{{item.title}}

{{item.text}}

{{item.text}}

Our first Pulse Survey of 2021 finds confidence among US business leaders surging amid expectations of a strong US economic recovery. But that positive outlook is clouded by concerns around social factors. While many companies have found ways to prosper without going back to pre-COVID-19 patterns, they remain troubled by the lingering effects of the pandemic on the workforce and their communities. For example, 29% told us that resuming business travel is very important, well below the 52% who believe their prospects are intertwined with the pace of schools reopening. Less than a third of executives are optimistic that the country can close the social and economic gaps that became more apparent last year.

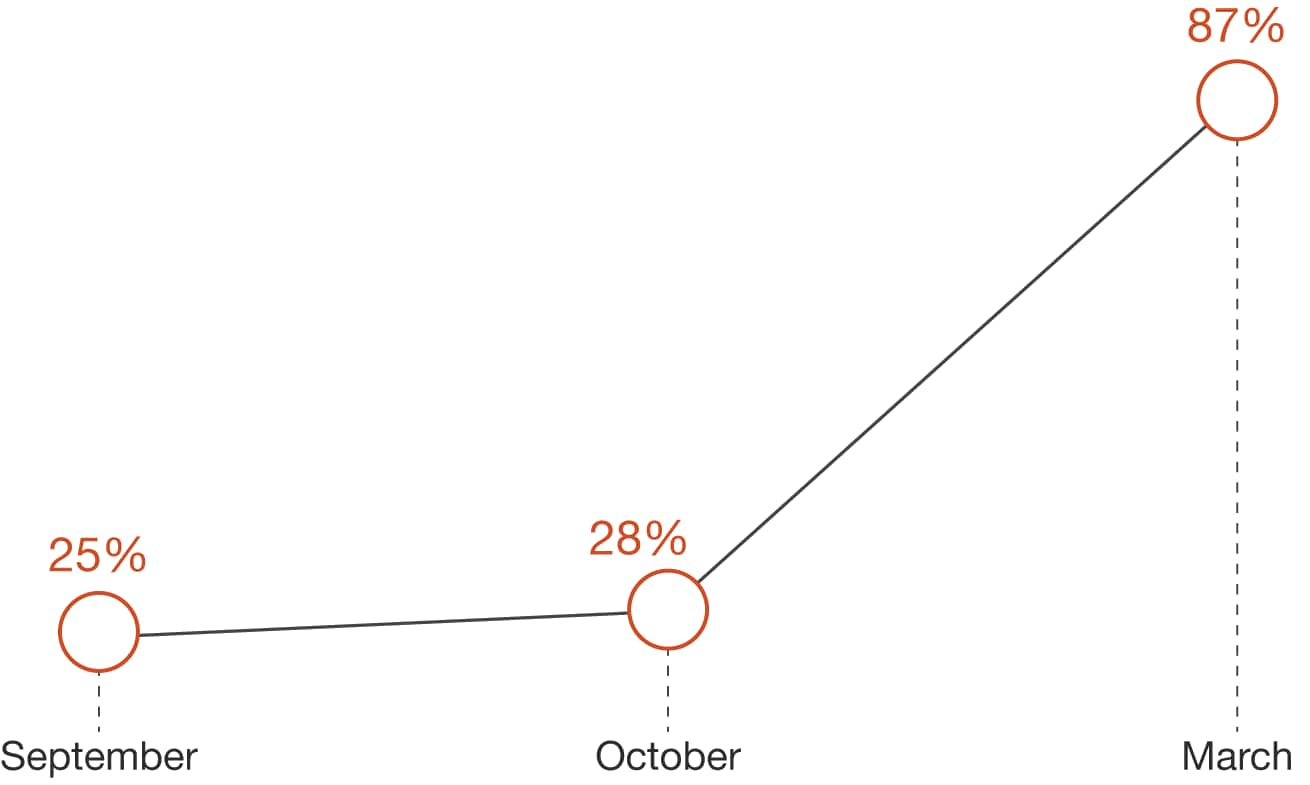

Eighty-three percent of all US business leaders are expecting to increase revenues this year. That’s a significant jump over last fall when only a quarter of finance leaders were expecting growth. Part of that optimism comes from the $1.9 trillion in COVID-19 relief money that’s flowing into the economy — just as rapid vaccine rollout is easing restrictions on economic activities. In our past Pulse surveys, business leaders have consistently, and almost unanimously, sought a strong federal government response to the COVID-19 crisis. Today, 71% percent express satisfaction with the US pandemic response.

