The General government deficit is set to remain relatively high in 2023, as the Government seeks to allocate €0.6b to energy support measures and pledges to maintain local energy prices unchanged …

Government expenditure is projected to amount to €6.9b in 2022, increasing to €7.3b in 2023, compared to revenue of €5.9b by the end of this year, rising to €6.3b next year.

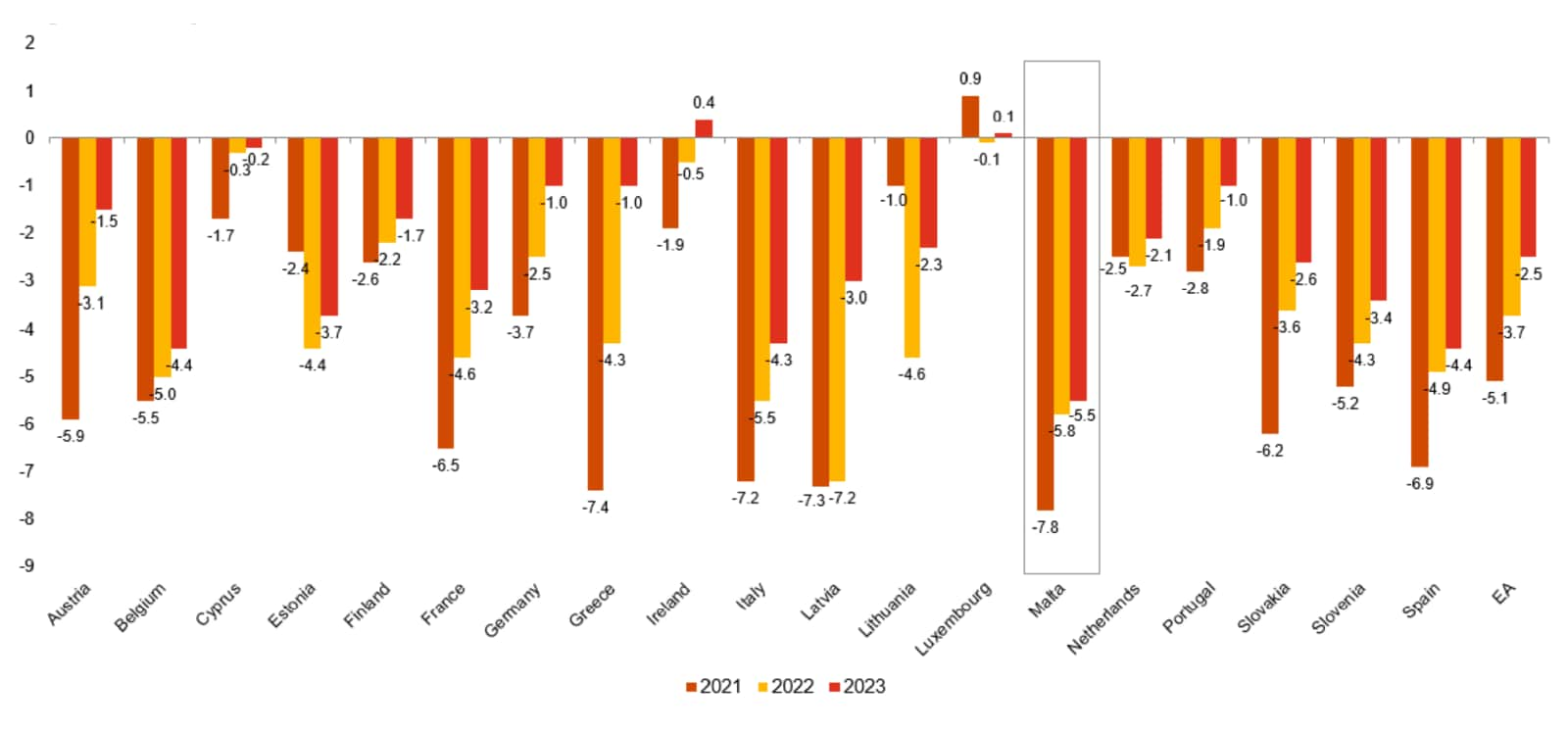

As a result, the deficit is estimated at 5.8% of GDP in 2022, moderating somewhat to 5.5% by 2023. In fact, the past two deficits in Malta have been amongst the highest in the euro area largely as a result of the stimulus packages provided by Government to boost aggregate demand following the disruption caused by the COVID-19 pandemic. The deficit is anticipated to remain relatively high compared to other euro area countries in 2023, as a result of significant energy and food support measures valued at €608m.

