The latest global projections from the PwC Network suggest global growth to moderate somewhat, at 2.6% in 2025 and 2026, down from 2.8% in 2024, as geopolitical uncertainties and increased protectionism dampen the outlook.

The US economy is expected to grow at just over 2% and China’s growth moderating to around 4.5%. Growth is expected to remain slow in the eurozone, at 1.1% in 2025, picking up marginally to 1.3% as the German economy recovers somewhat. Meanwhile India’s economy remains robust, with growth expected to be over the 6% mark. Within this context, Malta’s actual growth of 6% in 2024, and forecast growth of around 4% over the next two years, appears relatively strong.

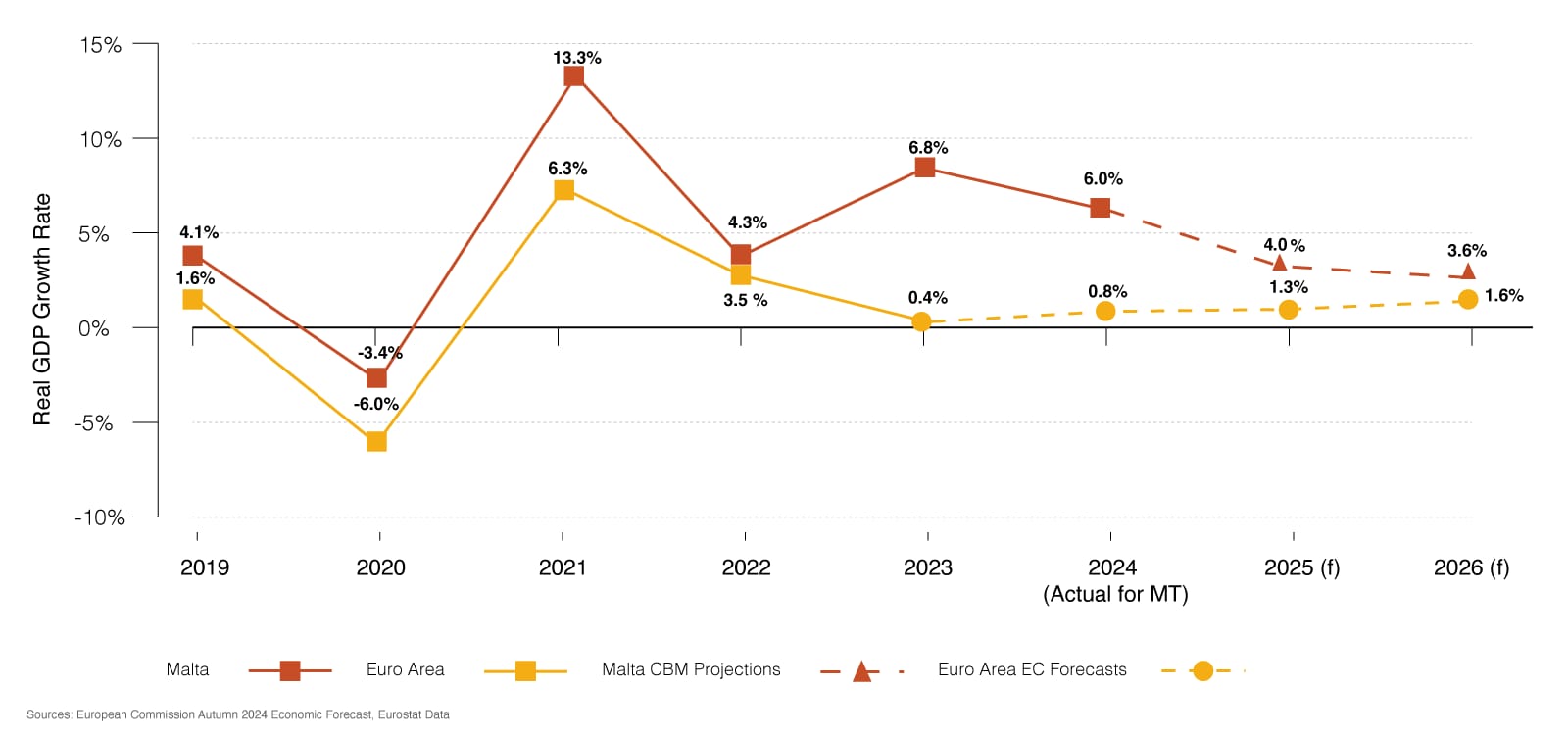

GDP growth in Malta remained strong in FY24, although decelerating somewhat from 6.8% to 6.0%; projected to dip below the 4% mark by 2026.

Real GDP Growth

Malta's Real GDP growth rate is forecasted to decline over the next two years, from 6% in 2024 to 4% in 2025 and 3.6% in 2026. In contrast, GDP growth within the Euro Area is anticipated to experience a moderate increase, rising from 0.8% in 2024 to 1.3% in 2025 and reaching 1.6% by 2026. Consequently, Malta's real GDP growth is projected to remain higher than that of the Euro Area, although the disparity is expected to narrow over time.

