Doing deals is challenging. The large majority of deals fail to achieve their original financial or strategic objectives, with many companies being ill-prepared for the speed and intensity of the deal process.

Delivering Deal Value

We help you navigate the risks associated and still deliver value.

This challenging deal landscape makes the experience and expertise we can offer through all stages of the deal continuum all the more critical.

We help your business identify, quantify and deliver full deal value, with greater speed, insight and confidence. Our combination of unrivalled industry experience and well-honed deal expertise means that we know what to look for in the target business and how the issues can be addressed. Our approach is rooted in practical experience of what works in particular sectors.

Download our Delivering Deals Value offerings brief

Discover our Deals Services

Read about our different value added services to help you perform your deals in the most successful manner.

Integrate successfully

Making sure your acquisition delivers value

Delivering deal value continues to be challenging, even in today’s dynamic deal environment. The most experienced deal makers say they know what to do, but success remains hard to come by and despite the best of intentions, integrations too often fall short of meeting expectations.

A strategic and tailored approach to integration will ensure that your deal delivers its full potential. By setting clearly defined objectives and targets that focus explicitly on value delivery, we maximise the value of your deal while reducing the risks involved in post-close value capture activities.

- You want to create a robust revenue and cost synergy cases that capture the full deal potential;

- You want to design and implement combined operating models (including organisation structure and leadership appointments) that deliver rapid value impact, create a path for change, and foster sustainable long term deal value across people, businesses, geographies, functions and technology;

- You want to establish a robust and tested integration capability to effectively and efficiently manage integration planning and delivery;

- You want to align leadership to capture deal value; or

- You want to drive cultural changes and integrations that motivate, retain and excite employees.

- At PwC, our disciplined approach to integration helps companies achieve early wins, build momentum and instil confidence among their stakeholders.

- We take an active, hands-on approach to helping clients focus on the right things at the right times, creating early and sustainable capture of deal value.

- We deliver time-tested integration processes to support client integration teams and supplement those teams with experienced resources to fill resource and technical gaps as required.

- We customize our tools and services to complement each client’s specific needs and internal capabilities;

- Over the years, PwC has developed a winning approach to launching and managing enterprise-wide integrations, and the integration management offices that lead them.

- Our solution includes a proven integration methodology and an expansive set of processes, tools, templates, and guides to support the overall integration;

Through a centralized IMO staffed with experienced PwC integration management professionals, we are able to uniformly roll out our methodology, or adapt to yours, and facilitate the overall integration process across the combined organization; and

The PwC Delivering Deal Value team assists clients understand the main business drivers as well as the key areas of upside opportunity to deliver deal value from transactions as quickly and efficiently as possible.