Budget Balance Projections

Source: European Commission, Government of Malta

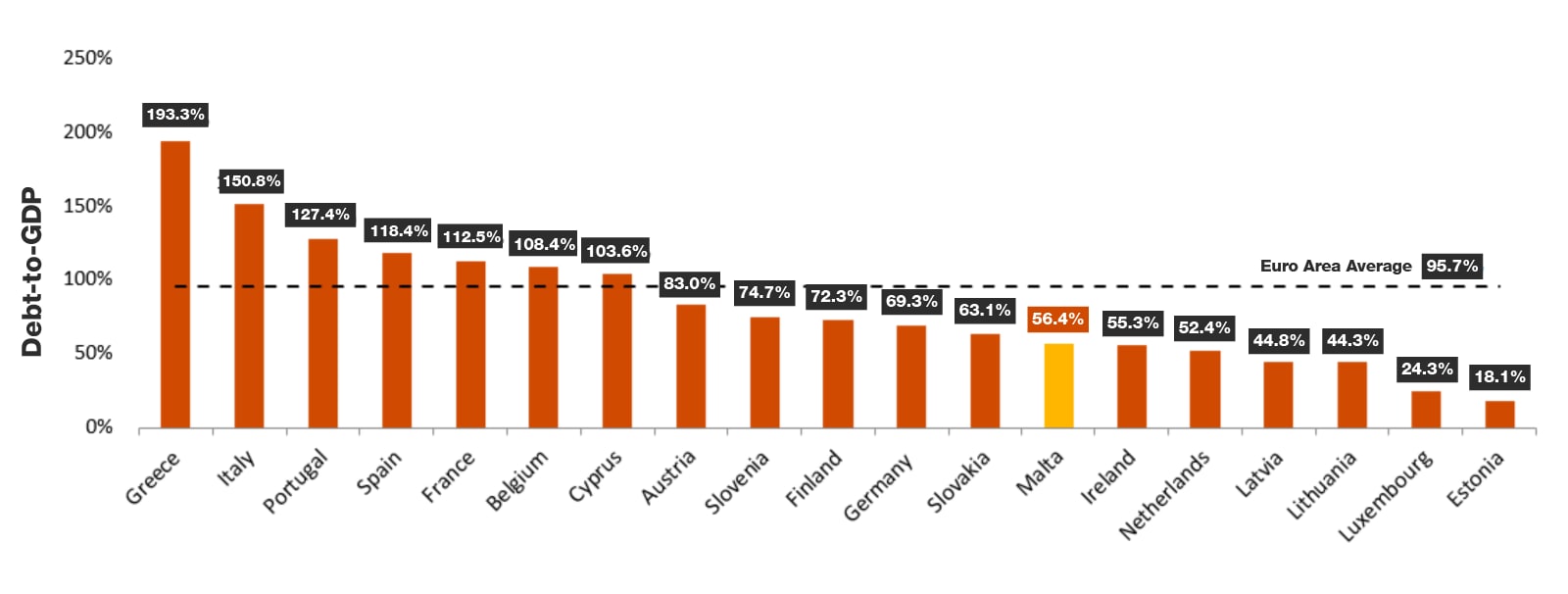

... As a result, the Government’s debt-to-GDP ratio is set to increase from 57.0% in 2022 to 59.1% by 2023, just below the 60% Maastricht criteria threshold …

Malta’s debt to GDP ratio is expected to continue to increase in 2022 and 2023, but will still remain below the 60% Maastricht criteria threshold. When compared to other countries, Malta’s debt-to-GDP ratio appears relatively healthy, well below the Euro Area average of 95.7%.

Euro Area Government Debt

Source: European Commission, Government of Malta

In fact, some high level analysis on key budget assumptions implies that even a slowdown in growth or a material overshooting of expenditure will not necessarily imply unsustainable public finances in the short-term ...

In order to assess Malta’s ability to sustain its public finances in the next year, we considered and tested two scenarios that could negatively impact Malta's debt-to-GDP ratio. In the first scenario, we assume that geopolitical uncertainty will not stabilise in 2023, but would in fact intensify, i.e. energy and food inflation will persist throughout next year. This in turn would require the government to spend over and above the €600m allocated to energy and food support measures to maintain its inflation objectives. In the second scenario, we assume that GDP growth in 2023 will be lower than forecasted. In both of the scenarios, the outcomes indicate that even though the debt-to-GDP ratio exceeds the Maastricht criteria threshold of 60%, it still remains well below the 88.1% EU average. This implies that the Government has a relatively high amount of fiscal manoeuvrability when compared to other EU countries.

Inflation is projected to stand at 5.7% for the year 2022, declining to 3.7% in 2023, with energy prices in Malta expected to remain stable as a result of government intervention ...

When looking at the components that make up Malta’s inflation rate, one can observe that it is mainly driven by the services component, followed by the non-energy industrial goods component and the processed and unprocessed food sectors. This is starkly different from the composition of the Euro Area inflation rate, which is fuelled mainly by energy price pressures.

Malta’s headline Harmonised Index of Consumer Prices (HICP) inflation rate has consistently remained below the Euro Area average. However, when excluding the energy component from the overall HICP, Malta’s inflation rate actually exceeds the Euro Area average.