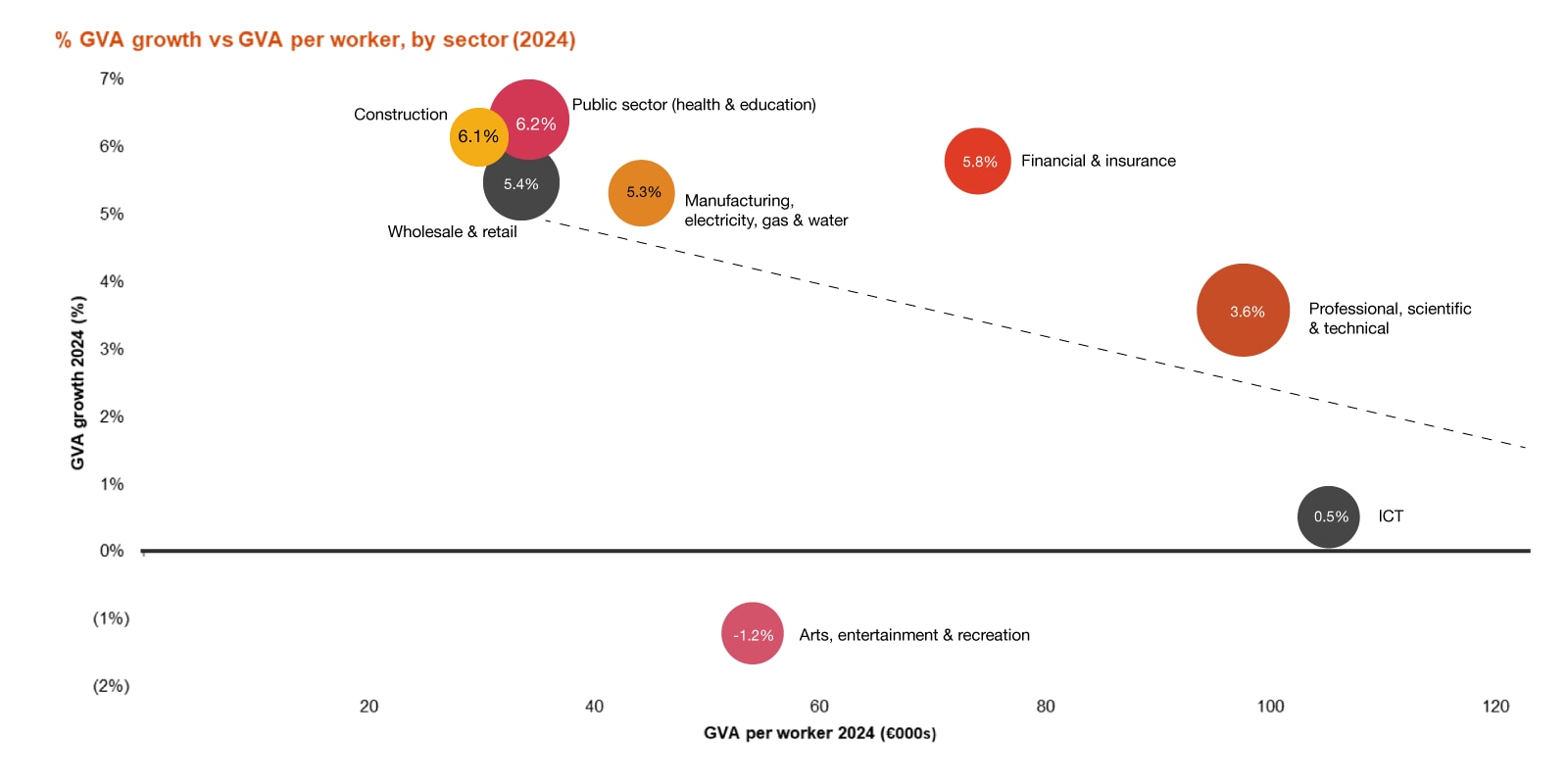

From a sectoral perspective, real estate, construction, financial services and public sector appear to be driving growth; slowdowns registered in professional services and manufacturing.

When analysing economic performance at a sectoral level, it appears that not all industries grew in line with Malta’s overall GDP growth. Growth in the real estate and construction sectors outpaced national growth, as did education and finance. However, traditionally more high-performing and higher value-added sectors, such as professional services, ICT and arts & entertainment (which includes i-gaming), slowed down or even contracted slightly.

When considered on an output-per-employee basis, the ICT, professional services and finance sectors continue to lead in terms of productivity per worker, followed by more traditional industries which registered lower levels of productivity.

ICT, finance and professional services registered strong employee output levels for both 2023 and 2024 with little movement YoY, Followed closely by the Arts & Entertainment sector. The remaining industries observed more modest output levels per employee, including wholesale & retail and the public sector, which together make up a substantial portion of total output.

It is interesting to note that in 2024, the higher value-added sectors grew at a slower rate, with growth being driven largely by the less productive sectors .

Sources: NSO, PwC Analysis ( Note: Real estate excluded due to underrepresented employee sample size as per NSO)

Sectoral GVA data for 2024 suggests a negative correlation between productivity and rate of growth, with ICT and professional services (the two highest value-added sectors at around €100k per employee) growing at just 1% and 4% respectively. Meanwhile, fastest growth was registered in