The Finance (Miscellaneous Provisions) Act 2022

Summary of Tax and Regulatory measures, prepared in collaboration with PwC Legal (Mauritius).

Following the National Budget 2022 - 2023 in June 2022, the much awaited Finance Act 2022 is finally out. We are pleased to share a Summary of Tax & Regulatory Measures which has been jointly prepared by PwC Mauritius and PwC Legal (Mauritius).

Subscribe and download the full PDF for our opinion, the key measures and an infographic depicting the impact of the newly introduced 12.5% tax rate.

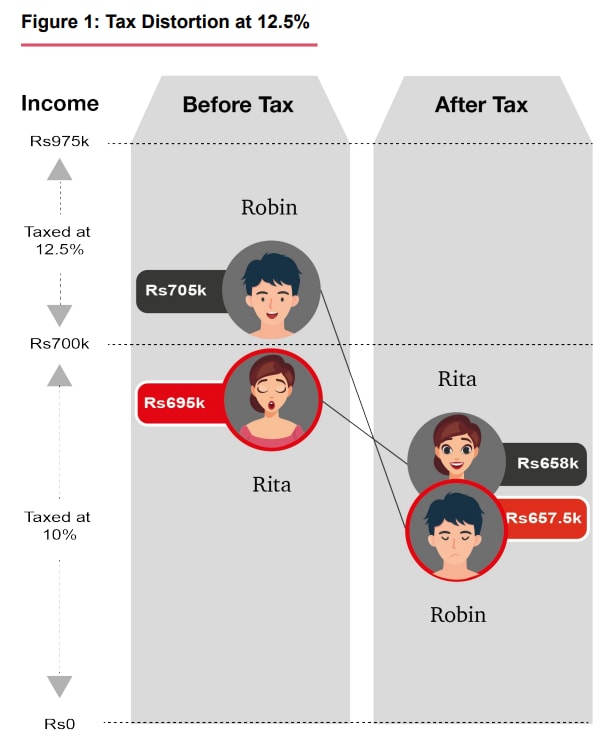

In the PDF, you'll discover the calculations of how Robin earns more than Rita but is worse off after paying 12.5% tax.

Some of the key measures in The Finance (Miscellaneous Provisions) Act 2022 are as follows:

Personal tax - A new tax rate of 12.5% has been introduced

.png)

Global Business sector - Introduction of a qualified

domestic minimum top-up tax

SMEs - Turnover threshold increased to Rs100m (previously Rs50m);

Refund of salary compensation of Rs375

Tourism - Refund of salary compensation of Rs260 - Rs500

Support scheme - Prime a l’Emploi for the first 10,000 eligible employees; Monthly income allowance of Rs1,000 for all those earning less that Rs50,000

We invite you to register and download our summary of Tax and Regulatory measures.

The introduction of a new tax band and tax rate of 12.5%, although providing relief to some taxpayers, creates a distortion for those earning slightly above Rs700,000.

Dheerend Puholoo

PwC | Tax Leader

d.puholoo@pwc.com

+230 404 5079

Amendments are being proposed to the tax dispute resolution process seeking to resolve tax disputes expeditiously, but at what cost?

Late Mr Razi Daureawo

Head of PwC Legal (Mauritius) Ltd

PwC Legal (Mauritius) Ltd is an independent law firm registered in Mauritius under the Law Practitioners Act and forms part of the PwC network of firms.

Contact us

Anthony Leung Shing, ACA, CTA

EMA Deputy Regional Senior Partner, Country Senior Partner, PwC Mauritius

Tel: +230 404 5071

.jpg.pwcimage.370.208.jpg)