PwC Malta's latest CEO Confidence Tracker, which was carried out during Q3 of 2023, offers ongoing insights into the current performance of local businesses in various industries. It also gauges expected business sentiment. This survey holds significant relevance in the present economic environment, as CEOs navigate their businesses through a challenging landscape characterised by pressing issues such as soaring inflation, rising interest rates, and geopolitical tensions triggered by the conflicts in Eastern Europe and Middle East, besides the impact of climate change.

Amidst a challenging international economic environment, Malta’s economy has in 2022 outperformed a number of its EU peers, and the expectations of GDP growth for 2023 and 2024 remain strong, at 4.1% and 4.2% respectively, as announced by the Government in the budget in October.

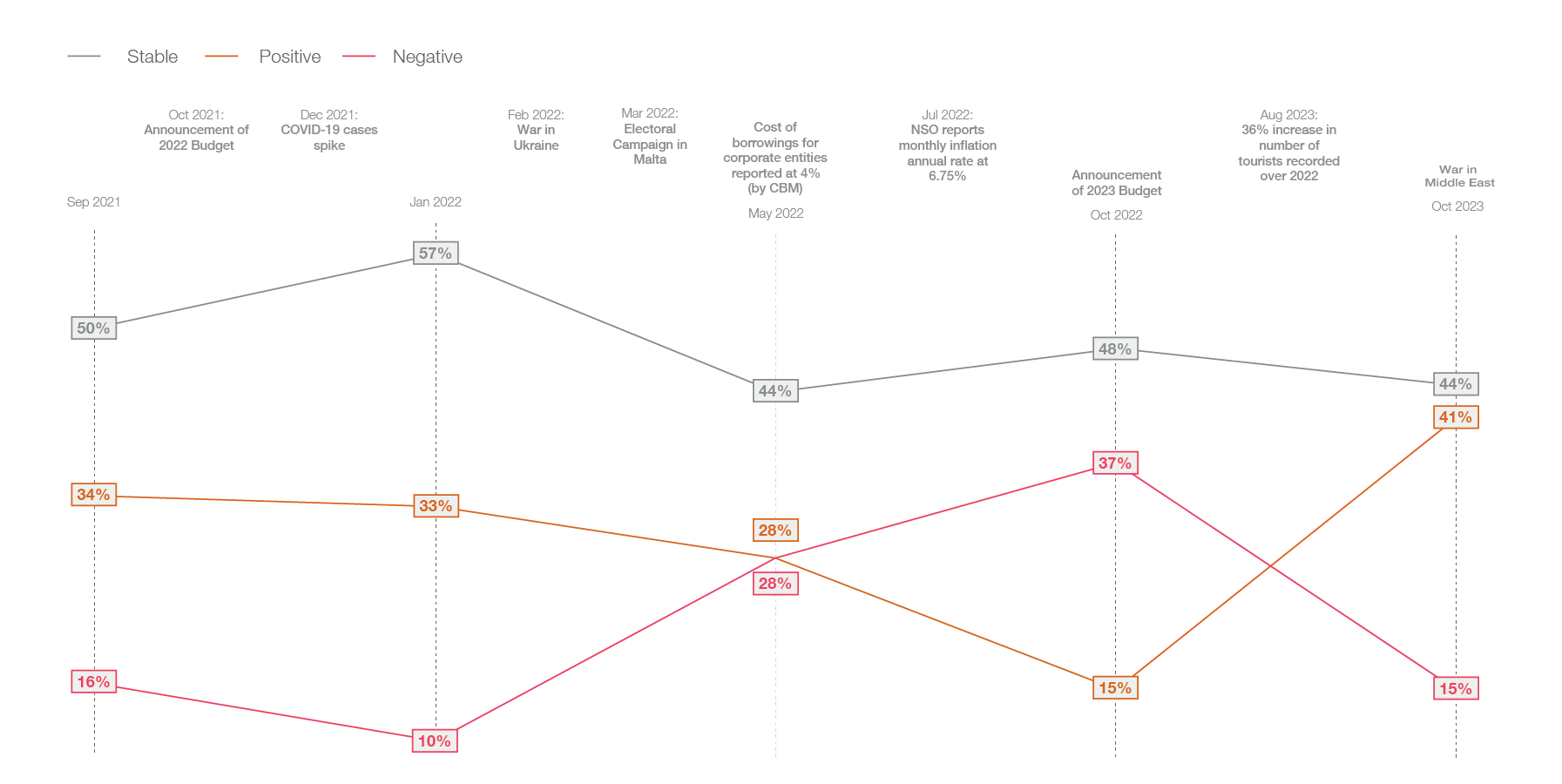

The messages coming out from the 2023 Q3 PwC CEO barometer, in which over 40 CEOs participated are generally consistent with this economic trend given that a large majority of respondents reported either improved or stable performance, indicating resilience and adaptability in the face of various economic challenges. A higher proportion of CEOs leading financial services entities appear to be more upbeat about the last quarter’s business performance and the outlook for the next six months - in a suggestion that inflation, competition and supply chain issues are creating a heightened level of pressure on local and family business. Recent economic data indicates that inflation has proved more difficult to contain, with price inflation remaining stubborn, despite repeated interest rate hikes from central banks.