the public sector (6.2%), Construction (6.1%) and wholesale and retail, which includes hotels & restaurants (5.4%). GVA data suggests that these three sectors have the lowest value-added per employee at around €30-€35k per worker. This analysis suggests that while headline GDP growth was strong during 2024, its drivers were the less productive sectors. It remains to be seen whether there is any evidence of a low-growth trend developing in the higher value-added sectors - , then Malta’s overall productivity could be impacted.

From an expenditure perspective, the positive economic growth witnessed in the Maltese economy stems from the tourism and related sectors; growth in the more local-related expenditure appears to be slowing.

The restaurant & hotels sector continues to consistently outperform with 17% YoY growth down from 21% in 2023, followed by education and communication which together have been key in driving the strong economic growth for Malta. On the other hand, more traditional sectors seem to be slowing down in expenditure terms, with alcohol & tobacco, food & beverage and personal care sectors all registering mild declines in growth rates to relatively low levels. Growth in health spend remained flat at 6%, while furnishing sector rebounded from its 2023 decline to substantial growth at 7%.

Honing in on consumption trends, latest data suggest that growth in real terms on a per capita basis, while still positive, appears to be slowing.

Nominal consumption per capita grew by 7.1% in 2024, from €17,042 in 2023 to €18,247. Expressed in real terms, this growth was more muted, at 3.7%. In fact, as highlighted by the diversion between the two graphs post-2021, it can be shown that a lot of the growth in consumption is driven by price growth – with nominal CAGR of 6.9% vs a real CAGR of 3.3% from pre-covid levels.

