Sustainability, also known as environmental, social and governance (ESG), is not a new concept and, for many, brings to mind environmental issues like climate change and resource scarcity. While these are an important element of ESG, the term in fact means much more and covers social issues, like a company’s labour practices, talent management, product safety or data security, and governance matters, like board diversity, executive pay and business ethics. Sustainability reporting or ESG reporting, is therefore all about how companies are weighing risks and shaping business strategy within the context of these issues.

Today however, the gap between corporate organisations and investors on sustainability related disclosures is as wide as ever. On the one hand, investors are increasingly seeking to understand a company’s long-term value creation plan and are demanding credible, standardised information for them to assess the long-term risks being faced. On the other hand, many companies, even when they have a good story to tell and robust processes to manage sustainability risks, are not being effective in providing investors with the right information in the right format.

Investors are increasingly aligning their messaging and engagement practices to make clear that they want ESG-related data to answer critical questions for risk and strategy assessments.

Yet this messaging has largely been unsuccessful: many corporates are unclear on why investors want ESG-related data, what exact data they want and in what form they want it. Many are concerned about providing information that might be misunderstood or misapplied. However, due to little alignment around reporting standards, even when individual corporates do provide good data on ESG-related questions, investors may not be able to make comparisons with peers. The end result, unfortunately, is that investors are increasingly demanding ESG information, but the messaging is confusing, inconsistent and scattered, which does not command a compelling response.

