Public Finance

Successfully resetting the course of the economy, more than just the deployment of financial resources, will require thoughtful decision making underpinned by a real desire for long-term sustainability.

2019/2020 - Explaining the gap 2020/21 Budget Deficit Public Debt Macroeconomic indicators Debt-to-GDPOverview

Economic Growth

Inducing economic growth through increased spending by government on capital projects (+26%)

Public Debt

Computed under the old definition (pre-The Covid Act), the Debt-to-GDP ratio has breached the 80% mark

Government Spending

Expenditure primarily geared towards large scale multi-period infrastructure projects and non-productive assets

Sustainability

Food security, renewable energy, environmental preservation, technological innovation remain laudable initiatives that require a serious commitment at execution... and the time is now

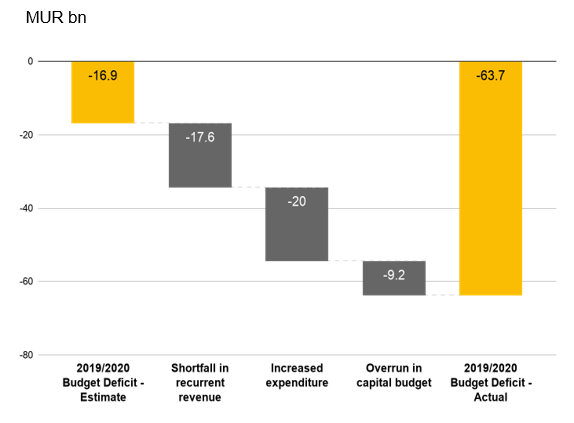

2019/2020 - Explaining the gap

Estimated at Rs16.9bn, the 2019/2020 budget deficit reached Rs63.7bn, representing 13.6% of GDP compared to a forecast of 3.2%.

Reduced tax collection and increased social aid in the wake of the national lockdown largely explain the observed increase in budget deficit.

2020/21 Budget Deficit

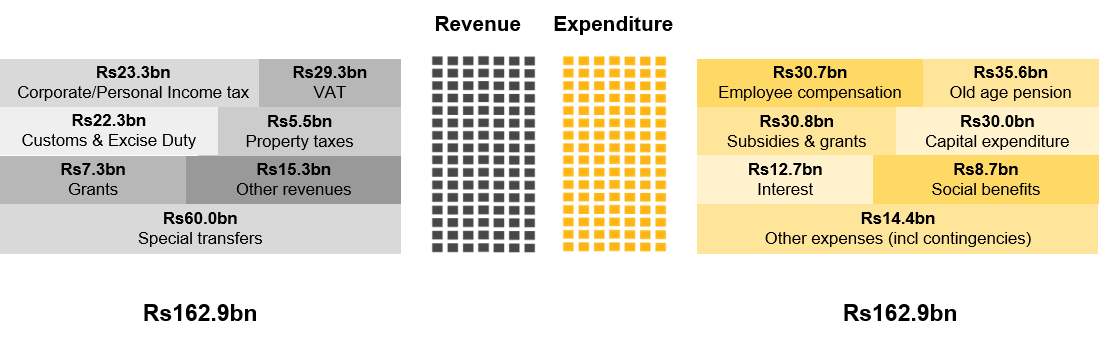

As the Government looks to restore economic growth in the aftermath of the pandemic, it has revised its planned expenditure up by 13.6% to Rs162.9bn. This is expected to be funded by revenues of similar magnitude, thus resulting in a deemed balanced budget for 2020/21.

It is worth noting that is included in the revenue estimate some Rs60.0bn of special transfers of which Rs33.0bn is being earmarked as recurrent revenue and the balance as capital revenue.

