Growth forecasts for FY23 have been revised slightly upward since our last economic update, with Euro Area, UK and US coming out less muted than previously expected

In our last economic update, taking January 2023 forecasts, the global economy was expected to grow by 1.6% in 2023. This figure has been revised upwards in July, with the global economy set to grow by 2.5% for this current year.

All of the reported countries had their figures revised upwards from the previous forecast, with Italy experiencing the largest upward revision, whereby GDP growth was revised from negative 0.4% to 1.2%. The United States was revised upwards, stemming away fears of heading towards a recession, in large part due to both consumer expenditures and exports being stronger than initially expected.

Real GDP Growth 2023 Forecasts: January 23 vs July 23 (Upward revision)

Projections for FY24 are that growth will slow down marginally in US and China, while picking up slightly in the Euro Area

Despite the positive upward revision of 2023 expectations, projections for 2024 still indicate a slowdown in global economic growth, anticipated at 2.2%, driven mostly by declines in the growth rate in the US and major Asian economies. European countries on the other hand are expected to enjoy a marginal increase in growth, increasing from an expected 0.8% in 2023 to 1.2% in 2024.

Real GDP Growth: 2023 vs 2024 Forecasts

In Malta, GDP growth is set to continue to outpace that of the EU, however, is expected to moderate to just under 3.6% by 2024

In line with the Euro Area, Malta’s growth is set to slow down in 2023. For 2024, growth is set to ease slightly further for Malta, while the same cannot be said for the Euro Area as the growth rate is set to pick up again. Nevertheless, Malta's growth rate is expected to remain above the EA average over the next two years.

