Global M&A trends in energy, utilities and resources: 2024 mid-year outlook

Velocity of energy transition and industrial reconfiguration create an exciting arena for M&A in energy, utilities and resources.

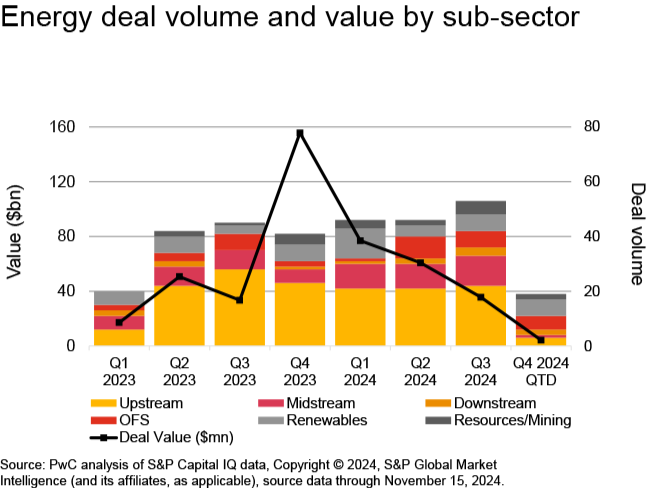

The effects of upstream global megadeals in the past year have profoundly reshaped the energy sector. Industry consolidation, which has already transformed the upstream market, is now occurring among midstream and oilfield services firms, creating opportunities and imperative for changes in the sector. This across-the-board consolidation is also driving growth and innovation in the industry.

However, there are several challenges energy executives must navigate, including shifts influenced by geopolitics, government initiatives and a focus on energy security and sustainability.

Other mergers and acquisitions (M&A) trends in the sector include:

Note: The primary M&A data source used in the 2025 outlook is S&P Capital IQ.

Following the upstream wave seen in the second half of 2023, the midstream sector experienced a significant shift in M&A activity in 2024. While high-profile deals captured the attention of the market, an emerging trend of strategic buyers increasingly dominating the sector is also evident, gradually eclipsing the previously prominent role of private equity firms. This shift is highlighted by the growing number of private equity firms selling their midstream investments to industry buyers. Companies are leveraging M&A to enhance their midstream infrastructure — including transportation, storage facilities and processing plants — further fueling the rise in strategic acquisitions.

"Demand for energy continues to increase with the expanded use of artificial intelligence (AI), and the U.S. isn't solely relying on traditional sources. Instead, it is adopting an 'all-of-the-above' approach — utilizing oil, natural gas, nuclear, coal and renewables — to meet these growing needs.”

The renewed focus on traditional energy sources is expected to persist under the new administration. While consolidation among oil and natural gas companies will drive M&A, the demand for power generation is spurring investments in renewable energy and related infrastructure. Despite regulatory hurdles, U.S. oil production has reached an all-time high in August 2024 at 13.4 million barrels1 per day. Under President-elect Trump, a business-friendly outlook could further enhance dealmaking. The new administration's policies may include increasing energy production through expanding drilling, reducing regulation and scaling back renewable energy initiatives.

1. Source: U.S. Energy Information Administration

Velocity of energy transition and industrial reconfiguration create an exciting arena for M&A in energy, utilities and resources.

Political uncertainty stalls deal activity despite widespread investor interest.

Corporate development executives are balancing strategy, regulatory changes and evolving technology to help their companies thrive in a new M&A environment.

The latest analysis from the PwC Deals team reveals how the shifting tides of domestic and international regulations are set to impact the M&A world