"Economic activity level has cooled off and outlook for 2024 remains positive"

Published in Discover & Invest - December 2023

Anthony Leung Shing

Country Senior Partner

PwC Mauritius

The world continued to experience major disruptions and the global recovery has been slow, with divergent growth prospects across the world. Tighter monetary policy to bring down inflation has cooled off economic activity. Advanced economies are slowing down at a faster pace than emerging economies while global inflation is on a declining trend as we near the end of 2023.

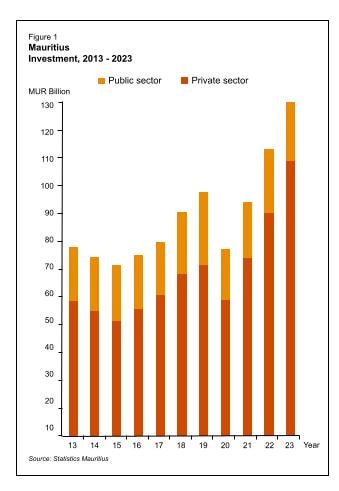

Despite the Mauritius economy losing some steam, the level of economic activity on the island remains buoyant and the country’s GDP is expected to grow at 6.8% in 2023. In its latest release in October 2023, the IMF uplifted the growth forecast for Mauritius and this indicates a more optimistic outlook. Investment projects are on the rise, with private sector investment expected to reach Rs109bn in 2023 (20% increase on 2022) and public sector investment at Rs33bn (47% increase on 2022). The share of private sector investments

remains dominant, with further developments in smart cities, real estate and land parcelling schemes as well as the renovation of hotels while public sector investments are being funnelled towards projects such as the extension of Metro-Express, the construction of social housing units, and the expansion of road network (Figure 1). For the first time in over 5 years, the investment rate will move above the 20% threshold and closer to the 25% needed to help drive growth to meet the country’s aspiration to become a high income nation.

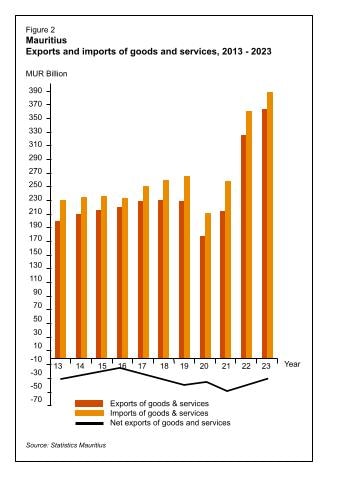

Growth in manufacturing activities is decelerating to 3.3% in 2023 compared to 9.1% in 2022, mainly driven by contraction in the textile sector. After an unexpected resurgence in 2022, revenue from the textile sector fell by 15% for the period to September 2023 compared to prior year due to many global brands holding back on new orders following stockpiling in 2022. Our main export markets in Europe and South Africa are being impacted by global instability and loss of purchasing power arising from inflationary pressures and high interest costs. For the US market, the anticipated expiry of The African Growth and Opportunity Act in 2025 is also causing some uncertainties although the expectation is that it would be extended. The total exports of goods and services for 2023 is expected to be up by 5.5% compared to 2022. Consumption is stable despite inflationary pressures and represents a major component of GDP. The Government continues to support household spending following the 2023-24 budgetary measures, in particular, the overhaul of the personal income tax regime and the implementation of various social and income support schemes. The total imports of goods and services will grow by 2.1% in 2023. Overall, the net effect of exports and imports will result in a trade deficit in goods of Rs25bn (Figure 2).

Tourism is a major boom for the country. After reaching just under 1 million tourists in 2022, the number of arrivals is estimated at 1.3 million for 2023, reaching more or less its pre-COVID level. With a depreciated Rupee and high occupancy rates, the hospitality sector is experiencing record earnings. European tourists remain the main market with a share of over 60%, followed by Africa 23% and Asia 10%. Whilst the sector is at an all-time high, it is highly vulnerable to any downturn in Europe and the pre-COVID market diversification strategy has had limited impact. Further, labour market constraints continue to undermine the sector’s ability to support growth and maintain service excellence. Many operators are having recourse to foreign labour (which remains low at 4%, expressed as a percentage of the total workforce) and, with unemployment at an all-time low, the Government should continue to promote easier access to foreign labour.

Despite the tourism outlook remaining positive, weaker international demand for Mauritius’ exports will hamper headline growth next year. High inflation is likely to persist in 2024 and will continue to slow consumption growth. However, public spending in terms of welfare support, subsidies, etc is likely to ramp up with general elections due to be held in 2024 and this should help to maintain consumer activity. The gross international reserves stand at Rs297m as at October 2023 and, based on the imports for 2022, this represents around 10 months of imports cover. The impact of country’s trade deficit will result in increasing demand for foreign currency, while slowdown in the exports of goods will reduce the inflow of foreign currency. The combined effect will put pressure on the exchange rate to depreciate in the short term.

The business environment has improved significantly and there has been real boost in financial performance

A recent Business Pulse Survey 2023 reveals that the current level of business confidence in the country is good and local companies have been resilient to external shocks. The business environment has improved significantly and there has been real boost in financial performance. Most companies are not only back to normal operations, but their activities are also exceeding pre-COVID levels. This renewed investor confidence will provide further impetus to economic growth in 2024, with increased capital spending and new projects being implemented. The pressure on foreign currencies, higher debt service costs and lack of local labour force remain the main challenges in 2024.

The Government’s objective to achieve a more sustainable Mauritius remains a key feature of the country’s ambition, with the renewable energy mix target being set at 60% by 2030. With the current level of renewable energy production being at 20%, there is significant investments and progress to be made. Notwithstanding its commitment to sustainability, the country is still heavily reliant on fossil fuels (impacting on the balance of payment in terms of imports) and the legal framework could be simplified to speeding up the renewable energy uptake. More broadly, as a small island state, Mauritius is vulnerable to rising sea levels and the effects of global warming on climate change is having a devastating impact on our environment and beaches. The Government has allocated significant funds to climate change and, as at 1 July 2023, a balance of Rs1.7bn remained in the National Environment and Climate Change Fund and this will be spent, over the coming year, on beach rehabilitation, drainage system and embellishment programmes. However, what the country needs, is a more holistic and cohesive sustainable development strategy to integrate the different sectors of the economy in terms of tourism, manufacturing and financial services.

As we turn into 2024 and, looking into the future, growth remains key in order to fulfil the country’s ambition. In recent years, Mauritius has signed a number of trade agreements: the Comprehensive Economic Cooperation and Partnership Agreement (India), the Free Trade Agreement (China), and the African Continental Free Trade Area Agreement. All these agreements came now into effect in 2022 and it is time for the country to realise its potential as a regional trading hub, linking Asia to Africa. As a small island state, integration is an important catalyst to gain access to new markets, reduce trade barriers and increase country participation in regional and global trade. Mauritius’ trade flow with African countries is insignificant (except for South Africa and Madagascar) and Africa can be a large market for export of business services, which account for a third of total imports of trade in services on the continent. Further, leveraging on the various trade agreements, Mauritius can now promote greater cross border investments in Africa. For example, an Indian manufacturer can move some of their manufacturing processes to Mauritius to produce for the African market and the same can also applies to the services sector. Mauritius offers a broader regional dimension, which could be of interest to Indian or Chinese businesses wishing to tap in the African market.

Mauritius will do well in 2023, with a vibrant domestic economy on the back of a dynamic tourism sector, and the outlook for 2024 remains positive. However, we cannot expect much to happen in a year of elections.

Contact us