Customer journey driving the future of Insurers | PwC Mauritius

By Nelly Lacaze, Manager, Advisory Consulting - PwC Mauritius

Introduction

Our new influencer, COVID-19, has been pulling strings for almost three years now, forcing individuals to rethink their priorities; and leaders to re-invent ways to play to fuel growth and returns on investment. Along the way, we have seen customers’ expectations across industries change, reinforcing the need to adopt a mobile first and experience-led approach.

In our last edition, we uncovered the four fundamentals to help insurers rethink their customer’s experience. Redesigning customer journeys, to be future fit, was one of them.

In this series, we will explore how getting moments of truth right is key for insurers to sustain.

But first, let’s decode the moments of truth

Roy H. Williams (founder of the Wizard Academy institute), once said “The first step in exceeding your customer’s expectations is to know those expectations.”

The challenge with meeting customer expectations to drive differentiated value during these times, is that, while preference for digital interaction is increasing, the specifics of how individual customers want to interact with their insurer on each transaction differ even within generational segments. Success requires you to understand specific target segments and their unique preference mix, and then build experiences and solutions that let insurance customers ‘choose their own adventure’.

Hence, when it comes to understanding your customer’s expectations, depicting their journeys is the easiest way as it helps uncover moments that matter.

Grasping these moments will help to fathom customers’ feelings and what they experience to reach your products and services: where they go, who they interact with and what information they are exposed to along the way.

Depending on the journey, there will be multiple Moments of Truths (MoTs) and critical touchpoints that vary from customer segments.

For instance, a journey can be as simple as visiting your insurer and purchasing travel insurance for vacation. Or, it can be complex, incorporating multiple interactions across physical (agents, brokers and branches) and digital channels (such as websites, mobile apps, social media and digital advertising, and so on).

Say you are buying your first car and opting for a ‘pay as you drive’ policy. You do a quick search on compare.com, and you are captivated by the package of an incumbent. You browse through its website (perchance spotting some ads for multiple policy bundles). You ask for a quotation online and depending on the premium, onboarding process and engagement with an employee, you finally decide to acquire the policy!

Now, the above journey called for different channels and multiple interactions. Still, various customers can have the exact same journey, but with divergent feedback at the end. Why is that?

Analysing moments of truths helps you get into your customers’ heads, empathise with them and identify opportunities to deliver superior service and quality, thus retaining more customers.

It’s all about experience

We are living in an era where insurance customers prefer simple, tailored and intuitive policies; an era where all is about great experience at moments of truth. While a customer journey provides a step by step guide towards a product or service, experience occurs at every step of that journey.

It’s the touchpoints (physical, digital, or a combination of the two) that should be designed to cater to the customer’s emotions and needs, all along. As an insurer, your job is to take the knowledge and insights you’ve collected from your customers’ journey and apply it to ‘wow’ them throughout the value chain. Analysing moments of truths helps you get into your customers’ heads, empathise with them and identify opportunities to deliver superior service and quality, thus retaining more customers.

Now, how does it all fit together?

Some insurers look at each customer touchpoint, from visiting the website to calling an agent, as a siloed event. But customers see those events as steps in a single journey to meet an important need, such as protecting their families or recovering from an accident.

Can you imagine losing one-fifth of your customers in a single day, for good? That’s exactly what could happen if you don’t understand and focus on moments that matter. To avoid such a flop, insurers need to harness the power of data and build insights on moments of truths.

This will improve experience across channels and boost overall customer satisfaction which can be an engine of profitable growth. That is why, we believe:

