Pricing financial transaction #4: The applicability of bank quotations

Financial transactions transfer pricing (FTTP) is a relatively new topic in Thailand, and the spotlight on the issue is intensifying. While inter-company funding or parent company guarantees for subsidiary bank loans are common, it can be challenging to assess the appropriateness of intra-group transactions and whether they’re conducted at arm’s length. This is due to a lack of clear guidance specifically for FTTP from the Thai Revenue Department (TRD).

Several queries about FTTP

In recent years, we’ve received several queries from Thai taxpayers regarding how to price financial transactions and whether their current practices align with the arm’s-length principal. One of the most common questions is about whether ‘bank quotations’ (what the OECD guidelines refer to as ‘bankability opinions’) can be used as comparables for benchmarking (BM) studies from a transfer pricing (TP) perspective.

In this chapter of our series on pricing financial transactions, we explore the technical and practical application of bankability opinions.

Can a bankability opinion be used for FTTP?

A bankability opinion is a written opinion offered to taxpayers by an independent bank, which states the interest rate or fee the bank would be willing to offer to the taxpayer. Bank quotations are commonly used in pricing or kept as a BM study when pricing inter-company financial transactions – e.g. interests on loans and guarantee fees for financial guarantee transactions. However, is this method technically allowed from a transfer pricing (TP) perspective?

To better understand bankability, we examine its applicability below.

1. If we get a quotation from a commercial bank, can we use it to set our transfer price?

The arm’s length principle serves as the foundation of TP compliance. It requires all transactions between related companies be fairly conducted as if they were between unrelated companies.

With this fundamental concept in mind, relying solely on bankability opinions as evidence of an arm’s length transaction may not be sufficient. This is because bank quotations can’t be considered actual offers. Further due diligence and approval processes are typically required before a loan or a service is formally offered. This is supported by the OECD Guidelines (revised 2022).

However, if a company obtains an actual offer from a bank with an official commitment to transact at a specific rate, the offer may serve as a valid comparable. However, it’s important to ensure other comparability factors align with the focused inter-company transaction.

Also, when pricing a transaction, especially a financial transaction, the level of comparability between the official bank quotation and inter-company transactions is crucial. This is because the price of financial instruments can vary significantly based on the terms and features of the transactions as well as underlying economic circumstances. For example, macroeconomic trends affect the market and reference rates, so an official bank offer to a company a few years ago probably wouldn’t be comparable with a current inter-company transaction.

Therefore, before using a bankability opinion to set or justify a transfer price, it’s essential that the quotation from the commercial bank is comparable to the inter-company transaction being reviewed.

2. Are there any TP risks in using bankability opinions in Thailand?

Currently, there’s no specific legislation in Thailand regarding FTTP or any guidelines that explicitly permit or prohibit the use of bankability opinions. Based on the existing TP relevant laws, taxpayers must prove their TP adheres to the arm’s length principle.

Without specific legislation or equivalent provisions for FTTP in Thailand, it may be beneficial to observe the situation in other countries as a point of reference.

