We can help you become a more sustainable business

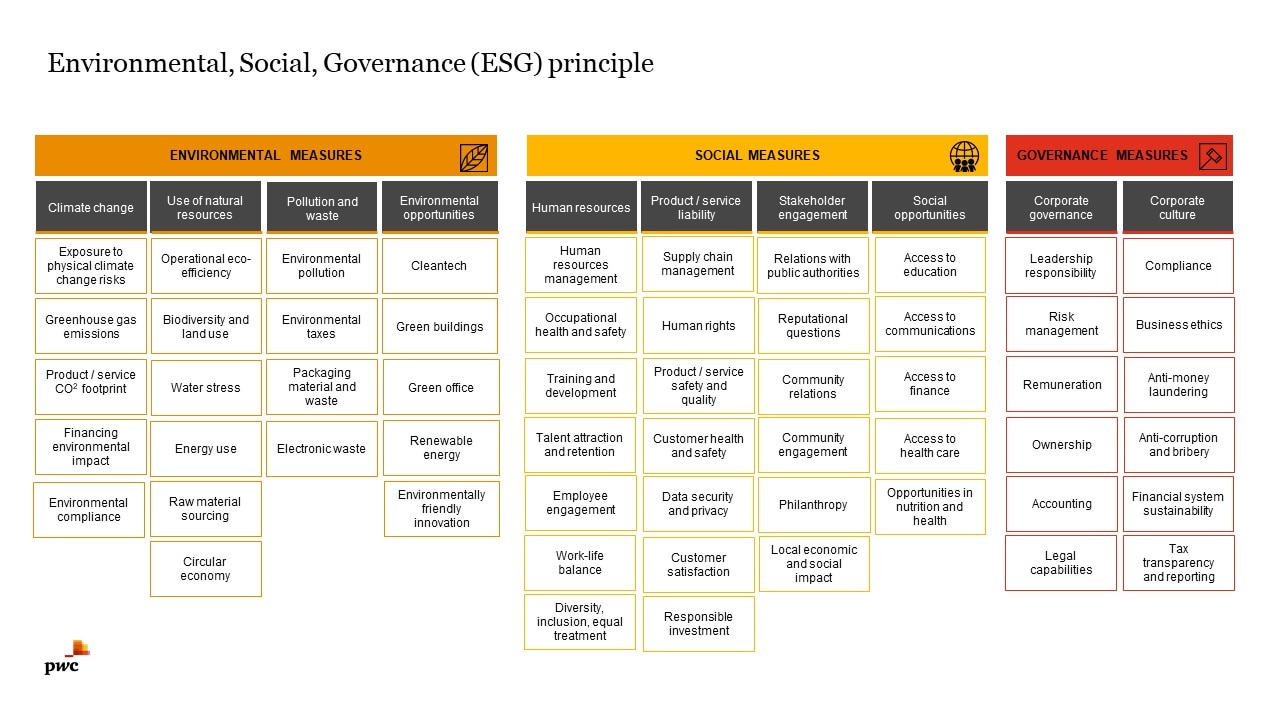

Things that companies used to consider optional are now crucial for their long-term financial success. It is essential now for companies to take environmental, social, and governance issues into consideration in their business activities to ensure their competitiveness and ability to create value.

Today’s customers, investors, and regulators are interested in more than just standard financial information; they expect companies to take responsibility by identifying the ecological and social impacts of their business models, and to adopt sustainable business management practices.

By working together with PwC, we can help you become a more sustainable business and create new opportunities in a changing market environment.

Step into your ESG journey

ESG isn’t just a responsibility. It’s a mindset and an opportunity for growth. But knowing where to start can be overwhelming. Every journey starts with one step. Start yours below.

Why choose PwC for ESG?

We are proud leaders in ESG

PwC is a recognized leader in over 150 major analyst reports spanning risk and regulatory, digital and technology, ESG, trust and transparency and more. We help guide our clients through ESG risks and opportunities with advice, strategy, transformation, and reporting solutions.

We have strong global network

Our global network has more than 1900 dedicated specialists providing ESG and sustainability services in 60 territories. We bring a breadth of experience and a multi-competency approach and skillset - crossing strategy, operations, risk, deals, regulatory, reporting, workforce, controls, assurance, technology, tax and more. That means that no matter what your challenge - we are positioned to help you get insight and solutions aligned to your unique goals and values. Our ESG teams are human-led and tech-powered and through this powerful combination, we can help you build a roadmap for your ESG journey.

We walk the talk

Like you, we are committed to the careful management and integration of ESG principles and investments. Our own journey has taught us that it is possible to help solve problems in society and strengthen business at the same time. We’re actively working with standard setters to improve the integrity of reporting for the community at large and, with the help of technology, we’re helping our clients take practical, meaningful steps on their own ESG journeys.

Do you want to contribute to solving global challenges such as poverty, inequality and climate change? See more about how to integrate sustainable development goals in your organization.

Nature & Biodiversity

We are helping businesses create a nature positive future. Bringing together 500+ nature specialists, our Centre for Nature Positive Business is accelerating the global transition to a nature positive and net-zero future.