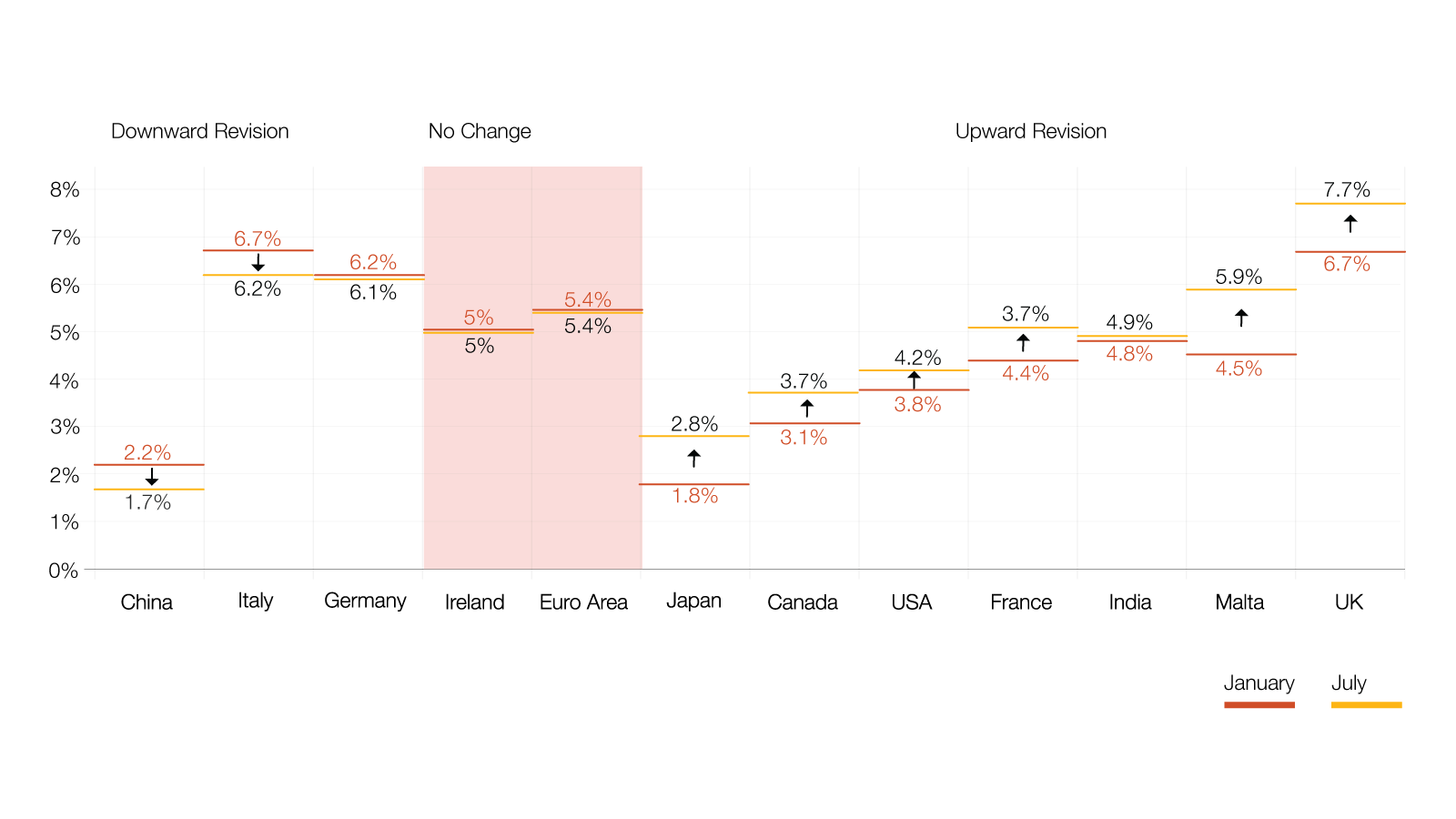

Meanwhile, inflation remains high across the world economy, largely revised upwards since the last forecast, despite central banks efforts in tightening monetary policy

Inflation did not ease as much as expected in the beginning of 2023 and has in fact been revised upwards for most major economies. As a result, there are expectations of potential further increases in interest rates over the second half of 2023.

Inflation 2023 Forecasts: January 23 vs July 23

Source: Eurostat

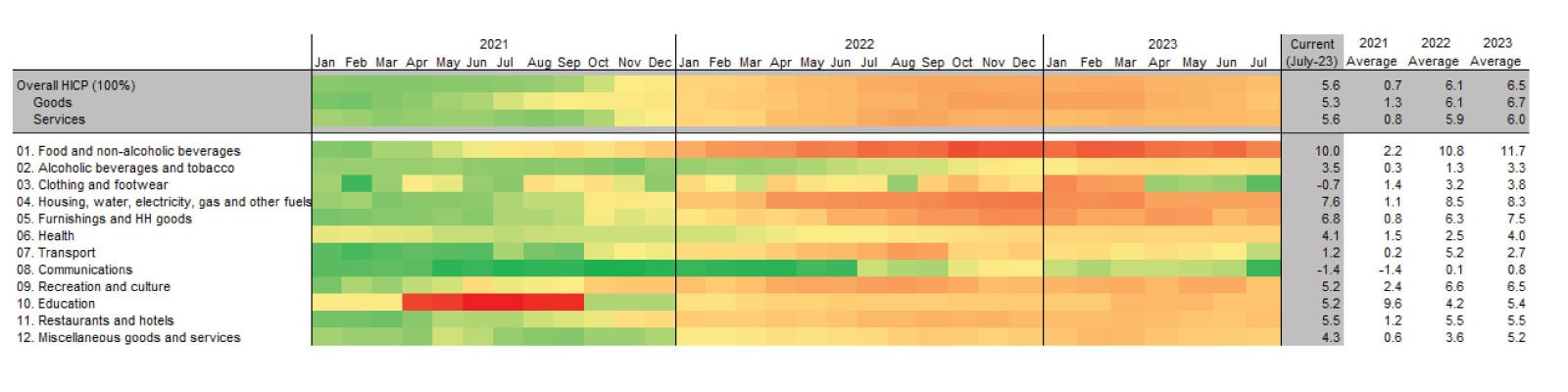

In Malta, as in other economies, inflation remains persistent, however on a downward trend, declining marginally to 5.6% in July 2023. Services price remains the largest contributor, due to its weighting, followed by food

Malta’s inflation rate has been on a downward trend since last April, falling to 5.6% in July. This trend reflects a decrease across all sub-components of HICP (apart from the energy component which remains unchanged due to government intervention), however, most particularly due to decreases in the non-energy industrial goods component, who’s contribution to the headline rate has declined by almost a half from January to July. The services component remains the biggest contributor to Malta’s headline rate, amounting to 2.6% in July, followed by food which stood at 1.9% in July.

