Streaming service and internet advertising are the rising segments

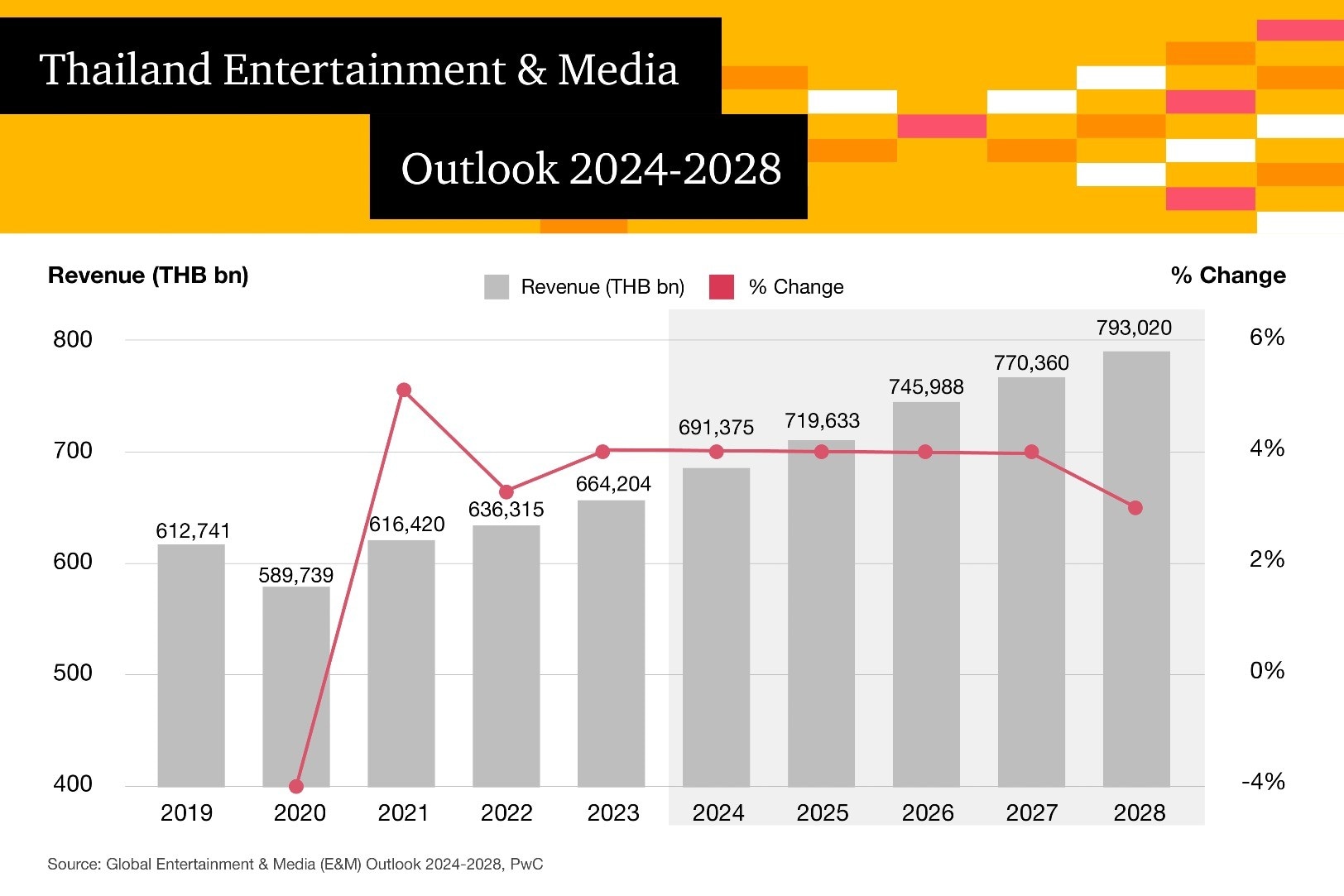

BANGKOK, 20 August 2024 – PwC forecasts that the revenue growth of Thailand’s entertainment and media industries will reach THB690 billion in 2024, representing a 4% increase from the previous year.

The industry is expected to experience revenue growth to nearly THB800 billion, driven by streaming and online advertising businesses. Business leaders are advised to adapt to changing consumer behaviours and leverage GenAI to analyse new business models, thereby adding new value.