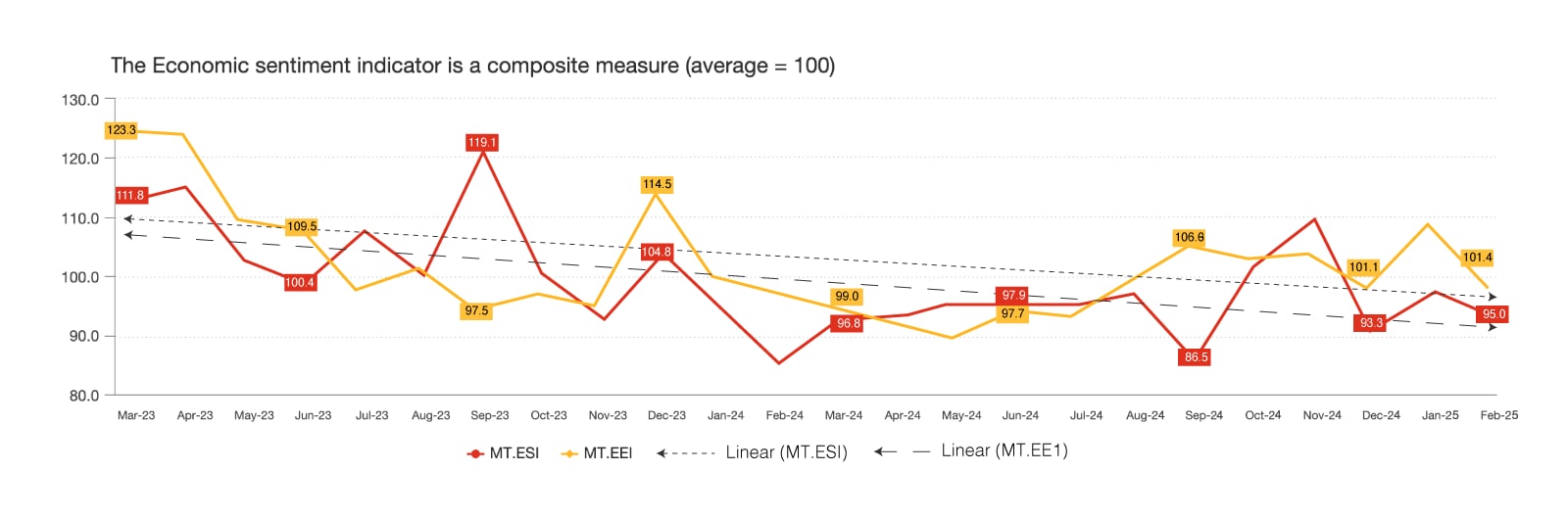

Local economic sentiment in Malta observed a downward trend throughout 2024. Following a brief rebound in October and November, sentiment continued on its downward trend in early 2025.

The Economic Sentiment Indicator (ESI) continued to decline in 2025, following a temporary increase from the two-year low observed in September 2024. Despite a notable rebound in November above the 100 long-term average, the downward trajectory resumed into 2025, reflecting persistent concerns over economic uncertainty and a more pessimistic outlook for early 2025. The Employment Expectation Indicator (EEI) stabilized above the 100 average at the beginning of 2025, yet overall remained on a downward trend.

Conclusion

In summary, Malta’s economic performance remains above its European peers, despite the expected moderation in growth in the coming years. Official statistics for FY24 indicate that this growth was driven by expenditure related more to entertainment & leisure and tourism-related activity, rather than more domestic expenditure. Sectoral level data for 2024 also highlight a slowdown in the higher value-added sectors such as professional services and ICT, with lower-productive sectors such as construction and public sector experiencing the highest growth rates.

This apparent negative correlation between sectoral productivity and annual growth rate in 2024 is by no means a trend, and in fact was not observed in recent years – however, it should be monitored throughout 2025 as any such trend would impact Malta’s target for increased levels of overall productivity across the economy.

Contact us