{{item.title}}

{{item.text}}

{{item.text}}

Introduction of a 15% domestic minimum top-up tax applicable to companies resident in Mauritius forming part of a multinational enterprise group having a global annual revenue of more than EUR750m.

Foreign employers of Premium Visa holders will not, in respect of that employee, be subject to corporate tax and social security contributions.

Annual turnover threshold to qualify as SME amended as follows:

Additional tax deduction available to large manufacturers on purchases of locally manufactured products from small enterprises will be increased from 10% to 25%.

Penalties imposed on SMEs with regards to the late submission of income tax returns and late payment of income tax for the years 2020 and 2021 and which remain outstanding as at 25 March 2022 will be waived.

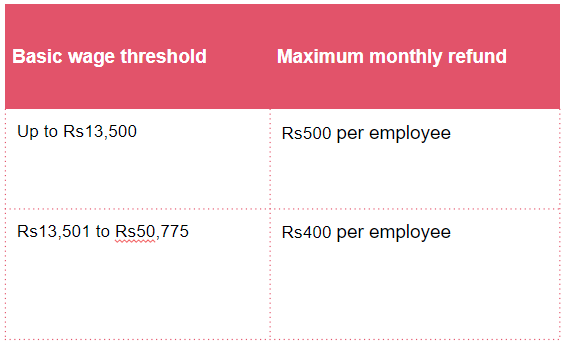

Effective as from 01 January 2022, salary compensation paid by a non-export oriented SME to its employees, for the period up to 30 June 2022, will be refunded as follows:

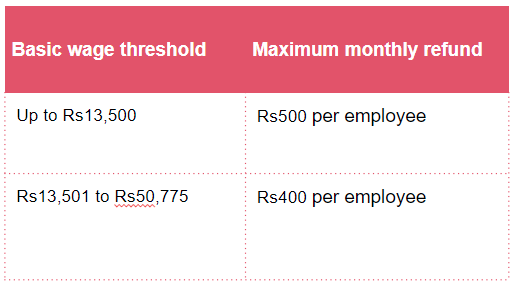

Effective as from 01 January 2022, salary compensation paid by an enterprise in the tourism sector to its employees for the period January 2022 to June 2022, will be refunded as follows:

Transfer of assets to related companies at net tax value extended to include all assets subject to depreciation and not limited to plant, machinery or industrial premises.

As from income year 2022-2023, new tax bands and tax rates introduced as follows:

Medical insurance premiums increased to Rs25,000 for individual and first dependent and increased to Rs20,000 for every other dependent.

Tax deduction up to Rs50,000 for contributions to personal pension scheme.

Tax deduction up to Rs50,000 for donations to approved NGOs, including religious bodies.

Tax deduction in respect of bedridden next of kin also applicable to spouses, irrespective of any financial assistance received by the bedridden spouses.

Tax exemption for petrol or travelling allowance increased to Rs20,000.

Tax allowance available on amount invested by angel investors providing seed equity financing to SMEs.

An individual deriving pension or director’s fees may request the person responsible for the payment to deduct Pay As You Earn (“PAYE”) for Solidarity Levy at the rate of 10%.

8-year tax holiday to planters engaged in sustainable agricultural practices registered with Economic Development Board (“EBD”).

Self-employed persons opting to make annual returns will not be required to submit quarterly statements.

Private household employers may make social contribution payments on a yearly or monthly basis.

VAT refund for events with a minimum of 50 participants under MICE scheme.

VAT exemption granted on cars (and spare parts) and automobilia imported for the purpose of exhibition in a motor museum.

A person contracting a secured housing loan under the home loan payment scheme to construct his residence will continue to benefit from a refund of 5% of the loan amount, up to a maximum of Rs500,000, until 30 June 2023.

With effect from 01 July 2016, the transfer of a VRS property to the heirs of a deceased beneficiary shall be free from duty and tax.

The 5% rate of tax on transfer of leasehold rights in State land for hotels built on State land will be increased to the rate of 10% as from 30 June 2023.

A share buyback i.e. acquisition by a company, holding immovable property, of its own shares, will be subject to registration duty and land transfer tax.

Exemption from payment of registration duty on a plot of land exceeding 2 arpents to encourage innovative agricultural practices under the Integrated Modern Agricultural Morcellement Scheme.

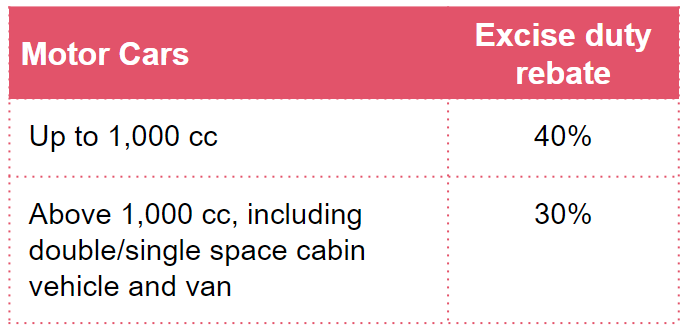

Exemption on customs and excise duty will be granted on cars (and spare parts) and automobilia imported for the purpose of exhibition in a motor museum.