Source: Eurostat

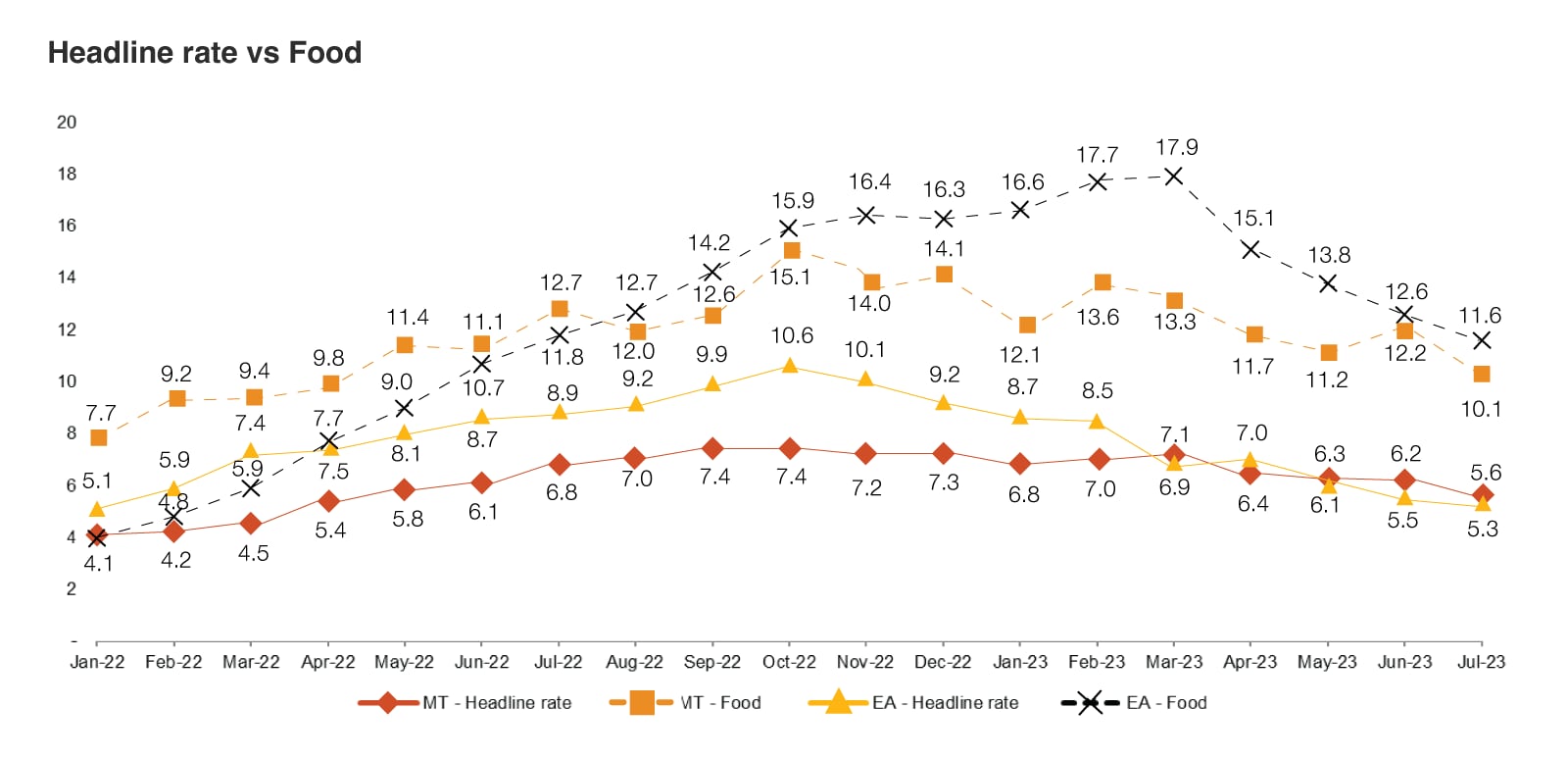

In fact, on a sub-component basis, it is the food category which has seen the sharpest increase in prices over the past year or so

Source: Eurostat

On a sub-component level, the food category has seen the highest inflation rate over the past year or so, consistently exceeding Malta’s headline rate throughout the period under review. In the euro area, food price inflation was even higher, but has been slowing over the past few months.