With an acute awareness of their own role in rebooting work and lives in 2021 after a devastating year, many business leaders are taking concrete action. Topping the business agenda is supporting and strengthening a pandemic-weary workforce and growing trust among all stakeholders. We conducted this survey from March 8 to March 12 and fielded responses from 732 senior executives in C-suite and corporate board director roles. Senior executives shared what’s most important for their companies to thrive in a post-pandemic economy and their strategies for success in 2021.

Bring data and critical insights to policymakers: The outlook on the US policy and regulatory environment is mixed, with 42% viewing it favorably and 37% expressing pessimism. While this suggests that executives are still assessing the likely impacts of the president’s whole-of-government approach to policy, a wait-and-see attitude could be costly. Biden’s call on Congress to act on his Build Back Better economic recovery plan is expected to begin with bipartisan outreach around issues like infrastructure and clean energy transition (even if Democrats ultimately use a second reconciliation bill to pass parts of the plan). This creates a window of opportunity for business to help shape the potentially tax-increasing legislation, yet only 33% of respondents in our survey are planning to engage with legislators on tax policy. More companies will benefit from communicating the potential impacts of proposed policy changes on jobs and business operations to the White House and Congress.

For companies, the supply of skilled and healthy workers is at risk just as consumer demand has snapped back and the economy is poised for recovery. A refreshed workforce, equipped with technical and trade skills, is critical for prospering. More than half of business leaders are taking action to secure talent with technical skills. In parallel, they will step up support for stressed, burned-out employees who have been juggling job insecurity with family demands over the past year. These actions matter far more than returning to old ways of working, such as business travel, or further government support.

As companies plot their growth trajectories, they’re not rushing to bring people back into the office. Instead, they’re creating hybrid work models to meet employee needs while helping companies emerge stronger. Some temporary actions quickly taken during the crisis are here to stay — most notably, remote work is becoming permanent for suitable roles, and investments in digital tools are being made to help the workforce succeed in virtual work environments. Companies are also rethinking their real estate footprints to enable more collaborative employee experiences while reducing costs.

The challenge for leaders is to sustain such improvements while also addressing areas where companies have fallen short. Almost 3 million women have dropped out of the workforce over the past year, but just 42% of business leaders see their reentry as very important to their ability to prosper. Schools reopening alone won’t solve this workforce crisis. Our workforce surveys show that women aged 35-44 have been struggling much more than other workforce segments. How companies address the pandemic’s disproportionate toll on women as the economy recovers will affect not only women’s career growth but also employee morale, D&I goals and business performance.

The pandemic and the social justice movement have highlighted gaps between economic growth and social equity and inclusion. Now, as economic recovery takes hold, business leaders recognize the need to lead a recoupling of growth with social progress. Many are embracing ESG strategies to achieve more equitable and sustainable growth while turning a profit for their business.

Our survey reinforces what we know from our work with clients: Companies are at different stages of tying all the elements of ESG into consolidated reporting and to their broader strategy. Fifty-six percent of business leaders are planning to increase D&I training, and almost half (49%) are increasing D&I reporting this year. And 39% are also considering ESG-related investments and deals, signaling a pivot toward more climate-resilient business models as pressure builds from consumers, investors and the Biden administration.

A health industry that bore the brunt of the pandemic impact is showing resilient optimism with 75% of health industry leaders telling us they feel very or somewhat optimistic about the US pandemic response in the year ahead. As its frontline workforce continues to care for COVID-19 patients and its pharmaceutical and life sciences sector is continuing to develop and manufacture vaccines at a breakneck pace, industry leaders also recognize the need to boost its stressed workforce, with 89% citing support for burned-out employees as important to their ability to be successful in the year ahead.