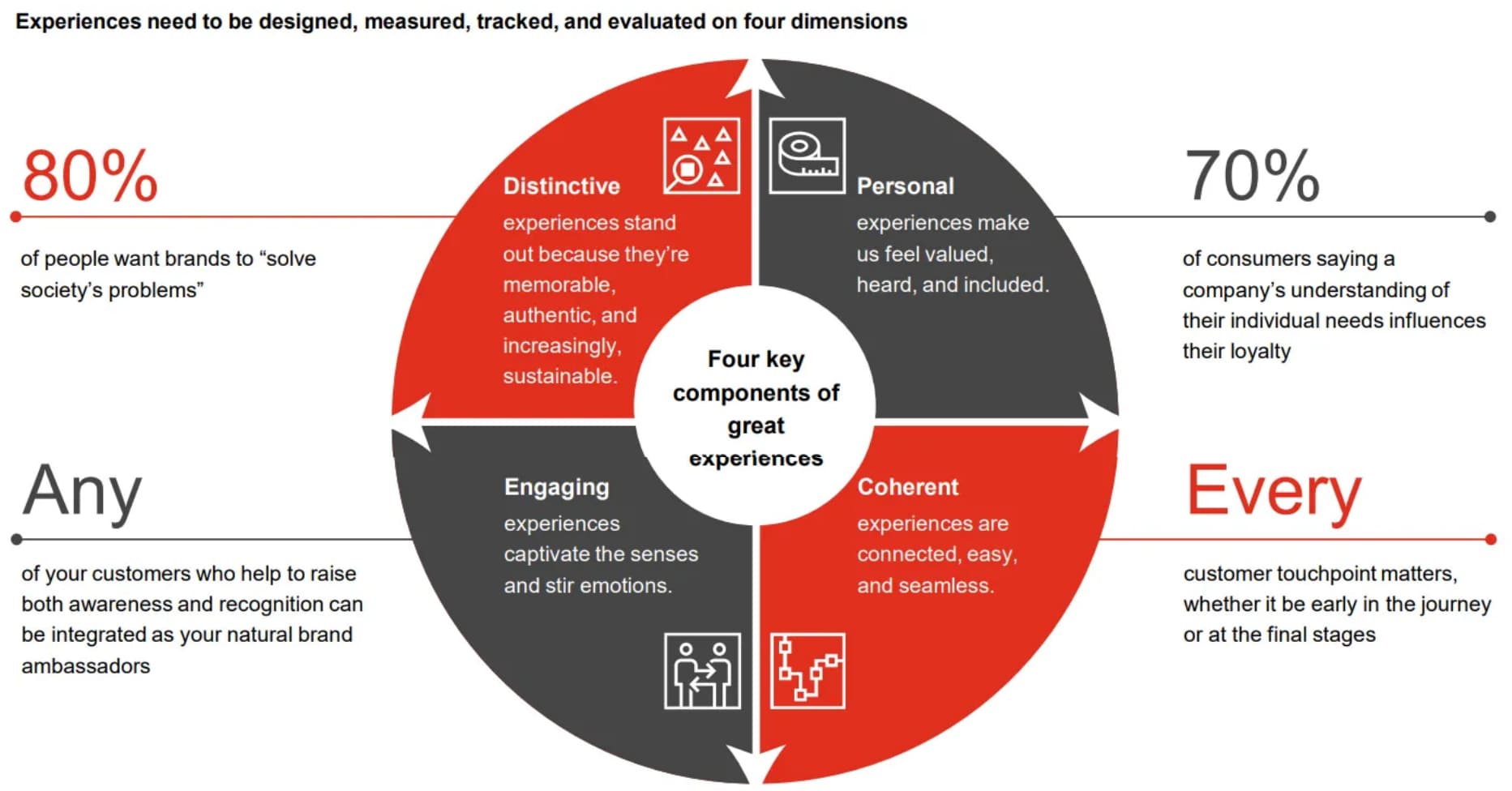

• Customer experience (CX) needs to be measured and tracked at each MoT, with the same rigor as costs and revenue.

• Insurers need to keep CX at the centre when designing their customers’ journeys. Great experiences can only be created by putting customers’ needs and innovation at the centre of the organisation.

• Growth can be sparked through experience. Through measurable customer experiences and the right insights we can create growth, and more importantly: show impact

Achieving growth through experience and the right insights is real.

We have helped clients to win this game by leveraging PwC's experience-led framework - Growth through Experience (GtE).

With GtE, our clients were able to:

• Get a clear understanding of their ambition and growth goal.

• Identify the relevant KPIs that will measure customer experiences and identify potential growth opportunity areas to achieve that goal.

• Map the customer journey by digging into the current state of their experience.

• Craft innovative solutions at the Make stage and provide ‘out of the box’ experience.

• This framework helps to understand what a great experience is, so that we can create better experiences across every step of our customer’s journey.

Bottom line:

Every customer’s experience is unique. However, the complexity inherent in today’s insurance journey creates lots of opportunities to get it wrong. This complexity increases exponentially when adding the variables of product type, interaction channel, and customer persona.

Get that right, you will be giving customers a great experience and they’ll buy more, be more loyal and share their experience with friends who will in turn buy more, be more loyal and share their experience with their friends. And repeat.

And yes, this is nothing new but it is more important today as customer expectations have been deeply affected by COVID as well as digital innovation. Customers have more options, influence and demands, so understanding the moments of truths of our customers is crucial today to sustain.

Nelly Lacaze

Experienced Manager at PwC Mauritius | Digital Transformation, Digital Strategy, Customer Experience, Change Management | T: +230 404 5214 | M +230 5476 8905 | E: nelly.lacaze@pwc.com