All hybrid and electrical vehicles will be duty-free as from 01 July 2022.

Introduction of a negative excise duty scheme of 10% for the purchase of electric vehicles by individuals, up to a maximum of Rs200,000.

Excise tax on cans will be applicable on all beverages in cans.

Excise duty of 6 cents per gramme of sugar on locally manufactured and imported non-staple sweetened products will be effective as from 01 July 2025.

Abolition of municipal tax on the family home as from 01 July 2022.

Reintroduction of TASS providing full waiver of penalties and interests for tax arrears outstanding under the Income Tax Act, the Value Added Tax Act and the Gambling Regulatory Authority Act, provided the taxpayer registers by 31 December 2022 and pays the tax in full by 31 March 2023.

TASS also applicable to assessments pending before the Assessment Review Committee (ARC), the Supreme Court or Judicial Committee of the Privy Council.

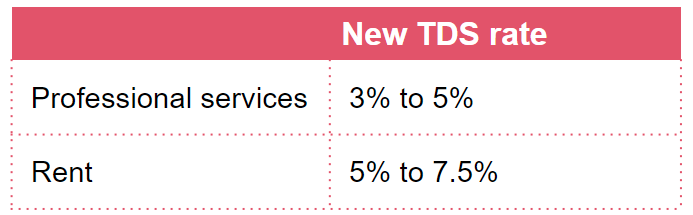

The TDS rate has increased as follows:

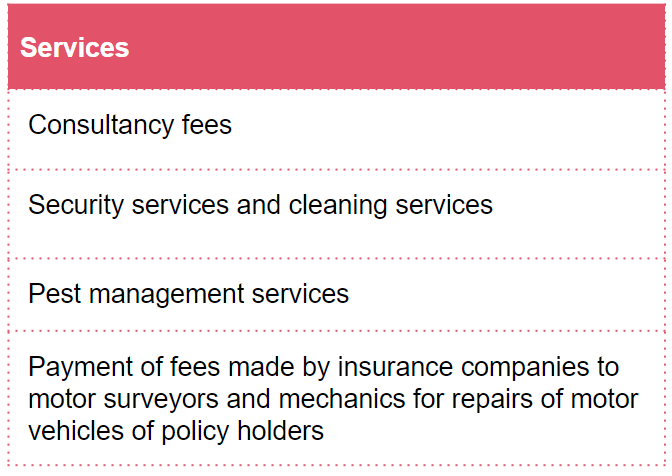

3% TDS now applicable on the following:

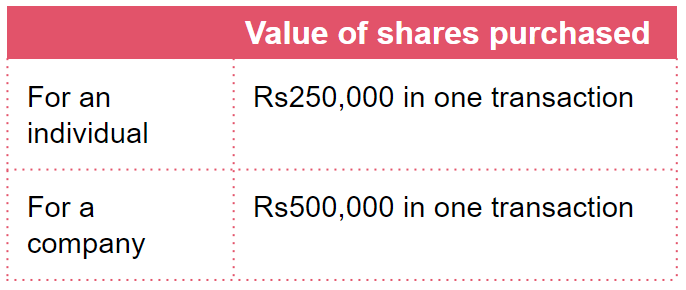

A statement of financial transaction required to be submitted to the MRA annually on individuals and companies having purchased shares in listed companies exceeding:

MRA may request information from a foundation or trust in order to make an assessment, collect tax or comply with any request for the exchange of information under a Double Taxation Avoidance Agreement.

The MRA allowed to share information on an applicant with the GRA.

Information shared would enable the GRA to determine whether applicant is a fit and proper person for the purpose of issuing a personal management licence.

The MRA allowed to publish on its website the names of non-filers.

Extension of the power of the Minister of Finance to make regulations to cover internationally agreed policies to address the tax challenges arising from the digitalisation of the economy.

A definition of audit-based control under customs laws will be introduced in line with the provisions of revised Kyoto Convention.

Where goods are purchased by a departing citizen of Mauritius free of taxes under the deferred duty and tax scheme, and the goods are imported back by him within 6 months of the date of his departure, no taxes will be payable on those goods.

Payment instructions given by an importer for taxes to be paid electronically to MRA customs will have to be credited within 3 working days.

The requirement to furnish a security by bond with adequate surety to cover the amount of taxes in case of default will be harmonised and at least one adequate surety will be required in all cases.

The penalty provision for failure to submit a bill of entry for the clearance of goods within 5 working days after the time an aircraft has landed or a vessel has been berthed will be suspended up to 30 June 2023.

The implementation of the penalty provision applicable upon failure by a master/agent to make amendments to his aircraft/vessel manifest within 5 working days after the aircraft has landed or vessel has been berthed will be deferred until 30 June 2023.