Healthcare employees not only have had to cope with how to take care of their families and themselves while simultaneously working in highly stressful clinical care environments, they’ve also had to cope with a rapidly changing operating model that’s shifting more toward virtual health. While this care model shift presents challenges, it provides healthcare companies the opportunity to offer employees alternative work arrangements that combat burnout, improve morale and enhance retention and recruitment.

The industry may find opportunity to be part of the solution when it comes to a stressed US workforce more broadly, as nearly all executives surveyed across industries (94%) identified workforce support as key for the year ahead, support that could involve increased investment in mental health services and other benefits provided by the healthcare sector.

Health executives appear optimistic about a US economic recovery, with nearly 75% of respondents describing themselves as hopeful, although concerns exist over the regulatory environment under the Biden administration. Our analysis of the president’s healthcare agenda anticipates an enhanced Affordable Care Act, value-based care and efforts to lower drug prices, among other measures.

Improving the supply chain remains an important focus for an industry that scrambled for equipment and supplies during the pandemic, with 83% of health industry leaders saying that removing disruptions to the supply chain is key to their ability to prosper in the year ahead. That focus and related investments can help lay the groundwork for a more flexible, responsive supply chain, as outlined in PwC Health Research Institute’s Top health industries issues of 2021 report.

When it comes to environmental, social and governmental (ESG) priorities for the year ahead, health industry leaders identified increased diversity and inclusion training and reporting as well as building a more diverse board as areas of priority for the year ahead.

Financial services (FS) leaders view products tied to sustainability as an important market opportunity. Over half (53%) of the 159 FS leaders who answered our March US Pulse Survey say they’re considering actions over the next 12 months that include deals or investments like “green” bonds that relate to environmental, social and governance (ESG) factors. This is considerably more than what we heard from their C-suite peers across all industries (39%). These findings strongly suggest that the pipeline of ESG-related products and services in FS will continue to grow following what has already been a surge of investment flows into ESG-type funds by US investors.

What’s driving the attention for ESG issues in 2021?

The Biden administration is weighing in by supporting measures intended to both advance racial justice and help transition the US to a net zero emissions economy by 2050, reflecting ESG’s influence on virtually all areas of business operations.

Government regulators are already starting to highlight climate risk. The SEC, for example, has announced plans to update its decade-old climate disclosure guidance.

Congressional action may include an infrastructure spending bill reflecting expectations for a clean energy focus.

Sustainability is on the minds of dealmakers as they evaluate companies on their perceived resilience to a wide range of ESG-related issues. Private equity firms will likely look to acquire “clean” assets (and this in itself will encourage change), and investors are increasingly expecting solid ESG performance.

Like leaders elsewhere, FS executives are focused on these practices internally as well. Sixty percent say their companies plan to increase diversity and inclusion training, in line with 56% of all respondents. Some firms are also looking to raise their voice on ESG matters this year, reflecting expectations among some stakeholders for a robust private sector response to climate change and other concerns, with 43% of FS leaders planning to increase company-endorsed public statements on social and environmental issues.

After a year fraught with health and economic challenges, optimism about the recovery permeates consumer-facing companies. The vast majority (82%) of consumer markets (CM) leaders, as with their counterparts in other sectors, expect revenue growth in the year ahead, anticipating an additional boost to the economy from the $1.9 trillion pandemic relief package. In line with other sectors, CM leaders are bullish about economic recovery, both domestic (76%) and global (66%), as well as the federal pandemic response (69%).

With vaccinations paving the way for easing shelter-in-place mandates and driving a robust recovery, CM leaders are looking ahead to manage supply chains already strained by spikes in demand. Almost two-thirds (64%) say reducing supply chain disruption is very important for their ability to prosper in 2021 (compared to 49% for all sectors), with most updating existing facilities (82%) as well as diversifying supply chains outside North America (82%). CM leaders are also more concerned than leaders in other sectors about the availability of skilled trade labor (56% versus 47% overall).