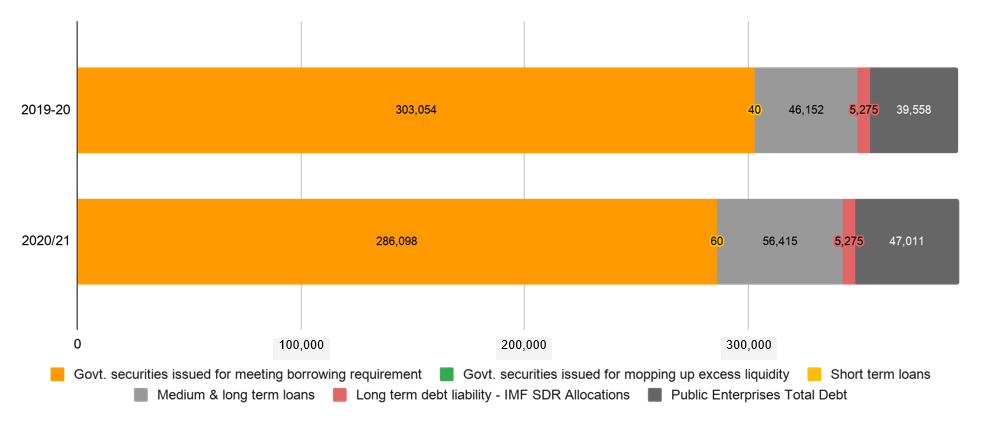

Public Debt

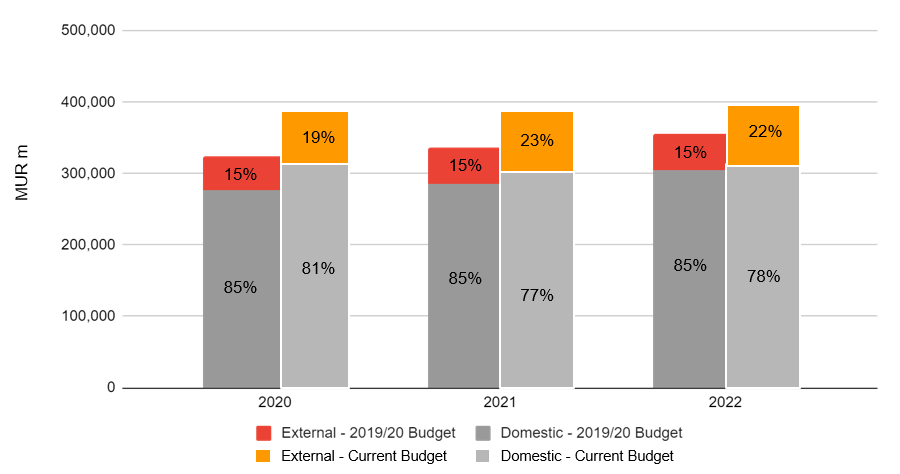

Following the amendment to the Public Debt Management (PDM) Act 2008 with the enactment of The Covid-19 (Miscellaneous Provisions) Act in May 2020, public debt is now reported net of cash and cash equivalents and equity held by public institutions.

A comparison of public debt estimates over the period 2020-2022 on a gross basis (i.e pre amendment) between last year’s budget and the current budget shows public debt levels are expected to increase. Interestingly, the proportion of domestic debt to foreign debt is expected to average 79% down from 85%.

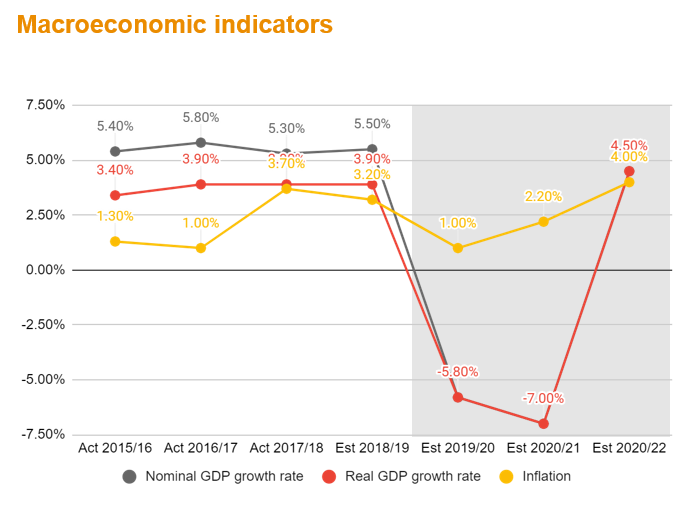

Macroeconomic indicators

It comes as little surprise that the primary macroeconomic indicators have all been negatively impacted and estimates for the next two years look bleak.

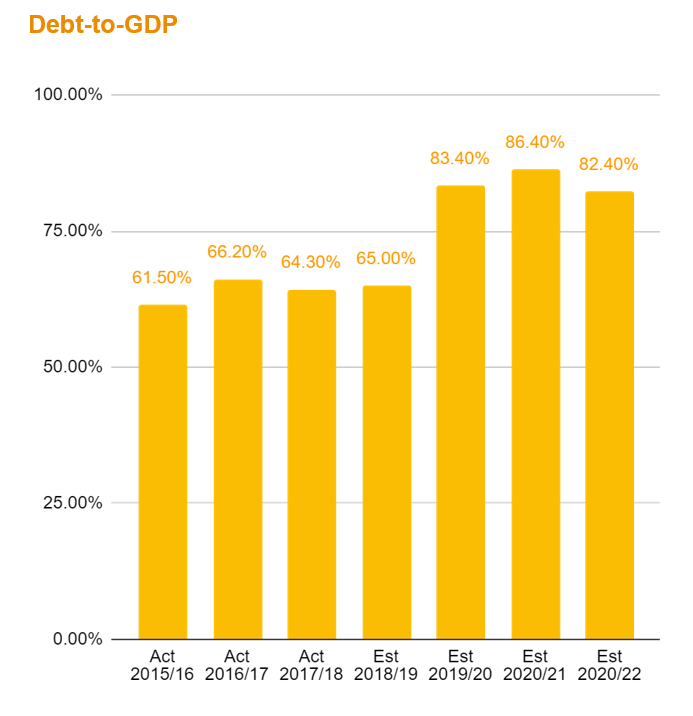

Debt-to-GDP

The previous statutory ceiling for public debt of 65% of GDP was repealed following the introduction of The Covid-19 Act in May 2020.

Computed under the old definition, the Debt-to-GDP ratio for 2019/20 reached 83.40% compared to a forecast of 61.6%.

Subscribe to receive our #Budget20 Brief

Subscribe to receive our Budget 2020 Brief with our overall opinion on the measures, a tax perspective, and reviews of the top sectors in Mauritius.

Subscribe hereContact us

Anthony Leung Shing, ACA, CTA

EMA Deputy Regional Senior Partner, Country Senior Partner, PwC Mauritius

Tel: +230 404 5071