{{item.title}}

{{item.text}}

{{item.text}}

At PwC, we believe that sustainability and climate change should be at the heart of every business. The effects of climate change and the transition to a low carbon economy are already having a significant impact on the Financial Services sector, and it has become an imperative to assess and manage climate-related and environmental risks that may impair or strand assets.

Likewise, an increasing a number of regulators globally that have started to react to the threat that climate-related and environmental risks are posing to global financial stability.

In line with this same philosophy, the Bank of Mauritius (BoM) has published guidelines intended to assist local financial institutions in embedding sound governance and risk management frameworks for climate-related and environmental financial risks within their existing risk management frameworks.

Our 2022 CEO survey found that globally 33% of CEOs believe climate change is a threat to their organisation. For financial institutions, pressure to act is coming from different directions.

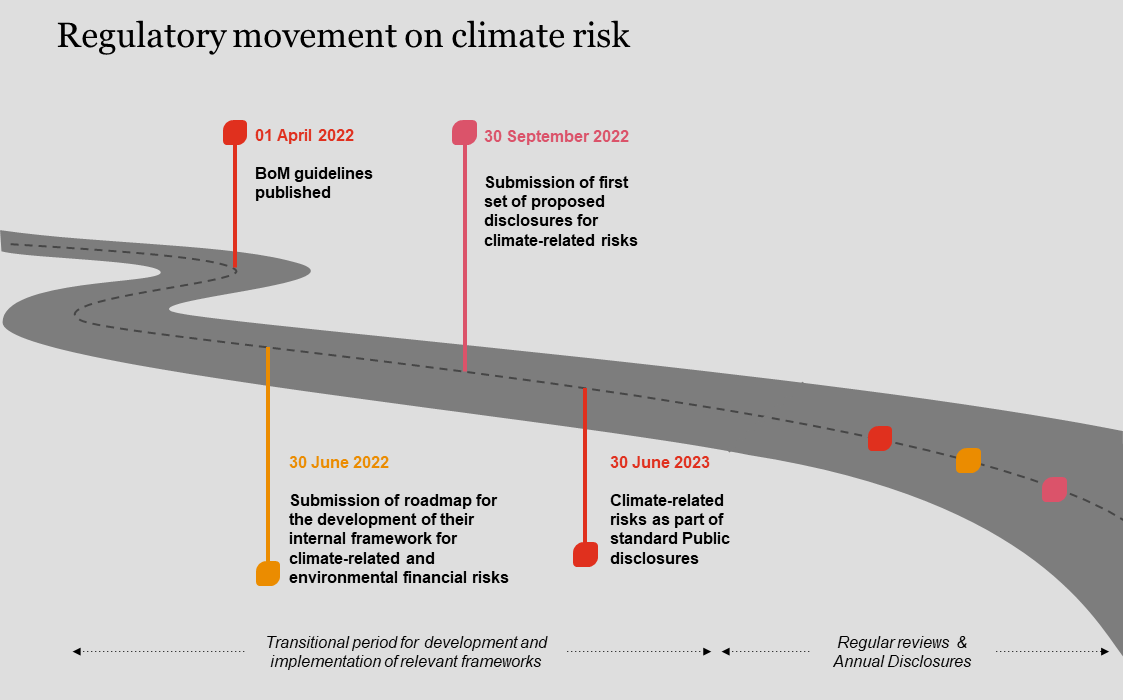

The Guideline on Climate-related and Environmental Financial Risk Management is now finalised by the Bank of Mauritius (BoM) and has been made effective as of 01 April 2022. The immediate challenge for the regulated institutions under BoM is to define a roadmap and put a policy framework in place by 30 September 2022.

See how we can help you

As per the timelines in the published guidelines, the clock has already started ticking and Financial Institutions need to start taking action.

In line with this same philosophy, the Bank of Mauritius (BoM) published guideline that is intended to assist financial institutions in embedding sound governance and risk management frameworks for climate-related and environmental financial risks within their existing risk management frameworks.

We have supported clients in several jurisdictions that have already introduced climate risk guidelines. The combination of our global network capabilities with our deep understanding of the local market makes PwC well-equipped to guide you in this journey.

Managing Disclosures is a critical element in the whole exercise and cuts across all the four pillars. PwC can assist in developing your overall disclosure strategy, while putting in place an effective monitoring and evaluation framework against the identified KPIs related to climate risk.

We can support with:

{{item.text}}

{{item.text}}

Vikas Sharma

Regional Consulting & Risk Services (C&RS) Leader, PwC Mauritius

Tel: +230 404 5015

Julien Tyack

Risk Assurance Services Partner and Sustainability Leader, PwC Mauritius

Tel: +230 404 5210