Source: Eurostat

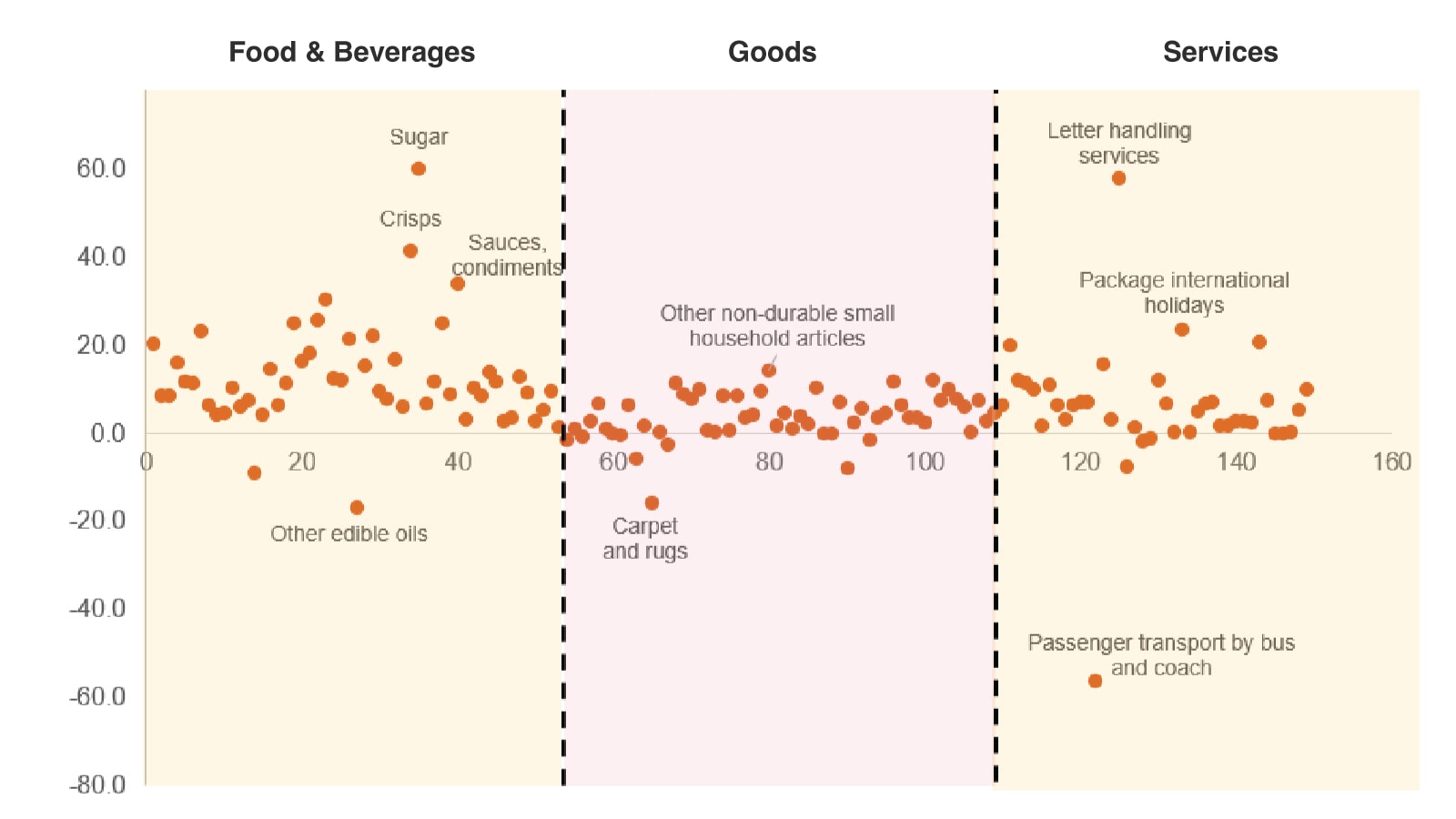

Delving deeper into individual items, some outliers can be observed, where inflation rates increased sharply, many of which pertain to the food and beverages category (e.g. sugar, crisps and sauces and condiments). Compared with food, inflation rates of other goods and services categories seem to have a smaller variance from the mean, with some exceptions such as letter handling services and passenger transport.