Acutely aware that environmental, social and governance (ESG) considerations influence buying decisions, CM companies are taking steps to communicate their ESG efforts more publicly, starting with streamlining data across their organizations (76% versus 69% overall).

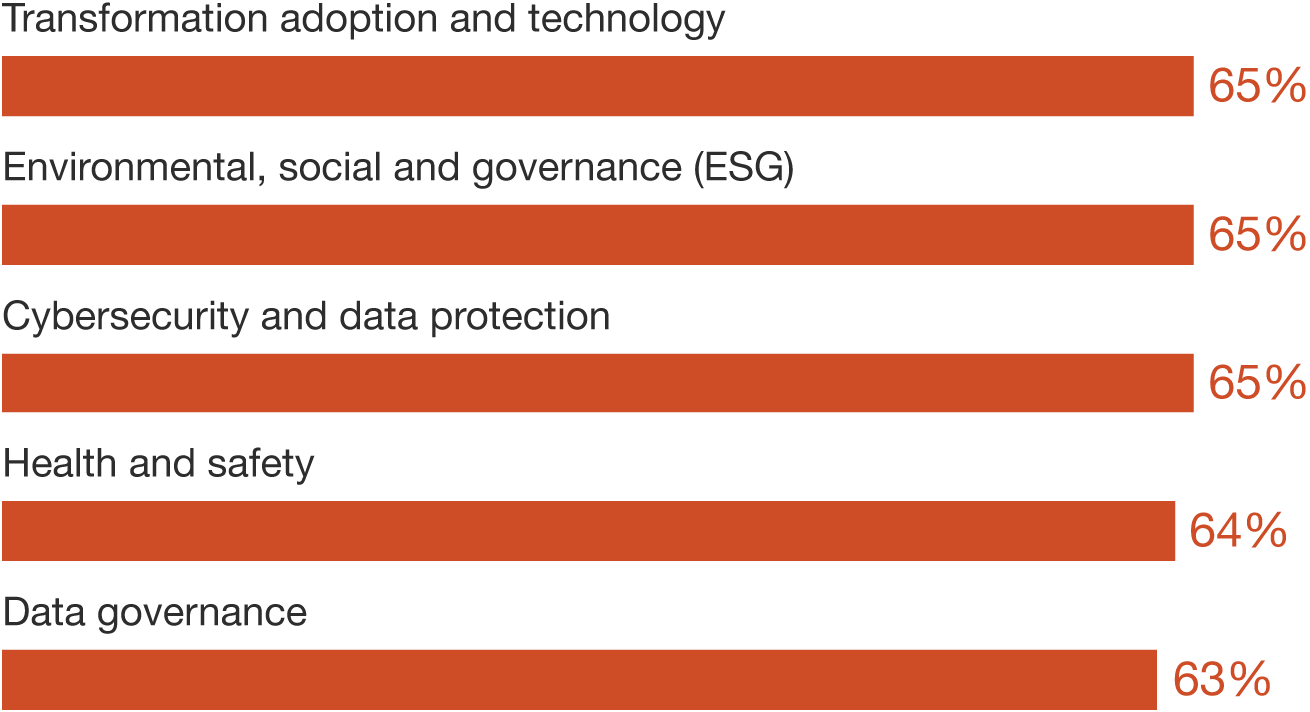

As essential workers in retail and other service businesses took center stage during the pandemic, CM companies came to rely on them to drive trust in the business. Going forward, CM leaders told us customer trust will be crucial, especially in the digital space with consumers having migrated online in droves last year. CM companies will likely seek richer, more lasting engagement with customers, making data governance by far their most pressing risk in 2021 (84% versus 63% overall) followed by cybersecurity and data protection (74% versus 65%). And, as they emerge from the restrictions of the pandemic, health and safety also merits careful navigation (74% versus 64%).

The opportunity for these companies lies in providing safe spaces to help reassure consumers, whether online or in stores, airplanes or hotels, as well as in product offerings that respond to changing consumer preferences for healthy, sustainable options.