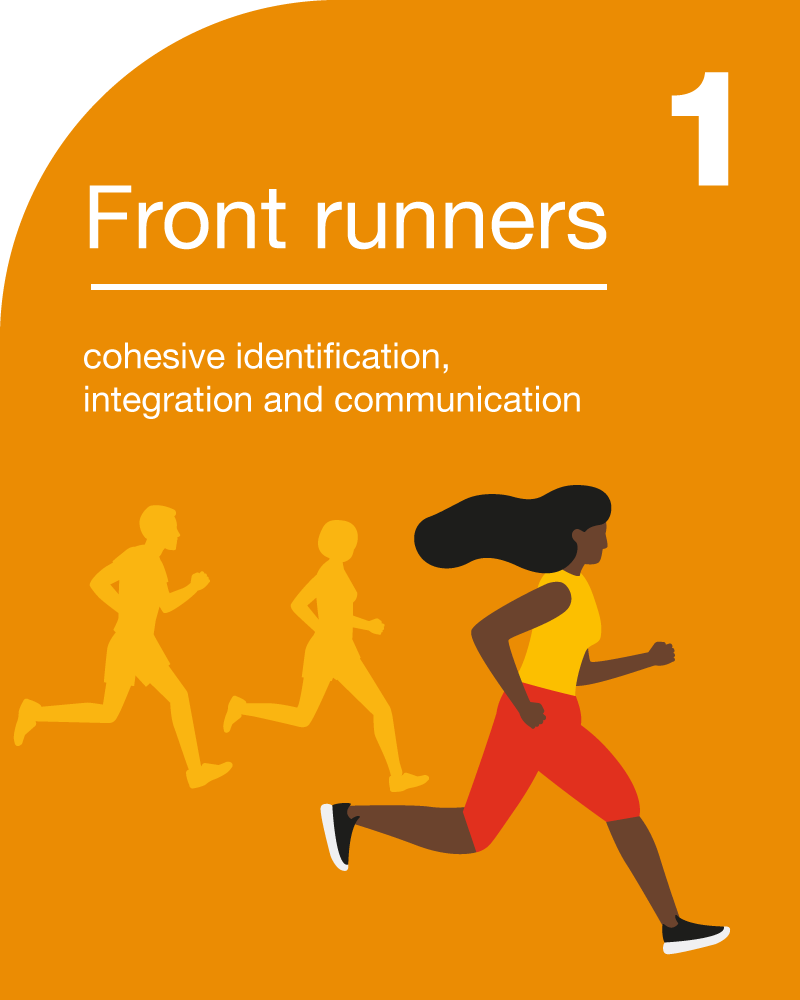

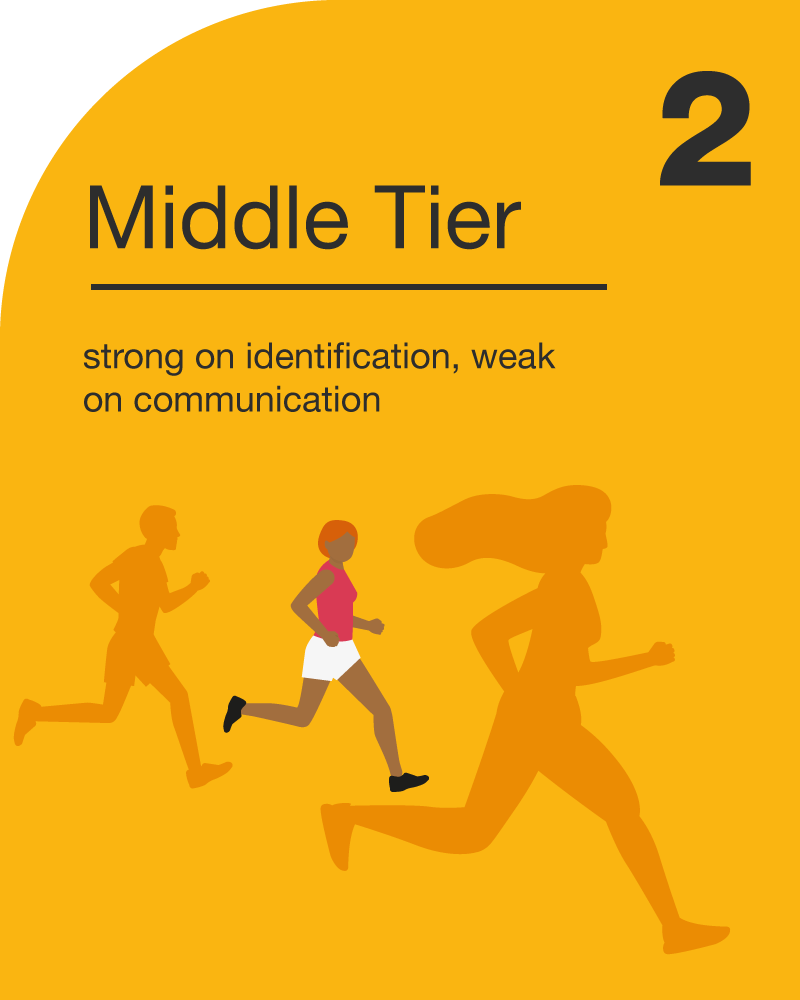

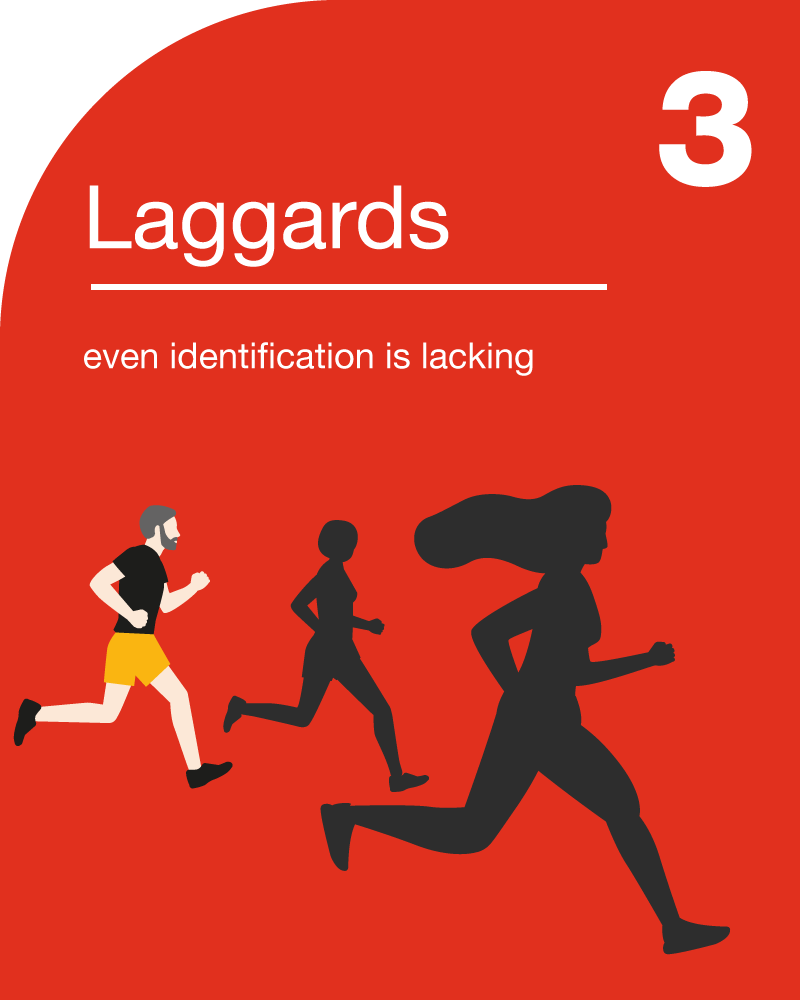

As we see it, the ESG evolution has three stages:

Some leading companies have identified ESG-related risks and opportunities, embedded them into their long-term value creation story and are communicating this story effectively.

Since ESG questions will impact their present and future business model, these forward-thinking organisations are integrating values, goals and metrics into business strategies to mitigate ESG risks. They are seizing related opportunities to innovate and reduce costs. Driven by strong internal leaders, they also tell this story effectively.

Some investors are already rewarding ESG front runners, and we expect more to do so soon.

Some companies have integrated ESG questions into enterprise risk management processes, which identify and work to mitigate these risks. Yet they fail to get the message out.

These companies typically provide robust sustainability reports, but neither their content nor their form is aimed at investors. The reports often contain so much information it's hard for investors to find what's most relevant to their needs and make comparisons among competitor companies. These reports also may not appear to have the same credibility as other, more investor-focused disclosures.

Many of these companies have also minimally, if at all, integrated ESG goals info business strategy, limiting further progress.

Companies in this third tier have not dedicated significant attention to how ESG factors might impact their business. They view sustainability issues as areas that belong solely in a corporate responsibility report, which they may or may not provide.

Some of these companies merely publish purpose statements and other material from corporate social responsibility departments. These statements typically focus on employee efforts in their communities and other activities meant to demonstrate good corporate citizenship, but which might not have anything to do with the company's long-term strategy.

With so many different investor voices asking for different kinds of ESG information in different ways—often without expressing compelling and consistent reasons—many corporates feel only scattered pressure to provide this information. Now’s the time to establish best practices in ESG risk management and communications, building the company’s brand in this area and establishing credibility with investors.

Our recommendation therefore is for corporates, even local SMEs, to embed ESG factors into their overall strategy so as to be able to present their risk mitigation and value creation story. The first step, we believe, is for boards to begin the conversation on ESG; in this respect, working towards drafting a sustainability strategy and carrying out a carbon footprint assessment would be a good place to start.

Contact us