Aerospace and defense services

PwC helps clients in the aerospace and defense (A&D) industry address key business issues, comply with government regulation and manage supply chain risks.

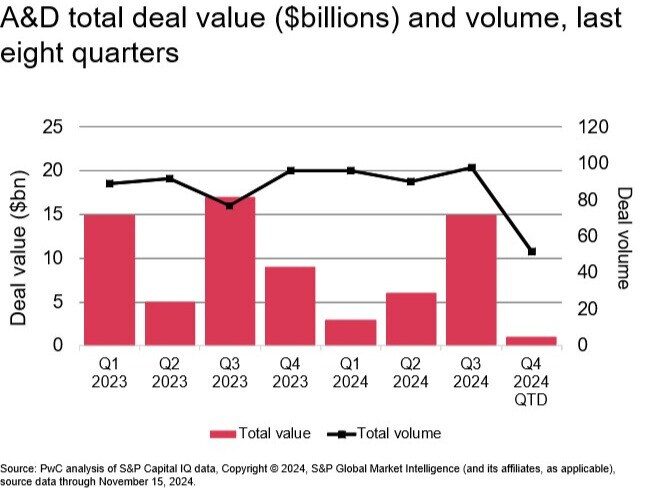

Over the past six months, the aerospace and defense (A&D) sector has aligned with global mergers and acquisitions (M&A) activity, though at a slower and more measured pace. There’s been a marked increase in portfolio reshaping as companies aim to streamline operations and focus on core assets.

Meanwhile, heightened geopolitical tensions and political shifts led to strategic partnerships, including with international allies, to mitigate risk and capture potential benefits. Strong cash flow in A&D companies and a supportive stock market are expected to drive M&A activity in the coming quarters.

Key trends include:

Note: The primary M&A data source used in the 2025 outlook is S&P Capital IQ.

In a shifting M&A landscape, A&D companies are adapting strategies to balance growth with risk mitigation. Increased regulatory focus has led to a shift toward partnerships with domestic and allied nations and reduced reliance on foreign capital. Additionally, many companies are prioritizing asset-light models, often through JVs and partnerships, to pursue emerging capabilities. However, they must navigate geopolitical tensions and capital constraints to align with current defense spending priorities and protect against unpredictable market shifts.

Growing global conflicts and continued focus on domestic security have led to increased defense budgets worldwide. Both US prime contractors and international defense firms continue to receive significant new orders, indicating strong momentum for the defense sector as countries invest in their defense infrastructure.

“M&A drivers are positive although A&D deal execution is measured. Easing interest rates, geopolitical tensions and new technologies will contribute to M&A activity in the near term.”

The A&D deals market is in a transformative phase, with trends indicating a shift toward streamlined portfolios, strategic partnerships and heightened geopolitical awareness. As companies adapt and look to deploy cash on the balance sheet, the emphasis will remain on sustainable growth, resilience, aerospace growth trends and supplier consolidation plus alignment with evolving defense priorities.

PwC helps clients in the aerospace and defense (A&D) industry address key business issues, comply with government regulation and manage supply chain risks.

PwC's annual review and analysis of aerospace and defense industry performance in the past year, and the challenges and opportunities in the years ahead.

Corporate development executives are balancing strategy, regulatory changes and evolving technology to help their companies thrive in a new M&A environment.

The latest analysis from the PwC Deals team reveals how the shifting tides of domestic and international regulations are set to impact the M&A world