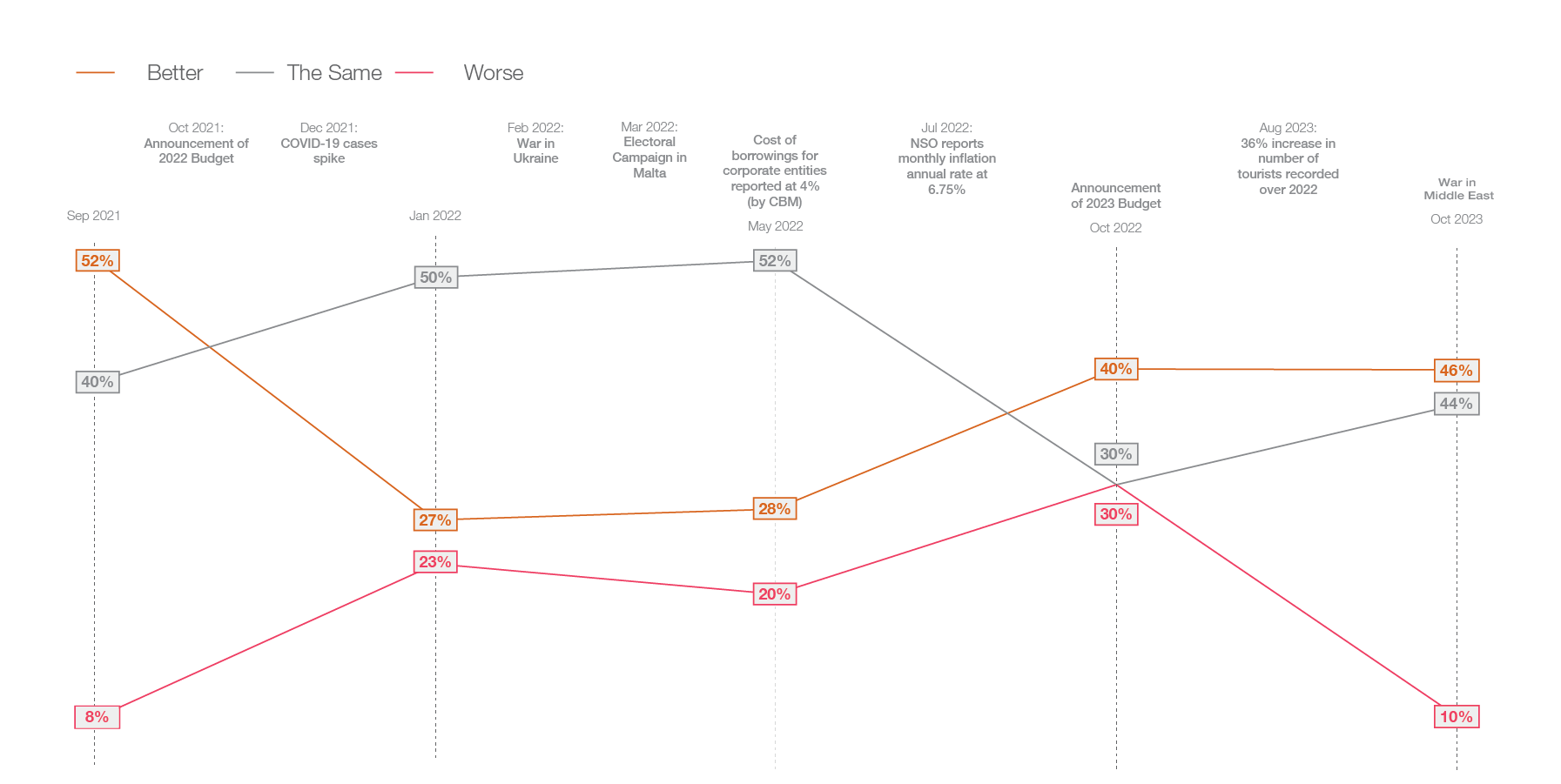

Nonetheless despite such challenges the overall business sentiment captured in the 2023 barometer suprasses that reported in Q3 of 2022, both in terms of level of business and future outlook. The Q3 2023 results appear to be influenced by a very strong tourism season. In its latest release in October, the NSO reports that inbound tourists for the first eight months of 2023 amounted to almost 2 million, an increase of 33.5% over the same period in 2022. Total nights spent by inbound tourists went up by 25%, almost reaching 13.6 million nights. Total tourist expenditure was also higher than 2022 and estimated at €1.8 billion, 36.2% cent higher than that recorded in the previous year.

From an international perspective, in an equivalent CEO survey carried out across the PwC network and in which almost 4,500 CEOs participated, the biggest near-term challenge facing CEOs appears to be the state of the global economy. Not surprisingly, nearly three-quarters of CEOs responding to the 2023 survey project that global economic growth will decline over the next 12 months. Whilst this trend appears to be in contrast with both the economic data released by the Central Bank of Malta and the sentiment reported in the local PwC CEO Confidence tracker, the results of the global survey could be indicative that the Maltese economy, which is very sensitive to international pressures, could be navigating uncharted volatile territory, especially in scenarios where the level of Government induced energy subsidies oscillate.

How has your business performed over the past quarter when compared to the previous quarter?

What is your business outlook for the next 6 months?

Contact us