A stakeholder allowed to make an objection to a decision of MRA customs electronically for customs, Customs Tariff Act and Excise Act.

Refund of taxes by MRA customs allowed in cases where a stakeholder objects to a tax assessment and the Objection Directorate at the MRA allows the objection.

MRA customs allowed to communicate valuation information to Ministries/Departments upon request provided authorisation is obtained from the Minister of Finance.

Where an order approving a bonded warehouse is revoked, taxes on all warehouse goods will have to be paid by the proprietor/occupier within 2 months of the date of revocation.

Master/agent or representative of a vessel allowed to submit a consolidated Bill of Entry in respect of bunker fuel loaded during a month on vessels bound for the high seas.

Where a broker or Freight Forwarding Agent informs MRA customs that he has ceased or intends to cease operation, MRA customs may revoke his authorisation to act as a broker or freight forwarding agent.

Where a broker or freight forwarding agent has committed a breach entailing suspension but the breach relates to a specific function, MRA customs may allow a broker or freight forwarding agent to continue carrying out those functions where there has been no breach.

Where, for audit purposes, books and records requested from an importer, exporter, freight forwarding agent or broker are not submitted or access to computers and other electronic devices is not granted to the satisfaction of MRA customs, the latter may raise a claim for payment of taxes.

Entries for excisable goods made by a manufacturer in respect of goods deposited in an excise warehouse or removed from a factory or a consolidated bill of entry for excisable goods to be warehoused or cleared during a month will be deemed to be a self-assessment.

Where the MRA allows an objection by a stakeholder claiming refund of excise duty, the refund made shall carry interest.

With retrospective effect, a distiller-bottler of alcohol will be allowed to at his factory sell fusel oil for use as biofuel.

The MRA may carry out “controlled delivery” of excisable goods such as cigarettes and tobacco for the purpose of gathering evidence on the smuggling chain.

Extension of the opening hours on consumption of alcohol products in restaurants and pubs to 2am everyday.

Extension of the requirement to affix excise stamps to beer and wine in cans and other types of packaging.

MRA empowered to register a person who is required to be compulsorily VAT registered but fails to do so.

MRA to publish a list of all VAT registered persons on its website on a quarterly basis to avoid fraudulent practices.

Where a taxable person fails to submit a VAT return, MRA can publish its name, address, directors and taxable period for which the VAT return was not submitted 3 months after the due date. The taxable period will be notified prior to the publication.

If the MRA lapses an objection due to failure to provide information, books and records within a required time frame, the taxpayer will not be able to produce those documents at the Assessment Revenue Committee (ARC) level.

VAT refund to be effected no later than 30 days of receipt of all documents supporting an application.

To qualify for VAT refund, the covered construction area should not exceed 1,800 square feet.

VAT Refund Scheme available to small farmers with turnover less than Rs10m registered with the Small Farmers Welfare Fund.

The heir/legatee of a deceased taxable person accepting the succession or any executor/liquidator of the estate deemed to be an agent of the deceased and liable to file VAT returns and pay VAT due with respect to VAT collected by the deceased.

Succession taking over the business of a deceased taxable person required to register for VAT.

Government ministries, departments and local authorities to withhold a percentage of VAT on contracts exceeding a certain threshold. The VAT withheld can be offset against additional tax payable by the VAT registered contractors when submitting VAT returns.

The amount of tax payable under dispute in order to apply to the ATDR Panel reduced from Rs10m to Rs5m.

The Arrears Payment Scheme under the Registrar-General’s Department will be re-introduced. The Scheme will provide for full waiver of penalties and interest if a debtor of the Department settles any debt amount on or before 31 March 2023.

This scheme will apply to tax arrears due as at 31 May 2022.

No claim for additional duty or tax will be issued by the Registrar-General for an amount of less than Rs7,500 following a re-assessment of the value of an immovable property.

A non-citizen will be required to produce a certified copy of the certificate under the Non-Citizens (Property Restriction) Act on the acquisition and disposal of shares in a partnership, societe or a company.

Provision will be made in the Registration Duty Act to accept a deed for registration where a secure digital signature has been affixed in conformity with the Electronic Transactions Act.

Residence Permit holders allowed to acquire residential property of a minimum of USD350,000 outside existing schemes, subject to a 10% contribution to the Solidarity Fund.

Status of residency available to non-citizens who have acquired property under “fractional ownership” provided the investment of each non-citizen is greater than USD375,000.

A committee chaired by the Prime Minister will be set up to expedite the issuance of work permits.

Personalised services offered to ultra high net worth passengers by Airports Holdings Ltd. Services will include handling of private jets and transfers from airport to hotels by helicopter.

Entrepreneurs and students completing their studies will benefit from the premium visa.

Read more on National Budget 2022 - 2023 from a Tax Perspective.

Click here

{{item.text}}

{{item.text}}