Inflation rate by component

Source: Eurostat

The downward shape of the global yield curves implies that markets expect interest rates to decrease in the short and long term …

US, EU & MT Yield Curves (24 August 2023)

Typically, liquidity preference theory implies that yield curves are upward sloping, i.e. investors are compensated with higher interest rates for investing in longer-term securities (this is the case with Malta’s yield curve as at today, as shown in chart).

However, at the moment, US and EURIBOR yield curves are largely downward sloping from 6 month maturity onwards. In our last Economic update there was a ‘kink’ in the yield curves, possibly showing an indication of unsettled markets which were pricing in offsetting potential monetary policy responses to an ambiguous economic outlook.

Now that the yield curves are downward sloping, we can interpret this as the markets having a bearish outlook for the short to long term. In fact, downward sloping yield curves are often associated with pessimistic economic outlooks, as investor’s increase their demand for long-term maturities (which offer more safety as they lock-in a rate for a longer period), which pushes up prices of long-dated bonds, thus lowering their yields.

Amidst the pessimistic outlook for the US and EURIBOR yield curves, Malta’s yield curve has remained upward sloping, similar to previous periods. This is possibly because of the dominance of the Government as a borrower, which sets its own rates when it issues Government stock, thereby moving existing yields in line with the latest issue. Also, the dominance of the Central Bank of Malta as a market maker in the bond market could help explain why the local yield curve does not necessarily move in line with global money market demand and supply dynamics.

The Maltese economy has, on average, constantly lagged behind its European counterparts when it comes to labour productivity…

Between 2013 and 2022, Malta has increased real labour productivity (real GVA per worker) by 13.7%, from €42,593 to €48,442 per worker, whilst the EU-27 and Euro Area countries increased labour productivity at a lower rate of 6.9% and 5.0% respectively.

Additionally, it's important to highlight that despite the relatively higher growth observed during the period, Malta's actual labour productivity, which stands at €48,442 per worker, remains noticeably below the averages of €63,509 and €70,362 per worker in the EU-27 and Euro Area, respectively. This discrepancy underscores the fact that there is still progress to be made before Malta's productivity aligns with that of its European counterparts.

