The MRA clarifies measures announced in the Budget speech 2023-24 on the personal tax system

Tax Alert - June 2023

On 8 June 2023, the Mauritius Revenue Authority (“MRA”) issued a Communiqué to provide further details on the changes announced in the budget speech on the personal tax system. These are summarised below:

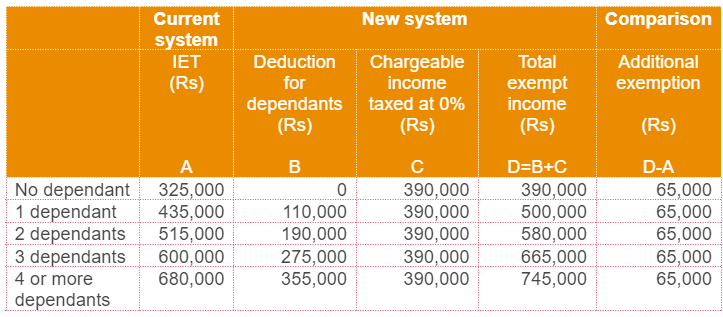

1. Replacement of Income Exemption Thresholds (“IET”)

The exemption currently available in the form of IET has been replaced by a deduction for dependants, where applicable, coupled with a tax rate of 0 percent on the first Rs 390,000 chargeable income.

The overall effect is that each individual will benefit from an additional exemption of Rs 65,000.

2. Personal reliefs and deductions

The personal reliefs and deductions to which an individual is entitled remain unchanged. This implies that interest relief, deduction for children attending university, contribution to approved pension plans etc. are still available.

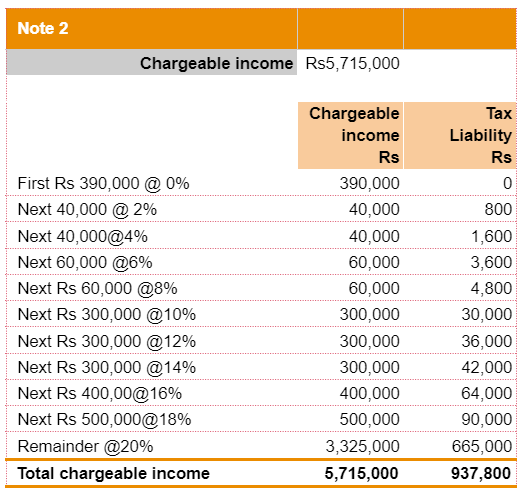

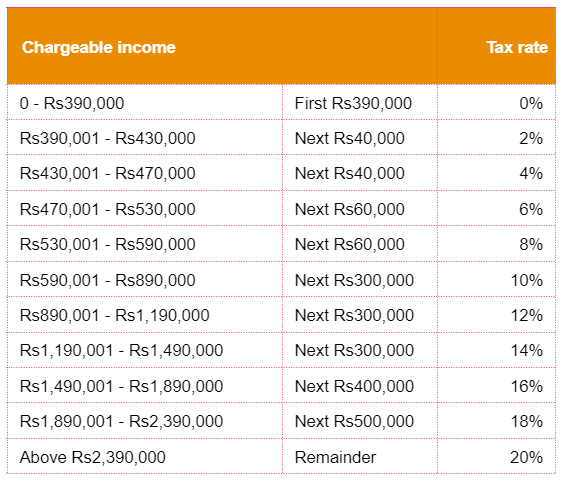

3. Introduction of a progressive tax system

A progressive tax system has been introduced with eleven tax brackets as follows:

4. Abolition of solidarity levy

Solidarity levy has been abolished. As a result, local dividends received are tax exempt.

5. Effective date

The changes will apply to income received by an individual as from 1 July 2023.

