Taxation

Corporate Tax

- Reduced Rate on Export

- Tax Holiday

- Solar & Renewable Energy

- Corporate Social Responsibility

- Global Business

- Research and Development

- Double Tax Deduction

- Unrelieved Tax Losses

Reduced Rate on Export

- Profits of domestic enterprises from exports of goods will be taxed at a rate of 3% for financial year 2017-2018

- Tax credit granted on investment in new plant and machinery will be prorated

Tax Holiday

8 year income tax holiday for:

- companies incorporated after 8 June 2017 engaged in the manufacturing of pharmaceutical products, medical services and high tech products

- companies engaged in the exploitation and use of Deep Ocean Water for providing air conditioning installations, facilities and services

- new companies involved in innovation-driven activities on income from Intellectual Property Assets

Solar & Renewable Energy

- Tax deduction from taxable income by businesses for investment in solar photovoltaic system

- Tax exemption for interest income on debentures issued to finance MRA approved renewable energy projects (‘’Green Bonds’’)

Corporate Social Responsibility

- Companies to continue remit 50% of their CSR contributions to the MRA instead of 75% as announced last year

Global Business

- GBC1 will be required to fulfil at least two (currently one) of the six FSC criteria to demonstrate substance

Research and Development

Companies investing or spending on innovation, improvement or development of a process, product or service eligible to:

- accelerated capital allowances of 50% in respect of capital expenditure on R&D

- double deduction for 5 years (up to income year 2021-2022) on qualifying R&D expenditure directly related to the entity’s trade and incurred in Mauritius

Qualifying expenditure includes:

- staff costs

- consumable items

- computer software directly used in R&D

- subcontracted R&D

Double Tax Deduction

Double tax deduction on expenditures incurred in respect of:

- deep ocean water air conditioning bill for a period of 5 years

- the acquisition and setting up of water desalination plant

Unrelieved Tax Losses

Manufacturing companies will be allowed to carry forward accumulated tax losses on change of more than 50% shareholdings provided that the change is deemed to be in the public interest and the conditions to safeguards employment are met

Personal Tax

- Relief for Medical Insurance Premiums

- Exempt Income

- Household Workers

- Basic Pension

- Solar Energy Investment Allowance

- Mauritius Diaspora Scheme

- Negative Income Tax

- Solidarity Levy

Relief for Medical Insurance Premiums

Maximum allowable deduction raised

Exempt Income

Exemptions from Income Tax

- Financial Government assistance to disabled persons under National Pensions Act

- Interest income on debentures issued to finance MRA approved renewable energy projects (“Green Bonds”)

Household Workers

- Tax deduction of wages paid to household employees up to a limit of Rs30,000

Basic Pension

- Beneficiaries of industrial injury and survivor’s pension will obtain Basic Pension

Solar Energy Investment Allowance

- Allowance applicable only to solar photovoltaic system

Mauritius Diaspora Scheme

- 10 year tax holiday applies only to income from the registered employment, business, trade, profession or investment

Negative Income Tax

- Financial support granted to Mauritians in full time employment earning Rs9,900 or less monthly

- Monthly income includes overtime, leave pay, basic retirement pension and other allowances and excludes travelling and end-of-year bonus

First payment to be made by MRA by 30 August 2018 in respect of period January to June 2018

Conditions:

- Person is in continuous employment for 6 months

- Employer and employee are compliant with NPF and NSF

- Total taxable income of a couple including dividend and interest income does not exceed Rs30,000 monthly

Solidarity Levy

- Solidarity levy of 5% applicable on resident individual having chargeable income plus dividends (excluding interest income) in excess of Rs3.5m.