Real labour productivity per person employed, 2013-2022

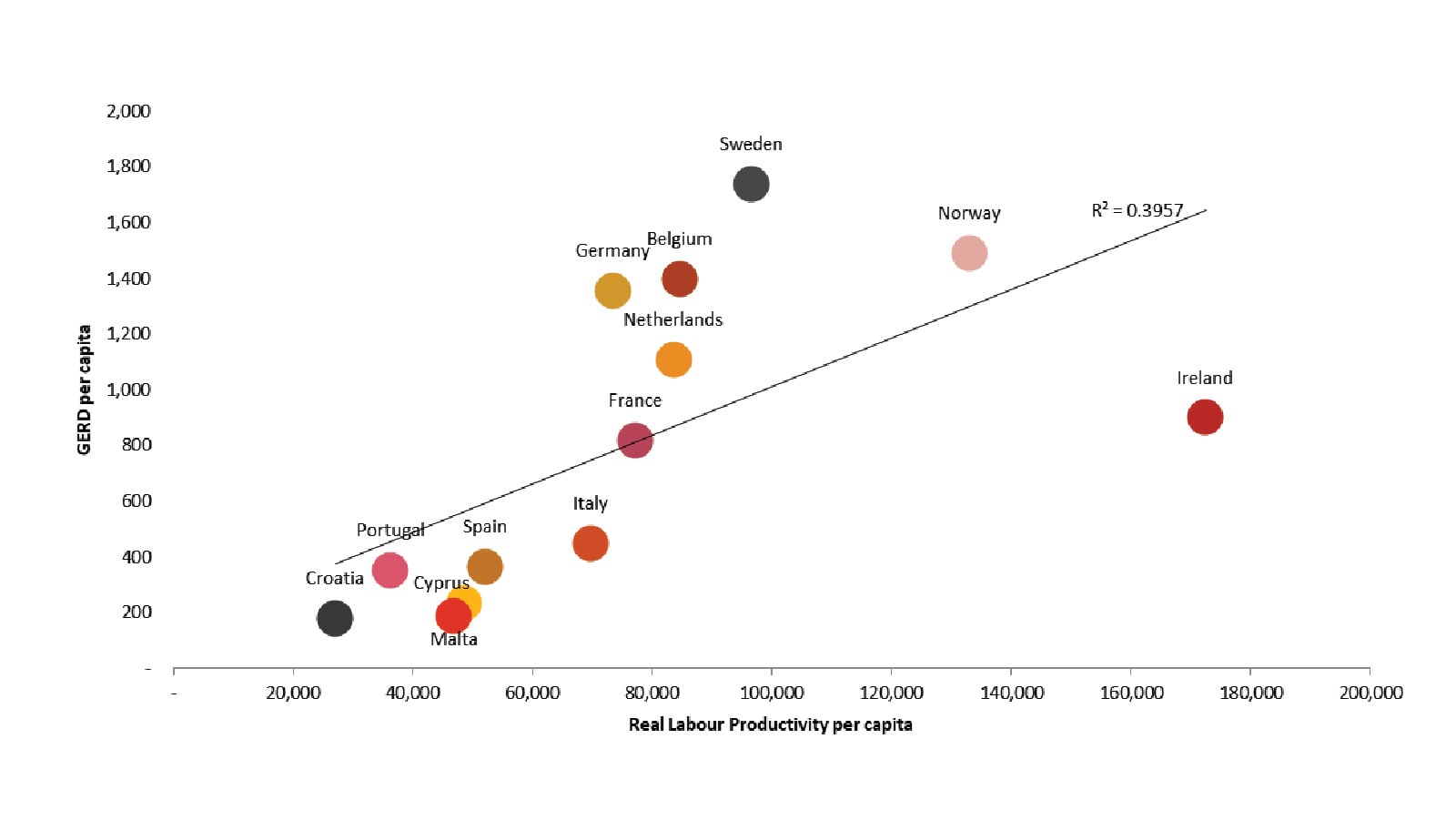

In fact, when observing the relationship between gross domestic expenditure on research and development (GERD) per capita and real labour productivity per capita, the Maltese Economy sits at the bottom of the chart when compared to its EU counterparts …

The GERD captures the total annual spending on research and development (R&D) of a country. In 2021, Malta’s GERD per inhabitant was €184.7, significantly lower than the EU-27 and Euro Area averages at €734.0 and €818.0 respectively.

With reference to the following chart, Malta sits at the bottom of the chart with GERD of €184.7 and real labour productivity of €46,829 per inhabitant. In comparison, Sweden sits at the top of the chart with GERD of €1,737.40 and real labour productivity of €96,702.

We can observe a relationship between GERD and labour productivity. In fact, Malta tends to spend less on R&D and has lower labour productivity, when compared to its EU counterparts who tend to spend more on R&D and have higher labour productivity.

Source: Eurostat

In summary, inflation remains stubborn across most developed economies and central banks will likely maintain tight monetary policy over the rest of year. In Malta, headline GDP growth is expected to slow but will still outperform the euro area average, while inflation is set to remain relatively high from a historical perspective.

The outlook for the world economy has ameliorated slightly in terms of expected growth, with the US and the EU both expected to perform better than expected at the beginning of the year. On the other hand, inflation has proved more difficult to contain, with core inflation remaining stubborn, despite repeated interest rate hikes from central banks.

In Malta, economic growth is expected to remain relatively robust but begin to slow, with cost-of-living pressures beginning to impinge on consumption. In fact, inflation remains high, driven by imported food-price inflation, but also reflecting price increases across various services, as the economy grows post-pandemic and prices adjust to pent-up demand.

Ultimately, long-term growth in Malta will require an amelioration in producitivity, as figures show that output per worker has remained more or less stagnant over the past few years. This presents an exciting opportunity for the Maltese economy, as it continues to mature and catch up with our european peers.

Contact us