Optimize and digitize your decisioning processes to be more competitive

Decision intelligence

PwC CZ Risk Management & Modelling team provides full range of services to support the back-end of your decisioning processes mainly in the following areas:

- Credit risk decisioning

- Digital onboarding

- Dynamic pricing

- Collections

- Offer optimization

- Monitoring

Credit risk decisioning

On-line lending and digitization of the credit decision process (specifically in retail and SME) are the answers for credit institutions aiming to increase their market share and to be flexible and able to respond much faster to customer needs. Our services cover:

Credit Decision Manager

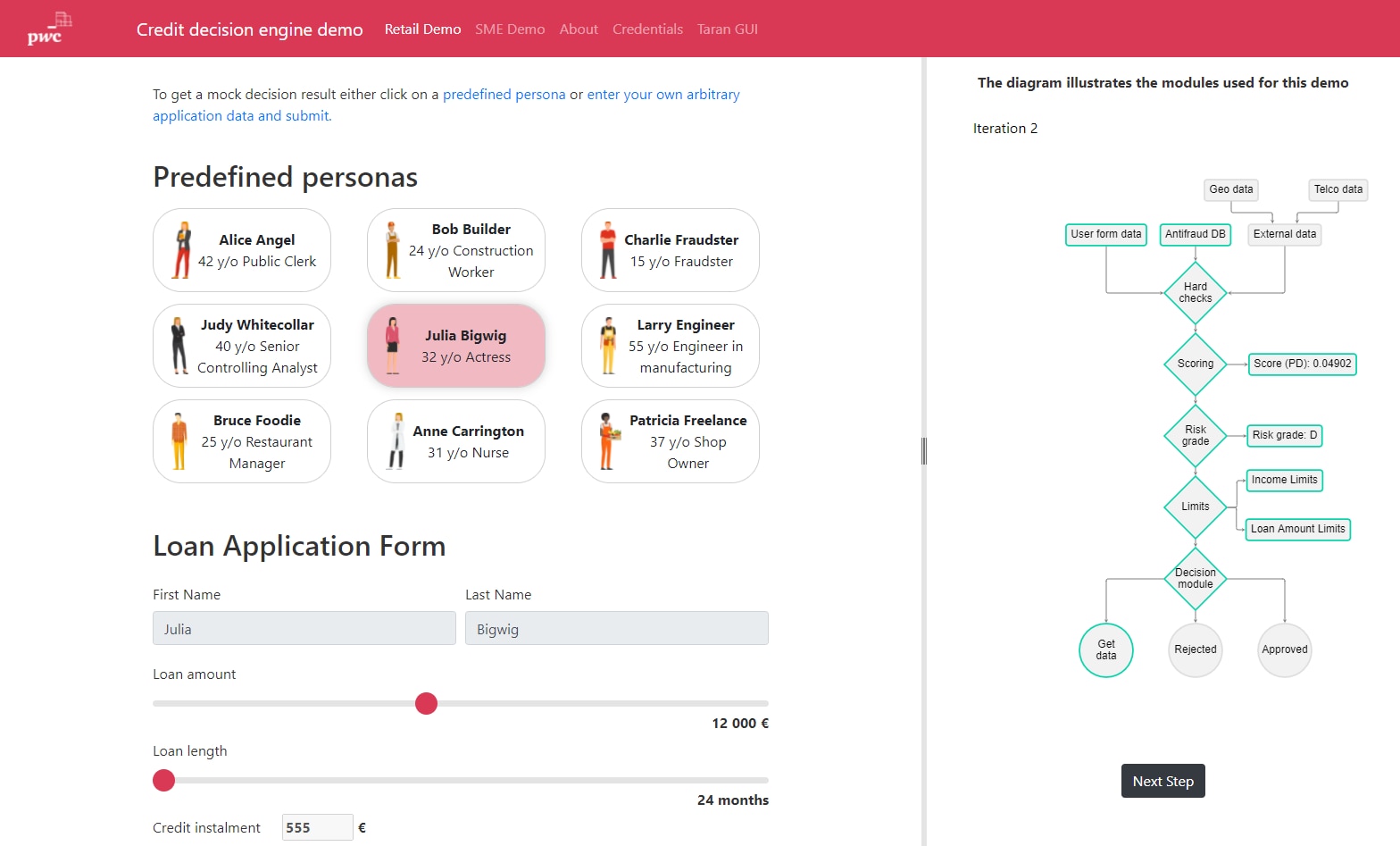

Together with our partnered firm Taran we deliver end-to-end back-end implementation of your loan approval process.

Innovative Data Sources

We enhance your scoring with innovative data sources, such as geographic features, telco data or client’s digital footprint.

Regulatory Support

We ensure your credit decision process is compliant with relevant regulation regarding credit underwriting and consumer protection.

Scoring Model Development

We develop a scoring model, heart of your decision process, tailored to your needs.

Why Taran Decision Manager (with PwC components)?

Many of the benefits of our solution revolve around its modularity, flexibility and tooling enabling rapid redeployment and innovation without being too reliant on the IT department. This is especially beneficial in new segments such as online lending requiring frequent strategy updates.

Modular and flexible

Highly modular and flexible. Set-up a custom strategy for your approval process from available modules.

Smart pricing and x-sell

In-built cross-sell and up-sell capabilities based on defined strategies. Supports risk based pricing and/or propensity based smart pricing.

Auditable, transparent

Every input and output is saved and every historical decision is replicable and deterministic. Interactive reporting module over SQL database for monitoring your online population and basis for upgrades.

Anti-fraud module

Anti-fraud check based on information from anti-fraud DB such as device ID, IP address.

Cost-effective

Cost-effective – smart caching of external and costly data source in the data caller. New data are only requested when needed.

Modern technology stack

Open source technologies, microservices architecture and easy deployment into existing infrastructure. Clients can modify the Taran Decision Manager themselves (no vendor lock-in).

Multiple strategies

Multiple scoring strategies for benchmarking and/or segmentation of the loan approval process.

Real-time and batch

Real-time and batch scoring in one unified engine – real time for BAU application process and batch for campaigns on existing population.

Easy to maintain

Analytical utilities - suite of utilities for data scientist working with Taran Decision Manager. Extract predictors for analytical work. Predictor form and binning embedded in strategy.

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.