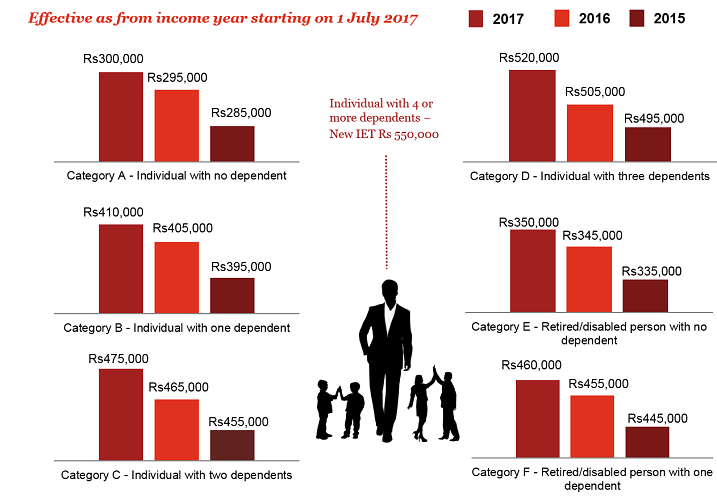

Income Exemption Threshold

Value Added Tax

- Exempt Goods or Services

- Zero-rated Supplies

- Deferred Duty and Tax Scheme

- VAT Refund Scheme

Exempt Goods or Services

- Construction of a building by a third party purposely and exclusively for lease to a provider of tertiary education with claw back provisions if the building is put to another use

- Construction of private hospital, nursing home or residential care home by charitable institution with claw back provisions if the building is put to another use

- Sanitary pad and tampon

- Sterile water used for pre-operative, per-operative or post operative cleaning of wound

- First Rs3,000 of the value of an imported article by post and courier services

Zero-rated Supplies

- Security patrolling and monitoring systems that are integral part of an overall burglar system

- Fitness fees payable for examination of vehicles (extended to 30 June 2018)

Deferred Duty and Tax Scheme

- Duty free purchase of articles from downtown duty-free shops by Mauritians travelling overseas

VAT Refund Scheme

- Replacement of old lorries for carrying cane harvest

- Specified equipment used by

Tea Cultivator

- Hand-held plucking shear

- Hand-held pruning machine

- Motorised tea harvester

Planter

- Sharlon shade, green house and shade green

- Fertigation pump

- Irrigation equipment

- Hydroponic filter

- Water tank

Pig breeder

- Farrowing/gestation/nursery crate

- Heat lamp/hot blast

- Incubator

- Pig feeder/drinker

- Cooling fan

Other breeder

- Feed grinder

- Ventilation fan

- Chicken crate

- Cages and coops

- Water tank

Other Taxes

- Property Taxes

- Customs and Excise Duties

Property Taxes

Exemption from:

- Registration Duty and Land Transfer Tax on transfer of immovable property to be used for qualifying Hi-Tech manufacturing activities

- Registration Duty on leases or subleases of agricultural land not exceeding 10 hectares held by small planters

- Registration Duty on leases or subleases of immovable property for operating a health institution, with retrospective effect as from December 2016

- Tax on Transfer of Leasehold Rights in State Land on resale of an immovable property under the Invest Hotel Scheme

- Registration Duty for a first time buyer of an ex-CHA residence or of a residence originally acquired from the NHDC

- Registration Duty on the registration of a secured housing loan of up to Rs2m extended to a loan agreement drawn up by a notary

- Registration Duty and other transfer taxes on transfer of assets by a company under special administration to repay policy holders or depositors

- Land Conversion Tax extended to golf courses of 9 holes

Remission or Refund of Registration Duty, Land Transfer Tax and Tax on Transfer of Leasehold Rights in State Land in the following 3 specific cases where:

- there is no effective change in ownership of an asset;

- an application for an existing exemption is made within one year of registration of deed; and

- several documents are required to be registered in order to complete a transaction or in relation to the same subject leading to multiplicity of taxation

Customs and Excise Duties

Exemption from Customs Duty on:

- Importation of all animal feed except poultry feed and pet feed

- Specified wood or plastic equipment used by job contractors

- Knocked–Down (Ready-to-assemble) furniture imported in the context of a Smart City project conditional on 20% local value addition

- First Rs3,000 of the value of an imported article by post and courier services

- Purchase of a 15-seater motor vehicle by Trade Union Confederations

- Sterile water used for pre-operative, per-operative or postoperative cleaning of wound

Exemption from Excise Duty on:

- Purchase of a single/double space cabin vehicle extended to small tea grower

- Excise Regulations amended to change definition of a “classic or vintage” motor car from “a motor car registered before 1st January 1970” to “a motor car aged at least 40 years”

- Increase in the rates of excise duty on beer and alcoholic products by 5%

- Increase in the rates of excise duty on tobacco products by 10%

Tax Administration

- Personal Taxation

- Corporate Tax

- Value Added Tax

- Customs Duty

Personal Taxation

Statement of Assets and Liabilities by High Net Worth Individuals

- Mauritian tax resident citizens are required to file statement of assets and liabilities. Non-citizen tax residents are not required to submit the statement

- Disclosure of assets of spouse and dependent children of the taxpayer in the statement

