“Climate change is here, it is terrifying, and it is just the beginning. The era of global warming has ended; the era of global boiling has arrived.”

UN secretary general, António GuterresAs the first half of 2023 comes to an end, the undeniable reality of climate change is clearer than ever. The global climate crisis has reached a critical tipping point, as experts highlight the need for urgent action. In response, the EU has demonstrated its commitment to this crisis by seeking to reduce carbon emissions through various measures. Most notably, the EU has pioneered one of the world’s largest compulsory carbon credit markets that prices in the negative externality of greenhouse gas emissions.

At its core, the EU Emissions Trading System (ETS) operates as an annually diminishing “cap and trade” mechanism, setting a limit on emissions for these sectors and subsequently issuing allowances for these emissions, tradeable on the carbon market. The system incentivises companies to curtail their carbon footprint, as those emitting less than their allowances can profit by trading surplus allowances with those exceeding their quotas. Already accounting for approximately 40% of greenhouse gas emissions in Europe, the EU ETS extends to energy-intensive sectors like oil refineries, steel, cement, glass, paper production, commercial aviation and as of June 2023, maritime transport and shipping.

To date, Malta has been minimally involved in the carbon market due to the absence of significant energy-intensive industries. However, the European Commission has further proposed expanding emissions trading to other sectors, including road transport, heating and cooling for buildings, and implementing more demanding laws relating to the aviation industry. As a result, along with the recent inclusion of the maritime sector, Malta finds itself at a pivotal juncture in the transition towards a low-carbon future. Embracing these new regulations, and recognising them as opportunities, Maltese companies have the chance to actively participate in carbon trading, promoting sustainable practices and contributing to global emission reduction goals.

Beyond those official sectors, however, the voluntary carbon market is also growing rapidly in importance as those companies that fall outside the scope of the EU ETS set net-zero targets. As part of this commitment, many companies are seeking to purchase carbon offsets to claim carbon neutrality. Carbon credits allow companies to offset their carbon emissions that would otherwise have been challenging to address by allowing them to invest in projects that reduce an equivalent amount of carbon elsewhere, such as through reforestation, building renewable energy, carbon-storing agricultural practices, the list goes on.

How can you make sure that your carbon strategy will be successful?

Getting this right involves 5 key steps:

- 1. Consider constraints

- 2. Understand your role in the carbon market

- 3. Value carbon credits correctly

- 4. Navigate supply and demand issues

- 5. Define 'success'

1. Consider constraints

Several key concepts come into play when making strategic decisions linked to carbon credits. This includes analysing the allocation of available capital and the associated processes, as well as assessing the required expertise and skills necessary for effective execution. Constraints may be financial, technical or regulatory and may also act as catalysts for change. Consider them, understand them and deploy the necessary measures to make the most of them.

2. Understand your role in the carbon market

An equitable marketplace design does not mean that carbon markets will impact each participant equally. Rather, carbon markets will impact every company differently.