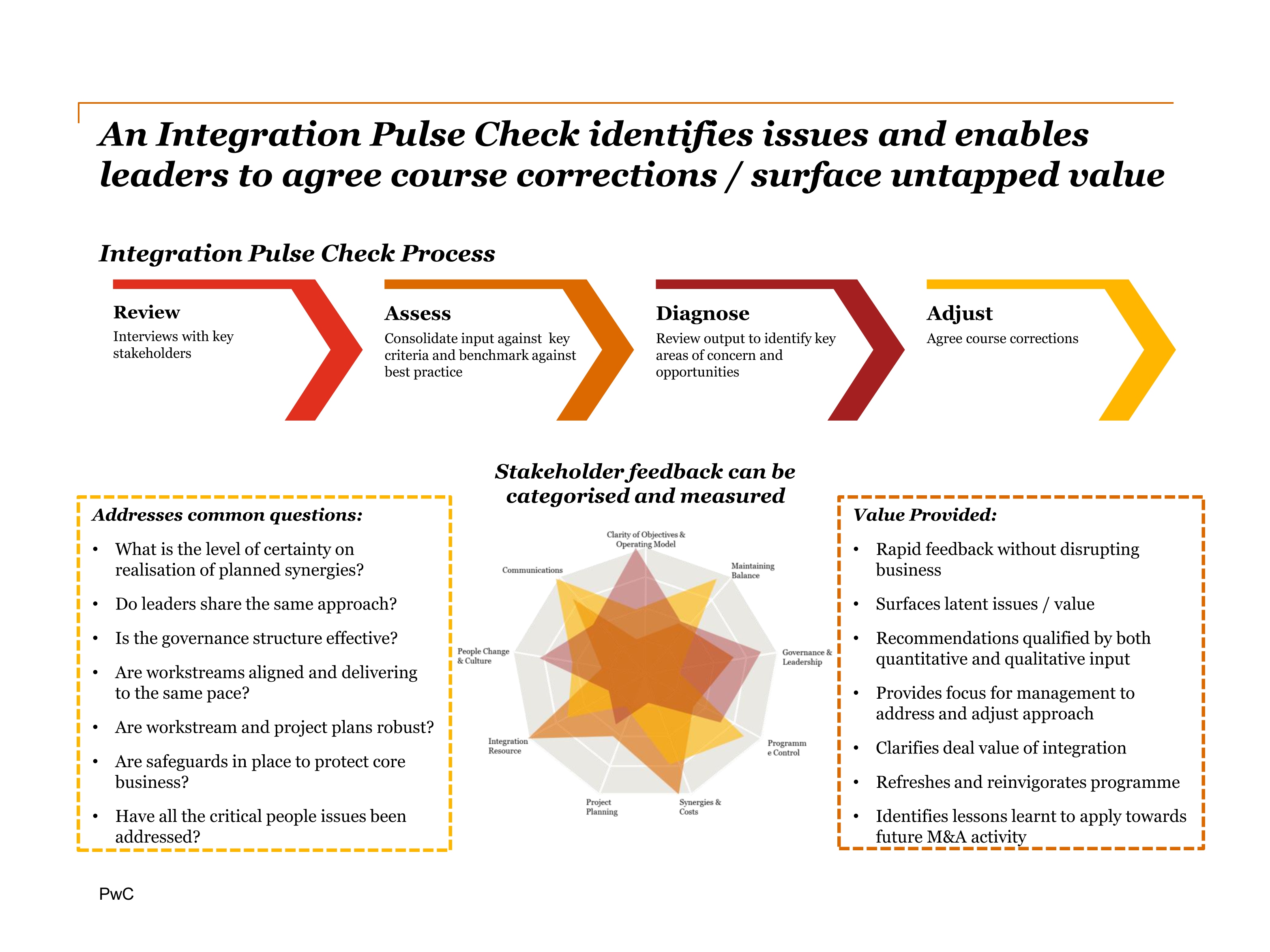

Our Integration Pulse Check

Our Integration Pulse Check identifies issues and enables leaders to agree course corrections / surface untapped value. Download our Integration Pulse Check ➡

M&A integration: choreographing great performance

PwC’s 2017 M&A Integration survey

The report explores these challenges in detail, allowing you to see what dealmakers are getting right about integration and where they need to improve. Along with the results, we offer our insights to assist you in making decisions when choreographing your organization’s next big performance.

Maximising return on Divestment: Carve Out

Failure to evaluate the costs of operational separation and prepare clear terms for transition can risk under-pricing a deal and leave buyers and vendors exposed to significant unforeseen costs.

We have experience of carve outs from both buyer and vendor perspectives – and can help to prepare and implement robust, executable and cost-efficient arrangements for carve-out, transition and hand-over.

Carve-outs are a growing feature of the current deal market. They are by their nature more complex than the sale of a fully standalone business. Our services are geared to making sure the carve-out is as smooth and value-enhancing as possible.

We understand the costs, practicalities and potential risks of operational separation. We understand both vendor and buyer perspectives and their impact on the value of the deal.

- You want to develop a standalone operating model based on your needs;

- You have to prepare separation plans that safeguard the business and ensure the carve-out is fully operational on Day 1;

- You want to quantify the financial impact of the separation (both for the carved out business and for the parent it leaves behind); or

- You want to maximise the operational efficiency of the carved out business and deliver this value through implementation.

- We ensure separation plans can be delivered, that business disruption is minimised and that there is an appropriate and executable level of support during the transition. We also advise on how to make operations more efficient following the separation.

- If you’re an acquirer, we provide the same assurance of certainty, and deliverability plus challenge on efficiency through carve out diligence. This includes helping to evaluate and challenge the cost and effectiveness of the transition plans and improve operational efficiency, both during the transition and as a standalone business. We will work alongside you to implement these plans effectively

- If you’re a vendor, we can help you to assess the full costs of the carve-out and transitional support and the implications for the expected returns from the deal. We can also help you to anticipate bidder requirements and hence sustain competitive tension in the auction, which can accelerate the deal process and maximise the proceeds.

Contact us