Growth from outbound investment and cross-border trades

Investors and large corporations in Thailand have expanded overseas investments in recent years, and this trend is expected to continue. One major reason is to diversify portfolios, spreading risk. Another is that they have reached the limit of growth in the domestic market and see huge business opportunities in foreign markets.

Thailand’s export of products and services, including food and agriculture, textiles and garments, cement, and banking, have been constantly rising.

According to the Bank of Thailand (BoT), in the second quarter of 2018, Thai direct investment overseas reached THB872 billion. The top five countries where Thai firms poured money into were Singapore (THB228 billion), Japan (THB108 billion), the US (THB65 billion), the UK (THB49 billion) and China (THB35 billion).

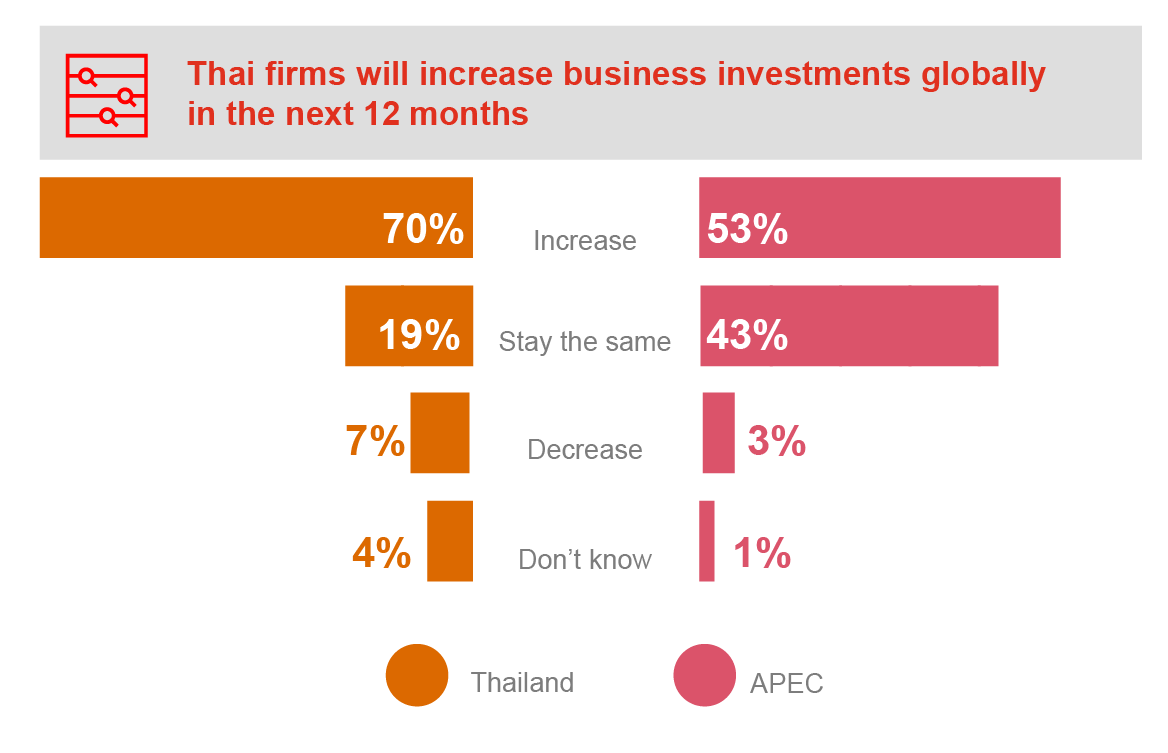

The findings from the survey reflect this trend as most Thai executives (70%) said that they will increase their business investments globally in the next 12 months, compared to only 53% across the rest of APEC.

Q8: Thinking of your business investments globally, will your investments increase, stay the same or decrease in the

next 12 months?

Source: PwC’s APEC CEO Survey 2018

Recently, APEC has committed to advance free and open trade and investment among its members by agreeing to accelerate efforts to address the World Trade Organisations’ (WTO) inconsistent barriers to trade and investment and take concrete action on this issue. The sentiment towards this issue showed in the survey findings.

When considering cross-border activities over the last 12 months, 38% of Thai CEOs and 30% of APEC CEOs said that they had experienced an increase in revenue opportunities due to a new bilateral trade arrangement. But they are more optimistic about next year: 44% of Thai CEOs and 31% of APEC CEOs believe that a new bilateral trade arrangement will result in an increase in revenue opportunities over the next 12 months.