This shows how crucial the government’s efforts to maintain low energy prices are, which would otherwise have caused Malta’s inflation rate to be significantly higher than it is. In fact, Government estimates that if it did not intervene in the energy and cereals market, the COLA would have been close to €25 as opposed to the €9.90 allocated.

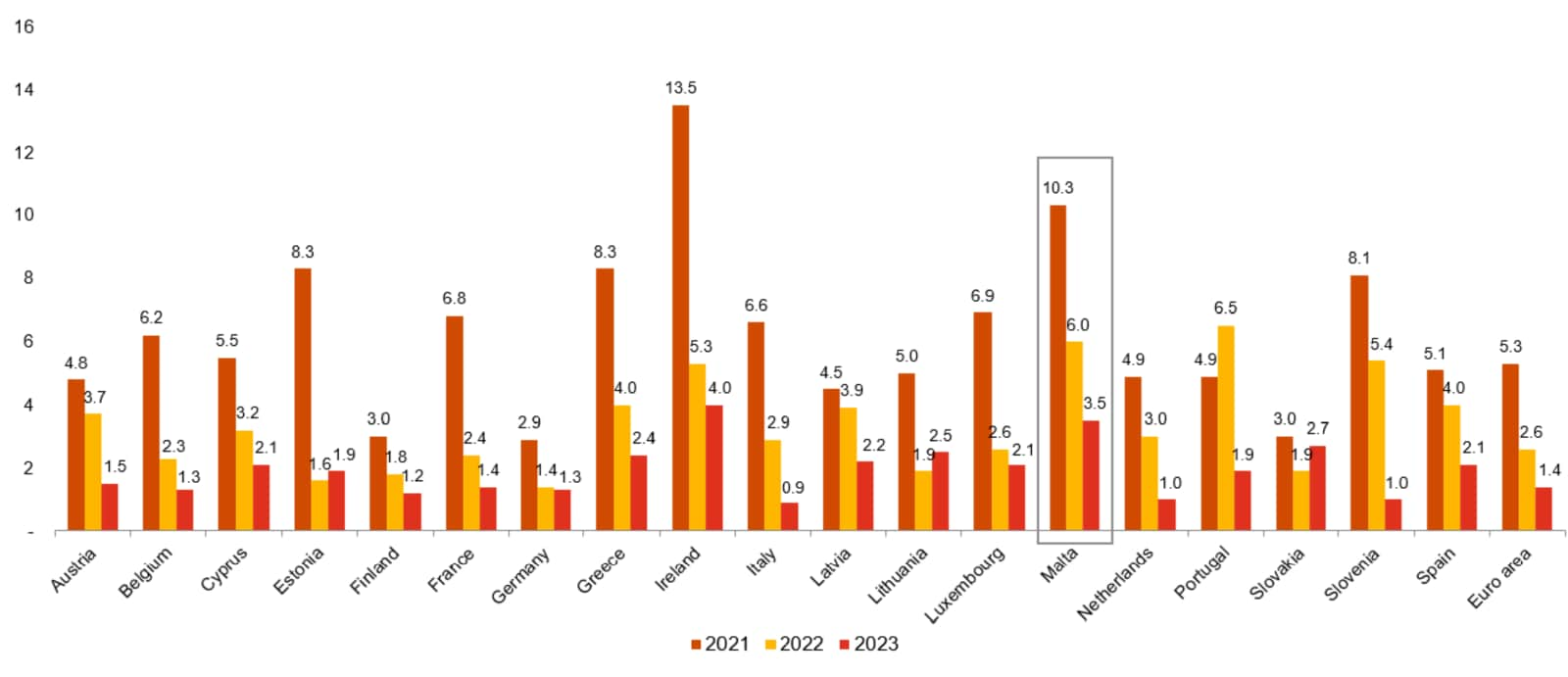

One major underlying assumption is that the economy continues to grow robustly, at 6.0% and 3.5% in 2022 and 2023 in real terms, thereby partly funding the significant increase in expenditure required to keep energy prices stable …

Coming off the back of strong growth in 2021 and exceeding initial expectations for 2022, Malta’s growth rate is amongst the highest in the Euro Area. However, it is expected to dampen in 2023, reflecting a more moderate international economic outlook amidst higher interest rates and heightened uncertainty. As GDP growth rates fall across the Euro Area, Malta is still set to boast one of the highest projected growth rates in 2023.

GDP Growth Forecasts

Source: European Commission, Government of Malta

This increase in expenditure arises against the backdrop of the “General Escape Clause” which the European Council had activated in 2020 ...

In light of the COVID-19 crisis, the European Council activated the “General Escape Clause'' of the SGP for the first time. The clause is set to be deactivated by the end of 2023 as economies return to normality. This therefore implies that the Maltese Government should be aiming to decrease its budget deficit in order to be in closer proximity to the rest of the European Union economies by the time the General Escape Clause is deactivated. In view of this, it's important that the deficit continues to decline to ensure that by the time the clause is deactivated, public finances will not exceed the general criteria and trigger an excessive deficit procedure.