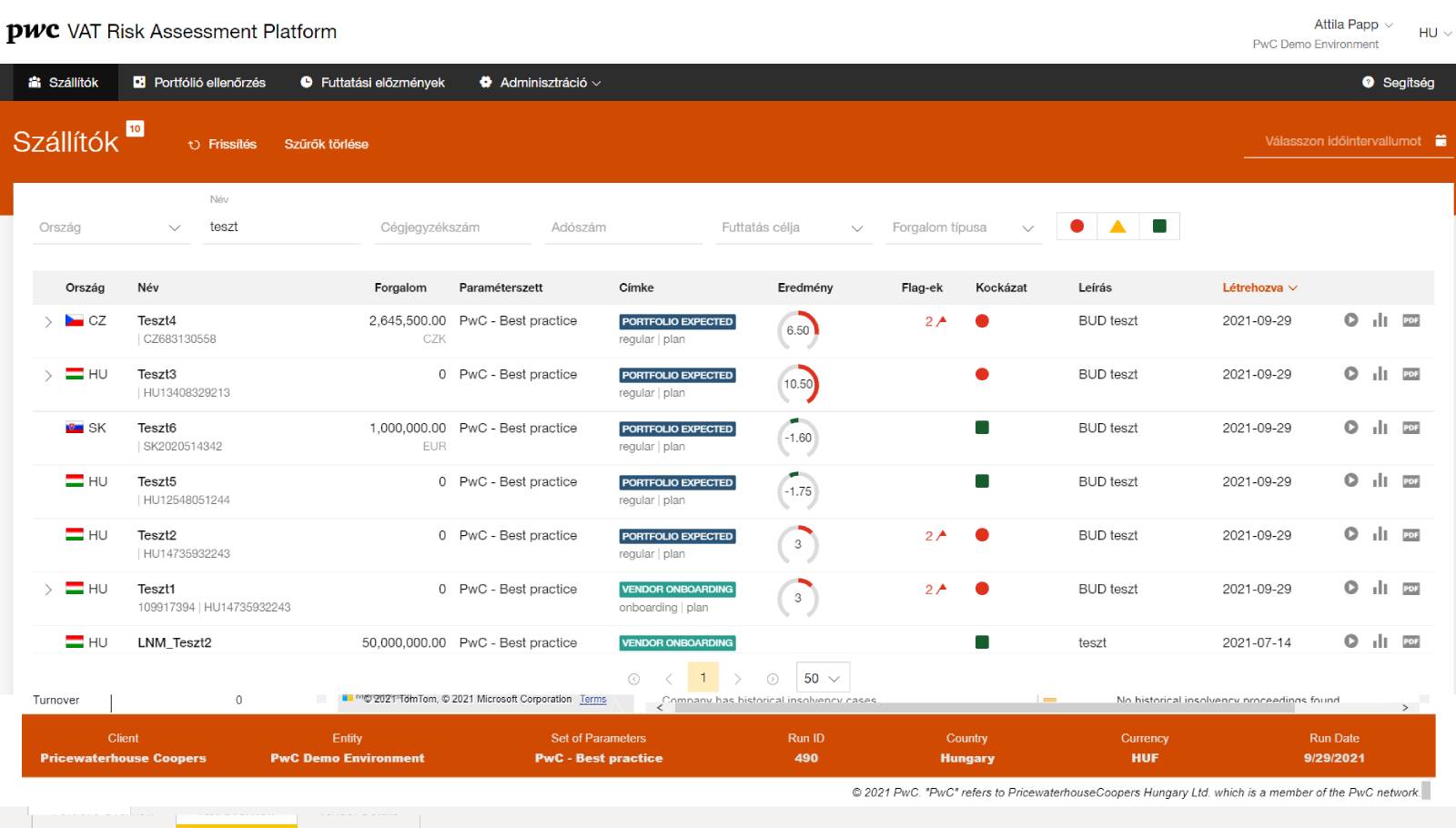

PwC’s Intelligent Risk Monitoring makes it possible to verify both prospective suppliers (onboarding check) and existing suppliers during the contractual relationship (portfolio check) in a verifiable and automated way, in accordance with NAV’s audit requirements.

Due to the nature of the solution developed by PwC, no implementation or complex IT processes are required. The platform can be easily accessed after subscribing. The nearly 70 risk aspects considered in the review draw on the expertise and decades of experience of PwC’s VAT specialists, and on relevant tax authority practice and case law. In this way, the software not only offers an IT solution, but also our professional experience and expertise.

PwC’s Intelligent Risk Monitoring system uses databases to set the appropriate parameters for monitoring company data, and provides an automated solution not only for verifying suppliers, but also for the following:

- monitoring the financial stability and solvency of customers and other business partners;

- monitoring the stability of partners supplying raw materials and components for manufacturing or other uses, in order to reduce potential supply risks;

- monitoring the reliability of subcontractors, other business entities involved in joint deliverables, or screening them for quality assurance.

Our solution not only automates the manual work involved in listing suppliers and partners, but also provides you with a tool to perform a comprehensive review of the entire supplier and partner base within minimal time and resources through ongoing automated reporting.

The benefits of the solution at a glance

Minimizing risks

By checking suppliers, risks can be minimized and VAT fraud prevented.

Automated reports

Reduce the manual work and time required to screen the entire supplier and partner base.

Software and Expertise

The software has been developed based on the experience of PwC's VAT colleagues and tax authority practice.

Full analysis

The software analyses suppliers against more than 70 risk criteria.

Versatile use

Monitoring of solvency, quality assurance due diligence, etc.

Ready-to-use solution

No implementation or complex IT processes are required.

Pricing

- Minimize risks, prevent VAT fraud

- Automated reports

- Comprehensive analysis across 70 risk aspects

- Versatile use

- Ready-to-use solution