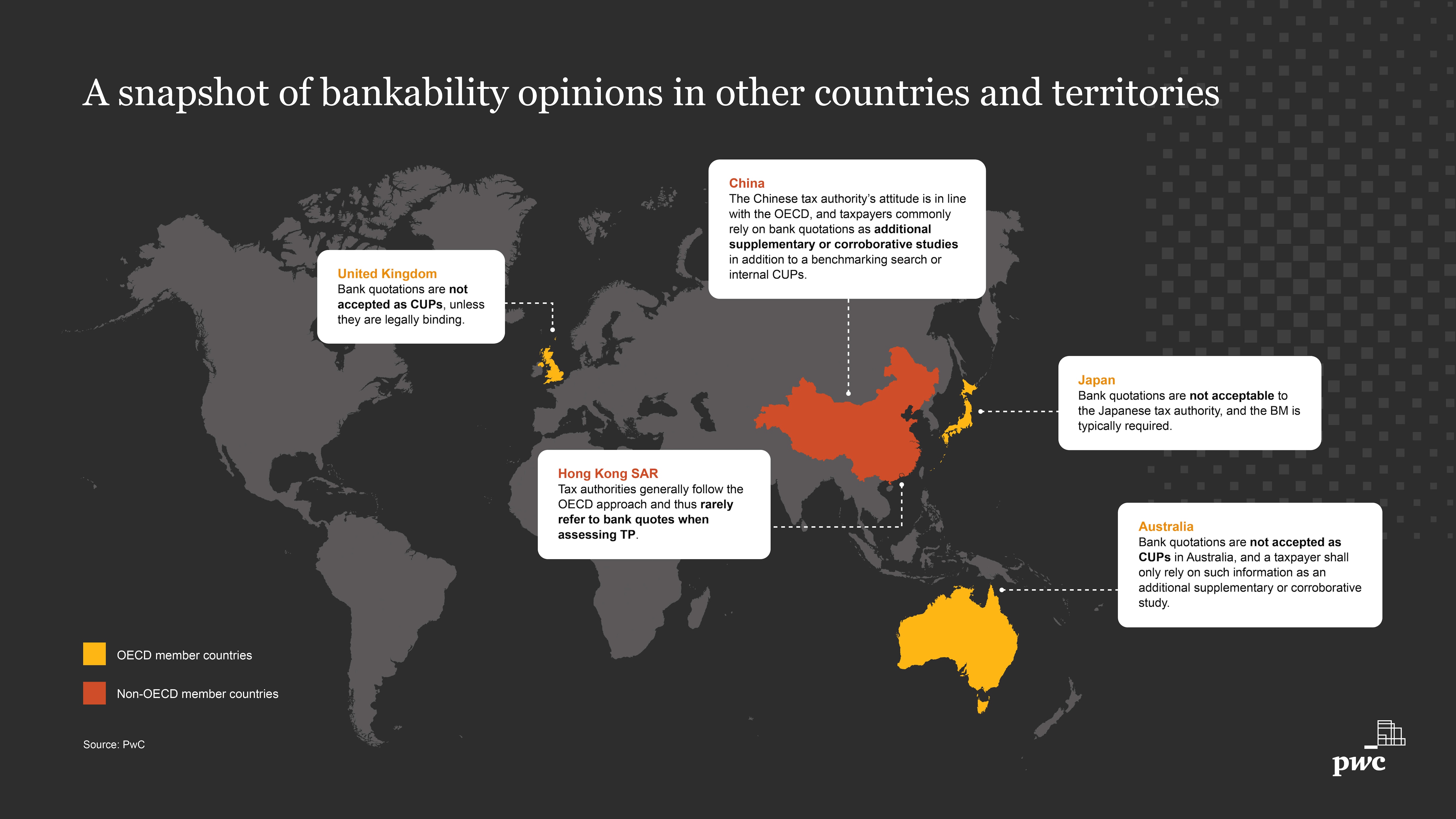

A snapshot of bankability opinions in other countries

Below is a collection of examples that represent the general attitude of authorities towards bankability opinions in different jurisdictions, both OECD member and non-member countries. However, it’s important to note that the perception of bankability opinions will vary, depending on the specific fact and circumstances of each case.

The examples above reveal a pattern in the use of bankability opinions. Tax authorities in OECD countries follow the OECD guidelines and typically don’t accept bankability opinions. Meanwhile, even without the standards set by the OECD, non-OECD countries still tend to align with OECD guidance.

Given this observable trend, what’s Thailand’s stance?

The future of Thailand’s transfer pricing standards

Even though Thailand isn’t an OECD member, the OECD guidelines on TP have had a substantial influence in shaping the Thai TP regime, with OECD principles appearing in Thai TP regulations and sub-ordinate legislation.