Our ESG services

- ESG strategy and implementation

- Sustainability statements & Non-financial reporting

- EU Taxonomy eligibility

- Climate risk assessment

- ESG trainings and raising awareness

- ESG Tax & legal services

- ESG and Environmental due diligence

ESG strategy and implementation

We help businesses make the right decisions to position themselves for a more sustainable and inclusive future. By implementing ESG into core strategy, PwC supports organisations to identify new opportunities, realise future growth, create value and engage effectively with stakeholders.

Main services:

- Mapping current status and the way forward

- ESG targets setting

- ESG risks and opportunities assessments

- ESG strategy and implementation plans development

Sustainability statements & Non-financial reporting

There is growing consensus that organisations, investors and governments can no longer rely solely on traditional financial information for decision making. Regulatory requirements and businesses are increasingly creating a demand for consistent, high quality disclosure by including a range of non-financial information in investor, customer, employee and other stakeholder communications.

Sustainability reporting is a relatively new process, and it can be challenging to routinely report consistent, reliable, and complete data, especially given the increasing number of disclosure requirements, organisations, and awards bodies.

This is where PwC can help by making sure that your organisation’s reporting data is credible and current.

Main PwC support areas:

- Setting up ESG reporting framework and structure

- Compliance with legal and other requirements and regulations

- Data governance process set up and assistance

- Preparation and publishing of ESG reports

- Third party assurance on non-financial information and reporting

EU Taxonomy eligibility

The EU Taxonomy Regulation defines a system of classification of sustainable economic activities that are aligned and substantially contributing to the climate and environmental objectives of the EU. Furthermore, the Taxonomy Regulation describes disclosure requirements and categories of financial market participants and certain large non-financial entities to report additional information, including Taxonomy alignment indicators related to their revenues, CAPEX and OPEX.

PwC supports financial institutions and other companies with the following service:

- Taxonomy alignment analysis

- Identification of required data

- Taxonomy-related workshops and other guidance

Climate risk assessment

Growing efforts to address climate change and pursue net-zero goals create challenges and opportunities for businesses, investors, customers and other stakeholders alike. Whether you are developing renewable energy resources, investing in carbon-capture technology, financing sustainability projects through green bonds, trading carbon credits or simply considering how your business can establish measurable climate change targets, you’ll need to consider various implications.

PwC team of integrated wide range of professionals delivers a holistic perspective. Working with specialists from across a spectrum of areas including Assurance, Deals, Consulting and Tax & Legal can give you clear, actionable expert advice on climate risks related issues. Whatever the challenge you’re facing, PwC’s global network of professionals can help your business meet its strategic goals.

Main areas:

- Climate risks assessment and policies

- Net zero transformation

- Carbon footprint tracking using GHG protocol methodology

ESG trainings and raising awareness

ESG means designing business activities that are sustainable and responsible. This is a trend that will alter the business environment beyond recognition already in the near future. The years to come will bring wider non-financial data disclosure obligations, implementation of the principles of sustainable finance and more specific goals and measures to reduce climate impact.

Every industry sector and organisation have their own set of ESG challenges, but also opportunities to tackle them. That’s why PwC provides trainings meant to help you raise awareness and upskill your team with the latest ESG regulations and sustainability topics.

Main services areas:

- Introducing concepts of ESG and sustainable business model

- Leading ESG and sustainability workshops, meetings campaigns

- Taylor-made ESG trainings

ESG Tax & legal services

Tax and legal areas also plays a critical role in solving today’s ESG challenges - managing an organisation’s legal and tax considerations now means also thinking about ESG issues. Done right, it goes well beyond ticking boxes as the standards and regulations around ESG are expanding rapidly at the local, national and global levels.

ESG factors are also increasingly important in weighing the legal and tax implications of business decisions and long-term plans. As climate change accelerates, businesses will encounter both new risks and new opportunities with far-reaching legal and tax impacts. And to stay viable, they will need to keep up with both society’s evolving expectations about corporate behaviour and changing business models. This has created a complex environment for any business to navigate.

Whatever your need when it comes to ESG, tax and legal matters, PwC community of solvers can help guide you through this changing landscape. We understand our clients’ unique problems and bring global expertise to help them find solutions to new and emerging problems.

Main services:

- Legal compliance with ESG legal regulations

- Environmental taxes

- Tax strategy sustainability assessment

- State subsidies and incentives

- Paperless Office

ESG and Environmental due diligence

When buying or selling companies, its growing tendency for the institutional investors to check that there are no environmental showstoppers (e.g. contaminated land), no social red flags (e.g. human rights issues) and no governance problems (e.g. bribery and corruption). No investor wants to be caught out and face bad press, heavy fines or see the value of an acquisition drop.

PwC provides a tailored approach to each ESG due diligence assessment depending on the risks identified in your screening assessment, the depth of detail required for the overall due diligence, the time and budget available, and the access to management.

We apply our strong capabilities and deep knowledge of ESG DD to help you develop an effective approach to the management of ESG factors on new ‘control’ deals, where you plan to hold a majority stake. The scope of our ESG due diligence work will be tailored to reflect the material ESG issues inherent to the specific target company according to the specifics of the target’s commercial activities.

Contact us