Despite disruptions wrought by this year’s winter storms (with industrial output down by 2.2% in February — the first contraction since September 2020) and persistent COVID-19 supply chain disruptions, US manufacturers appear to be eyeing a path of post-pandemic recovery.

Looking ahead, 55% of the US manufacturing leaders who responded to our survey expect revenue growth of 5% or more over the next 12 months. They’re also upbeat about the economy, with 74% expressing optimism about a US economic recovery for the rest of 2021 (and 68% about a global recovery).

Manufacturers are still working through supply chain issues, with 90% agreeing that reducing disruption to the supply chain is very important to their ability to prosper for the rest of 2021. Most manufacturers are busy reengineering their supply chains, with 85% saying they’re developing additional or alternative sourcing options in North America (and 78% saying they are doing so outside of North America). Most US manufacturers are also changing their operational footprints, with 84% saying they’re reshoring or nearshoring to reduce sourcing concentration and 73% doing so to cut logistics costs (ie., ocean long-haul freight).

On the ESG front, US manufacturers see both risk and opportunity: 75% see sustainability as a risk to their business model. But, when asked specifically about the trend toward a net zero future, 74% see a growth opportunity.

Manufacturers are getting better visibility into how the pandemic will likely change their workplaces, with 50% saying they’ve already implemented plans to make remote work a permanent option in jobs that allow for it. Additionally, 55% say they’ve already created (or are in the process of creating) hybrid work schedules for employees.

Having buttressed the shelter-in-place economy throughout 2020 — as consumers sought information, entertainment and solace online, often while working or studying remotely — technology, media and telecommunications (TMT) companies are poised to build on that growth in 2021. Close to two-thirds (62%) of TMT leaders expect revenue growth of 5% or greater (compared to 54% for all sectors); almost one-quarter (24%) anticipate revenue growth of 10% or more (compared to 17% for all sectors).

Concerns about regulatory scrutiny, meanwhile, do not appear widespread. TMT leaders have a similar level of optimism about regulation as all sectors (45%). They’re also in line with other business leaders in their positive outlook on economic recovery, both domestic (80%) and global (66%), as well as the pandemic response (74%).

TMT companies continue to lead all sectors in preparing for a hybrid work model. Fifty-five percent plan to make remote work a permanent option for roles that allow it (compared to 47% for all sectors). They’re also ahead of other sectors in addressing residency taxation issues (47% versus 38%) and allowing employees to relocate permanently outside of a core office location (43% versus 35%).

Customer trust, integral to the success of TMT companies, is high on their list of priorities. A full 50% of TMT leaders say that among various stakeholder groups, they’ll focus most on customers to drive trust in their business. With impending changes to how companies engage with customers online, this emphasis on cultivating customer trust is timely. Customers have already told us that trust is essential to sharing the data on which long-term growth for TMT companies might well depend.

Executives in the energy sector (oil and gas, utilities and mining) are generally optimistic about near-term sector and economic growth in the wake of the pandemic. Roughly one-third (32%) of these industry leaders expect revenue growth of 5% to 10% over the next year, and another third (34%) expect growth of up to 5%. Most are also bullish on economic prospects through the end of 2021, with 68% expressing optimism about a US economic recovery and 66% saying they’re optimistic about a global recovery.

Still, there appears to be some question in the sector over how sustainability and net zero trends will affect their businesses. Looking ahead, just one-third (32%) feel optimistic about environmental policy and regulation under a Biden administration, compared to 42% of business leaders surveyed across all industries. Still, energy companies are signaling that they are ready to dive into ESG initiatives as the net zero trend gathers momentum. Roughly one-quarter of energy sector executives (26%) say they will disclose their company’s strategy surrounding the transition to achieving net zero emissions footprint over the next 12 months. Furthermore, nearly half (45%) of leaders say they expect to consider other ESG initiatives over the next year (e.g., making capital investments or carrying out mergers or acquisitions).

Meanwhile, energy companies are also getting a clearer picture of how their workplaces will look in the next year. Nearly three in four (74%) of the industry leaders surveyed expect their companies to invest in new tools to support remote work (compared to an average of 62% across all industries), and half plan to make remote work a permanent option for certain roles.

