Use of unique biological characters to recognize retail customers such as facial recognition and eye scans.

Read more

25/03/22

Rajeev Basgeet, Partner, Business Recovery Services and Forensics

Doshala Luchmunparsad | Senior Associate, Forensics

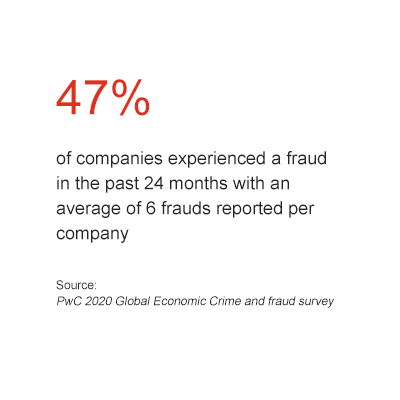

Financial crime is a global problem that costs the global economy as much as $2.1 trillion a year. Preventing and detecting financial crime has become one of the greatest challenges for financial institutions, impacting not just monetary losses, but reputation, brand, culture, relationships, and regulatory censure.

Financial Institutions are struggling with the growing cost of financial crime compliance and the increased complexity of regulatory reporting. To alleviate this pressure, they are increasingly seeking to enhance existing technology and design their “next generation” compliance architecture.

Major regulatory and risk incidents where compliance challenges significantly impact an institution’s reputation

Highly burdensome compliance processes constrain customer experience, costs and culture.

Unprecedented change and opportunity - fit for future, technology-enabled and efficient compliance functions will no longer be optional, but a requirement to remain not only competitive but operational and positioned for future success.

Business is rapidly changing, and so is the financial crime threat landscape. Preventing and detecting financial crime is quickly becoming one of the biggest challenges for financial institutions, impacting not just monetary losses, but also institutions' reputation, brand, culture and relationships.

Financial institutions are struggling with the growing cost of financial crime compliance and the increased complexity of regulatory requirements. To alleviate this pressure, financial institutions are increasingly seeking to enhance existing technology and design their “next generation” compliance architecture.

Existing financial crime technology is siloed, which makes it difficult for compliance officers to get a holistic view of financial crime risk. Future improvements will need to “connect the dots” to derive insights.

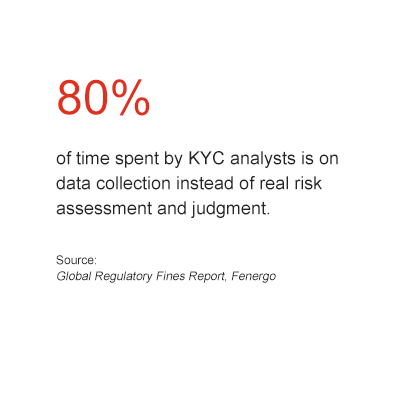

Most compliance processes and handovers still incorporate a high level of manual work for screening, alerts processing and other activities.

The rigidity of “hard-coded” or static transaction monitoring algorithms makes it difficult to adjust for policy changes or client behaviors.

Regulatory actions across financial crimes disciplines have forced financial institutions to take a conservative approach in terms of adopting new technology.

Low-quality and unstructured data resides within most Financial Institutions without being fully integrated leading to difficulties in extraction, aggregation, and sharing.

If transaction monitoring processes are performed with inexperienced employees, the amount of investigation effort will continue to increase.

Systems must attempt to scale to effectively monitor ever-increasing levels and types of financial activity.

How are you managing the cost of compliance and leveraging emerging technologies to drive efficiencies?

How are you identifying emerging risks and developing processes and analytics to manage these risks?

Are you designing your compliance technology to include data infrastructure, data mining tools and behavioral surveillance solutions?

Workflow automation maximises efficiency by allowing a smaller workforce to deliver superior compliance through a reduction of the administrative burden and keeping their focus on risk assessment.

Integrated compliance technology allows companies to realise the full potential of their internal data greatly improving their compliance management and risk assessment in a cost effective manner.

Nothing can match a machine's ability to constantly scan huge amounts of data which is getting more effective as machines learn to identify increasingly complex patterns and linkages.

Embedding the enterprise risk assessment results into the transactions monitoring identification and embedding the intelligence collected by the financial institution into scenarios optimisation and new scenarios identification process.

The right solution for each institution is dependent on several factors included but not limited to products and services offered, geographic footprint, laws and regulations, and customer demographics. This is why it is important to identify the various technologies and tools and start determining the steps required to move to more effective solutions.

Understand and define your financial crime technology strategy to ensure that systems procured not only align to your current anti-money laundering needs, but are in tandem with your overall financial crime risk management framework and roadmap.

Select a vendor appropriate to the financial institutions' bespoke requirements. We would also provide advisory and technical guidance through the contracting process and licensing agreements to ensure your business requirements are catered for.

Undertake a risk assessment to assess the adequacy of controls in place and identify the gaps and pain points that would be addressed by the new system. By doing so, institutions would align the business needs and the regulatory requirements and global leading practices, forming the blue print that would act as guide to the subsequent stages of the implementation process. This exercise typically culminates in the development of a business requirements document.

Consider the quality assurance and implementation support advisory you need, to ensure that system installation and design reflects your agreements with the vendor and meet the highest quality of standards.

Managing institutional changes that typically accompany installation of a new financial crime system including but not limited to updating/reviewing system policies, support in defining alert escalation and investigation matrices, developing a post go-live support strategy, undertaking data analytics etc.

Developing a training system strategy that will ensure all relevant teams are well equipped to interact with the system optimally, escalate issues of concern, undertake investigations and compile reports. A comprehensive training strategy will help derive maximum value from the system and ensure continued use in the long term.

Whilst we look at the future of the financial crime control landscape within the financial industry, we foresee an increasing application of advanced technologies such as Machine Learning (including Artificial Intelligence), advanced analytics and Robotic Process Automation as indispensable weapons in their battle against money laundering risks, releasing compliance teams from repetitive, time-consuming tasks to concentrate on complex decision-making assignments.

Further, advanced technologies and platforms can strengthen investigations through systematic, rapid data collection and processing from multiple sources for financial crime control processes.

Read more

Read more

Read more

Read more

Read more

{{item.text}}

{{item.text}}