Data from PwC’s Global Entertainment & Media (E&M) Outlook 2024-2028 report predicts that the total revenue of Thailand’s E&M industry will reach THB691.375 billion in 2024, growing 4% from last year’s THB664.204 billion. This is despite the country facing challenges such as economic slowdown, structural problems, emerging technologies affecting business operations and geopolitical and industrial competition.

The PwC report, which surveyed revenue data and forecast growth trends for 11 segments across 53 countries and territories, indicated that the total revenue of Thailand’s E&M industry will reach THB793.020 billion in 2028, representing a 3.5% compound annual growth rate (CAGR).

Tithinun Vankeo, Assurance Partner, PwC Thailand, said:

“This year, Thailand’s E&M industry has capability for growth despite facing pressures from the economic outlook and sluggish purchasing power, with some business sectors set to grow significantly in line with changes in consumer behaviour towards the internet and digital platforms.”

According to the PwC report, over-the-top (OTT)1 video services (which grew 27% year-on-year to THB28.043 billion), internet advertising (up 13% year-on-year at THB58.358 billion) and out-of-home advertising (up 8% year-on-year at THB17.286 billion) are expected to the top three fastest-growing segments in the Thai E&M industry in 2024.

Streaming service providers must adapt continually

Tithinun stated that the COVID-19 pandemic led Thai consumers to use the internet more, which resulted in the emergence of OTT media services. Of these, video streaming and internet advertising have become two segments that have continuously grown at a staggering rate in Thailand.

However, the growth rate is likely to slow down as service providers face increasingly fierce competition in terms of content and the entry of new players, as well as the challenge of enticing consumers to pay more for digital products and services, she said.

“In the next phase, streaming platforms will need to reshape their business models and find new ways to generate revenue beyond subscriptions, including the introduction of ad-based models, lower subscription fees or even the possibility of mergers and acquisitions as competition intensifies,”

Tithinun said.

According to the PwC report, the average CAGR of OTT media service revenue has dropped from 57% (2019-2023) to 10.7% (2024-2028) while total revenue is expected to reach THB42.122 billion in 2028.

Internet advertising revenue continues to grow

Thailand’s internet advertising revenue in 2028 is expected to reach THB85.242 billion from THB51.551 billion in 2023, growing at a CAGR of 10% (2024-2028). Tithinun said that the main reason for this growth is that consumers prefer to use the internet and social media to research and study information about brands, making it an important channel for advertisers to reach their target market.

According to the Digital 2024: Thailand report by We Are Social and Meltwater, there were 63.21 million internet users in Thailand at the beginning of 2024, representing an internet penetration rate of 88%. Additionally, there were 49.10 million social media users, accounting for 68.3% of the total population.

“In the medium to long term, Thailand will continue to face risks and uncertainties from ever-changing consumer demands, as well as the impacts of digital transformation and emerging technologies such as GenAI.

“Business leaders in the E&M industries should seek new business models that arise from these changes. By leveraging technologies such as GenAI to create added value through the production of diverse content that meets the interests of target groups, whether it producing contents on social media, commercial ad or music, as well as analysing new solutions, it will help connect with consumers across all platforms quickly and efficiently,”

said Tithinun.

Globally, internet advertising is the largest and one of the fastest-growing segments of the advertising industry, growing by 10.1% in 2023 and expected to grow at a 9.5% CAGR through 2028, accounting for 77.1% of total advertising spending.

//ENDS//

[1] A video service delivered directly to viewers via the Internet, such as video-on-demand subscriptions (streaming platforms) that provide access to film and television content. The report states that OTT video includes online TV advertising and video-on-demand subscriptions and transactions.

Notes to Editors:

About the Outlook

PwC’s Global Entertainment & Media Outlook 2024-28, now in its 25th year, provides in-depth analysis of global entertainment & media (E&M) consumer and advertising spending. The Outlook includes five-year historical and five-year forecast data and commentary for 11 industry segments across 53 countries and territories. Segments are business-to-business; cinema; connectivity service; internet advertising; music, radio and podcasts; newspapers, consumer magazines and books; out-of-home (OOH) advertising; over-the-top (OTT) video; traditional TV; video games and esports; virtual reality (VR) and augmented reality (AR). In addition, the Outlook tracks data consumption and important developments in technologies such as AI, the metaverse and NFTs. The full Outlook can be accessed at www.pwc.com/outlook.

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 151 countries with over 360,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2024 PwC. All rights reserved.

Click here to read Thai version

Contact us