With a year of COVID-19 disruption and the many challenges that came with it behind them, CFOs’ outlook for 2021 is brighter. CFOs are moving from a defensive posture to a more offensive stance, looking at lasting changes from the pandemic as opportunities for growth. Our latest Pulse survey findings show that CFOs see significant growth opportunities in key areas around the digital economy, consumer behavior shifts because of the pandemic and the work-from-home shift. As they lead the charge toward growth, CFOs are also bullish about the economy and their role in helping shape strategy.

Increase in revenue

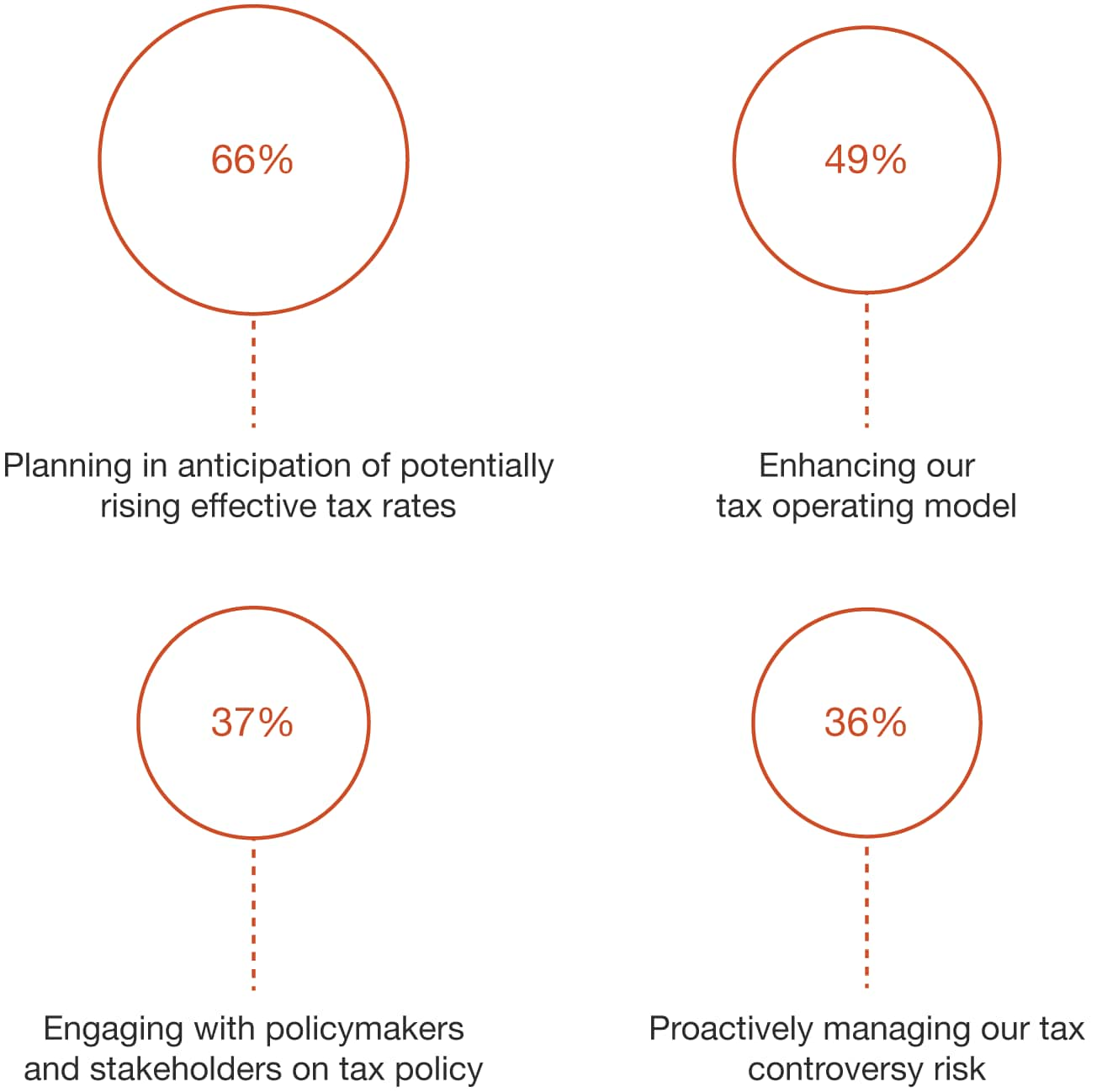

A rising tax rate environment is dominating the focus of many tax departments, with 66% of tax leaders prioritizing planning in anticipation of potentially rising effective tax rates this year. But only 37% of tax leaders say engaging with policymakers and stakeholders is a top priority. And it’s not just US tax rates that may be rising. Companies with global operations also will need to plan for potential tax rate changes in other countries. Enhancing the tax department operating model is another priority for almost half of tax leaders.

As shipping bottlenecks and semiconductor shortages put US supply chains through another test, operations leaders are planning multiple moves to get ahead of the next shock. They are investing in technologies that can speed up insights into customer shifts or supplier problems, and they’re lining up alternatives to break dependencies on sole suppliers. Leaders are also looking ahead to tackle demands to perform in a fast-digitizing world. COO priorities for the year show a near-equal balance of meeting the growth agenda, such as faster fulfillment or building supplier flexibility, with meeting cost imperatives.