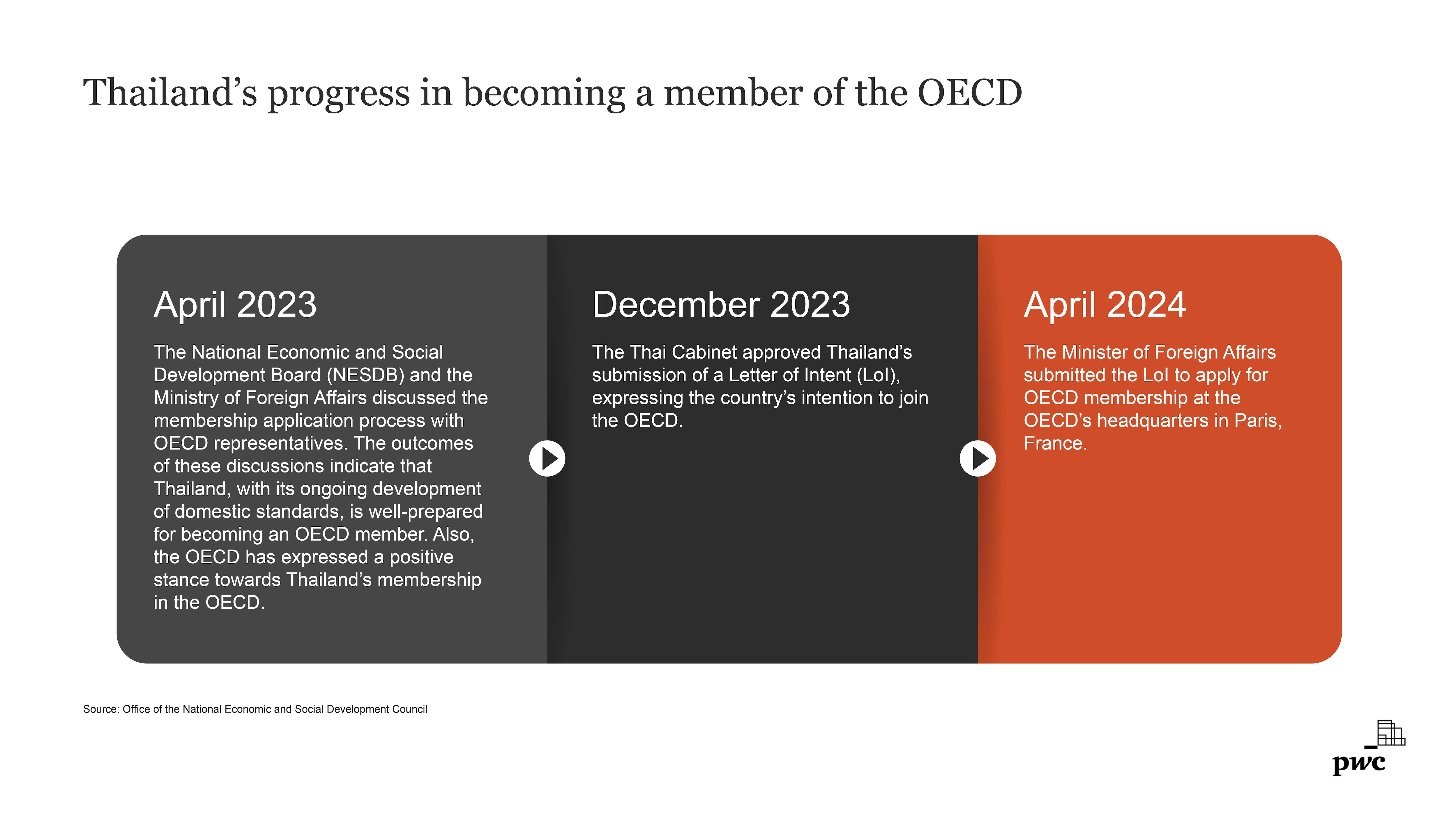

The Thai government announced its intention to join the OECD in November 2023 and was given a green light to submit the letter of Intent (LoI) by the Thai Cabinet in December of the same year. Later, in April 2024, Thailand finally submitted an application for OECD membership. Even though the timeline for achieving membership is uncertain, it’s expected that Thailand’s TP rules will still align with the OECD guidelines.

This news and subsequent developments may help to increase awareness among taxpayers. In addition, it may introduce uncertainty around their intercompany financing arrangements and how to price TP if the bank quote isn’t technically usable.

In conclusion, while bankability opinions are seen as a practical option for setting or testing TP in Thailand, taxpayers must carefully consider their own situation. In reality, the level of the TP risk will depend on the views of the TRD officers and the reliability of the documentation. This includes whether the bankability opinion can be justified as an actual transaction and demonstrates a reasonable level of comparability.

Considering these imminent developments in Thailand, we believe the TRD will strengthen TP legislation, prioritise monitoring of intra-group financial transactions and conduct their assessments in alignment with OECD guidelines.

Therefore, to mitigate the TP risks associated with using bankability opinions, which aren’t technically comparable, we advise companies engaged in intra-group financial transactions to keep up to date with the regulatory requirements. It would also be sensible to regularly review your TP policies and benchmarking studies.

References:

[1] OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2022, The Organisation for Economic Co-operation and Development (OECD)

[2] Thailand aiming for OECD membership, Royal Thai Embassy, Washington, D.C.

[3] Thailand Moves Toward OECD Membership Foreign Office, The Government Public Relations Department

Authors:

- Nopajaree Wattananukit

Associate Partner, Tax and Legal, PwC Thailand - Thunchanok Sangwatanachai

Manager, Tax and Legal, PwC Thailand

Click here to read Thai version

Contact us

Marketing and Communications

Bangkok, PwC Thailand

Tel: +66 (0) 2844 1000, Ext. 4713-15, 18, 22-24, 26, 28 and 29