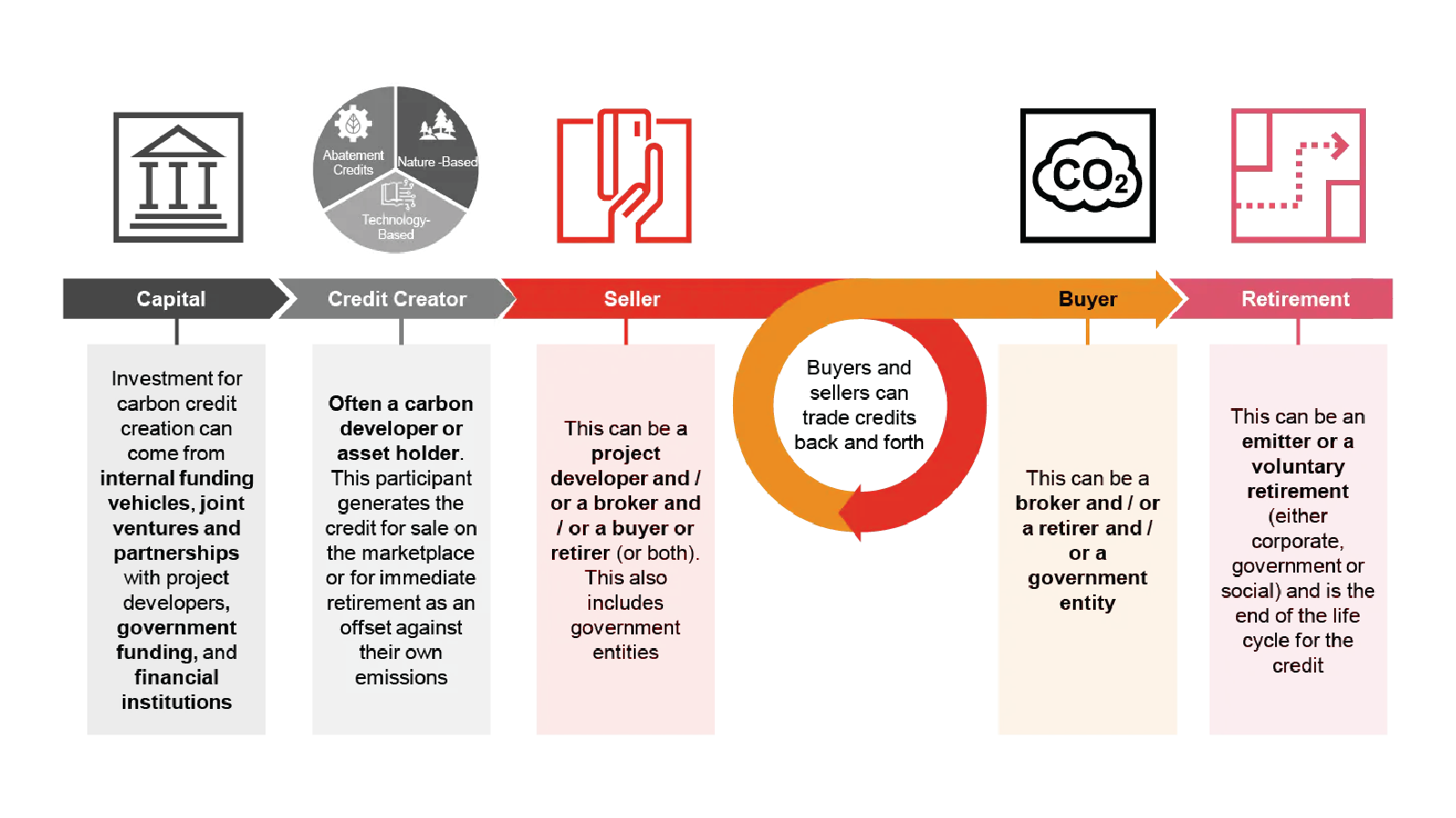

At the simplest level, there are five stages in the carbon credit lifecycle and participants in the market can decide to play just one or multiple roles within that lifecycle. The ‘fair value’ that an individual participant determines for carbon can vary depending on which stage in the lifecycle they are assessing the credit.

3. Value carbon credits correctly

Understanding the role you play in the market will help you answer questions such as, ‘What is the “fair value” for a carbon credit?’ Accurately valuing carbon credits is a pivotal endeavour in today’s sustainable landscape. It demands a nuanced understanding of the interplay between environmental impact and economic factors. Accurate valuation ensures that the true worth of carbon mitigation efforts is recognised, promoting informed decision-making.

4. Navigate supply and demand issues

Like most marketplaces, the price of carbon will settle at the marginal cost of the supply of credits. However, in carbon markets, the supply and demand equations are not evenly balanced. Demand comes from the need to abate or reduce emissions. The supply side comprises an assortment of carbon credits of varying perceived quality (and therefore value), especially when international markets are included. Understanding and managing these dynamics is crucial since this interplay has a direct impact on price.

5. Define 'success'

What might successful outcomes of a carbon strategy look like? We can think of this at several levels:

At a societal level, this may mean a more rapid path towards a sustainable solution to climate change;

At an economic level, this may mean a reduction in total emissions alongside economic growth, the correct valuation of carbon or support for sustainable capital redeployment;

At a company level, this may mean more confidence in their ability to deliver on strategic choices, the actual costs of addressing emissions, the potential revenues generated by addressing emissions and the decision-making about capital expenditure and expected return.

The solutions to decarbonisation are far from simple. They require collaboration and the ability to work in ways that are very unfamiliar to most businesses. However, if you are exposed to emissions regulations or have made public commitments to reduce your emissions, you will likely need to enter the carbon market, if you haven’t already done so.

As with any investment, a level of rigour needs to be applied to ensure you get the best value out of your purchase. Ultimately, the road to decarbonisation is within reach and opportunities exist to participate in and benefit from global carbon markets now.

Contact us