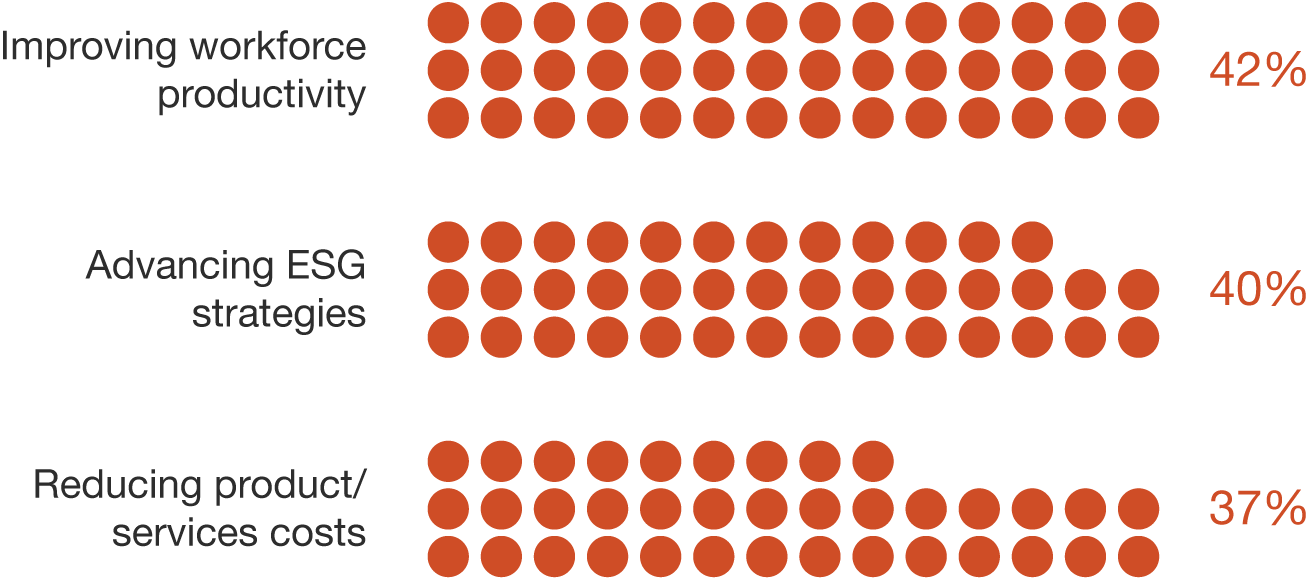

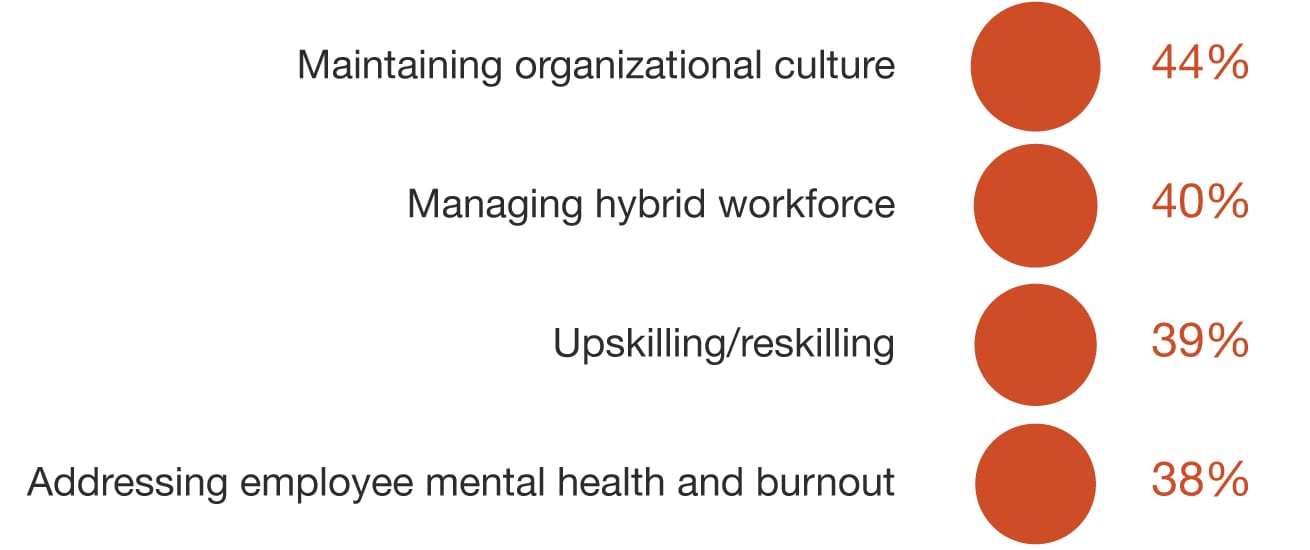

Chief human resource officers (CHROs) are taking charge of inventing a new vision for work in a post-pandemic world, and they’re focusing on the employee experience. From new initiatives around purpose and upskilling to investments aimed at improving remote work, CHROs are considering how the world has changed and what employees need in order to thrive in it. CHROs are also focused on accelerating adoption of digital skills and continuing efforts to address employee health and burnout.

Most risk management leaders are very optimistic or somewhat optimistic about the US economy and the global economy. And while digitization will likely be a driver of growth this year, 65% of risk management leaders say that risks from transformation adoption and tech will increase. Risk executives also expect risks around cyber and data protection, data governance, and human capital and talent management to change. Meanwhile, risk leaders are focusing on risk management capabilities that are both human-led and tech-powered.

Responses to ‘Significantly increased’ and ‘Somewhat increased’

Corporate directors are maintaining their focus on overseeing strategy, talent and cybersecurity, as environmental, social and governance (ESG) issues move to center stage. Issues like diversity and inclusion continue to gain prominence on boards’ agendas in response to the social unrest of last summer, increased investor focus, new human capital management disclosure requirements and state laws mandating board diversity. Crisis management and board culture rank lower on directors’ list of priorities.

Between March 8 and March 12, 2021, PwC surveyed 732 US executives including CFOs and finance leaders (25%); tax leaders (21%); risk management leaders, including CROs, CAEs and CISOs (14%); CHROs and human capital leaders (13%); COOs and operations leaders (13%), and corporate board directors (14%). Respondents were from public and private companies in six sectors: financial services (22%), industrial products (25%), consumer markets (17%), technology, media and telecommunications (19%), health industries (8%), and energy, utilities and mining (5%). Seventy-three percent of respondents were from Fortune 1000 companies. The PwC US Pulse Survey is conducted on a periodic basis to track the changing sentiment and priorities of business executives

To view data and insights from previous PwC Road to Election Surveys, please see below

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}