- Assets below Rs200,000 are excluded from the disclosure requirements

Definition of residence with respect to Individuals

- Reduction in the criterion to determine an individual’s tax residence for income years ending 30 June 2016 and 2017 from 270 days to 225 days

Purchase of immovable property, motor vehicle or pleasure craft

- No compulsory filing of income tax return for person acquiring high value immovable property, a motor vehicle or pleasure craft

Contributions to superannuation fund

- Introduction of anti-avoidance provision to disallow contributions to superannuation funds providing unreasonable benefits to selected employees

Withholding tax on pension and other emoluments

- Persons liable to income tax and deriving pension may opt to receive pension or “other emoluments” net of PAYE of 15%

Employees to provide National Identity Card Number

- Employees to provide their national identity card number or non-citizen’s identification number to employer instead of Tax Account Number

Corporate Tax

- Mandatory electronic filing and online payment of income tax and PAYE for all companies

- Companies will have to submit to MRA a list of individuals who have been paid dividends exceeding Rs100,000 in a year

- Sociétés or successions with annual turnover below Rs6 million will not be required to operate TDS

- MRA will be empowered to request Annual Statement of Financial Transactions from banks, insurance companies and non-bank deposit institutions for transactions exceeding Rs500,000 or if total deposit exceeds Rs4m in a year

- MRA can refuse to give ruling under the Income Tax Act, the Value Added Tax Act and Customs Act for issues relating to a matter under objection or appeal

- Re-introduction of Tax Arrears Payment Scheme (“TAPS”) for another final year to expedite collection of long outstanding arrears of tax. Applicable to assessments raised or tax returns submitted before 1 July 2015

- Waiver of up to 100% of interests and penalties under TAPS if taxpayer agrees to settle debt by 31 March 2018 and settle debt in full by 31 May 2018

- Re-introduction of Expeditious Dispute Resolution of Tax Scheme (EDRTS) for another year for disputes below Rs10m for taxpayers failing to lodge an objection due to payment of 30% or 10% of the amount assessed

- Alternative Tax Dispute Resolution Panel allowed to review assessments raised by the MRA under the Gambling Regulatory Authority Act, assessments for PAYE and TDS, and the decisions taken by the MRA for amounts exceeding Rs10m

- Written representations relating to income tax, VAT and gambling taxes accompanied by written statement of case and a witness Statement will be allowed instead of hearing at ARC

- Cases to be heard within 2 months from date of representation and decisions to be given within 4 weeks of hearing

- Objection will be considered valid if a person who has appealed to ARC subsequently decides to pay the objection fee prior to the case being called Proforma

- TDS of 15% to be withheld in lieu of PAYE if director fees are paid to the employer of a director rather than to the director

- A company awarding contracts for construction works will be required to operate TDS irrespective of its turnover

Companies under special administration

- No surcharge will be payable in respect of contributions due to the NSF, NPF and training levy

- Corporate taxes, PAYE and VAT due will be waived if deemed to be in public interest

Value Added Tax

- Wholesalers of alcoholic drinks should register for VAT

- Option to lodge an electronic objection for VAT assessments

- Maximum penalty for failure to submit tax return and pay tax increased to Rs100,000

- Bad debt adjustment to be made in tax return for the taxable period during which it is actually written off

- MRA can raise assessments without authorisation of Independent Tax Panel increased to 4 years

- Introduction of penalty provisions to cater for failure to use, or for tampering with an Electronic Fiscal Device which records and transmits electronically fiscal data to the MRA

Customs Duty

- Automatic cancellation of bill in case of failure to pay required duties and taxes within 14 days from date of validation of the bill

- MRA Customs will be empowered to detain currency for passengers having in possession undeclared amount exceeding Rs500,000. Penalty for non declaration will be substantially increased

- MRA Customs will be empowered to detain imports suspected to be counterfeit or of misleading geographical origin

- MRA will be empowered to recoup disposal and damage costs from importers who abandon goods at Customs

- Limit of 5 working days for MRA to issue tax claim after decision of ARC on a tax liability dispute. The taxpayer will have to settle amount within 28 days of the notice

- Administrative penalty will be introduced for offences relating to import of specified prohibited goods (other than illicit drugs and counterfeit goods)

Contact us

Anthony Leung Shing, ACA, CTA

EMA Deputy Regional Senior Partner, Country Senior Partner, PwC Mauritius

Tel: +230 404 5071