In terms of the new multilateral trade arrangement, 27% of Thai executives and 25% of APEC executives believed that their firms experienced an increase in revenue opportunities in the past year due to the new arrangement, while 33% of Thai executives and 30% of APEC executives anticipate increased revenue from the new multilateral trade arrangement next year.

Q12a/12b:Considering your organisation’s cross-border activities only, which of the following changes have you experienced

in the last / next 12 months?

Source: PwC’s APEC CEO Survey 2018

Since the establishment of the ASEAN Economic Community (AEC) in 2015, Thailand has benefitted from the bloc, aiming to create a free flow of goods, services, investment, capital and skilled labour within the 10-nation region. This has in part resulted in a rise in the country’s trade and services in recent years.

The expectations of Thai executives are in line with the national economy’s progress and expansion.

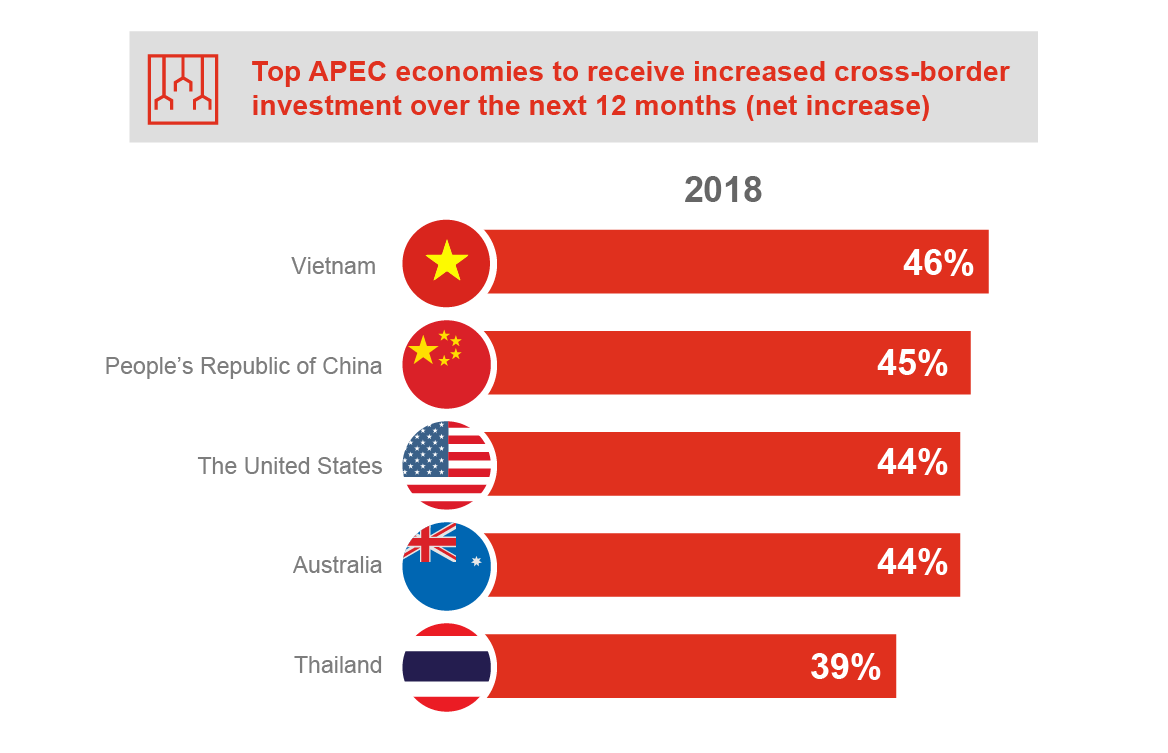

According to PwC’s 2018 APEC CEO Survey, Thailand also ranks among top APEC economies expected to receive increased cross-border investment over the next 12 months after Vietnam (46%), China (45%), the US (44%) and Australia (44%).

Q10:Thinking of your footprint in APEC economies, will your business investments increase, stay the same or decrease

over the next 12 months?

Base: APEC CEOs Cross-border investment 2018 310-493, 2017 379-552. ‘Net increase’ refers to % ‘increasing’ their investment minus % ‘decreasing’ their investment. ‘Increasing’ includes those currently investing in the economy with plans to increase AND those planning to invest in the economy for the first time minus those who will decrease their investment. Percentages recalculated on respondents with a footprint in each relevant economy only

Source: PwC’s APEC CEO Survey 2018