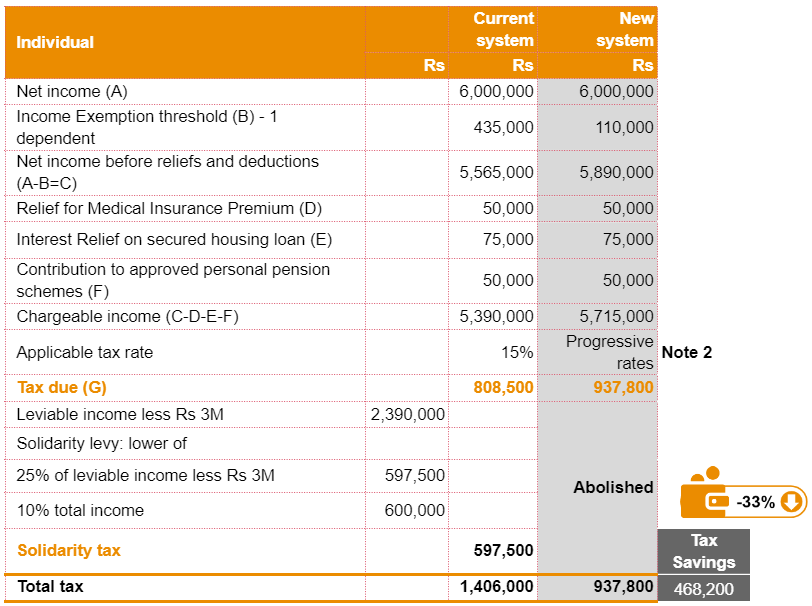

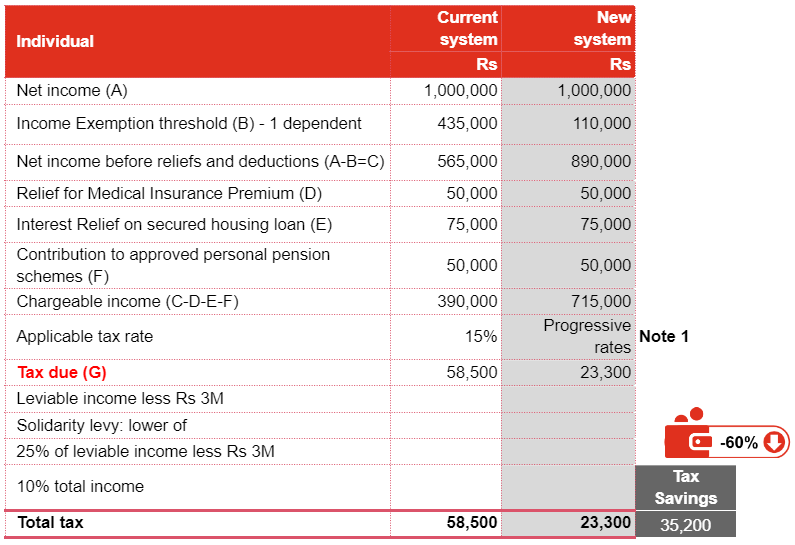

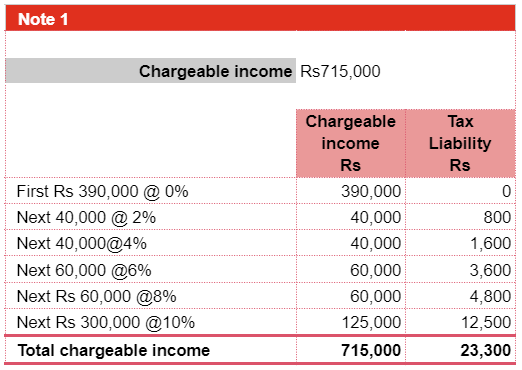

PwC comments: As shown in examples 1 and 2 below, the reform of the personal tax system will result in significant tax savings for all individuals.

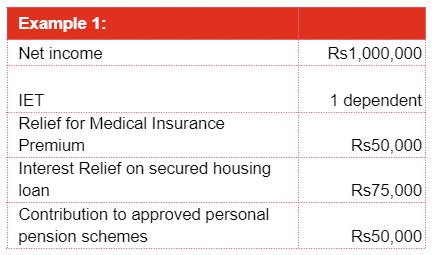

Example 1

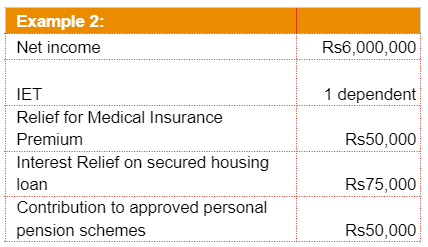

Example 2